Global Optical Character Recognition (OCR) Market - Key Trends & Drivers Summarized

What Is Optical Character Recognition (OCR), and Why Is It So Crucial in Modern Information Processing?

Optical Character Recognition (OCR) is a technology used to convert different types of documents, such as scanned paper documents, PDF files, or images captured by a digital camera, into editable and searchable digital data. OCR systems analyze the shapes and structures of printed or handwritten characters within images or scanned documents and then translate them into machine-readable text. This technology is widely used in various industries for digitizing printed materials, automating data entry, extracting information from forms, and enabling text-to-speech functionality.The importance of OCR lies in its ability to enhance data accessibility, automate workflows, and support digital transformation initiatives across diverse sectors. By converting physical documents into digital formats, OCR helps organizations improve efficiency, reduce manual data entry errors, and facilitate faster information retrieval. It plays a critical role in industries like banking, healthcare, education, government, and logistics, where the need for accurate, efficient, and scalable data processing is high. As businesses and institutions increasingly seek to digitize and streamline their operations, OCR has become a fundamental technology for modern document management, compliance, and customer service.

How Are Technological Advancements Shaping the Optical Character Recognition (OCR) Market?

Technological advancements have significantly improved the accuracy, versatility, and applications of OCR systems, driving innovation across various sectors. One major development is the integration of artificial intelligence (AI) and machine learning (ML) algorithms into OCR technology. AI-driven OCR systems, often referred to as intelligent OCR or ICR (Intelligent Character Recognition), can recognize complex characters, handwriting, and different fonts with higher accuracy. ML models enable these systems to continuously learn from new data inputs, improving their ability to recognize context, interpret errors, and process multilingual text. These advancements have expanded the use of OCR beyond simple text extraction, supporting more complex document processing tasks such as invoice processing, legal document analysis, and automated compliance checks.The adoption of cloud-based OCR solutions has further enhanced the capabilities of OCR technology, making it more accessible and scalable. Cloud-based OCR systems offer real-time processing, greater storage capacity, and seamless integration with other digital tools such as enterprise resource planning (ERP), customer relationship management (CRM), and document management systems. This has enabled organizations to deploy OCR on a larger scale, supporting remote work, global operations, and faster decision-making. Additionally, cloud-based OCR facilitates API integration, allowing developers to embed OCR functionality into various applications, websites, and services, thereby broadening its adoption across different platforms.

The development of natural language processing (NLP) and computer vision technologies has also improved the performance of OCR systems. NLP enhances the contextual understanding of recognized text, allowing OCR to extract relevant information more accurately, even from complex documents like contracts, legal agreements, or medical reports. Computer vision enables OCR systems to better interpret the layout, structure, and visual context of documents, supporting more sophisticated data extraction and organization. These innovations not only improve the accuracy and speed of OCR processing but also align with broader trends toward automation, digital transformation, and smarter information management across industries.

What Are the Emerging Applications of OCR Across Different Industries?

OCR is finding expanding applications across a wide range of industries, driven by the need for automated data processing, digital transformation, and improved customer service. In the banking and financial sector, OCR is widely used to automate document-intensive processes such as processing checks, extracting information from financial statements, verifying identities through scanned IDs, and automating KYC (Know Your Customer) compliance. The ability to quickly and accurately convert paper-based financial documents into digital formats improves operational efficiency, reduces manual errors, and accelerates service delivery.In the healthcare sector, OCR is used to digitize patient records, process insurance claims, and extract data from medical forms, prescriptions, and lab reports. By converting physical medical documents into digital data, healthcare providers can maintain more organized, accessible, and secure electronic health records (EHRs). This supports better patient management, faster information retrieval, and compliance with regulations like the Health Insurance Portability and Accountability Act (HIPAA). OCR's role in automating data entry and processing also reduces administrative burdens on healthcare staff, allowing them to focus more on patient care.

In the logistics and supply chain industry, OCR is used to process bills of lading, invoices, shipping labels, and inventory records. It helps companies improve operational efficiency by streamlining document handling, reducing processing times, and enhancing accuracy in tracking shipments and inventory. OCR technology is also being utilized in transportation systems to automate ticketing processes, license plate recognition, and toll collection. Additionally, in the government sector, OCR is employed to digitize and manage public records, legal documents, and historical archives, making information more accessible to the public while supporting transparency and compliance.

In the education sector, OCR is used to convert textbooks, research papers, and exam papers into digital formats, supporting e-learning platforms, digital libraries, and remote education. By enabling text-to-speech functionality, OCR also supports accessibility for visually impaired students, making educational resources more inclusive. In the retail industry, OCR is applied to automate receipt scanning, customer data extraction, and inventory management, improving both operational efficiency and customer experience.

The expanding applications of OCR across these industries highlight its versatility and critical role in facilitating faster, more accurate, and automated data processing. By supporting digital transformation, improving compliance, and enhancing service delivery, OCR technology continues to drive operational efficiency and innovation across sectors.

What Drives Growth in the Optical Character Recognition (OCR) Market?

