Speak directly to the analyst to clarify any post sales queries you may have.

10% Free customizationThis report comes with 10% free customization, enabling you to add data that meets your specific business needs.

Key Market Drivers

The Increasing Sales of Passenger Cars

The increasing sales of passenger cars significantly drive the growth of the car loan market in India. As consumer preferences shift toward personal mobility, more individuals are opting for passenger vehicles, resulting in a surge in demand for car loans. Factors such as rising disposable incomes, urbanization, and the expanding middle class contribute to this trend, as families seek reliable transportation options. According to the report, the Indian automobile industry experienced a 19% growth in value in FY24, driven by increased purchases of utility vehicles (UVs) and sport utility vehicles (SUVs). This surge in vehicle sales is significantly propelling the growth of the car loan market.Financial institutions are responding to this demand by offering tailored loan products with competitive interest rates and flexible repayment terms, making it easier for consumers to purchase new or used passenger cars. The government's initiatives to boost the automotive sector, including incentives for electric vehicles, further enhance the appeal of passenger cars, encouraging more buyers to secure financing.

Urbanization and Changing Lifestyles

Rapid urbanization is another significant driver of the car loan market. As more people migrate to urban areas in search of better job opportunities and living conditions, the demand for personal vehicles has surged. Public transportation systems in many cities struggle to meet the increasing demands of the population, prompting individuals to seek alternative transportation solutions. Additionally, changing lifestyles, such as the growing trend of nuclear families and the need for convenience, further emphasize the need for personal vehicles. Car ownership provides flexibility and independence, making it an attractive option for urban dwellers.Government Initiatives and Policies

Government initiatives and policies that promote vehicle ownership have significantly contributed to the growth of the car loan market. Several state and central government policies aimed at encouraging manufacturing, the introduction of electric vehicles (EVs), and the promotion of sustainable transportation options have indirectly boosted car sales, thereby increasing the demand for car loans.The government's push for electric vehicles through subsidies and incentives has also given rise to a new category of car loans for EVs, which is expected to grow rapidly in the coming years. Additionally, the government has implemented tax benefits and financial aid schemes to ease the burden of vehicle financing, making it easier for the average Indian to purchase a car. The implementation of these supportive policies has not only improved the overall economic environment but also played a crucial role in creating a favorable environment for car loan financing in India.

Rising Disposable Income and Affordability

As India's middle class continues to grow, the purchasing power of individuals has increased significantly. Rising disposable income is a key factor that has made car ownership more accessible to a broader population. Consumers, particularly in urban and semi-urban areas, now find it easier to finance car purchases through loans. With income levels improving, people are more willing to invest in personal vehicles, especially as lifestyle changes lead to a preference for convenience, comfort, and personal mobility. This increase in disposable income also encourages consumers to opt for higher-end models and more expensive cars, further driving the demand for car loans. As a result, financial institutions have seen a steady rise in car loan applications, pushing the market toward more favorable terms and conditions for buyers.Key Market Challenges

Limited Access to Financing for Low-Credit Consumers

Access to car loans remains a significant hurdle for individuals with limited or poor credit histories. Many financial institutions rely on credit scores to determine loan eligibility, and those with low scores often face challenges in securing financing. This situation disproportionately affects low-income individuals and first-time buyers, who may have insufficient credit histories to qualify for loans.Consequently, this segment of the population is left with limited options, often resorting to informal lending channels that charge exorbitant interest rates. To mitigate this challenge, lenders need to explore alternative credit assessment methods that consider factors beyond traditional credit scores, such as income stability, employment history, and transaction behavior. Developing products tailored for these consumers can help expand the customer base and increase overall market participation.

Inadequate Vehicle Valuation and Transparency Issues

The used car market in India is often characterized by a lack of standardized vehicle valuation and transparency, which poses significant challenges to both consumers and lenders. Many buyers are uncertain about the fair market value of used vehicles, making it difficult to assess whether they are receiving a good deal. This uncertainty can lead to mistrust among consumers and deter them from pursuing financing options.Additionally, lenders face risks in approving loans for vehicles with unclear valuations, as they may be uncertain about the asset's worth in the event of a default. The absence of comprehensive vehicle history reports, including previous ownership, accident records, and maintenance logs, further complicates the situation. To address these issues, stakeholders must invest in creating standardized valuation frameworks and reliable vehicle history reports. Enhancing transparency can build consumer trust and enable lenders to make informed decisions, thereby fostering a healthier car loan market.

