The report Industrial Robotics Global Market & Forecast covers by Industrial Robotics Market & Volume (Automotive Industry and Forecast, Electrical and Electronics Industry and Forecast, Metal and Machinery Industry and Forecast, Plastic and Chemical Products, Food Industry and Forecast, Others) Countries and Company Analysis, 2025-2033.

Industrial Robotics Industry Overview

Recent developments in automation technology, artificial intelligence, and machine learning have propelled the industrial robotics sector's notable expansion. Robots are being used more and more in manufacturing processes for jobs like assembling, welding, painting, and material handling in a variety of industries, including consumer products, electronics, and the automotive sector. The main advantages of industrial robots are their enhanced safety, accuracy, and efficiency as well as their capacity to work in dangerous conditions where human workers could be in danger. Robots also help organizations remain competitive in a global market by lowering labor costs and increasing overall productivity.The increasing need for automation in factories and warehouses is expected to fuel the growth of the worldwide industrial robotics market. Advanced sensor technologies and collaborative robots (cobots), which operate alongside people, are examples of technological advancements that are expanding robot capabilities and increasing their task-adaptability. Robots with IoT and AI integration are also becoming essential to supply chain management and production systems as companies transition to smart factories. The growth of robots in industries including logistics, food processing, and pharmaceuticals demonstrates the adaptability and promise of these devices. The industrial robotics sector will continue to be a major source of innovation in the manufacturing sector as businesses adopt Industry 4.0 and aim for increased automation.

The market's expansion has been mostly fueled by regional expenditures in robots and growing IoT adoption. The 'Made in China 2025' declaration, for example, sought to modernize the Chinese economy in general by shifting toward production that is driven by innovation and quality. The latest industrial revolution, known as Industry 4.0, has spurred the development of new technologies, such as collaborative robots and AI-enabled robots, among others. These technologies have allowed enterprises to use robots to boost productivity, remove errors, and streamline numerous operations. Further motivating enterprises to invest in robotic systems are enhanced production capacity and increased workplace safety.

The International Federation of Robots (IFR) estimates that collaborative robots will make up 34% of all robot sales in 2025. As a result, industrial robot penetration is predicted to increase across a variety of industries, including plastics, food and consumer goods, semiconductors and electronics, life sciences, and pharmaceuticals. With Foxconn's robots, Apple's factories are anticipated to undergo yet another significant factory automation. IC foundries in the semiconductor industry are among the adopters who have influenced the demands of the market today.

Growth Drivers for the Industrial Robotics Market

Increasing Use in the Automobile Industry

The In the production of automobiles, industrial robots are essential, especially for welding and painting. Robots are highly accurate and repeatable in their spot, arc, and laser welding, guaranteeing constant quality and structural integrity. More than 1,300 ABB robots were used by Volvo Cars at its plants in China and Sweden in December 2023 to perform tasks including riveting and spot welding. These modular robots, which include the IRB 6710, 6720, and 6730 types, have movable cargo capacities and sizes. Additionally, automotive paint businesses use robots to apply primer, basecoat, and clearcoat layers with accuracy and efficiency. BMW introduced an AI-controlled robotic system in May 2023 to process and check painted car surfaces, improving quality and cutting lead times. The market for industrial robotics is boosted by these developments.Growing Combination of 3D Printing and Additive Manufacturing

The market for industrial robotics is expanding as a result of the combination of 3D printing and additive manufacturing (AM). Complex geometries and unique parts can be created by using robots with extrusion or deposition heads to precisely deposit materials like metals, ceramics, and thermoplastics layer by layer. The AMDroid laser-wire DED deployable robotic system, for instance, was introduced by ADDitec in November 2023 and is intended for high deposition rates in mass production, especially with titanium. Additionally, large-scale 3D printing for construction uses robots to manufacture structures like panels and walls on-site. The RIC-M1 PRO robotic printer for construction was introduced by RIC Technology in January 2024, providing time-saving and cost-effective solutions. The industrial robotics market forecast is being positively impacted by these advancements in AM and 3D printing.Growing Industry 4.0 Adoption

The market for industrial robotics is expanding as a result of Industry 4.0, which emphasizes automation and connection to maximize manufacturing. Assembling, welding, and material handling are among the duties performed by industrial robots, which are networked to provide smooth connection with other devices and control systems. For instance, the February 2024 debut of KUKA AG's KR FORTEC robot, which has a 145-inch reach and a 529-pound payload, makes it perfect for low-energy operations like welding and handling. Furthermore, by enabling robots to help with repetitive activities while humans concentrate on more complicated ones, human-robot collaboration - especially with collaborative robots, or cobots - improves productivity and safety. The market need was further increased in February 2024 when Figure and BMW partnered to deploy humanoid robots.Challenges in the Industrial Robotics Market

