Global Chemicals Packaging Market - Key Trends and Drivers Summarized

Why Is Chemicals Packaging Crucial in Today's Global Economy?

Chemicals packaging plays an essential role in the global supply chain, ensuring the safe transport, storage, and handling of a vast array of chemical products. The chemical industry is one of the most diversified and essential sectors, supplying products that are key to industries like agriculture, pharmaceuticals, manufacturing, and consumer goods. Whether dealing with hazardous chemicals such as acids and solvents or non-hazardous ones like fertilizers and detergents, the right packaging ensures that these materials can be moved across long distances without risking contamination, leakage, or safety incidents. Chemicals packaging not only protects the products themselves but also shields people, the environment, and transport infrastructure from the risks associated with chemical spills or exposure. This is especially important in a world where chemicals are frequently transported internationally, with the packaging being one of the first lines of defense in preventing accidents. Moreover, the increasing complexity of chemical products - many of which have specific requirements for temperature, pressure, and contamination control - has driven the development of more sophisticated packaging solutions tailored to meet the demands of modern industries.What Are the Key Requirements for Effective Chemicals Packaging?

Effective chemicals packaging must meet stringent regulatory, safety, and functional requirements to ensure the safe transport and storage of chemical products. The most critical factor is ensuring the integrity and compatibility of the packaging material with the chemicals it contains. For example, strong acids or corrosive materials require packaging made from materials resistant to chemical degradation, such as high-density polyethylene (HDPE) or specialized metals. This prevents the packaging from reacting with or being damaged by the contents, which could lead to leaks or contamination. Packaging must also be robust enough to withstand the physical stresses of transportation, including shocks, vibration, and changes in temperature or pressure. This is why many chemicals are packaged in drums, intermediate bulk containers (IBCs), and other rigid containers designed to handle rough conditions. In addition to material compatibility and durability, chemicals packaging must comply with international regulations and standards, such as those set by the United Nations for the transport of dangerous goods. These regulations govern aspects like labeling, hazard identification, and safety warnings to ensure that handlers are aware of the risks and take appropriate precautions. Moreover, proper sealing mechanisms are vital to prevent leaks, evaporation, or contamination, particularly for volatile or hazardous substances. Packaging for chemicals also needs to consider environmental factors, such as resistance to UV radiation for materials stored outdoors or the use of biodegradable materials to reduce waste.How Is Technology Shaping the Future of Chemicals Packaging?

Technological advancements are transforming the chemicals packaging industry. One of the most significant innovations in chemicals packaging is the development of smart packaging solutions, which incorporate sensors and digital tracking systems. These technologies enable real-time monitoring of critical factors like temperature, pressure, and humidity, ensuring that sensitive chemicals are maintained within safe parameters during transport and storage. For instance, chemicals that must remain stable under specific temperature ranges can now be tracked using Internet of Things (IoT)-enabled packaging, which sends alerts if conditions deviate from the safe range, allowing immediate corrective action. This technology is particularly important for high-value or hazardous chemicals, where maintaining product integrity is paramount. Another key technological advancement is in material science, with the introduction of new, more sustainable packaging materials. Biodegradable plastics, multi-layer barrier films, and advanced composites are being developed to reduce the environmental impact of traditional chemical packaging while still providing the necessary protection. Lightweight, high-strength materials are also being used to create packaging that minimizes waste and reduces shipping costs, as lighter containers mean lower fuel consumption during transport. Additionally, innovations in packaging design are making it easier to handle, store, and transport chemicals more efficiently. For example, collapsible IBCs and stackable containers allow for better use of space in warehouses and during shipping, while also being more environmentally friendly by reducing the volume of packaging waste. These advancements are not only improving the performance and safety of chemicals packaging but are also aligning the industry with broader trends toward digitalization and environmental responsibility.What Are the Factors Propelling the Growth in the Chemicals Packaging Market?