Key Market Trends

Increased Digitalization and Online Lending Platforms

The digital revolution has profoundly impacted the car loan market in India. The emergence of online lending platforms and mobile applications has simplified the loan application process for consumers. These platforms offer features like instant loan approvals, comparison tools for different loan products, and the ability to manage loans digitally. This shift toward digitalization is particularly appealing to tech-savvy younger consumers who prefer quick and hassle-free experiences. Financial institutions are investing in technology to enhance user experience, streamline operations, and reduce turnaround times for loan approvals. Additionally, the use of artificial intelligence and data analytics allows lenders to assess creditworthiness more accurately, expanding access to financing for a broader customer base. As digital lending becomes more entrenched, traditional banks and NBFCs are compelled to innovate and enhance their offerings to remain competitive.Growing Demand for Electric Vehicles (EVs)

The growing emphasis on sustainability and environmental awareness is significantly influencing trends in the car loan market, particularly the rising demand for electric vehicles (EVs). The Indian government's initiatives, including incentives and infrastructure development, are encouraging consumers to view EVs as a viable alternative to traditional vehicles. In response to this shift, companies are increasing their investments in electric vehicle technology. For example, in February 2024, Hyundai Motors announced plans to invest over USD 3.85 billion from 2023 to 2033 to enhance its EV lineup and existing platforms, which is expected to substantially drive market growth during the forecast period.This trend is evident in the growing number of EV models available in the market and the increasing awareness of their long-term cost benefits. Financial institutions are responding by introducing specialized loan products designed specifically for EV purchases, often featuring lower interest rates and flexible repayment options. This focus on financing for EVs not only supports the government’s sustainability initiatives but also positions lenders to tap into a burgeoning market segment.

Segmental Insights

Type Insights

The new car segment was the dominating force in the India Car Loan Market, driven by increasing disposable incomes and a growing middle class. Consumers are increasingly viewing car ownership as a necessity, leading to a surge in demand for personal vehicles. Financial institutions are responding with tailored loan products that offer competitive interest rates and flexible repayment options, making it easier for buyers to finance new cars. Additionally, attractive promotions from automakers, along with government incentives for electric vehicles, further boost the appeal of new car purchases, solidifying this segment's dominance in the market.Regional Insights

The North region was the dominant segment in the India Car Loan Market, accounting for a substantial share of total car loans. This dominance is driven by factors such as higher disposable incomes, urbanization, and a robust infrastructure network that supports vehicle ownership. Additionally, the increasing presence of automotive dealerships and financing institutions in metropolitan areas facilitates easier access to car loans for consumers. As the demand for personal vehicles grows in this region, financial institutions are offering competitive loan products tailored to the needs of buyers, further solidifying the North's leading position in the market.Key Market Players

- State Bank of India

- HDFC Bank Ltd

- ICICI Bank Limited

- IDFC FIRST Bank Limited

- TATA Motors Finance Ltd.

- Shriram Finance Limited

- Mahindra & Mahindra Financial Services Limited

- Axis Bank Limited

- Kotak Mahindra Prime Limited

- Toyota Financial Services India Limited

Report Scope:

In this report, the India Car Loan Market has been segmented into the following categories, in addition to the industry trends which have also been detailed below:India Car Loan Market, By Type:

- New Car

- Used Car

India Car Loan Market, By Car Type:

- SUV

- Hatchback

- Sedan

India Car Loan Market, By Source:

- OEM

- Bank

- NBFCs

India Car Loan Market, By Percentage of Amount Sanctioned:

- Up to 25%

- 25-50%

- 51-75%

- Above 75%

India Car Loan Market, By Type of City:

- Tier 1

- Tier 2

- Tier 3

- Tier 4

India Car Loan Market, By Tenure:

- Less than 3 Year

- 3-5 Year

- Greater than 5 Year

India Car Loan Market, By Region:

- North

- South

- East

- West

Competitive Landscape

Company Profiles: Detailed analysis of the major companies present in the India Car Loan Market.Available Customizations:

With the given market data, the publisher offers customizations according to a company's specific needs. The following customization options are available for the report.Company Information

- Detailed analysis and profiling of additional market players (up to five).

This product will be delivered within 1-3 business days.

Table of Contents

Companies Mentioned

- State Bank of India

- HDFC Bank Ltd

- ICICI Bank Limited

- IDFC FIRST Bank Limited

- TATA Motors Finance Ltd.

- Shriram Finance Limited

- Mahindra & Mahindra Financial Services Limited

- Axis Bank Limited

- Kotak Mahindra Prime Limited

- Toyota Financial Services India Limited

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 85 |

| Published | February 2025 |

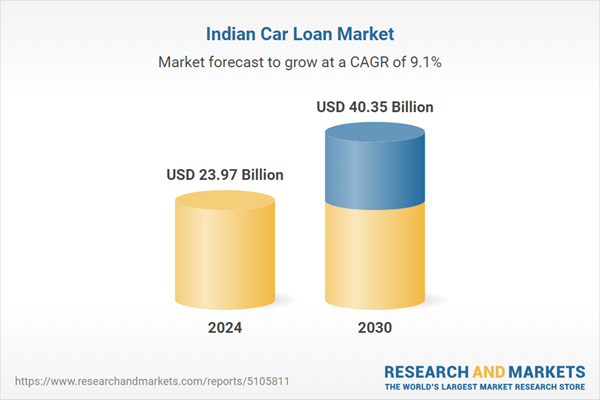

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 23.97 Billion |

| Forecasted Market Value ( USD | $ 40.35 Billion |

| Compound Annual Growth Rate | 9.1% |

| Regions Covered | India |

| No. of Companies Mentioned | 10 |