The growth in the OCR market is driven by several factors, including increasing demand for digital transformation, rising adoption of automation technologies, and advancements in AI and machine learning. One of the primary growth drivers is the global push for digitization, as organizations seek to reduce reliance on paper-based processes and enhance data accessibility. OCR technology enables faster document processing, easier information retrieval, and seamless integration with digital workflows, making it a fundamental tool for businesses looking to enhance productivity and achieve digital transformation goals.The rising adoption of automation across industries has further fueled demand for OCR solutions. As businesses aim to automate repetitive tasks, reduce manual errors, and improve overall efficiency, OCR technology has become a key enabler of intelligent automation. It supports robotic process automation (RPA) initiatives by converting unstructured data from scanned documents into structured, actionable information that can be further processed by automation systems. This has made OCR an essential component of broader automation strategies, driving its adoption in sectors like finance, healthcare, logistics, and government services.

Advancements in AI and machine learning have contributed to market growth by improving the accuracy, speed, and functionality of OCR systems. AI-driven OCR can handle more complex documents, recognize multiple languages, and interpret diverse character styles, making it suitable for global organizations and multilingual environments. These technological improvements have expanded the use of OCR in areas such as document classification, automated compliance checks, and fraud detection, further increasing its appeal across different industries.

Regulatory compliance and data management requirements have also driven the adoption of OCR technology. Many industries, such as banking, healthcare, and government, are subject to strict regulations regarding data accuracy, storage, and accessibility. OCR helps organizations meet compliance standards by digitizing and securely managing documents, enabling faster audits, easier reporting, and better data protection. Additionally, the need for effective customer service and improved user experience has prompted businesses to adopt OCR to streamline processes like onboarding, customer verification, and support ticket management.

With ongoing innovations in AI, cloud computing, and digital transformation, the OCR market is poised for continued growth. These trends, combined with increasing demand for efficient data processing, automation, and compliance, make OCR a vital component of modern information management strategies across industries worldwide.

Report Scope

The report analyzes the Optical Character Recognition market, presented in terms of market value (US$ Thousand). The analysis covers the key segments and geographic regions outlined below.- Segments: End-Use (Retail, BFSI, Transport & Logistics, Media & Entertainment, IT & Telecom, Other End-Uses); Type (Software, Service).

- Geographic Regions/Countries:World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; and Rest of Europe); Asia-Pacific; Rest of World.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the OCR Software segment, which is expected to reach US$33.7 Billion by 2030 with a CAGR of a 13.7%. The OCR Service segment is also set to grow at 16.2% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $5.8 Billion in 2024, and China, forecasted to grow at an impressive 13.7% CAGR to reach $7.2 Billion by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Optical Character Recognition Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Optical Character Recognition Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Optical Character Recognition Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as ABBYY Solutions Ltd., Accusoft, Adobe Systems, Inc., Anyline GmbH, ATAPY Software and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 127 companies featured in this Optical Character Recognition market report include:

- ABBYY Solutions Ltd.

- Accusoft

- Adobe Systems, Inc.

- Anyline GmbH

- ATAPY Software

- Black Ice Software LLC

- CCi Intelligence Co., Ltd

- Creaceed SPRL

- CVISION Technologies, Inc.

- Exper-OCR Inc.

- Google, Inc.

- IBM Corporation

- LEAD Technologies, Inc.

- Microsoft Corporation

- NTT DATA Corporation

- Nuance Communications, Inc.

- Paradatec, Inc.

- Prime Recognition Corporation

- Ricoh Company, Ltd.

- Ripcord Inc.

- SEAL Systems AG

- Transym Computer Services Ltd.

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- ABBYY Solutions Ltd.

- Accusoft

- Adobe Systems, Inc.

- Anyline GmbH

- ATAPY Software

- Black Ice Software LLC

- CCi Intelligence Co., Ltd

- Creaceed SPRL

- CVISION Technologies, Inc.

- Exper-OCR Inc.

- Google, Inc.

- IBM Corporation

- LEAD Technologies, Inc.

- Microsoft Corporation

- NTT DATA Corporation

- Nuance Communications, Inc.

- Paradatec, Inc.

- Prime Recognition Corporation

- Ricoh Company, Ltd.

- Ripcord Inc.

- SEAL Systems AG

- Transym Computer Services Ltd.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 266 |

| Published | January 2026 |

| Forecast Period | 2024 - 2030 |

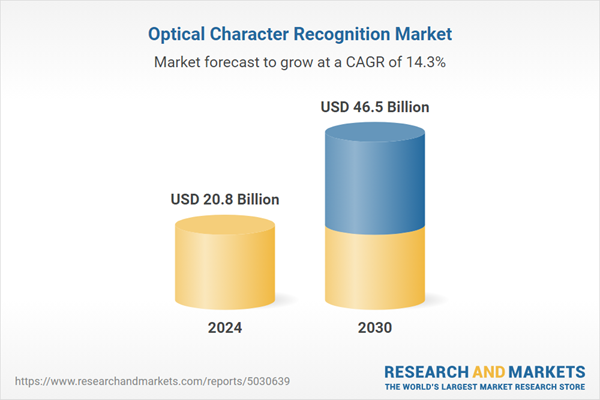

| Estimated Market Value ( USD | $ 20.8 Billion |

| Forecasted Market Value ( USD | $ 46.5 Billion |

| Compound Annual Growth Rate | 14.3% |

| Regions Covered | Global |