Global Electronic Grade Hydrofluoric Acid Market - Key Trends & Drivers Summarized

Why Is Electronic Grade Hydrofluoric Acid Crucial for the Semiconductor Industry?

Electronic grade hydrofluoric acid (HF) is an essential chemical used extensively in the semiconductor and electronics manufacturing industries. It is primarily utilized for cleaning, etching, and surface treatment of silicon wafers, which are critical components in the production of integrated circuits and microelectronics. The increasing miniaturization of electronic devices, combined with the demand for high-performance chips, has intensified the need for ultra-pure electronic grade hydrofluoric acid. This chemical ensures that silicon wafers achieve the precise surface characteristics required for advanced semiconductor applications. As the global electronics and semiconductor markets continue to expand, the demand for high-quality hydrofluoric acid that meets stringent purity standards is expected to rise, reinforcing its critical role in the industry.How Are Technological Innovations and Purity Standards Influencing the Market?

Technological advancements and the need for higher purity levels are significantly shaping the electronic grade hydrofluoric acid market. Semiconductor manufacturers require HF with purity levels often reaching 99.99% to avoid contamination and defects in microchips and other electronic components. In response, producers are investing in cutting-edge purification technologies, such as advanced filtration and distillation processes, to meet these demands. Furthermore, the development of new manufacturing techniques for semiconductors, such as extreme ultraviolet (EUV) lithography, necessitates even higher purity levels, pushing hydrofluoric acid suppliers to refine their processes further. This drive for technological innovation and enhanced purity standards is transforming the market, ensuring the availability of high-quality HF critical for next-generation electronics.How Do Environmental Regulations Impact the Market?

Stringent environmental regulations concerning the production, handling, and disposal of hydrofluoric acid play a crucial role in influencing market dynamics. HF is highly corrosive and toxic, making its management a significant environmental and safety concern. Regulatory agencies such as the Environmental Protection Agency (EPA) and equivalents in other regions enforce strict guidelines to minimize emissions and prevent accidents during the manufacturing and transportation of hydrofluoric acid. In light of these regulations, manufacturers are investing in environmentally compliant production facilities and developing innovative packaging and storage solutions to mitigate risks. The push for sustainable practices and reduced environmental impact is encouraging companies to develop safer, more efficient methods for producing and handling electronic grade hydrofluoric acid.What Is Driving the Growth of the Electronic Grade Hydrofluoric Acid Market?

The growth in the electronic grade hydrofluoric acid market is driven by several factors, including the expanding semiconductor and electronics industries, which demand ultra-pure chemical solutions for their manufacturing processes. The increasing adoption of advanced technologies such as 5G, artificial intelligence (AI), and the Internet of Things (IoT) has amplified the need for high-performance microchips, further boosting demand for electronic grade HF. Additionally, the global transition towards electric vehicles (EVs) and renewable energy sources, which rely heavily on semiconductors, supports market expansion. The continuous push for miniaturization and high efficiency in electronic devices also drives the market as semiconductor manufacturers seek higher purity HF to meet these evolving technological requirements. Lastly, government initiatives to establish local semiconductor production facilities and reduce dependency on imports are spurring regional market growth, ensuring consistent demand for electronic grade hydrofluoric acid.Report Scope

The report analyzes the Electronic Grade Hydrofluoric Acid market, presented in terms of market value (US$ Thousand). The analysis covers the key segments and geographic regions outlined below.- Segments: HF Concentration (49% & Above, Below 49%); Application (Microelectronics, Solar Cells / Photovoltaics, Semiconductors, Other Applications).

- Geographic Regions/Countries:World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; Spain; Russia; and Rest of Europe); Asia-Pacific (Australia; India; South Korea; and Rest of Asia-Pacific); Latin America (Argentina; Brazil; Mexico; and Rest of Latin America); Middle East (Iran; Israel; Saudi Arabia; United Arab Emirates; and Rest of Middle East); and Africa.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the 49% & Above HF Concentration segment, which is expected to reach US$369.3 Million by 2030 with a CAGR of a 5.1%. The Below 49% HF Concentration segment is also set to grow at 4.4% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $113.1 Million in 2024, and China, forecasted to grow at an impressive 8.4% CAGR to reach $131.8 Million by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Electronic Grade Hydrofluoric Acid Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Electronic Grade Hydrofluoric Acid Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Electronic Grade Hydrofluoric Acid Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as Advance Research Chemicals, Inc., Buss ChemTech AG, Derivados del Fluor SAU (DDF), Do-Fluoride Chemicals Co., Ltd., Formosa Daikin Advanced Chemicals Co., Ltd. and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 31 companies featured in this Electronic Grade Hydrofluoric Acid market report include:

- Advance Research Chemicals, Inc.

- Buss ChemTech AG

- Derivados del Fluor SAU (DDF)

- Do-Fluoride Chemicals Co., Ltd.

- Formosa Daikin Advanced Chemicals Co., Ltd.

- Fujian Shaowu Yongfei Chemical Co., Ltd.

- Honeywell International, Inc.

- KMG Chemicals

- Loba Chemie Pvt Ltd

- Morita Chemical Industries Co., Ltd.

- Qshi Industry (Shanghai) Co., Ltd.

- Shanghai Changhua New Energy & Technology Co., Ltd.

- Solvay SA

- Stella Chemifa Corporation

- Xinxiang Yellow River Fine Chemical Industry Co., Ltd.

- Zhejiang Juhua Co., Ltd.

- Zhejiang Sanmei Chemical Incorporated Company

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Advance Research Chemicals, Inc.

- Buss ChemTech AG

- Derivados del Fluor SAU (DDF)

- Do-Fluoride Chemicals Co., Ltd.

- Formosa Daikin Advanced Chemicals Co., Ltd.

- Fujian Shaowu Yongfei Chemical Co., Ltd.

- Honeywell International, Inc.

- KMG Chemicals

- Loba Chemie Pvt Ltd

- Morita Chemical Industries Co., Ltd.

- Qshi Industry (Shanghai) Co., Ltd.

- Shanghai Changhua New Energy & Technology Co., Ltd.

- Solvay SA

- Stella Chemifa Corporation

- Xinxiang Yellow River Fine Chemical Industry Co., Ltd.

- Zhejiang Juhua Co., Ltd.

- Zhejiang Sanmei Chemical Incorporated Company

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 189 |

| Published | February 2026 |

| Forecast Period | 2024 - 2030 |

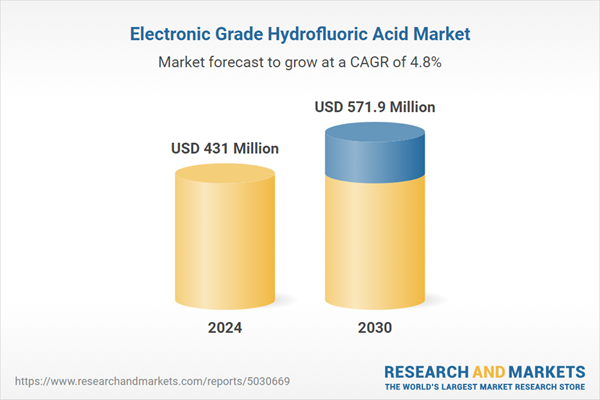

| Estimated Market Value ( USD | $ 431 Million |

| Forecasted Market Value ( USD | $ 571.9 Million |

| Compound Annual Growth Rate | 4.8% |

| Regions Covered | Global |