Global Chromium Carbide Market - Key Trends and Drivers Summarized

What Is Chromium Carbide and Why Is It a Key Material in Industrial Applications?

Chromium carbide (Cr3C2) is a ceramic compound composed of chromium and carbon, known for its remarkable hardness, wear resistance, and ability to withstand high temperatures. It is commonly utilized as a surface coating or as an additive to enhance the properties of metals and alloys. Chromium carbide's most significant attribute is its ability to protect surfaces against wear, corrosion, and oxidation, making it an indispensable material in industries where components are subjected to extreme operating conditions. Found in various forms, including powders and coatings, chromium carbide is used in the production of cutting tools, machine parts, and wear-resistant coatings. In the aerospace, automotive, and mining industries, where machinery and tools are exposed to harsh environments, chromium carbide helps to extend the lifespan of components, reducing maintenance costs and downtime. Its high melting point and ability to maintain hardness at elevated temperatures also make it valuable in industrial processes that require materials capable of performing in extreme conditions.How Does Chromium Carbide Coating Enhance Performance in High-Stress Environments?

One of the primary uses of chromium carbide is as a coating material, typically applied through thermal spraying or other deposition techniques to improve the durability and performance of industrial parts. Chromium carbide coatings provide a significant increase in wear resistance, protecting surfaces from abrasive and erosive forces. This is particularly useful in industries like oil and gas, mining, and power generation, where equipment is frequently exposed to particles and debris that can cause rapid wear. In addition to wear resistance, chromium carbide coatings offer excellent corrosion resistance, particularly in environments where chemical exposure is a concern. For example, in the chemical processing industry, chromium carbide is used to protect equipment from corrosive chemicals, extending the life of components and ensuring reliable operation. Moreover, chromium carbide's resistance to oxidation at high temperatures makes it an ideal choice for applications in furnaces, engines, and turbines, where components must withstand both extreme heat and oxidizing environments. By significantly enhancing the lifespan and performance of industrial components, chromium carbide coatings have become a standard solution in high-stress applications where conventional materials fail.Which Industries Rely Heavily on Chromium Carbide for Enhanced Durability?

The use of chromium carbide spans a wide range of industries, each benefiting from its unique combination of hardness, heat resistance, and corrosion protection. In the aerospace industry, chromium carbide is applied to turbine blades and engine components that operate under intense heat and stress, helping to prevent wear and degradation. The automotive sector also relies on chromium carbide coatings for parts that require enhanced durability, such as brake discs, piston rings, and engine valves. These components are exposed to constant friction and high temperatures, and chromium carbide helps to extend their service life. The mining industry, with its need for heavy-duty machinery and tools that can withstand abrasive materials, frequently uses chromium carbide to coat equipment such as drilling tools, conveyor screws, and crushers. In the oil and gas sector, chromium carbide is applied to pipelines, valves, and other equipment that must endure both high pressure and corrosive substances. Additionally, the power generation industry benefits from chromium carbide's ability to resist thermal fatigue and oxidation, particularly in boilers and turbines. The broad spectrum of industries relying on chromium carbide underscores its critical role in enhancing the longevity and efficiency of key components in demanding environments.What Are the Key Growth Drivers in the Chromium Carbide Market?

The growth in the chromium carbide market is driven by several factors, particularly the increasing demand for wear-resistant and high-performance materials across multiple industries. In sectors like aerospace and automotive, the shift toward more fuel-efficient and high-performance engines has created a need for materials that can withstand higher temperatures and more extreme operating conditions, driving the demand for chromium carbide coatings. The mining and oil and gas industries, facing the challenge of working with abrasive materials and harsh chemicals, have increasingly adopted chromium carbide to extend the lifespan of expensive equipment and reduce downtime. Another significant growth driver is the rise in infrastructure development, especially in emerging markets, where construction and mining activities are expanding rapidly. Chromium carbide's ability to enhance the durability of machinery used in these sectors is a key factor supporting market growth. Additionally, advancements in coating technologies, such as thermal spraying techniques, have made the application of chromium carbide coatings more efficient and cost-effective, broadening their use across various industries. Furthermore, as environmental regulations become stricter, industries are seeking materials that can reduce the frequency of part replacements, lower energy consumption, and improve operational efficiency, all of which align with the benefits provided by chromium carbide. These trends, coupled with ongoing industrial growth and technological innovations, are set to drive continued demand for chromium carbide in the coming years.Report Scope

