Global Shape Memory Alloys Market - Key Trends & Drivers Summarized

Why Are Shape Memory Alloys Transforming Advanced Engineering and Biomedical Applications?

Shape Memory Alloys (SMAs) are revolutionizing advanced engineering and biomedical applications due to their unique ability to return to a pre-defined shape when exposed to certain stimuli, such as temperature or stress. This distinctive property, known as the shape memory effect, enables SMAs to undergo significant deformation and then recover their original shape when triggered, making them ideal for applications requiring high durability, flexibility, and actuation. SMAs are primarily composed of nickel-titanium (Nitinol) or copper-based alloys, which exhibit excellent mechanical properties, corrosion resistance, and biocompatibility, making them suitable for use in industries such as aerospace, automotive, robotics, and healthcare. Their ability to perform complex movements and return to their original form without permanent deformation is opening new possibilities for innovation and design in various fields.The growing demand for SMAs in the biomedical industry is one of the primary drivers of the global shape memory alloy market. SMAs are widely used in the manufacturing of medical devices such as stents, guidewires, orthodontic archwires, and surgical instruments, where their unique properties enable minimally invasive procedures and enhanced patient outcomes. For instance, Nitinol-based stents can be compressed for easy insertion into blood vessels and then expand to their original shape at body temperature, providing support and restoring blood flow. The biocompatibility of Nitinol and its ability to withstand fatigue and stress without fracturing make it an ideal material for medical implants. As the global healthcare industry continues to expand and the demand for minimally invasive surgical procedures rises, the adoption of SMAs in medical applications is expected to increase significantly, driving market growth.

What Technological Advancements Are Driving the Evolution and Adoption of Shape Memory Alloys?

Technological advancements are playing a pivotal role in enhancing the properties, performance, and applicability of shape memory alloys, enabling their use in more sophisticated and demanding applications. One of the key innovations in this field is the development of advanced alloy compositions and manufacturing techniques that improve the functionality and durability of SMAs. Researchers are exploring new alloy combinations, such as nickel-titanium-copper and nickel-titanium-hafnium, to achieve specific performance characteristics, such as higher transformation temperatures, improved fatigue resistance, and enhanced shape memory properties. These advancements are expanding the applicability of SMAs in environments with extreme temperatures and high mechanical loads, making them suitable for use in aerospace components, automotive actuators, and oil and gas exploration equipment.Another significant technological advancement is the integration of additive manufacturing (3D printing) with SMA production processes. Additive manufacturing enables the creation of complex geometries and customized designs that are difficult or impossible to achieve using traditional manufacturing methods. This capability is particularly valuable for producing intricate SMA components for biomedical implants, micro-actuators, and aerospace systems, where precision and lightweight properties are critical. The use of 3D printing also allows for the rapid prototyping and testing of new SMA designs, accelerating the development of innovative applications. Additionally, advancements in surface treatment and coating technologies are enhancing the corrosion resistance, wear resistance, and biocompatibility of SMAs, making them more durable and reliable for long-term use in challenging environments.

The emergence of smart materials and the integration of shape memory alloys with sensors and control systems is further expanding the scope of SMA applications. SMAs are increasingly being used in the development of smart actuators, sensors, and adaptive structures that can respond to environmental changes in real-time. For example, SMAs are being incorporated into robotic systems and prosthetics to create soft actuators that mimic the movement and flexibility of human muscles. The ability of SMAs to generate significant force and displacement with a small volume and weight is making them ideal for compact and lightweight actuators used in robotics, automotive components, and consumer electronics. The development of hybrid materials that combine SMAs with polymers, ceramics, or other metals is also enabling the creation of multifunctional materials with enhanced performance characteristics. These technological advancements are making SMAs more versatile and effective, supporting their adoption in a wider range of industrial and consumer applications.

How Are Market Dynamics and Industry Standards Shaping the Shape Memory Alloys Market?

