Global Ride Hailing Services Market - Key Trends and Drivers Summarized

How Are Ride Hailing Services Redefining Urban Mobility?

Ride hailing services have transformed urban transportation by providing an on-demand and convenient alternative to traditional taxis and public transport. Companies such as Uber, Lyft, Didi, and Grab have disrupted the conventional taxi industry by leveraging smartphone apps, GPS technology, and cashless payment systems to connect passengers with nearby drivers. This model offers a seamless experience for users, characterized by transparency in pricing, route optimization, and enhanced safety features like driver ratings and trip tracking. Ride hailing services have also introduced various ride options, from economy to luxury, and even carpooling services, catering to a wide range of customer preferences. As urban populations grow and congestion intensifies, these services are becoming integral to modern urban mobility, offering flexible and scalable transportation solutions.What Technological Innovations Are Shaping the Future of Ride Hailing?

Technological advancements are at the heart of the evolution of ride hailing services, driving improvements in efficiency, safety, and user experience. Artificial Intelligence (AI) and Machine Learning (ML) are being used to optimize routing, predict demand, and dynamically adjust pricing to balance supply and demand. The integration of advanced algorithms and data analytics enables real-time decision-making, improving driver allocation and reducing wait times for passengers. Additionally, the development of autonomous vehicles presents a potential paradigm shift for the ride hailing industry. Companies like Waymo and Uber are investing heavily in self-driving technology, which could significantly reduce operational costs and improve service reliability. The incorporation of electric vehicles (EVs) into ride hailing fleets is another significant trend, driven by the growing emphasis on sustainability and reducing carbon emissions in urban areas.What Challenges and Opportunities Exist in the Ride Hailing Market?

Despite the rapid growth, the ride hailing market faces several challenges, including regulatory hurdles, intense competition, and concerns over driver working conditions. Regulatory frameworks vary significantly across countries and cities, with some regions imposing stringent requirements on ride hailing companies, such as licensing, insurance, and data sharing. This regulatory uncertainty can impact market expansion and profitability. Additionally, the market is highly competitive, with companies engaged in price wars and offering various incentives to attract both drivers and customers, which can strain profit margins. However, the market also presents numerous opportunities. The integration of multi-modal transportation options, such as bike-sharing, e-scooters, and public transit within ride hailing apps, is opening new revenue streams and enhancing user convenience. Moreover, the rising adoption of digital payments and the increasing use of smartphones are expanding the potential customer base for ride hailing services.What Factors Are Driving the Growth of the Ride Hailing Services Market?

The growth in the Ride Hailing Services market is driven by several factors, including the increasing urbanization and the need for efficient and flexible transportation solutions in congested cities. Technological advancements such as AI, ML, and autonomous vehicles are enhancing service efficiency and customer experience, propelling market growth. The growing emphasis on sustainability is driving the integration of electric vehicles into ride hailing fleets, appealing to environmentally conscious consumers. Additionally, the expansion of digital payment systems and the increasing penetration of smartphones are broadening the accessibility and convenience of ride hailing services. The rising demand for multi-modal transportation options and the potential for new revenue streams through partnerships with public transport systems are also significant growth drivers in the ride hailing market.Report Scope

The report analyzes the Ride Hailing Services market, presented in terms of market value (USD). The analysis covers the key segments and geographic regions outlined below.- Segments: Service (E-Hailing, Car Sharing, Car Rental, Station-Based Mobility); Vehicle Type (Four-Wheelers, Three-Wheelers, Two-Wheelers, Other Vehicle Types); End-Use (Institutional, Personal).

- Geographic Regions/Countries: World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; and Rest of Europe); Asia-Pacific; Rest of World.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the E-hailing segment, which is expected to reach US$62 Billion by 2030 with a CAGR of 9.6%. The Car Sharing segment is also set to grow at 8.8% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $19.7 Billion in 2024, and China, forecasted to grow at an impressive 8.6% CAGR to reach $18.5 Billion by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Ride Hailing Services Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Ride Hailing Services Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Ride Hailing Services Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as Angkas, Autofleet, Avancar, CabStartup, FREE NOW and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 19 companies featured in this Ride Hailing Services market report include:

- Angkas

- Autofleet

- Avancar

- CabStartup

- FREE NOW

- Higer Bus Company Limited

- inDriver

- Liftago

- Onde

- RideGuru

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Angkas

- Autofleet

- Avancar

- CabStartup

- FREE NOW

- Higer Bus Company Limited

- inDriver

- Liftago

- Onde

- RideGuru

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 183 |

| Published | February 2026 |

| Forecast Period | 2024 - 2030 |

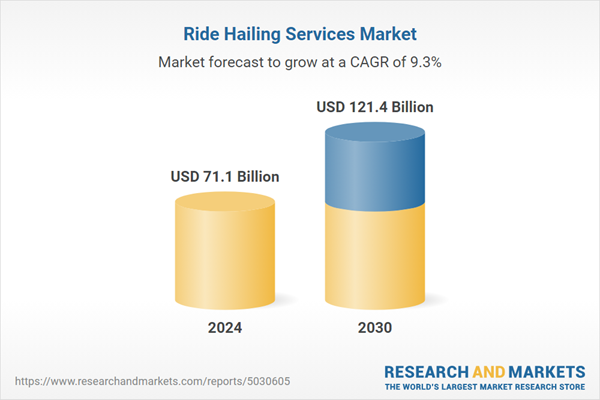

| Estimated Market Value ( USD | $ 71.1 Billion |

| Forecasted Market Value ( USD | $ 121.4 Billion |

| Compound Annual Growth Rate | 9.3% |

| Regions Covered | Global |