The report analyzes the Chromium Carbide market, presented in terms of market value (USD). The analysis covers the key segments and geographic regions outlined below.- Segments: End-Use (Mining, Energy, Steel, Cement, Pulp & Paper, Other End-Uses).

- Geographic Regions/Countries: World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; Spain; Russia; and Rest of Europe); Asia-Pacific (Australia; India; South Korea; and Rest of Asia-Pacific); Latin America (Argentina; Brazil; Mexico; and Rest of Latin America); Middle East (Iran; Israel; Saudi Arabia; United Arab Emirates; and Rest of Middle East); and Africa.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the Mining End-Use segment, which is expected to reach US$81.2 Million by 2030 with a CAGR of 5.6%. The Energy End-Use segment is also set to grow at 5% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $51.9 Million in 2024, and China, forecasted to grow at an impressive 7.3% CAGR to reach $57.6 Million by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Chromium Carbide Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Chromium Carbide Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Chromium Carbide Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as Alfa Aesar, American Elements, Changsha Langfeng Metallic Material Co., Ltd., H.C. Starck GmbH, Inframat Corporation and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 14 companies featured in this Chromium Carbide market report include:

- Alfa Aesar

- American Elements

- Changsha Langfeng Metallic Material Co., Ltd.

- H.C. Starck GmbH

- Inframat Corporation

- LTS Research Laboratories, Inc.

- MilliporeSigma

- Nanoshel LLC

- NewMet Ltd.

- OC Oerlikon Corporation AG, Pfaffikon

- Praxair S.T. Technology, Inc.

- Reade International Corporation

- Strem Chemicals, Inc.

- ZhuZhou GuangYuan Cemented Material Co., Ltd.

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Alfa Aesar

- American Elements

- Changsha Langfeng Metallic Material Co., Ltd.

- H.C. Starck GmbH

- Inframat Corporation

- LTS Research Laboratories, Inc.

- MilliporeSigma

- Nanoshel LLC

- NewMet Ltd.

- OC Oerlikon Corporation AG, Pfaffikon

- Praxair S.T. Technology, Inc.

- Reade International Corporation

- Strem Chemicals, Inc.

- ZhuZhou GuangYuan Cemented Material Co., Ltd.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 182 |

| Published | February 2026 |

| Forecast Period | 2024 - 2030 |

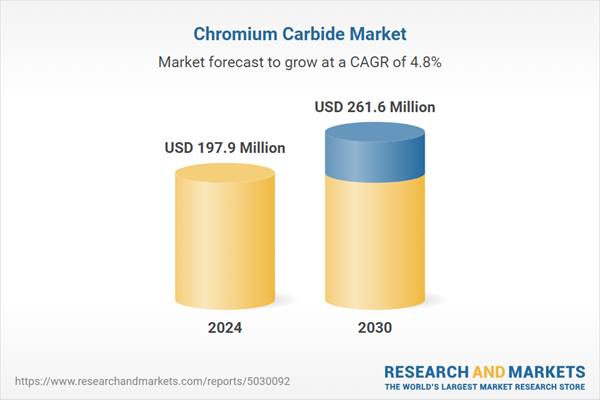

| Estimated Market Value ( USD | $ 197.9 Million |

| Forecasted Market Value ( USD | $ 261.6 Million |

| Compound Annual Growth Rate | 4.8% |

| Regions Covered | Global |