The shape memory alloys market is shaped by a complex interplay of market dynamics, industry standards, and evolving consumer demands that are influencing product development, adoption, and strategic priorities. One of the primary market drivers is the increasing demand for high-performance materials in advanced engineering and biomedical applications. Industries such as aerospace, automotive, and healthcare are continuously seeking materials that offer superior mechanical properties, lightweight characteristics, and multifunctionality. SMAs, with their ability to recover their shape and generate actuation force, are finding growing applications in components that require precise movement control, vibration damping, and adaptive functionality. In the automotive industry, for example, SMAs are being used in variable geometry turbochargers, smart suspension systems, and adaptive side mirrors to enhance vehicle performance and safety. The rising focus on lightweight materials to improve fuel efficiency and reduce emissions is further supporting the adoption of SMAs in automotive design.Industry standards and compliance requirements are also playing a critical role in shaping the shape memory alloys market, particularly in sectors such as healthcare and aerospace, where safety, reliability, and performance are paramount. Regulatory agencies such as the U.S. Food and Drug Administration (FDA) and the European Medicines Agency (EMA) have established stringent guidelines for the use of SMAs in medical devices to ensure their safety and efficacy. Compliance with these regulations is essential for manufacturers to gain market access and maintain trust among healthcare providers and patients. Similarly, the aerospace industry has strict material standards for components used in aircraft and spacecraft, requiring manufacturers to conduct extensive testing and validation of SMA properties under various operating conditions. As industry standards continue to evolve to address new application requirements and technological developments, manufacturers are investing in research and development to create SMAs that meet these specifications and provide consistent performance across a range of environments.

Market dynamics such as competition among manufacturers, technological innovation, and economic fluctuations are also influencing the shape memory alloys market. The competitive landscape is characterized by the presence of established material science companies, specialty alloy producers, and innovative startups, each offering a range of SMA products tailored to specific applications and customer needs. Companies are differentiating themselves through product innovation, technical support, and the ability to provide customized alloy compositions and component designs. Technological advancements such as the development of high-performance alloys, additive manufacturing capabilities, and integrated smart systems are enabling manufacturers to offer differentiated products that address the limitations of traditional materials. Economic factors such as fluctuations in raw material prices, trade policies, and global demand for advanced materials are impacting the cost structure and pricing strategies of SMA manufacturers. Navigating these market dynamics and industry standards is essential for companies operating in the shape memory alloys market as they seek to expand their presence and address the needs of advanced engineering and healthcare applications.

What Are the Key Growth Drivers Fueling the Expansion of the Shape Memory Alloys Market?

The growth in the global shape memory alloys market is driven by several key factors, including the rising demand for advanced materials in the healthcare sector, the expanding use of SMAs in automotive and aerospace applications, and the increasing focus on smart materials and adaptive systems. One of the primary growth drivers is the widespread adoption of SMAs in the healthcare industry, where they are used in the development of minimally invasive medical devices such as stents, guidewires, and orthodontic products. The unique properties of SMAs, including biocompatibility, flexibility, and fatigue resistance, make them ideal for medical implants and devices that require precise movement and durability. The growing prevalence of chronic diseases and the increasing demand for advanced medical technologies are driving the use of SMAs in surgical instruments and implants, supporting the growth of the market.Another significant growth driver is the expanding use of shape memory alloys in the automotive and aerospace industries. In the automotive sector, SMAs are being used to create smart components that enhance vehicle performance, safety, and comfort. For example, SMAs are employed in adaptive airbag deployment systems, active grille shutters, and temperature-responsive valves to optimize vehicle efficiency and safety. The use of SMAs in automotive design is also aligned with the industry's focus on lightweight materials that can reduce vehicle weight and improve fuel efficiency. In the aerospace industry, SMAs are used in actuation systems, vibration damping components, and morphing structures that enhance the aerodynamic performance and reduce the weight of aircraft. The ability of SMAs to withstand extreme temperatures and mechanical stress is making them valuable materials for aerospace applications, supporting the adoption of SMAs in both commercial and military aviation.

The increasing focus on smart materials and adaptive systems is also fueling the growth of the shape memory alloys market. SMAs are widely used in the development of smart actuators, sensors, and adaptive structures that can respond to environmental changes such as temperature, pressure, or magnetic fields. These properties are enabling the creation of innovative products such as smart textiles, shape-shifting structures, and self-healing materials that can adapt to changing conditions and perform multiple functions. The integration of SMAs with digital technologies, such as sensors and control systems, is expanding their use in robotics, consumer electronics, and energy-efficient building systems. As demand for smart materials and adaptive systems continues to rise, the adoption of SMAs in these applications is expected to increase, supporting market growth.

