Global Halal Cosmetics Market - Key Trends and Drivers Summarized

Why Are Halal Cosmetics Becoming Essential for Global Beauty Markets and Ethical Consumerism?

Halal cosmetics have emerged as essential products in the global beauty industry, driven by the rising demand for ethical, sustainable, and religiously compliant beauty options. But why are halal cosmetics so critical today? Halal, an Arabic term meaning 'permissible,' refers to products that adhere to Islamic laws and guidelines. For cosmetics to be certified halal, they must be free from prohibited substances, such as alcohol or animal-derived ingredients like gelatin or collagen from non-halal sources, and must be produced without animal cruelty or unethical practices. These standards resonate deeply with Muslim consumers, who seek beauty products that align with their religious beliefs and lifestyle choices.The importance of halal cosmetics extends beyond the Muslim community. As ethical consumerism grows worldwide, many non-Muslim consumers are drawn to halal beauty products for their clean, cruelty-free, and eco-friendly attributes. The appeal of halal cosmetics lies in their transparency, purity, and sustainability, making them an attractive option for individuals seeking products that are not only safe and high-quality but also align with their personal values. As the demand for ethical and natural beauty products continues to grow, halal cosmetics are becoming a key player in the global beauty market, catering to a broad audience interested in conscious consumerism.

How Are Technological Advancements and Innovations Enhancing the Production and Appeal of Halal Cosmetics?

Technological advancements and innovations are significantly enhancing the production, safety, and appeal of halal cosmetics, making them more accessible to a diverse range of consumers. One of the most important advancements is the development of plant-based alternatives to ingredients that are traditionally derived from animals or alcohol. For example, plant-based collagen, which is used for anti-aging products, and botanical emulsifiers and preservatives are now widely used to replace non-halal substances. These alternatives not only comply with halal standards but also appeal to consumers seeking vegan or natural products. The use of natural ingredients such as shea butter, aloe vera, and coconut oil is increasingly popular in halal cosmetics, helping the industry create products that are both effective and ethically sound.The implementation of advanced extraction and formulation techniques has further improved the quality and performance of halal cosmetics. New extraction methods allow manufacturers to derive potent and pure active ingredients from plants and minerals while ensuring that they meet halal certification standards. These techniques improve the efficacy of halal skincare and makeup products, making them competitive with mainstream, non-halal alternatives. Additionally, advancements in clean beauty formulations ensure that halal cosmetics are free from harmful chemicals like parabens, sulfates, and phthalates, making them safer for all skin types, including sensitive skin. This focus on clean beauty enhances the appeal of halal cosmetics to health-conscious consumers who are not only looking for religiously compliant products but also for formulations that promote overall skin health.

Another critical innovation is the integration of sustainable and eco-friendly practices into the production of halal cosmetics. As environmental concerns continue to rise, halal beauty brands are increasingly adopting sustainable sourcing, biodegradable packaging, and eco-friendly production methods. For instance, halal-certified cosmetics companies are opting for packaging made from recyclable or biodegradable materials to reduce environmental impact. This move towards sustainability aligns with the growing global trend of reducing plastic waste and using renewable resources, further boosting the appeal of halal cosmetics to environmentally conscious consumers.

The rise of halal certification bodies and digital tools has also played a significant role in making halal cosmetics more transparent and accessible. Certification from recognized halal organizations ensures that a product complies with Islamic laws and guidelines. As more brands seek halal certification, consumers are gaining confidence in the authenticity and quality of halal cosmetics. Additionally, the development of apps and online platforms allows consumers to verify the halal status of products more easily. These technological innovations improve transparency, enabling consumers to make informed choices about the products they use, which is particularly important in a market where authenticity and adherence to religious principles are paramount.

The use of artificial intelligence (AI) in product development and consumer engagement is further enhancing the halal cosmetics industry. AI-driven analytics help brands understand consumer preferences, allowing them to tailor products to meet specific skin types, concerns, and regional preferences. AI also plays a role in ingredient formulation, where algorithms can predict how certain combinations of ingredients will perform, ensuring that halal cosmetics meet high performance standards while adhering to halal guidelines. This use of technology allows halal beauty brands to innovate quickly and stay competitive in an increasingly crowded beauty market.

Why Are Halal Cosmetics Critical for Addressing Consumer Demand for Ethical, Safe, and Inclusive Beauty Products?

