Global Clostridium Diagnostics Market - Key Trends and Drivers Summarized

Why Are Clostridium Diagnostics Gaining Importance in Healthcare?

Clostridium diagnostics have emerged as a critical area in modern healthcare due to the rising incidence of infections caused by Clostridium species, particularly Clostridium difficile (C. diff), Clostridium botulinum, and Clostridium perfringens. These bacteria can cause severe, and sometimes life-threatening, conditions such as gastrointestinal diseases, botulism, and gas gangrene. Clostridium difficile infections (CDI), in particular, have garnered significant attention due to their prevalence in healthcare settings, especially among immunocompromised patients or those receiving long-term antibiotic treatments. The growing frequency of hospital-acquired infections (HAIs) and the high rates of recurrence in CDI cases underscore the importance of rapid, accurate diagnostics in effectively managing these infections. Early detection is crucial for timely intervention, preventing the spread of the bacteria, and ensuring effective treatment. As a result, the demand for reliable diagnostic tools that can quickly identify Clostridium infections is rising, driving advancements in molecular diagnostics, immunoassays, and point-of-care testing solutions specifically tailored to target these pathogens.How Are Technological Innovations Shaping Clostridium Diagnostic Methods?

The development of advanced diagnostic technologies has revolutionized the way Clostridium infections are detected and managed. One of the most impactful innovations has been the widespread adoption of molecular diagnostic methods such as polymerase chain reaction (PCR) and nucleic acid amplification tests (NAATs). These technologies allow for the rapid and precise identification of Clostridium species, significantly reducing the time it takes to diagnose infections compared to traditional culture-based methods. PCR-based diagnostics are particularly beneficial in detecting toxins produced by C. difficile, helping clinicians distinguish between colonization and active infection, which is essential for appropriate patient management. In addition to molecular techniques, immunoassays have become an important tool for diagnosing Clostridium infections by detecting specific toxins or antigens. Enzyme-linked immunosorbent assays (ELISA) and lateral flow assays provide relatively fast and reliable results, making them valuable in both hospital laboratories and point-of-care settings. The push toward more automated and integrated systems has also led to the development of multiplex panels, which can simultaneously test for multiple pathogens, including various Clostridium species, thereby streamlining diagnostic workflows and improving patient outcomes. These technological advancements are making Clostridium diagnostics faster, more accurate, and more accessible, transforming the way healthcare providers approach the detection and management of infections.Where Are Clostridium Diagnostics Making the Greatest Impact?

The need for effective Clostridium diagnostics is particularly critical in hospitals and long-term care facilities, where infections like C. difficile are most prevalent. These healthcare settings are at high risk for outbreaks, especially among elderly patients or those with weakened immune systems. Accurate diagnostics in these environments can make a significant difference by facilitating early detection, enabling immediate infection control measures, and guiding appropriate treatment protocols to prevent further spread. Outside of healthcare institutions, diagnostics for Clostridium species are becoming increasingly important in the food and agriculture sectors. Clostridium botulinum, for instance, poses a major threat due to its ability to cause botulism, a rare but serious form of food poisoning that can lead to paralysis or even death. Rapid diagnostics are essential for detecting contamination in food products and preventing outbreaks. In veterinary medicine, Clostridium perfringens diagnostics are used to monitor and manage infections in livestock, which can lead to significant economic losses. Across these diverse sectors, the impact of Clostridium diagnostics extends beyond patient outcomes, playing a crucial role in safeguarding public health, food safety, and the agricultural economy. As awareness of the dangers posed by Clostridium species grows, the demand for comprehensive and reliable diagnostic solutions continues to rise across multiple industries.What Factors Are Fueling the Growth of the Clostridium Diagnostics Market?

