These are in-house development teams within telecom companies that leverage APIs to optimize network operations, build proprietary services, and support internal platforms. Their focus is primarily on network automation, infrastructure enhancements, and integration of customer-facing digital tools.

COVID-19 Impact Analysis

During the COVID-19 pandemic, the telecom API market witnessed significant growth as digital communication became the backbone of global operations. With strict lockdowns and widespread remote work mandates, businesses and institutions rapidly shifted to virtual platforms for continuity. Telecom APIs enabled seamless integration of communication functions such as messaging, voice, and video into enterprise and consumer applications, making them essential tools for maintaining connectivity in a socially distanced world. Similarly, government agencies and public health organizations used telecom APIs to develop and deploy contact tracing apps, emergency alert systems, and vaccination appointment platforms. Thus, the COVID-19 pandemic had a positive impact on the market.Driving and Restraining Factors

Drivers

- Advancements In 5G Technology

- Rising Adoption Of Iot And Connected Devices

- Increasing Demand For Digital Communication Services

- Shift Toward Open Ecosystems And API Standardization

Restraints

- Security And Privacy Concerns

- Complexity Of Integration And Interoperability

- Regulatory And Compliance Challenges

Opportunities

- Expansion Of Edge Computing Integration

- Growth Of AI-Driven Personalization

- Emergence Of Cross-Industry Collaboration Platforms

Challenges

- Limited Developer Awareness And Adoption

- High Development And Maintenance Costs

- Competition From OTT Providers

Market Growth Factors

The rollout of 5G technology is revolutionizing the telecommunications industry, serving as a primary driver for the Telecom API market. 5G’s ultra-high-speed connectivity, ultra-low latency, and massive device support enable a new wave of digital services, compelling telecom operators to leverage APIs to make these capabilities accessible to developers and enterprises. Unlike earlier network generations, 5G supports advanced use cases like augmented reality (AR), virtual reality (VR), autonomous vehicles, and smart cities, all requiring seamless integration of network services into applications. Thus, advancements in 5G technology are driving the Telecom API market by enabling innovative, scalable, and secure applications that leverage next-generation network capabilities.Additionally, the proliferation of the Internet of Things (IoT) and connected devices is a significant driver for the Telecom API market, fueling the need for scalable, interoperable communication solutions. IoT encompasses billions of devices - from smart home appliances to industrial sensors - requiring seamless connectivity for real-time data exchange. Telecom APIs, particularly for messaging, location, and device management, enable developers to integrate these devices with telecom networks, ensuring reliable data transmission and control. In conclusion, the rising adoption of IoT and connected devices is propelling the market by enabling seamless, secure, and scalable connectivity for a growing ecosystem of devices.

Market Restraining Factors

Security and privacy concerns pose a significant restraint on the Telecom API market, as the exposure of network capabilities through APIs introduces vulnerabilities that can be exploited by malicious actors. Telecom APIs, such as those for messaging, location, or billing, handle sensitive data, including personal user information, financial transactions, and device identifiers, making them prime targets for cyberattacks like data breaches or unauthorized access. Thus, security and privacy concerns restrain the Telecom API market by increasing operational complexity, costs, and risks, potentially slowing adoption and innovation.Value Chain Analysis

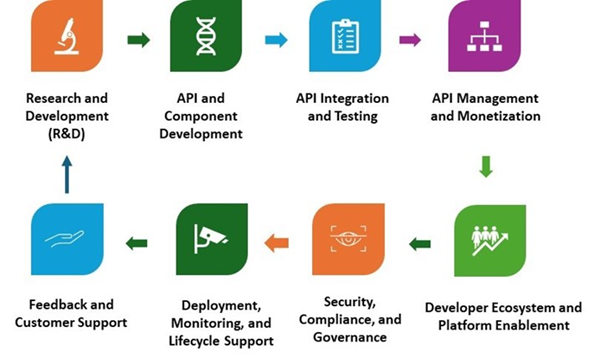

The Telecom API Market value chain begins with Research and Development (R&D), which drives API and component development for telecom services. These components undergo API integration and testing to ensure functionality and compatibility. Following this, API management and monetization focuses on streamlining access and generating revenue. The chain continues with developer ecosystem and platform enablement, enhancing innovation and third-party collaboration. Emphasis on security, compliance, and governance ensures safe and regulated operations. Deployment, monitoring, and lifecycle support maintain performance, while feedback and customer support complete the loop, feeding insights back into R&D for continuous improvement.