High Initial Costs

One major obstacle is the high upfront expenditures of industrial robots, especially for small and medium-sized businesses (SMEs). These costs include installation, calibration, and continuing maintenance expenditures in addition to the robots' purchase price. These financial requirements can be difficult for SMEs to meet, which restricts their capacity to implement automation technologies. The whole cost is further increased by the requirement for specialized knowledge to incorporate robots into current systems. Even while automation might increase productivity over time, smaller companies that do not have the funds to make significant investments in sophisticated robotics are nonetheless concerned about the initial outlay. The wider deployment of industrial robotics across different industries is thus slowed by this cost constraint.Skilled Labor Shortage

With an increasing dearth of individuals qualified to program, operate, and maintain sophisticated robotic systems, the industrial robotics sector is confronted with a serious skilled labor shortage. The need for workers with experience in robotics, automation, and related technologies has increased as robots become more and more integrated into manufacturing processes. However, there is a shortage of skilled workers as a result of training and education in these disciplines not keeping up with the pace. Businesses looking to fully utilize the potential of industrial robots face difficulties as a result of this skills mismatch. To create a trained workforce that is equipped to manage the complexity of contemporary robotic systems, businesses must fund specialist training programs or collaborate with academic institutions.United States Industrial Robotics Market

The market for industrial robots in the United States is expanding significantly due to the adoption of Industry 4.0 technologies, rising need for efficiency, and automation developments. Robots are employed extensively in industries like consumer goods, electronics, and automotive to carry out operations including material handling, welding, and assembling. Growth is also being aided by the emergence of collaborative robots, or cobots, which enable human-robot contact in settings that are safer and more efficient. The market is expanding due to important factors such labor shortages, lower manufacturing prices, and the demand for increased production efficiency. Furthermore, investments in robots are increasing as a result of the U.S. government's encouragement for innovation and modernization in manufacturing. However, obstacles to widespread implementation still exist, such as high upfront costs and the requirement for expert staff.United Kingdom Industrial Robotics Market

The market for industrial robots in the UK is developing as a result of the increased demand for automation in a number of sectors, such as electronics, pharmaceuticals, and the automotive industry. Robotics adoption is increasing production efficiency, lowering labor costs, and increasing productivity. Because they enable safe and efficient human-robot collaboration, collaborative robots, or cobots, are becoming more and more popular in the UK. The need for robotic solutions is growing as a result of factors such as labor shortages and the requirement for increased production speed and precision. The market's expansion is further supported by government programs that encourage advanced manufacturing and digital transformation. Broader adoption in the UK's industrial sectors is nevertheless hampered by issues including high upfront costs, the requirement for specialized training, and worries about job displacement.China Industrial Robotics Market

Due to the nation's quest for automation and advanced manufacturing, China has one of the biggest and fastest-growing industrial robotics markets in the world. China, the global center of manufacturing, has embraced robots more and more in industries like consumer products, electronics, and automobiles to increase production efficiency, lower labor costs, and improve product quality. Together with programs like "Made in China 2025," the government's robust support for innovation promotes the advancement and application of robots. The capacity of collaborative robots, or cobots, to work alongside human employees is another reason for their growing popularity. Notwithstanding these developments, obstacles to wider implementation across Chinese sectors remain, including high upfront costs, a lack of experienced workers, and the requirement for integration with current systems.United Arab Emirates Industrial Robotics Market

The push for automation and technological innovation in manufacturing in the United Arab Emirates (UAE) is propelling the market for industrial robotics to grow quickly. The UAE has been making significant investments in sectors like construction, logistics, and automotive, where robotics may boost productivity and lower labor costs, as part of its larger goal to diversify the economy and lessen reliance on oil. The UAE Vision 2021 and other government programs place a strong emphasis on robots and other sophisticated manufacturing technology. Furthermore, factories are becoming safer and more productive because to the advent of collaborating robots, or cobots. The UAE's industrial robotics adoption is still hampered by issues like high upfront costs, the requirement for specialized labor, and integrating robots with conventional manufacturing systems, despite the industry's potential for growth.Industrial Robotics Market Segments

Industrial Robotics Market & Volume - Market has been covered from 6 viewpoints.1. Automotive Industry and Forecast