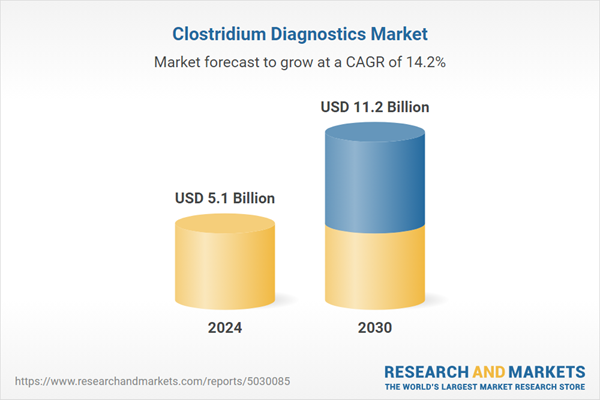

The growth in the Clostridium diagnostics market is driven by several factors, including the increasing prevalence of Clostridium difficile infections (CDI) in healthcare settings, which has become a leading cause of hospital-acquired infections. The rising awareness of the severe complications associated with C. difficile, such as recurrent infections, has led to greater demand for rapid and accurate diagnostic tools that can identify the pathogen and its toxins early in the infection process. Additionally, the aging population and the growing number of immunocompromised individuals - both groups at higher risk for Clostridium infections - are further propelling the need for effective diagnostic solutions. Advances in molecular diagnostics, particularly the adoption of PCR and NAATs, are also key drivers of market growth, as these technologies provide quicker and more reliable results than traditional methods. The shift towards point-of-care diagnostics, especially in environments where rapid decision-making is crucial, has bolstered the adoption of immunoassays and portable diagnostic devices that can detect Clostridium infections at the bedside or in outpatient settings. In the food industry, stringent regulations aimed at preventing foodborne illnesses, such as botulism caused by Clostridium botulinum, are increasing the demand for contamination testing and diagnostic tools. Moreover, growing investments in research and development to create more sophisticated, automated diagnostic platforms are expected to further fuel the expansion of the market. These factors collectively underscore the critical role of diagnostics in managing Clostridium infections and highlight the market's promising growth trajectory.Report Scope

The report analyzes the Clostridium Diagnostics market, presented in terms of market value (USD). The analysis covers the key segments and geographic regions outlined below.- Segments: Technology (Immunoassays, Molecular Diagnostics); Bacterial Strain (Clostridium Difficile, Clostridium Botulinum, Clostridium Perfringens, Clostridium Tetani, Clostridium Sordellii); End-Use (Hospitals, Independent Laboratories, Physicians Clinics).

- Geographic Regions/Countries: World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; Spain; Russia; and Rest of Europe); Asia-Pacific (Australia; India; South Korea; and Rest of Asia-Pacific); Latin America (Argentina; Brazil; Mexico; and Rest of Latin America); Middle East (Iran; Israel; Saudi Arabia; United Arab Emirates; and Rest of Middle East); and Africa.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the Immunoassays segment, which is expected to reach US$9.1 Billion by 2030 with a CAGR of 15.6%. The Molecular Diagnostics segment is also set to grow at 9.4% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $1.3 Billion in 2024, and China, forecasted to grow at an impressive 18.5% CAGR to reach $2.8 Billion by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Clostridium Diagnostics Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Clostridium Diagnostics Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Clostridium Diagnostics Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as Abbott Laboratories, Beckman Coulter, Inc., Becton, Dickinson & Company, bioMerieux SA, Chrono-log Corporation and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 13 companies featured in this Clostridium Diagnostics market report include:

- Abbott Laboratories

- Beckman Coulter, Inc.

- Becton, Dickinson & Company

- bioMerieux SA

- Chrono-log Corporation

- Corgenix

- Diazyme Laboratories

- F. Hoffmann-La Roche AG

- Fujirebio US, Inc.

- Hologic, Inc.

- QIAGEN GmbH

- Siemens Healthineers

- Sysmex Corporation

- Thermo Fisher Scientific, Inc.

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Abbott Laboratories

- Beckman Coulter, Inc.

- Becton, Dickinson & Company

- bioMerieux SA

- Chrono-log Corporation

- Corgenix

- Diazyme Laboratories

- F. Hoffmann-La Roche AG

- Fujirebio US, Inc.

- Hologic, Inc.

- QIAGEN GmbH

- Siemens Healthineers

- Sysmex Corporation

- Thermo Fisher Scientific, Inc.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 159 |

| Published | January 2026 |

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 5.1 Billion |

| Forecasted Market Value ( USD | $ 11.2 Billion |

| Compound Annual Growth Rate | 14.2% |

| Regions Covered | Global |