Halal cosmetics are critical for addressing the growing consumer demand for ethical, safe, and inclusive beauty products because they adhere to high standards of purity, transparency, and sustainability. One of the primary reasons halal cosmetics are so valuable is that they meet the religious and cultural needs of Muslim consumers, offering beauty products that align with their faith. For the world's Muslim population, which exceeds 1.8 billion people, halal-certified cosmetics provide assurance that the products they use are free from forbidden ingredients like pork derivatives, alcohol, or harmful chemicals, and that the manufacturing process adheres to ethical standards, such as cruelty-free practices.In addition to meeting religious requirements, halal cosmetics align with the broader shift toward ethical consumerism. Modern consumers, regardless of their religious background, are increasingly concerned with the ethical aspects of the products they purchase, including how they are sourced, produced, and tested. Halal cosmetics emphasize cruelty-free production, ensuring that no animal testing is involved, which is a key consideration for many ethically minded consumers. Furthermore, the avoidance of harmful or harsh chemicals in halal formulations appeals to consumers who are seeking safer, cleaner beauty options. This makes halal cosmetics not only relevant to Muslim consumers but also to a wider audience interested in ethical, transparent, and health-conscious beauty products.

Safety is another critical aspect of halal cosmetics, particularly for consumers with sensitive skin or specific health concerns. Since halal products are free from alcohol and animal by-products, they tend to be less irritating and more suitable for people with allergies, sensitive skin, or those seeking natural ingredients. This focus on purity and safety makes halal cosmetics a trusted choice for consumers who prioritize clean beauty without compromising on efficacy. Additionally, the rise in awareness about the potential risks of synthetic chemicals has led many consumers to seek out halal-certified products as a safer, more natural alternative.

The inclusive nature of halal cosmetics is also vital in addressing the diverse needs of global consumers. As the beauty industry becomes more inclusive, halal cosmetics cater to a wide range of skin tones, textures, and concerns. Halal beauty brands are expanding their product lines to offer inclusive makeup shades, skincare products for various skin types, and haircare options for different hair textures. This inclusivity ensures that halal cosmetics are accessible to a broad demographic, promoting diversity within the beauty industry. By offering products that cater to people of all backgrounds, halal cosmetics stand out as a welcoming and inclusive choice for consumers looking for beauty products that align with their ethical, religious, and personal values.

The sustainability of halal cosmetics also addresses the demand for environmentally responsible beauty products. As more consumers become aware of the environmental impact of their purchasing decisions, they are looking for brands that prioritize sustainability, such as using eco-friendly packaging, ethically sourced ingredients, and cruelty-free production methods. Halal cosmetics, by their very nature, often align with these principles, as the production process avoids harmful chemicals, focuses on ethical sourcing, and promotes humane practices. This makes halal cosmetics an appealing choice for consumers who are both environmentally and socially conscious.

What Factors Are Driving the Growth of the Halal Cosmetics Market?

Several key factors are driving the rapid growth of the halal cosmetics market, including the expanding global Muslim population, the rising demand for ethical and sustainable beauty products, increasing disposable incomes in emerging markets, and the growing awareness of halal certification and clean beauty trends. First and foremost, the global Muslim population is the primary driver of the halal cosmetics market. As the Muslim community grows, particularly in regions like the Middle East, Southeast Asia, and parts of Africa, so does the demand for halal-certified beauty products. These consumers prioritize products that align with their religious beliefs, and as more halal-certified brands enter the market, Muslim consumers are offered a greater variety of beauty options that cater to their specific needs.The rising demand for ethical and sustainable beauty products is another significant factor fueling the growth of the halal cosmetics market. Consumers are increasingly seeking products that are cruelty-free, free from harmful chemicals, and produced in environmentally responsible ways. Halal cosmetics naturally align with these values, as they are produced according to strict ethical guidelines that prohibit animal testing, harmful ingredients, and unethical practices. This overlap between halal principles and broader ethical consumerism trends has expanded the market for halal beauty products beyond the Muslim community, attracting a wide range of consumers who prioritize clean, ethical, and sustainable beauty.

The increase in disposable incomes in emerging markets, particularly in countries with large Muslim populations, is also contributing to the growth of the halal cosmetics market. As economies in regions such as the Middle East, Southeast Asia, and Africa continue to grow, more consumers are able to afford premium beauty products, including halal-certified options. These regions have a growing middle class with a strong desire for products that align with their religious beliefs and ethical values, making them prime markets for halal beauty brands. The combination of rising purchasing power and a desire for high-quality, religiously compliant products has created a robust demand for halal cosmetics in these regions.

Growing awareness and education about halal certification and clean beauty are also driving market expansion. As more consumers become informed about the benefits of halal-certified cosmetics - such as purity, safety, and ethical production - there is an increasing willingness to pay for products that meet these standards. Halal certification has become a symbol of trust and quality for consumers, providing assurance that the product adheres to rigorous standards of cleanliness, safety, and ethics. This awareness is further boosted by marketing efforts from halal beauty brands, as well as the availability of apps and online platforms that allow consumers to verify the halal status of products.

