Global Chemical Surface Treatment Market - Key Trends and Drivers Summarized

Why Is Chemical Surface Treatment Crucial for Modern Industries?

Chemical surface treatment plays an essential role in numerous industries, acting as a pivotal process that enhances the performance and longevity of materials. But why has this technology become indispensable? Modern industries, from aerospace and automotive to electronics and construction, rely on advanced materials like metals, plastics, and ceramics to meet increasingly stringent quality standards. These materials, though inherently strong, often require chemical surface treatments to ensure they can withstand the rigors of their working environments. By altering the surface properties, these treatments significantly improve corrosion resistance, wear tolerance, and adhesion characteristics. For instance, in the automotive industry, components are frequently exposed to moisture, extreme temperatures, and other harsh conditions. Without proper surface treatments, such as phosphating or anodizing, parts would degrade faster, leading to failures, increased maintenance costs, and potential safety hazards. In the aerospace sector, the lightweight materials used must be treated to ensure they maintain their integrity under extreme pressure and temperature fluctuations. This illustrates the growing reliance on chemical surface treatments across industries to enhance product durability and performance, making them an integral part of modern manufacturing processes.Which Chemical Surface Treatment Methods Are Most Common and Why?

There are numerous methods employed in chemical surface treatment, each designed to address specific material challenges and functional requirements. One of the most widely used techniques is chemical conversion coating, which involves converting the surface of a metal into a protective, corrosion-resistant layer. Phosphating and chromating are common examples of this method, providing essential protection in industries like automotive and construction. Chromating, though highly effective, has recently faced environmental concerns due to the use of hexavalent chromium, leading to the development of chromium-free alternatives. Another key method is anodizing, primarily used on aluminum, which increases the thickness of the natural oxide layer on the surface, making the material more resistant to wear and corrosion. Pickling, often used in steel production, removes oxides and contaminants from the surface, preparing it for subsequent treatments or coatings. Passivation is another important process, particularly for stainless steel, where it removes iron particles from the surface to enhance the material's corrosion resistance. Additionally, etching and electroplating provide functional benefits such as improved adhesion, aesthetic appeal, and electrical conductivity. Each of these processes is selected based on the specific material properties, desired performance, and environmental conditions the component will face, making chemical surface treatments a critical part of the manufacturing process for a wide range of industries.How Are New Developments Shaping the Future of Chemical Surface Treatment?

As industries evolve and global standards tighten, the field of chemical surface treatment is undergoing significant transformation to meet new challenges and demands. Environmental sustainability has emerged as a major driver of change in surface treatment technologies, prompting the development of more eco-friendly alternatives. Traditional methods, particularly those that involve harmful chemicals like hexavalent chromium, are being replaced by safer, greener options. This shift is not just due to regulatory pressure, but also a reflection of growing consumer awareness and demand for sustainable production practices. Innovations in nanotechnology have opened new avenues in surface treatments, allowing for the creation of ultra-thin, highly durable coatings that offer superior protection with minimal material usage. These advancements have resulted in treatments like nanocoatings, which can provide enhanced corrosion resistance and wear protection while maintaining the material's lightweight properties - critical for industries like aerospace and automotive that require strong yet light components. Automation and digitalization are also reshaping the landscape, enabling precision in treatment application and quality control, thereby reducing production errors and increasing efficiency. As a result, chemical surface treatment is now a more streamlined, efficient, and environmentally responsible process, ready to meet the demands of modern industrial applications.What Is Fueling the Growth in the Chemical Surface Treatment Market?

