Global Crude Oil Carriers Market - Key Trends & Drivers Summarized

How Are Global Oil Trade Patterns Influencing The Crude Oil Carriers Market?

The global crude oil carriers market is intricately linked to the dynamics of international oil trade patterns, which are influenced by geopolitical developments, supply and demand imbalances, and changes in energy policies. The market comprises various types of tankers, including Very Large Crude Carriers (VLCCs), Suezmax, and Aframax vessels, which are essential for transporting crude oil from production regions to refineries and consumption markets worldwide. The growing demand for energy in emerging economies, particularly in Asia-Pacific regions like China and India, is driving the need for crude oil imports, thereby boosting the demand for large-capacity crude oil carriers. Additionally, fluctuations in oil prices and OPEC production cuts influence the movement and storage strategies of crude oil, impacting the market for these carriers.What Technological Advancements Are Enhancing The Efficiency Of Crude Oil Carriers?

Technological advancements are playing a critical role in enhancing the operational efficiency and safety of crude oil carriers. The adoption of eco-friendly and fuel-efficient technologies, such as LNG-fueled engines and dual-fuel propulsion systems, is becoming more prevalent as shipping companies strive to comply with stringent environmental regulations set by organizations like the International Maritime Organization (IMO). Innovations in hull design and coatings are reducing drag and fuel consumption, thereby lowering operational costs and emissions. Moreover, the integration of advanced navigation and cargo management systems enables better route planning and cargo handling, reducing downtime and maximizing carrier utilization. The use of digital twins and predictive maintenance technologies is further aiding in minimizing mechanical failures and optimizing fleet management.How Are Environmental Regulations And Global Policies Shaping The Crude Oil Carriers Market?

Environmental regulations and global policies are significantly shaping the crude oil carriers market by enforcing stricter emission norms and operational standards. The IMO 2020 regulation, which mandates a reduction in sulfur content in marine fuels, has led to a shift toward low-sulfur fuels and the adoption of scrubber systems. Moreover, the growing emphasis on decarbonization and sustainability in the shipping industry is prompting carriers to invest in cleaner technologies and alternative fuels. Meanwhile, geopolitical tensions and trade policies impact crude oil shipping routes, tariffs, and insurance costs, affecting the overall market dynamics. The market is also influenced by strategic decisions made by oil-producing countries regarding output levels and export strategies, further underscoring the complex interplay of regulatory and policy factors.What Factors Are Driving The Growth Of The Crude Oil Carriers Market?

The growth in the crude oil carriers market is driven by several factors, including the rising global demand for crude oil, technological advancements in carrier design and propulsion, and the increasing focus on environmental compliance. A key driver is the expansion of oil refinery capacities in emerging markets, which necessitates efficient crude oil transportation. The global shift towards cleaner shipping fuels and the introduction of dual-fuel propulsion systems are also enhancing the appeal of modern, eco-friendly crude oil carriers. Additionally, strategic crude oil storage practices due to market volatility and geopolitical uncertainties are driving demand for floating storage units (FSUs). Furthermore, the surge in offshore oil production and the increasing need for long-haul crude oil transportation are contributing to market growth. These factors collectively underscore the sustained demand and growth potential for crude oil carriers worldwide.Report Scope

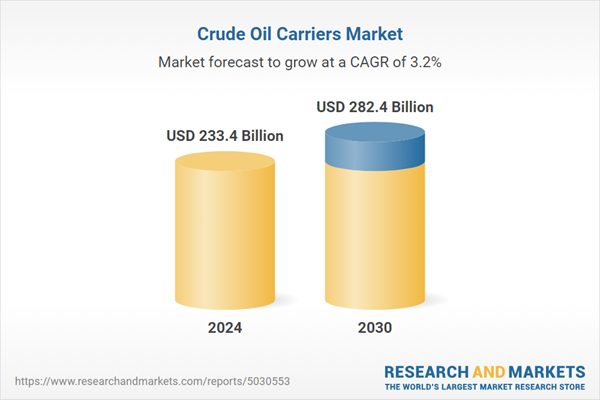

The report analyzes the Crude Oil Carriers market, presented in terms of market value (US$ Thousand). The analysis covers the key segments and geographic regions outlined below.- Segments: Carrier Type (VLCC / ULCC, Aframax, Suezmax, Other Carrier Types).

- Geographic Regions/Countries:World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; and Rest of Europe); Asia-Pacific; Rest of World.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the VLCC / ULCC segment, which is expected to reach US$180.9 Billion by 2030 with a CAGR of a 3.5%. The Aframax segment is also set to grow at 2.6% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $62.7 Billion in 2024, and China, forecasted to grow at an impressive 3% CAGR to reach $44.8 Billion by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Crude Oil Carriers Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Crude Oil Carriers Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Crude Oil Carriers Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as AET Technologies, Bahri, Euronav NV, Frontline Ltd., Maran Tankers Management and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 47 companies featured in this Crude Oil Carriers market report include:

- AET Technologies

- Bahri

- Euronav NV

- Frontline Ltd.

- Maran Tankers Management

- Mitsui O.S.K. Lines, Ltd.

- National Iranian Tanker Company

- NYK Line

- Ocean Tankers (Pte) Ltd.

- Oman Shipping Company SAOC

- OSG Ship Management, Inc.

- PAO Sovcomflot

- Teekay Corporation

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- AET Technologies

- Bahri

- Euronav NV

- Frontline Ltd.

- Maran Tankers Management

- Mitsui O.S.K. Lines, Ltd.

- National Iranian Tanker Company

- NYK Line

- Ocean Tankers (Pte) Ltd.

- Oman Shipping Company SAOC

- OSG Ship Management, Inc.

- PAO Sovcomflot

- Teekay Corporation

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 247 |

| Published | February 2026 |

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 233.4 Billion |

| Forecasted Market Value ( USD | $ 282.4 Billion |

| Compound Annual Growth Rate | 3.2% |

| Regions Covered | Global |