Global Refrigerants Market - Key Trends and Drivers Summarized

How Are Refrigerants Integral to Modern Cooling Systems?

Refrigerants are crucial components in modern cooling systems, including air conditioners, refrigerators, and heat pumps, playing a vital role in regulating temperature by absorbing and releasing heat during the refrigeration cycle. These chemical compounds undergo phase changes from liquid to gas and back to liquid as they circulate through the cooling system, enabling the transfer of heat from the interior of a building or appliance to the exterior environment. Refrigerants are used in a wide range of applications, from residential and commercial air conditioning to industrial refrigeration and automotive climate control. The efficiency, environmental impact, and safety of cooling systems are heavily dependent on the type of refrigerant used, making the selection and management of refrigerants a critical aspect of system design and operation.What Are the Environmental Considerations Surrounding Refrigerants?

Environmental considerations are increasingly influencing the development and use of refrigerants, particularly in light of global efforts to reduce greenhouse gas emissions and combat climate change. Many traditional refrigerants, such as chlorofluorocarbons (CFCs) and hydrochlorofluorocarbons (HCFCs), have been phased out due to their high ozone depletion potential (ODP) and global warming potential (GWP). In response, the industry has shifted towards more environmentally friendly alternatives, such as hydrofluorocarbons (HFCs), hydrofluoroolefins (HFOs), and natural refrigerants like ammonia, carbon dioxide, and hydrocarbons. These alternatives offer lower GWP and ODP, making them more sustainable options for modern cooling systems. However, the transition to these newer refrigerants also presents challenges, such as the need for system redesigns, increased costs, and safety considerations related to flammability and toxicity. The industry's ongoing efforts to balance environmental impact with performance and safety are driving innovation in refrigerant technologies.What Are the Key Applications and Benefits of Refrigerants?

Refrigerants are used in a variety of applications across different industries, offering significant benefits that are essential to modern life. In residential and commercial buildings, refrigerants are used in air conditioning systems to provide a comfortable indoor environment, particularly in hot climates. In the food and beverage industry, refrigerants are critical for preserving perishable goods, from refrigeration in supermarkets to large-scale industrial cold storage facilities. Refrigerants are also used in automotive air conditioning systems, ensuring passenger comfort during travel. The primary benefits of refrigerants include their ability to efficiently transfer heat, enabling the cooling and preservation of spaces and products. Additionally, advances in refrigerant technology have led to the development of more energy-efficient and environmentally friendly cooling systems, contributing to reduced energy consumption and lower greenhouse gas emissions. These advantages make refrigerants indispensable in a wide range of applications, supporting the modern lifestyle and industrial processes.What Factors Are Driving the Growth in the Refrigerants Market?

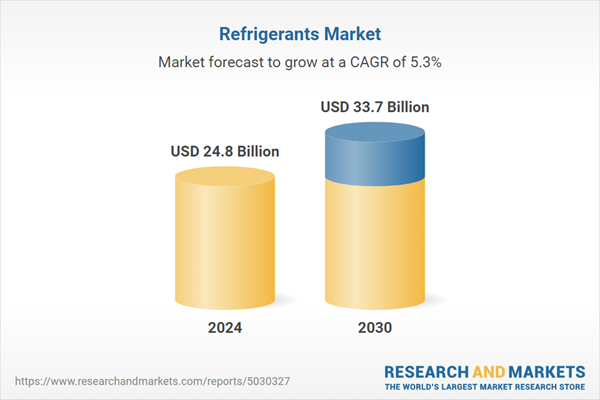

The growth in the Refrigerants market is driven by several factors. The increasing demand for cooling solutions in residential, commercial, and industrial sectors is a significant driver, as rising global temperatures and urbanization trends contribute to greater reliance on air conditioning and refrigeration. Environmental regulations aimed at reducing the use of high-GWP refrigerants are also propelling market growth, as the industry transitions to more sustainable alternatives. Technological advancements in refrigeration and air conditioning systems are further boosting demand for new refrigerants that offer improved efficiency and safety. Additionally, the growth of the automotive industry, particularly in emerging markets, is contributing to increased demand for automotive refrigerants. These factors, combined with the continuous development of new refrigerant formulations and applications, are driving the sustained growth of the Refrigerants market.Report Scope

The report analyzes the Refrigerants market, presented in terms of market value (USD). The analysis covers the key segments and geographic regions outlined below.- Segments: Type (Inorganic, Hydrocarbons, Zeotropic, Azeotropic, Halocarbons); Application (Air Conditioners, Refrigeration).

- Geographic Regions/Countries: World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; Spain; Russia; and Rest of Europe); Asia-Pacific (Australia; India; South Korea; and Rest of Asia-Pacific); Latin America (Argentina; Brazil; Mexico; and Rest of Latin America); Middle East (Iran; Israel; Saudi Arabia; United Arab Emirates; and Rest of Middle East); and Africa.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the Inorganic Refrigerants segment, which is expected to reach US$12.2 Billion by 2030 with a CAGR of 6.3%. The Hydrocarbons Refrigerants segment is also set to grow at 5.3% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $6.5 Billion in 2024, and China, forecasted to grow at an impressive 9.2% CAGR to reach $8 Billion by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Refrigerants Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Refrigerants Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Refrigerants Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as A-Gas International, AGC Inc., Airgas Inc., Arkema Group, Changsu 3f Fluorochemical Industry Co. Ltd. and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 38 companies featured in this Refrigerants market report include:

- A-Gas International

- AGC Inc.

- Airgas Inc.

- Arkema Group

- Changsu 3f Fluorochemical Industry Co. Ltd.

- Daikin Industries Ltd.

- Dongyue Group Ltd.

- Gas Servei S.A.

- Gujarat Fluorochemicals Ltd.

- Harp International Ltd.

- Honeywell International, Inc.

- Linde AG

- Mexichem Fluor S.A. de C.V.

- Navin Fluorine International Limited

- Oz-Chill Refrigerants

- Quimobasicos

- Refrigerant Solutions Inc.

- Shandong Yue'an Chemical Co., Ltd

- Sinochem Group Co., Ltd.

- SRF Ltd.

- Tazzetti S.p.A.

- The Chemours Company

- Zhejiang Fotech International Co Ltd.

- Zhejiang Juhua Co., Ltd.

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- A-Gas International

- AGC Inc.

- Airgas Inc.

- Arkema Group

- Changsu 3f Fluorochemical Industry Co. Ltd.

- Daikin Industries Ltd.

- Dongyue Group Ltd.

- Gas Servei S.A.

- Gujarat Fluorochemicals Ltd.

- Harp International Ltd.

- Honeywell International, Inc.

- Linde AG

- Mexichem Fluor S.A. de C.V.

- Navin Fluorine International Limited

- Oz-Chill Refrigerants

- Quimobasicos

- Refrigerant Solutions Inc.

- Shandong Yue'an Chemical Co., Ltd

- Sinochem Group Co., Ltd.

- SRF Ltd.

- Tazzetti S.p.A.

- The Chemours Company

- Zhejiang Fotech International Co Ltd.

- Zhejiang Juhua Co., Ltd.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 192 |

| Published | February 2026 |

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 24.8 Billion |

| Forecasted Market Value ( USD | $ 33.7 Billion |

| Compound Annual Growth Rate | 5.3% |

| Regions Covered | Global |