The influence of social media and beauty influencers is another factor driving the growth of the halal cosmetics market. Beauty influencers, particularly those who promote ethical and clean beauty, are increasingly featuring halal-certified products in their content, which raises awareness and interest among their followers. Social media platforms like Instagram, YouTube, and TikTok are powerful tools for showcasing the benefits of halal cosmetics and introducing new products to a global audience. This exposure has played a significant role in expanding the market, particularly among younger consumers who are more inclined to follow beauty trends and seek out innovative, ethical products.

Finally, the rise of e-commerce and global retail platforms has made halal cosmetics more accessible to consumers worldwide. Online shopping platforms allow consumers to easily access halal beauty products, regardless of their geographic location. This accessibility has helped halal beauty brands reach new markets and grow their customer base, contributing to the overall expansion of the market.

In conclusion, the growth of the halal cosmetics market is driven by the expanding global Muslim population, increasing demand for ethical and sustainable beauty products, rising disposable incomes in emerging markets, greater awareness of halal certification, and the influence of social media and e-commerce. As consumers continue to seek out beauty products that align with their values - whether those values are religious, ethical, or health-focused - the demand for halal cosmetics is expected to grow, making these products an increasingly important part of the global beauty industry.

Report Scope

The report analyzes the Halal Cosmetics market, presented in terms of market value (USD). The analysis covers the key segments and geographic regions outlined below.- Segments: Segment (Personal Care Products, Color Cosmetics, Fragrances); Application (Hair Care, Skin Care, Face Care, Beauty Care).

- Geographic Regions/Countries: World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; Spain; Russia; and Rest of Europe); Asia-Pacific (Australia; India; South Korea; and Rest of Asia-Pacific); Latin America (Argentina; Brazil; Mexico; and Rest of Latin America); Middle East (Iran; Israel; Saudi Arabia; United Arab Emirates; and Rest of Middle East); and Africa.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the Hair Care Application segment, which is expected to reach US$55.1 Billion by 2030 with a CAGR of 15.6%. The Skin Care Application segment is also set to grow at 14.4% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $17.4 Billion in 2024, and China, forecasted to grow at an impressive 18.3% CAGR to reach $38.3 Billion by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Halal Cosmetics Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Halal Cosmetics Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Halal Cosmetics Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as Clara International Beauty Group, INGLOT Cosmetics, Ivy Beauty Corporation Sdn Bhd, LIASARI SDN. BHD., Martha Tilaar Group and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 46 companies featured in this Halal Cosmetics market report include:

- Clara International Beauty Group

- INGLOT Cosmetics

- Ivy Beauty Corporation Sdn Bhd

- LIASARI SDN. BHD.

- Martha Tilaar Group

- OnePure LLC

- Paragon Cosmetics Pty., Ltd.

- Saaf Skincare

- SirehEmas Marketing Sdn Bhd

- The Halal Cosmetics Company

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Clara International Beauty Group

- INGLOT Cosmetics

- Ivy Beauty Corporation Sdn Bhd

- LIASARI SDN. BHD.

- Martha Tilaar Group

- OnePure LLC

- Paragon Cosmetics Pty., Ltd.

- Saaf Skincare

- SirehEmas Marketing Sdn Bhd

- The Halal Cosmetics Company

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 246 |

| Published | February 2026 |

| Forecast Period | 2024 - 2030 |

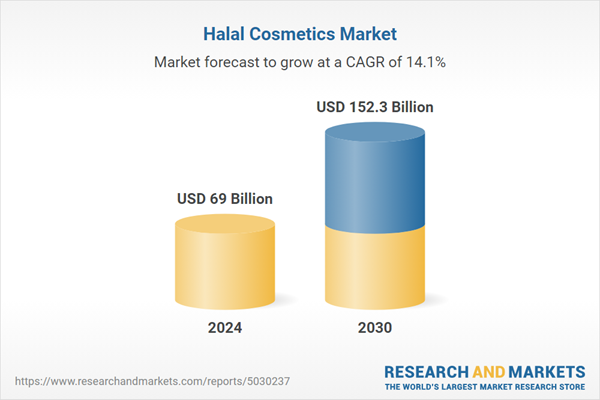

| Estimated Market Value ( USD | $ 69 Billion |

| Forecasted Market Value ( USD | $ 152.3 Billion |

| Compound Annual Growth Rate | 14.1% |

| Regions Covered | Global |