Global Sedimentation and Centrifugation Market - Key Trends and Drivers Summarized

Why Are Sedimentation and Centrifugation Vital for Industrial and Biotechnological Processes?

Sedimentation and centrifugation are critical separation techniques used across various industries, including biotechnology, pharmaceuticals, food and beverages, wastewater treatment, and mining. These methods are essential for separating solids from liquids, purifying cells, proteins, and other biomolecules, and clarifying fluids. Sedimentation relies on gravitational forces to separate particles based on their size and density, while centrifugation uses centrifugal force to achieve faster and more efficient separation. The demand for sedimentation and centrifugation equipment is rising in industries where process efficiency, yield, and product quality are critical. In the biopharmaceutical industry, centrifugation is widely used for cell harvesting, purification of vaccines, and production of monoclonal antibodies. In the wastewater treatment sector, sedimentation and centrifugation play a vital role in removing solids and impurities, ensuring compliance with environmental regulations.What Technological Advancements Are Enhancing Sedimentation and Centrifugation Techniques?

Technological advancements are significantly enhancing the efficiency and capabilities of sedimentation and centrifugation equipment, making them more suitable for diverse applications. The development of high-speed and high-capacity centrifuges is enabling faster and more efficient separation, particularly in large-scale industrial processes. The integration of automation and digital control systems is providing greater precision, repeatability, and ease of operation, reducing manual intervention and improving process reliability. The emergence of continuous centrifugation and clarification techniques is gaining traction in bioprocessing, where maintaining high yield and product purity is essential. Moreover, the development of compact and portable centrifuges for point-of-care and laboratory applications is expanding the use of these techniques in clinical diagnostics, research, and cell therapy. These technological advancements are driving the adoption of sedimentation and centrifugation equipment across various sectors.Which Market Segments Are Leading the Adoption of Sedimentation and Centrifugation?

The sedimentation and centrifugation market is segmented by type, application, end-use industry, and region. Types of equipment include decanter centrifuges, disc-stack centrifuges, tubular bowl centrifuges, and clarifiers, each designed for specific separation needs and applications. Applications span from bioprocessing, cell harvesting, and protein purification to wastewater treatment, mining, and chemical processing. The biopharmaceutical sector is one of the largest adopters of sedimentation and centrifugation equipment due to the critical need for high purity and yield in biomanufacturing processes. The wastewater treatment sector is also a significant user of these techniques for sludge dewatering and water purification. Geographically, North America and Europe dominate the market due to advanced industrial and biotechnological infrastructures, while Asia-Pacific is emerging as a high-growth region driven by increasing investments in biotechnology, healthcare, and environmental management.What Are the Key Drivers of Growth in the Sedimentation and Centrifugation Market?

The growth in the sedimentation and centrifugation market is driven by several factors, including advancements in high-speed centrifugation technologies, increasing demand in biopharmaceutical and wastewater treatment sectors, and the rising focus on process efficiency and sustainability. The development of continuous centrifugation and clarification techniques is enhancing the efficiency and yield of bioprocessing applications, driving their adoption in the biotechnology and pharmaceutical industries. The growing emphasis on environmental sustainability and the need for efficient wastewater treatment solutions are expanding the demand for sedimentation and centrifugation equipment. The integration of automation and digital control systems is improving process reliability and reducing operational costs, making these techniques more attractive to a wider range of industries. Additionally, the expansion of applications in sectors such as clinical diagnostics, cell therapy, and food and beverage processing is further supporting market growth.Report Scope

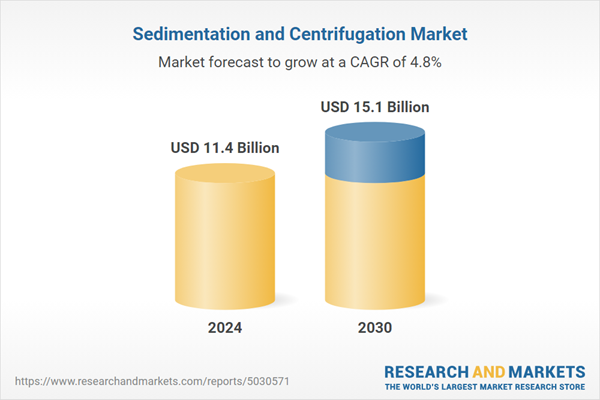

The report analyzes the Sedimentation and Centrifugation market, presented in terms of market value (USD). The analysis covers the key segments and geographic regions outlined below.- Segments: Segment (Clarifiers, Disk Centrifuge, Decanter, Dissolved Air Flotation, Hydrocyclone).

- Geographic Regions/Countries: World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; Spain; Russia; and Rest of Europe); Asia-Pacific (Australia; India; South Korea; and Rest of Asia-Pacific); Latin America (Argentina; Brazil; Mexico; and Rest of Latin America); Middle East (Iran; Israel; Saudi Arabia; United Arab Emirates; and Rest of Middle East); and Africa.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the Clarifiers segment, which is expected to reach US$7 Billion by 2030 with a CAGR of 5.3%. The Disk Centrifuge segment is also set to grow at 4.5% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $3 Billion in 2024, and China, forecasted to grow at an impressive 8.4% CAGR to reach $3.5 Billion by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Sedimentation and Centrifugation Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Sedimentation and Centrifugation Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Sedimentation and Centrifugation Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as Alfa Laval AB, Andritz AG, Eppendorf AG, Evoqua Water Technologies LLC, Flottweg SE and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 16 companies featured in this Sedimentation and Centrifugation market report include:

- Alfa Laval AB

- Andritz AG

- Eppendorf AG

- Evoqua Water Technologies LLC

- Flottweg SE

- FLSmidth & Co A/S

- GEA Group AG

- Gruppo Pieralisi MAIP SpA

- Helmer Scientific

- Hettich Instruments, LP.

- Hiller Separation & Process

- Labnet International, Inc.

- Rousselet Robatel

- TEMA Systems, Inc.

- Thermo Fisher Scientific, Inc.

- Thomas Broadbent & Sons Ltd.

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Alfa Laval AB

- Andritz AG

- Eppendorf AG

- Evoqua Water Technologies LLC

- Flottweg SE

- FLSmidth & Co A/S

- GEA Group AG

- Gruppo Pieralisi MAIP SpA

- Helmer Scientific

- Hettich Instruments, LP.

- Hiller Separation & Process

- Labnet International, Inc.

- Rousselet Robatel

- TEMA Systems, Inc.

- Thermo Fisher Scientific, Inc.

- Thomas Broadbent & Sons Ltd.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 281 |

| Published | January 2026 |

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 11.4 Billion |

| Forecasted Market Value ( USD | $ 15.1 Billion |

| Compound Annual Growth Rate | 4.8% |

| Regions Covered | Global |