Key Highlights

- According to the Food and Agriculture Organization (FAO), Europe is the second major market for oranges globally, with a cultivated area of 0.27 million ha in 2021 due to the increasing demand for orange juice in the region. Spain is the region's largest orange fruit producer, with 3.6 million metric tons in 2021, followed by Italy with 1.7 million metric tons and Greece with 0.8 million metric tons.

- Orange production is concentrated in the Mediterranean region. Spain and Italy account for 80% of Europe's orange production, with the remaining 20% distributed among the other European Union countries like Portugal, Greece, and Cyprus.

- High production capabilities and magnificent weather conditions contribute to the production of oranges. The production of oranges is majorly affected by several factors, such as environmental factors, bio stress, and government policies of the country. Spain is one of the major producers of citrus fruits, especially oranges. However, a rebound in citrus production in European countries may result in reduced imports from Spain.

- General consumption of fruit juices and nectars in Europe is decreasing due to consumers' concerns about calorie and sugar intake. However, Tropical and citrus juices are used as ingredients in carbonated drinks, low-calorie drinks, functional drinks, flavored waters, energy drinks, smoothies, fruit preparations, confectionery, and other products, maintaining a stable import demand.

- Europe accounts for 55% of the world's citrus and tropical juice imports. In the next few years, the European market for citrus and tropical juices will likely increase with an annual growth rate of 1%. Drivers behind the expected growth are product innovations based on natural ingredients. As consumers seek more natural products, manufacturers are increasingly replacing added flavors with juices as more natural ingredients.

Europe Orange Market Trends

Growing demand for oranges in processing industry

- According to the Food and Agriculture Organization (FAO), the production volume of oranges in the European Union increased to 6.59 million metric tons in 2021, up from 6.51 million metric tons in 2018, which is a 1.1% rise in the production volume. The harvest time or maturity period of oranges in the European Union is from September to June. The region's most cultivated varieties of oranges are Moro, Naveline, Tarocco, Valencia, Ippolito, Meli, and Sanguinello.

- Orange is one of the key raw ingredients for many food processing and other industrial applications. Many beverage processing industries, like the juice industry, cosmetic industry, and textile industry, consider oranges as one of the important ingredients in manufacturing products, which in turn is increasing the demand and consumption of oranges.

- Oranges are gaining popularity among consumers in the region owing to their natural sweetness, wide varieties, and diversity of uses, from juices and marmalades to face masks and candied orange slices. The nutritional benefits of these uses have driven the demand for oranges among consumers.

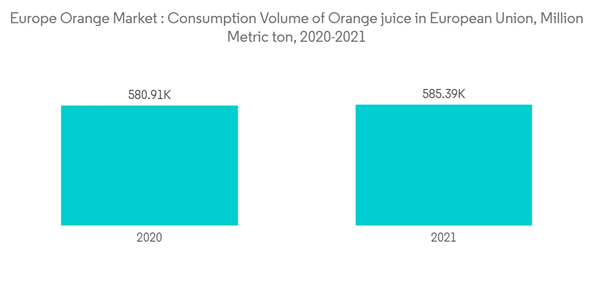

- According to the European Fruit Juice Association (EFJA) report, the import of orange juice in 2021-22 was 62,250 ion metric tons. That's a decline of about 19% from the 77,212 metric tons of orange juice the European Union produced in 2020-21. However, the orange juice segment in European Union is projected to increase by 4.43% over the forecast period resulting in a market volume of USD 8.46 billion in 2027.

Spain Dominates the Market in Terms of Production and Export

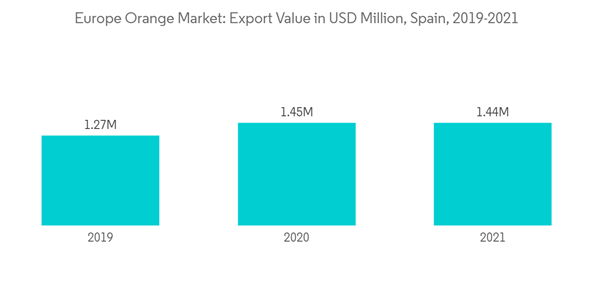

- Spain is the region's leading orange-producing and exporting country, with a 54% share in the total production in the European Union in 2021, owing to favorable weather conditions, including rainy spring and mild summer. According to the United States Department of Agriculture (USDA), the major orange-producing regions in Spain are Valencia and Andalusia, witnessing a majority of the Spanish orange production. The producers are focused on growing both early and late varieties of orange to expand the fruit availability and supply throughout the marketing year.

- The Spanish fruit sector is committed to and focused on sustainable production, smart farming, digital improvements, green packaging, and fruit quality. More efficient harvest and processing methods have resulted in higher productivity. According to Spanish official data, around 40 % of Spain's orange production is destined for domestic fresh consumption, 15% for processing (mainly into citrus juice, essential oils, and by-products), and 45%for exports.

- According to the International Trade Centre (ITC), Canada, China, and Saudi Arabia are the major importers of oranges from Spain. Canada accounted for the largest export market share, with 1.2% of the export market share in 2021. The European Union countries are exporting oranges in huge quantities among themselves. For instance, Spain exports oranges to Germany, France, the Netherlands, and other European Union countries, while the Netherlands also exports oranges to Germany, France, Belgium, and other countries.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

This product will be delivered within 2 business days.