End User Outlook

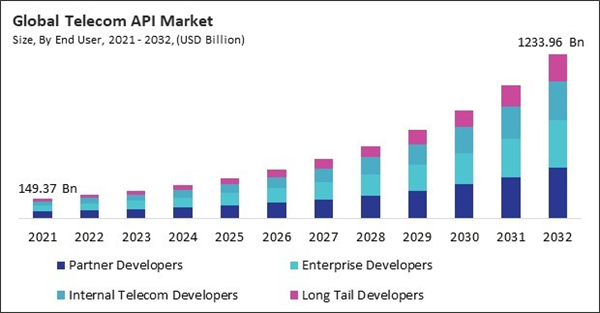

On the basis of end user, the telecom API market is classified into partner developers, enterprise developers, internal telecom developers, and long tail developers. The enterprise developers segment recorded 30% revenue share in the telecom API market in 2024. These developers work within enterprises that utilize telecom APIs to build customized communication solutions tailored to their operational needs. Enterprise developers often integrate APIs for unified communications, internal collaboration tools, customer service automation, and mobile workforce management.Type Outlook

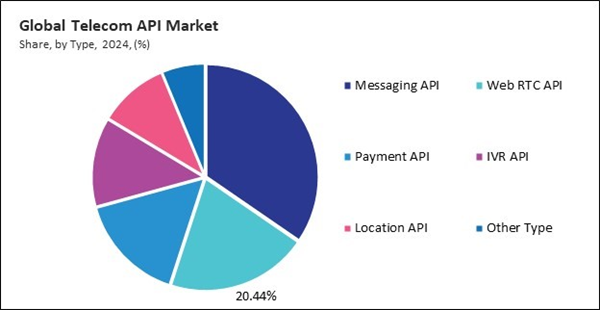

Based on type, the market is characterized into messaging API, web RTC API, payment API, IVR API, location API, and others. The web RTC API segment procured 20% revenue share in the telecom API market in 2024. Web Real-Time Communication (WebRTC) APIs enable audio, video, and data sharing directly between browsers and mobile applications without the need for intermediary plugins. These APIs are crucial for powering applications such as video conferencing, online customer support, and telemedicine. The increase in remote working models, virtual collaboration tools, and digital healthcare consultations has substantially elevated the integration of WebRTC APIs.Regional Outlook

Region-wise, the telecom API market is analyzed across North America, Europe, Asia Pacific, and LAMEA. The North America segment recorded 34% revenue share in the telecom API market in 2024. This dominance is largely driven by the region’s mature telecom infrastructure, widespread adoption of advanced technologies such as 5G and IoT, and a thriving ecosystem of digital service providers and application developers. Leading telecom companies in the U.S. and Canada have actively partnered with third-party developers and enterprises to deploy API-driven services that enhance customer engagement, automate operations, and introduce innovative offerings like cloud-based communication and AI-powered contact centers.List of Key Companies Profiled

- Adobe, Inc.

- Avaya, Inc. (Avaya Holdings Corp.)

- Deutsche Telekom AG

- IBM Corporation

- Microsoft Corporation

- Amazon Web Services, Inc. (Amazon.com, Inc.)

- AT&T, Inc.

- Verizon Communications, Inc.

- Ericsson AB

- Twilio, Inc.

Market Report Segmentation

By End User

- Partner Developers

- Enterprise Developers

- Internal Telecom Developers

- Long Tail Developers

By Type

- Messaging API

- Web RTC API

- Payment API

- IVR API

- Location API

- Other Type

By Geography

- North America

- US

- Canada

- Mexico

- Rest of North America

- Europe

- Germany

- UK

- France

- Russia

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Singapore

- Malaysia

- Rest of Asia Pacific

- LAMEA

- Brazil

- Argentina

- UAE

- Saudi Arabia

- South Africa

- Nigeria

- Rest of LAMEA

Table of Contents

Companies Mentioned

- Adobe, Inc.

- Avaya, Inc. (Avaya Holdings Corp.)

- Deutsche Telekom AG

- IBM Corporation

- Microsoft Corporation

- Amazon Web Services, Inc. (Amazon.com, Inc.)

- AT&T, Inc.

- Verizon Communications, Inc.

- Ericsson AB

- Twilio, Inc.