Lastly, the growing emphasis on research and development and the exploration of new applications are contributing to the expansion of the shape memory alloys market. Governments, academic institutions, and private companies are investing in research to develop new SMA compositions, enhance their properties, and explore their use in emerging fields such as biomedical engineering, soft robotics, and space exploration. The development of hybrid materials that combine SMAs with other smart materials, such as piezoelectric materials and shape memory polymers, is creating new opportunities for multifunctional products that can perform complex tasks. As demand from key sectors such as healthcare, automotive, aerospace, and robotics continues to rise, and as manufacturers innovate to meet evolving technological needs, the global shape memory alloys market is expected to witness sustained growth, driven by advancements in technology, expanding applications, and the increasing emphasis on high-performance materials for advanced engineering and biomedical solutions.

Report Scope

The report analyzes the Shape Memory Alloys market, presented in terms of market value (USD). The analysis covers the key segments and geographic regions outlined below.- Segments: Type (Nitinol (Nickel-Titanium) Alloys, Copper-based Alloys, Iron-Manganese-Silicon Alloys, Other Types); End-Use (Biomedical End-Use, Aerospace & Defense End-Use, Automotive End-Use, Consumer Electronics & Home Appliances End-Use, Other End-Uses).

- Geographic Regions/Countries: World; USA; Canada; Japan; China; Europe; France; Germany; Italy; UK; Rest of Europe; Asia-Pacific; Rest of World.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the Nitinol (Nickel-Titanium) Alloys segment, which is expected to reach US$25.9 Billion by 2030 with a CAGR of 11%. The Copper-based Alloys segment is also set to grow at 11.5% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $5.1 Billion in 2024, and China, forecasted to grow at an impressive 12.7% CAGR to reach $5.1 Billion by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Shape Memory Alloys Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Shape Memory Alloys Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Shape Memory Alloys Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as ALB Materials Inc.,, ATI Inc., Baoji Seabird Metal Material Co., Ltd., Boston Centerless, Dynalloy Inc, and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 58 companies featured in this Shape Memory Alloys market report include:

- ALB Materials Inc.,

- ATI Inc.

- Baoji Seabird Metal Material Co., Ltd.

- Boston Centerless

- Dynalloy Inc,

- Euroflex GmbH

- Fort Wayne Metals Research Products Corp.

- Furukawa Electric Co., Ltd,

- G. Rau GmbH & Co. KG

- Hangzhou Ualloy Material Co., Ltd

- M & T (Taiwan) Co., Ltd

- Metalwerks Inc.

- Nippon Seisen Co. Ltd.,

- Precision Castparts Corp.,

- SAES Getters S.p.A.

- Sma Wires India

- Stanford Advanced Materials

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- ALB Materials Inc.,

- ATI Inc.

- Baoji Seabird Metal Material Co., Ltd.

- Boston Centerless

- Dynalloy Inc,

- Euroflex GmbH

- Fort Wayne Metals Research Products Corp.

- Furukawa Electric Co., Ltd,

- G. Rau GmbH & Co. KG

- Hangzhou Ualloy Material Co., Ltd

- M & T (Taiwan) Co., Ltd

- Metalwerks Inc.

- Nippon Seisen Co. Ltd.,

- Precision Castparts Corp.,

- SAES Getters S.p.A.

- Sma Wires India

- Stanford Advanced Materials

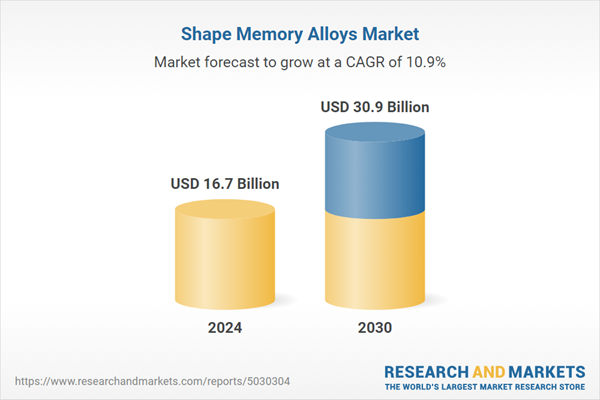

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 315 |

| Published | February 2026 |

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 16.7 Billion |

| Forecasted Market Value ( USD | $ 30.9 Billion |

| Compound Annual Growth Rate | 10.9% |

| Regions Covered | Global |