Global Chiral Chemicals Market - Key Trends and Drivers Summarized

Why Are Chiral Chemicals Crucial in Pharmaceutical and Chemical Industries?

Chiral chemicals play a vital role in modern chemistry, particularly within the pharmaceutical, agrochemical, and fine chemical industries. But why are these compounds so important? Chirality refers to a molecule that cannot be superimposed on its mirror image, much like left and right hands. These molecules, called enantiomers, often exhibit significantly different biological activities depending on their orientation, which is critical for drug development and other chemical applications. In pharmaceuticals, for example, one enantiomer of a chiral molecule might provide therapeutic benefits, while the other could be ineffective or even harmful. This makes the precise production and separation of chiral chemicals a necessity in drug development, as well as in the creation of agrochemicals, flavors, and fragrances. With regulatory requirements increasingly demanding enantiomerically pure compounds, chiral chemistry has become an indispensable tool for ensuring the safety and efficacy of many products that are integral to everyday life.How Do Chiral Chemicals Meet the Demands of Complex Drug Synthesis?

The complexity of modern drug synthesis has brought chiral chemicals into the spotlight, where they are essential for ensuring efficacy and safety. One of the major challenges in drug manufacturing is the production of enantiomerically pure compounds, as many biologically active molecules are chiral. The ability of one enantiomer to interact positively with biological receptors while its mirror image may have adverse effects means that precision in the creation of chiral chemicals is crucial. Technologies like asymmetric synthesis and chiral resolution techniques have become foundational in the production of chiral drugs, allowing chemists to control the orientation of these molecules and ensure the desired therapeutic outcome. Additionally, advances in biocatalysis and enzymatic processes are allowing for greener, more efficient production methods that minimize waste while improving yields. This precision in the synthesis of chiral chemicals has expanded their use in various medical applications, from cancer treatments to cardiovascular drugs, ensuring that these critical substances can be produced in the purity and quantities required by modern pharmaceutical demands.What Innovations Are Transforming the Chiral Chemicals Market?

Innovation is driving the chiral chemicals market forward, with new technologies and processes making it easier and more cost-effective to produce enantiomerically pure compounds. One major development is the increased use of biocatalysis, which leverages enzymes and microorganisms to achieve chiral resolution with high selectivity and efficiency. This method is not only more environmentally friendly but also allows for the production of chiral chemicals at lower costs compared to traditional chemical processes. Biocatalysis has become particularly important in the pharmaceutical industry, where sustainable, scalable production methods are in high demand. Additionally, advancements in asymmetric catalysis - where catalysts are used to favor the formation of one enantiomer over the other - have further improved the ability to produce high-purity chiral compounds on an industrial scale. This technology is being increasingly adopted in the synthesis of complex molecules, offering higher yields and reducing the need for extensive purification processes. Furthermore, innovations in chiral chromatography are transforming how enantiomers are separated and purified. This technique has become more efficient and scalable, allowing manufacturers to produce large volumes of enantiomerically pure chemicals with fewer steps and less waste. The development of advanced ligands and catalysts is also opening new doors for asymmetric synthesis, allowing chemists to tackle more complex chiral molecules with greater precision. These innovations are not only improving the efficiency and sustainability of chiral chemical production but also expanding their use in industries such as agrochemicals, where precise molecular targeting is becoming more critical in the development of pesticides and herbicides.What Factors Are Driving Growth in the Chiral Chemicals Market?

