Global Financial Services Cybersecurity Systems and Services Market - Key Trends & Drivers Summarized

How Are Cybersecurity Systems Revolutionizing the Financial Sector?

With the rise of digital banking, online transactions, and mobile payment platforms, the financial services industry faces an unprecedented level of cybersecurity threats. Financial institutions are increasingly adopting advanced cybersecurity systems and services to protect their infrastructure from data breaches, identity theft, and fraud. These systems include multi-factor authentication, biometric verification, and encryption technologies that safeguard sensitive customer data. The importance of cybersecurity in the financial sector cannot be overstated, as any breach can lead to severe financial and reputational damage. This heightened awareness is driving the adoption of comprehensive security solutions designed to protect financial institutions and their clients from evolving cyber threats.What Are the Technological Advances in Financial Cybersecurity Solutions?

Technological advancements are central to the evolution of financial services cybersecurity. The integration of artificial intelligence (AI) and machine learning (ML) has led to the development of predictive and adaptive security systems that can detect anomalies and respond to threats in real-time. Behavioral analytics tools are also becoming increasingly prevalent, monitoring user behavior to identify suspicious activities that may indicate fraud or account compromise. Blockchain technology is gaining traction as a secure method for protecting financial transactions and enhancing the transparency of digital processes. Additionally, the adoption of cloud-based cybersecurity solutions offers scalability and flexibility, allowing financial institutions to adapt quickly to changing security demands without compromising system integrity.What Are the Emerging Trends in the Financial Cybersecurity Market?

Several key trends are shaping the financial services cybersecurity market. The rapid growth of digital banking and fintech services is leading to an increased focus on securing mobile and online platforms, as these are prime targets for cybercriminals. The rise of regulatory frameworks, such as the General Data Protection Regulation (GDPR) and other regional standards, is compelling financial institutions to adopt robust cybersecurity measures to ensure compliance and avoid penalties. There is also a growing trend towards Zero Trust Architecture, which requires verification for every user and device accessing the network, thereby minimizing potential security breaches. Collaboration among financial entities to share threat intelligence is also becoming more common, creating a united front against cyberattacks.What Factors Are Propelling the Growth of the Financial Cybersecurity Market?

The growth in the financial services cybersecurity market is driven by several factors, including the increasing sophistication of cyber threats and the rising volume of digital transactions, which necessitate advanced security measures. Regulatory requirements demanding compliance with stringent data protection and privacy laws are compelling financial institutions to invest heavily in cybersecurity solutions. The proliferation of mobile and online banking platforms, as well as the expansion of fintech services, are further increasing the need for secure systems that protect sensitive data. Advancements in AI and machine learning, enabling more dynamic and predictive security models, are also contributing to the growth of this market. Additionally, the integration of cloud-based cybersecurity solutions that provide scalability and enhanced security capabilities is creating new opportunities for financial institutions to strengthen their defense mechanisms.Report Scope

The report analyzes the Financial Services Cybersecurity Systems and Services market, presented in terms of market value (US$ Thousand). The analysis covers the key segments and geographic regions outlined below.- Segments: Segment (Mobile Enterprise Management, Endpoint Security, Identity & Access Management, Mobile Security, Security Information & Event Management, Content Security, Data Loss Prevention (DLP), Firewall, Other Segments); End-Use (Banking, Insurance, Credit Unions, Stock Brokerages, Stock Exchange, Consumer Financing Services, Payment Card & Mobile Payment Services, Government Related Financial Services, Other End-Uses).

- Geographic Regions/Countries:World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; Spain; Russia; and Rest of Europe); Asia-Pacific (Australia; India; South Korea; and Rest of Asia-Pacific); Latin America (Argentina; Brazil; Mexico; and Rest of Latin America); Middle East (Iran; Israel; Saudi Arabia; United Arab Emirates; and Rest of Middle East); and Africa.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the Mobile Enterprise Management segment, which is expected to reach US$17.4 Billion by 2030 with a CAGR of a 15.1%. The Endpoint Security segment is also set to grow at 12.5% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $7.8 Billion in 2024, and China, forecasted to grow at an impressive 17.1% CAGR to reach $14.4 Billion by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Financial Services Cybersecurity Systems and Services Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Financial Services Cybersecurity Systems and Services Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Financial Services Cybersecurity Systems and Services Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as Accenture PLC, AhnLab, Inc., AIRBUS SAS, Akamai Technologies, Inc., Alert Logic, Inc. and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 46 companies featured in this Financial Services Cybersecurity Systems and Services market report include:

- Accenture PLC

- AhnLab, Inc.

- AIRBUS SAS

- Akamai Technologies, Inc.

- Alert Logic, Inc.

- Alien Vault, Inc.

- Avast Software

- Experian Information Solutions, Inc.

- IBM Corporation

- Resolver Inc.

- Vmware, Inc.

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Accenture PLC

- AhnLab, Inc.

- AIRBUS SAS

- Akamai Technologies, Inc.

- Alert Logic, Inc.

- Alien Vault, Inc.

- Avast Software

- Experian Information Solutions, Inc.

- IBM Corporation

- Resolver Inc.

- Vmware, Inc.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 173 |

| Published | January 2026 |

| Forecast Period | 2024 - 2030 |

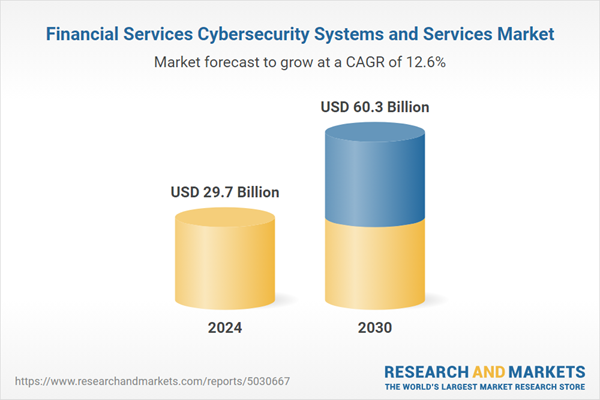

| Estimated Market Value ( USD | $ 29.7 Billion |

| Forecasted Market Value ( USD | $ 60.3 Billion |

| Compound Annual Growth Rate | 12.6% |

| Regions Covered | Global |