The growth in the chemical surface treatment market is driven by several factors, primarily the increasing use of lightweight materials, the rising demand for advanced manufacturing techniques, and the global push for sustainability. As industries like automotive, aerospace, and electronics shift towards lighter materials such as aluminum and composite materials, surface treatments become essential to enhance these materials' performance and durability. For example, the automotive sector's move towards electric vehicles has spurred the need for advanced chemical treatments that improve the corrosion resistance of battery casings and other critical components, ensuring longevity in harsh conditions. The aerospace industry, similarly, relies heavily on these treatments to maintain the structural integrity of lightweight materials used in aircraft construction, where durability and resistance to extreme conditions are crucial. The trend toward sustainability is another significant growth driver, as both manufacturers and consumers demand more eco-friendly products and processes. This has led to a rise in environmentally friendly surface treatments, particularly in regions like Europe and North America, where regulations are stringent, and green technologies are prioritized. Technological advancements in the field have also contributed to the market's growth. Innovations like plasma electrolytic oxidation and sol-gel coatings have expanded the scope of applications, allowing for more precise and effective treatments on complex geometries. Moreover, consumer expectations have evolved, with a growing emphasis on product longevity and performance, especially in sectors like electronics and construction, further propelling the demand for cutting-edge chemical surface treatments. As these trends continue, the market is poised for robust growth, with manufacturers investing in research and development to stay ahead of the curve.Report Scope

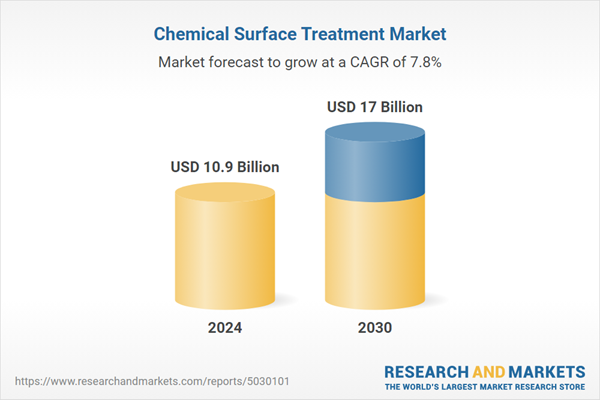

The report analyzes the Chemical Surface Treatment market, presented in terms of market value (USD). The analysis covers the key segments and geographic regions outlined below.- Segments: Chemical Type (Surface Cleaners, Surface Plating Chemicals, Surface Conversion Coatings, Surface Anodizing Chemicals, Surface Passivation Chemicals, Other Chemical Types); Material (Metal Material, Plastic Material, Composite Material, Other Materials); End-Use (Automotive End-Use, Aerospace & Defense End-Use, Electronics End-Use, Industrial Machinery End-Use, Construction End-Use, Other End-Uses).

- Geographic Regions/Countries: World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; Spain; Russia; and Rest of Europe); Asia-Pacific (Australia; India; South Korea; and Rest of Asia-Pacific); Latin America (Argentina; Brazil; Mexico; and Rest of Latin America); Middle East (Iran; Israel; Saudi Arabia; United Arab Emirates; and Rest of Middle East); and Africa.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the Metal Material segment, which is expected to reach US$5.8 Billion by 2030 with a CAGR of 7.3%. The Plastic Material segment is also set to grow at 9.1% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $1.9 Billion in 2024, and China, forecasted to grow at an impressive 9.3% CAGR to reach $3.6 Billion by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Chemical Surface Treatment Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Chemical Surface Treatment Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Chemical Surface Treatment Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as A Brite Company, Advanced Chemical Company, Atotech an MKS Brand, BASF Coatings GmbH, Bunty LLC and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 65 companies featured in this Chemical Surface Treatment market report include:

- A Brite Company

- Advanced Chemical Company

- Atotech an MKS Brand

- BASF Coatings GmbH

- Bunty LLC

- C. Uyemura & Co., Ltd.

- Chemetall GmbH

- Coventya Holding SAS

- Dow, Inc.

- Elementis Chromium LP

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- A Brite Company

- Advanced Chemical Company

- Atotech an MKS Brand

- BASF Coatings GmbH

- Bunty LLC

- C. Uyemura & Co., Ltd.

- Chemetall GmbH

- Coventya Holding SAS

- Dow, Inc.

- Elementis Chromium LP

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 643 |

| Published | February 2026 |

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 10.9 Billion |

| Forecasted Market Value ( USD | $ 17 Billion |

| Compound Annual Growth Rate | 7.8% |

| Regions Covered | Global |