The growth in the chemicals packaging market is driven by several factors, primarily the rising global demand for chemicals, the increasing focus on safety and compliance, and the push for sustainability in packaging materials and processes. One of the primary growth drivers is the expanding chemical production in emerging markets, particularly in regions like Asia-Pacific, where industrialization is increasing the demand for both hazardous and non-hazardous chemicals. As these regions become key players in global chemical production, the need for safe and efficient packaging solutions that can meet international transport and safety standards is growing. Furthermore, the increasing complexity of chemicals, especially those used in high-tech industries like pharmaceuticals, electronics, and biotechnology, is pushing manufacturers to develop packaging that offers greater protection against contamination, degradation, and leakage. This has led to a surge in demand for advanced packaging materials and designs that can safely transport these high-value, sensitive products. The rise in global regulations governing the transportation and storage of chemicals is also driving market growth. As governments and regulatory bodies impose stricter rules on the labeling, packaging, and handling of hazardous chemicals, companies are investing in compliant packaging solutions that minimize risk and ensure the safe transport of their products. Additionally, the shift toward sustainability is playing a major role in shaping the chemicals packaging industry. With consumers and businesses alike increasingly demanding eco-friendly solutions, packaging companies are innovating to create recyclable, reusable, and biodegradable options that reduce the environmental impact of chemical packaging. Advances in lightweight materials and packaging designs that reduce waste and improve transport efficiency are also contributing to the market's growth. Together, these trends - rising chemical demand, regulatory pressures, technological innovation, and sustainability - are propelling the chemicals packaging market forward, positioning it for continued expansion in the coming years.Report Scope

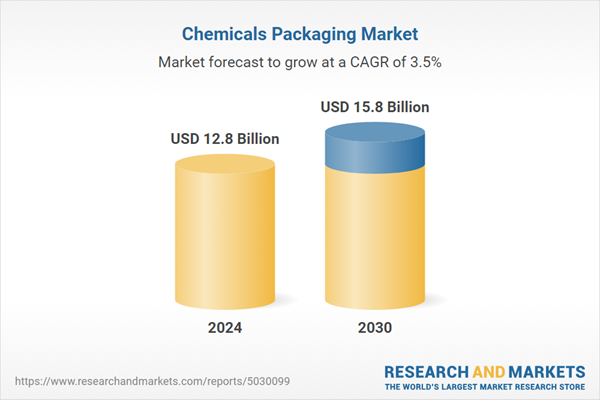

The report analyzes the Chemicals Packaging market, presented in terms of market value (USD). The analysis covers the key segments and geographic regions outlined below.- Segments: Segment (Sacks, Pails & Drums, FIBC, Other Segments); Application (Commodity Chemicals, Specialty Chemicals, Petrochemicals, Other Applications).

- Geographic Regions/Countries: World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; Spain; Russia; and Rest of Europe); Asia-Pacific (Australia; India; South Korea; and Rest of Asia-Pacific); Latin America (Argentina; Brazil; Mexico; and Rest of Latin America); Middle East (Iran; Israel; Saudi Arabia; United Arab Emirates; and Rest of Middle East); and Africa.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the Commodity Chemicals Application segment, which is expected to reach US$9.1 Billion by 2030 with a CAGR of 3.1%. The Specialty Chemicals Application segment is also set to grow at 4.4% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $3.4 Billion in 2024, and China, forecasted to grow at an impressive 5.2% CAGR to reach $3.2 Billion by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Chemicals Packaging Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Chemicals Packaging Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Chemicals Packaging Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as Airlite Plastics Co., Amcor Ltd., Ardagh Group SA, Bemis Company, Inc., Champion Plastics and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 42 companies featured in this Chemicals Packaging market report include:

- Airlite Plastics Co.

- Amcor Ltd.

- Ardagh Group SA

- Bemis Company, Inc.

- Champion Plastics

- Dow, Inc.

- DuPont de Nemours, Inc.

- Emerald Packaging, Inc.

- Fabri-Kal

- Georgia-Pacific LLC

- Gerresheimer AG

- Graham Packaging Company

- Huhtamaki Oyj

- Innovia Films Ltd.

- Mondi plc

- Nampak Ltd.

- Owens-Illinois, Inc.

- Plastic Ingenuity, Inc.

- PolyOne Corporation

- Sonoco Products Company

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Airlite Plastics Co.

- Amcor Ltd.

- Ardagh Group SA

- Bemis Company, Inc.

- Champion Plastics

- Dow, Inc.

- DuPont de Nemours, Inc.

- Emerald Packaging, Inc.

- Fabri-Kal

- Georgia-Pacific LLC

- Gerresheimer AG

- Graham Packaging Company

- Huhtamaki Oyj

- Innovia Films Ltd.

- Mondi plc

- Nampak Ltd.

- Owens-Illinois, Inc.

- Plastic Ingenuity, Inc.

- PolyOne Corporation

- Sonoco Products Company

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 273 |

| Published | February 2026 |

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 12.8 Billion |

| Forecasted Market Value ( USD | $ 15.8 Billion |

| Compound Annual Growth Rate | 3.5% |

| Regions Covered | Global |