Global Seed Colorant Market - Key Trends and Drivers Summarized

Why Are Seed Colorants Becoming Integral to Seed Treatment and Marketing?

Seed colorants play a vital role in seed treatment and marketing by providing an aesthetic and functional advantage. These colorants are used to differentiate treated seeds from untreated ones, ensuring that treated seeds are not mistakenly consumed by humans or animals. The visual appeal and branding of seeds through colorants also help in product differentiation and marketability. With the growing emphasis on quality and safety in the agricultural sector, seed colorants are increasingly used to indicate that seeds have undergone specific treatments, such as fungicidal or insecticidal coating. This is particularly important in certified and organic seeds, where transparency and traceability are critical. The rising demand for high-quality seeds that meet regulatory standards is driving the adoption of seed colorants among seed manufacturers and agricultural companies.What Innovations Are Shaping the Seed Colorant Market?

The seed colorant market is witnessing significant technological advancements aimed at improving the safety, durability, and visibility of colored seeds. The development of non-toxic and eco-friendly colorants, including natural dyes derived from plant sources, is gaining traction as the agriculture industry moves towards more sustainable practices. Advanced dispersion technologies are being utilized to ensure uniform and long-lasting color coverage on seeds, enhancing their aesthetic appeal and marketability. Additionally, seed colorants are being formulated with binders and adhesives that enhance the adherence of seed treatments, ensuring that protective chemicals remain on the seed coat throughout handling and sowing. The emergence of smart colorants that change color based on environmental conditions or seed viability is also an innovative trend, providing farmers with visual cues about seed quality and readiness for planting.Which Market Segments Are Leading the Adoption of Seed Colorants?

The seed colorant market is segmented by type, application, crop type, and region. Types of seed colorants include pigments, dyes, and polymer-based colorants, with pigments being the most widely used due to their stability and resistance to environmental factors. Applications of seed colorants span from agricultural seeds, such as cereals, oilseeds, and pulses, to ornamental and vegetable seeds. The cereals segment, including wheat, maize, and rice, is a significant user of seed colorants due to the large-scale planting and the need for clear differentiation of treated seeds. Geographically, North America and Europe dominate the seed colorant market, driven by strict regulations on seed treatment and the high adoption of certified seeds. However, Asia-Pacific is emerging as a high-growth region due to increasing agricultural activities, rising awareness about seed safety, and the growing demand for treated and branded seeds.What Are the Key Drivers of Growth in the Seed Colorant Market?

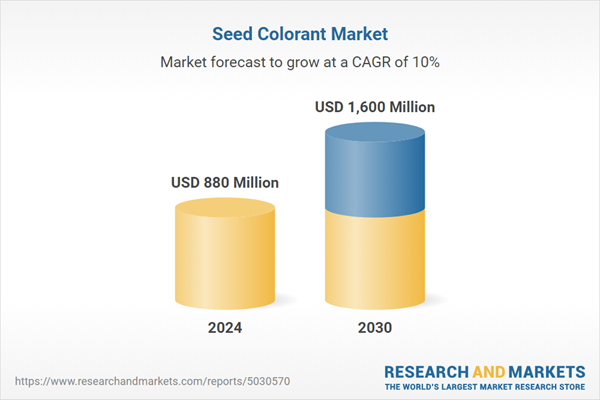

The growth in the seed colorant market is driven by several factors, including the increasing need for seed differentiation, rising demand for high-visibility and branded seeds, and the growing emphasis on seed safety and compliance with regulatory standards. The development of eco-friendly and non-toxic seed colorants is gaining popularity among seed manufacturers looking to align with sustainable agricultural practices. The demand for colorants that offer uniform dispersion and long-lasting visibility is driving innovation in the formulation of seed coatings. The growing adoption of precision planting and the use of colorants to distinguish between treated and non-treated seeds are also supporting market growth. Additionally, the focus on customized seed colorant solutions to meet specific crop and regional needs is creating new opportunities for expansion in the seed colorant market.Report Scope

The report analyzes the Seed Colorant market, presented in terms of market value (USD). The analysis covers the key segments and geographic regions outlined below.- Segments: Crop Type (Grains & Cereals, Oil Seeds, Fruits & Vegetables, Turf & Ornamentals, Other Crop Types).

- Geographic Regions/Countries: World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; Spain; Russia; and Rest of Europe); Asia-Pacific (Australia; India; South Korea; and Rest of Asia-Pacific); Latin America (Argentina; Brazil; Mexico; and Rest of Latin America); Middle East (Iran; Israel; Saudi Arabia; United Arab Emirates; and Rest of Middle East); and Africa.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the Grains & Cereals segment, which is expected to reach US$824.7 Million by 2030 with a CAGR of 11.2%. The Oil Seeds segment is also set to grow at 10.3% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $235.1 Million in 2024, and China, forecasted to grow at an impressive 14.3% CAGR to reach $353.8 Million by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Seed Colorant Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Seed Colorant Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Seed Colorant Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as Aakash Chemicals, BASF SE, Bayer AG, Centor Oceania, Chromatech Incorporated and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 12 companies featured in this Seed Colorant market report include:

- Aakash Chemicals

- BASF SE

- Bayer AG

- Centor Oceania

- Chromatech Incorporated

- Clariant AG

- Germains Seed Technology Inc.

- Globachem NV

- Greenville Colorants

- INCOTEC Group BV

- Mahendra Overseas

- Samarudhi Chemical Private Limited

- Sensient Technologies Corporation

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Aakash Chemicals

- BASF SE

- Bayer AG

- Centor Oceania

- Chromatech Incorporated

- Clariant AG

- Germains Seed Technology Inc.

- Globachem NV

- Greenville Colorants

- INCOTEC Group BV

- Mahendra Overseas

- Samarudhi Chemical Private Limited

- Sensient Technologies Corporation

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 158 |

| Published | February 2026 |

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 880 Million |

| Forecasted Market Value ( USD | $ 1600 Million |

| Compound Annual Growth Rate | 10.0% |

| Regions Covered | Global |