2. Electrical and Electronics Industry and Forecast

3. Metal and Machinery Industry and Forecast

4. Plastic and Chemical Products

5. Food Industry and Forecast

6. Others

Countries - Market has been covered from 4 viewpoints:

America

1. United States2. Canada

3. Mexico

4. Others

Europe

1. France2. Germany

3. Italy

4. Spain

5. Others

Asia Pacific

1. China2. India

3. Japan

4. Republic of Korea

5. Thailand

6. Others

Rest of the World

All the Key players have been covered from 4 Viewpoints:

1. Overview2. Key Persons

3. Recent Development & Strategies

4. Financial Insights

Company Analysis:

1. KUKA2. iRobot Corporation

3. Intuitive Surgical, Inc.

4. Panasonic Corporation

5. Fanuc

6. ABB Ltd

7. Stryker Corporation

Table of Contents

Companies Mentioned

- KUKA

- iRobot Corporation

- Intuitive Surgical, Inc.

- Panasonic Corporation

- Fanuc

- ABB Ltd

- Stryker Corporation

Methodology

In this report, for analyzing the future trends for the studied market during the forecast period, the publisher has incorporated rigorous statistical and econometric methods, further scrutinized by secondary, primary sources and by in-house experts, supported through their extensive data intelligence repository. The market is studied holistically from both demand and supply-side perspectives. This is carried out to analyze both end-user and producer behavior patterns, in the review period, which affects price, demand and consumption trends. As the study demands to analyze the long-term nature of the market, the identification of factors influencing the market is based on the fundamentality of the study market.

Through secondary and primary researches, which largely include interviews with industry participants, reliable statistics, and regional intelligence, are identified and are transformed to quantitative data through data extraction, and further applied for inferential purposes. The publisher's in-house industry experts play an instrumental role in designing analytic tools and models, tailored to the requirements of a particular industry segment. These analytical tools and models sanitize the data & statistics and enhance the accuracy of their recommendations and advice.

Primary Research

The primary purpose of this phase is to extract qualitative information regarding the market from the key industry leaders. The primary research efforts include reaching out to participants through mail, tele-conversations, referrals, professional networks, and face-to-face interactions. The publisher also established professional corporate relations with various companies that allow us greater flexibility for reaching out to industry participants and commentators for interviews and discussions, fulfilling the following functions:

- Validates and improves the data quality and strengthens research proceeds

- Further develop the analyst team’s market understanding and expertise

- Supplies authentic information about market size, share, growth, and forecast

The researcher's primary research interview and discussion panels are typically composed of the most experienced industry members. These participants include, however, are not limited to:

- Chief executives and VPs of leading corporations specific to the industry

- Product and sales managers or country heads; channel partners and top level distributors; banking, investment, and valuation experts

- Key opinion leaders (KOLs)

Secondary Research

The publisher refers to a broad array of industry sources for their secondary research, which typically includes, however, is not limited to:

- Company SEC filings, annual reports, company websites, broker & financial reports, and investor presentations for competitive scenario and shape of the industry

- Patent and regulatory databases for understanding of technical & legal developments

- Scientific and technical writings for product information and related preemptions

- Regional government and statistical databases for macro analysis

- Authentic new articles, webcasts, and other related releases for market evaluation

- Internal and external proprietary databases, key market indicators, and relevant press releases for market estimates and forecasts

LOADING...

Table Information

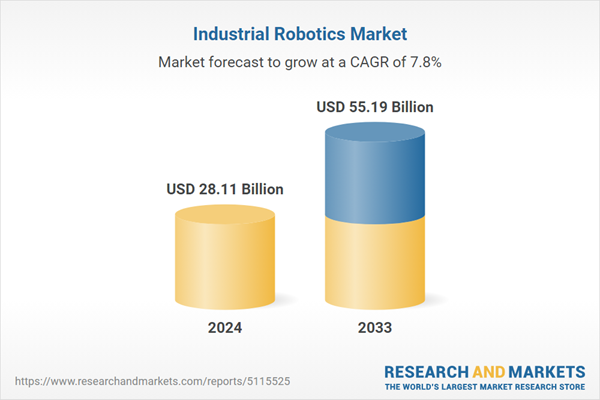

| Report Attribute | Details |

|---|---|

| No. of Pages | 200 |

| Published | April 2025 |

| Forecast Period | 2024 - 2033 |

| Estimated Market Value ( USD | $ 28.11 Billion |

| Forecasted Market Value ( USD | $ 55.19 Billion |

| Compound Annual Growth Rate | 7.7% |

| Regions Covered | Global |

| No. of Companies Mentioned | 7 |