The growth in the chiral chemicals market is driven by several factors, most notably the increasing demand for enantiomerically pure compounds in pharmaceuticals, agrochemicals, and fine chemicals. One of the primary drivers is the expanding pharmaceutical sector, where chiral chemicals are essential for the production of active pharmaceutical ingredients (APIs). With a growing focus on precision medicine, drug manufacturers are increasingly turning to chiral chemicals to ensure the safety, efficacy, and regulatory compliance of their products. This trend is further reinforced by the rising number of patent expirations for racemic drugs, prompting manufacturers to develop single-enantiomer versions that offer improved therapeutic profiles and reduced side effects. Advances in asymmetric synthesis and biocatalysis are also key growth drivers, as these technologies enable more efficient and cost-effective production of chiral compounds. The agrochemical industry is another area of significant demand, with farmers and producers increasingly seeking chiral pesticides and herbicides that offer targeted action with minimal environmental impact. Additionally, the growing focus on sustainable and green chemistry practices is pushing manufacturers to adopt biocatalysis and other environmentally friendly methods for chiral chemical production. Lastly, the increasing complexity of global supply chains is driving demand for high-purity chiral chemicals, as industries ranging from pharmaceuticals to flavors and fragrances seek to ensure product quality and consistency. These factors are collectively contributing to robust growth in the chiral chemicals market, with continued innovation expected to further expand its applications across various industries.Report Scope

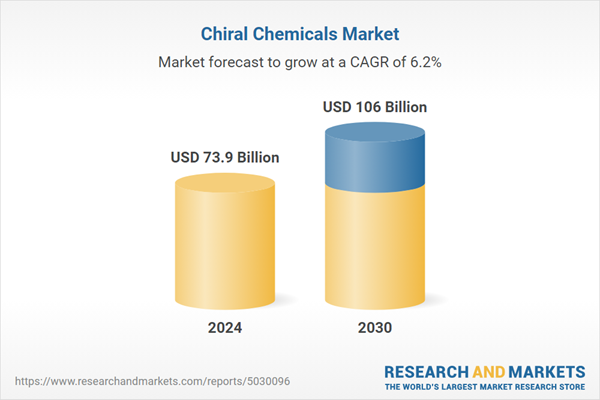

The report analyzes the Chiral Chemicals market, presented in terms of market value (USD). The analysis covers the key segments and geographic regions outlined below.- Segments: Method (Traditional Separation Method, Asymmetric Preparation Method, Biological Separation Method, Other Methods); Application (Pharmaceuticals Application, Agrochemicals Application, Other Applications).

- Geographic Regions/Countries: World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; Spain; Russia; and Rest of Europe); Asia-Pacific (Australia; India; South Korea; and Rest of Asia-Pacific); Latin America (Argentina; Brazil; Mexico; and Rest of Latin America); Middle East (Iran; Israel; Saudi Arabia; United Arab Emirates; and Rest of Middle East); and Africa.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the Pharmaceuticals Application segment, which is expected to reach US$76.9 Billion by 2030 with a CAGR of 6.1%. The Agrochemicals Application segment is also set to grow at 6.9% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $19.9 Billion in 2024, and China, forecasted to grow at an impressive 9.9% CAGR to reach $22.8 Billion by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Chiral Chemicals Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Chiral Chemicals Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Chiral Chemicals Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as BASF SE, Bayer AG, Chiracon GmbH, Chiral Technologies, Inc., Codexis, Inc. and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 46 companies featured in this Chiral Chemicals market report include:

- BASF SE

- Bayer AG

- Chiracon GmbH

- Chiral Technologies, Inc.

- Codexis, Inc.

- Dow, Inc.

- DuPont de Nemours, Inc.

- Johnson Matthey PLC

- PerkinElmer, Inc.

- Solvias AG

- Strem Chemicals, Inc.

- W. R. Grace & Co.

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- BASF SE

- Bayer AG

- Chiracon GmbH

- Chiral Technologies, Inc.

- Codexis, Inc.

- Dow, Inc.

- DuPont de Nemours, Inc.

- Johnson Matthey PLC

- PerkinElmer, Inc.

- Solvias AG

- Strem Chemicals, Inc.

- W. R. Grace & Co.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 196 |

| Published | February 2026 |

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 73.9 Billion |

| Forecasted Market Value ( USD | $ 106.1 Billion |

| Compound Annual Growth Rate | 6.2% |

| Regions Covered | Global |