Key Highlights

- The net turnover of the logistics service providers in Hungary is around HUF 3,400 billion (USD 9.8 billion), which accounts for nearly 5% of the total net turnover of the national economy. Currently, there are 40,000 logistics companies in Hungary, of which a significant portion are small and medium-sized enterprises. The Hungarian logistics sector employs 259 thousand people, which is around 6.5% of the total employment in the country's labor force. The logistics sector accounts for 6.3% of the Hungarian gross domestic product.

- Due to its geographical position, Hungary occupies a central position in Europe. The country is crossed by four Trans-European Transport Corridors (TEN-T), each reaching the capital. Hungary currently has four fully operational rail freight corridors: Orient-East Med, Mediterranean, Amber, and Rhine-Danube. It is also located at the intersection of two European Rail Traffic Management System (ERTMS) lines. Therefore, the country is acting as a ferry linking the European Union with the rest of Europe from the south (Serbia) and the north (Ukraine). This makes Hungary one of the most important transport hubs, providing easy access to all parts of Europe by rail, road, air, and water transport.

- Over the years, the government has made huge investments in all modes of transport (rail, road, air, and water) to develop them to their most efficient level of functioning. Further, the Hungarian government has budgeted to spend HUF 3,200 billion (USD 8.64 billion) on road development and HUF 1,500 billion (USD 4 billion) on railway development in 2022. So, for the next few years, extraordinary developments are expected on the entire Hungarian road and rail network, which drives the freight and logistics industry.

Hungary Freight and Logistics Market Trends

Rise in E-commerce Sector is Driving The Market

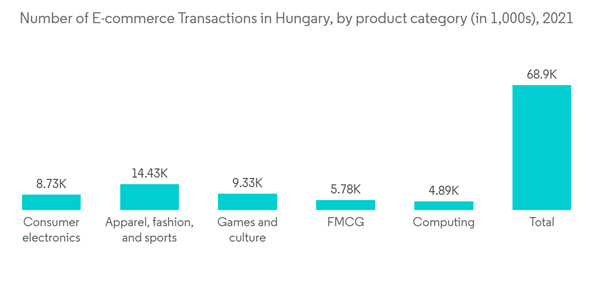

As internet penetration and accessibility increase, more people can benefit from the majority of online services, including e-commerce. The e-commerce sector is expected to break the net, accounting for double-digit growth in locations around the world. As digital payment options become more prevalent in these regions, e-commerce will thrive immensely. In 2021, the number of e-commerce transactions in Hungary will reach nearly 69 million majority of online services, including e-commerce. The e-commerce sector is expected to break the net, accounting for double-digit growth in locations around the world. As digital payment options become more prevalent in these regions, e-commerce will thrive immensely. In 2021, the number of e-commerce transactions in Hungary will reach nearly 69 million. The highest number of online purchase transactions were made in the apparel, fashion, and sports product categories, totaling over 14 million. By 2022, the share of people shopping online will reach over 74 percent in Hungary. Moreover, with the growing popularity of e-commerce, online retail trade revenue increased year over year in Hungary. In 2021, revenues from online retail will total 1.2 trillion forints. Even though in previous years the new online shopper growth rate had slowed down, the COVID-19 pandemic led to significant growth in e-commerce. E-commerce in Hungary is expected to have a USD 2.04 billion total turnover in 2020, representing 6.2% of the total retail trade.Due to its geographical position, Hungary occupies a central position in Europe, acting as a ferry linking the EU with the rest of Europe. U.S. companies wishing to establish a presence in Hungary can take advantage of this by establishing their logistic center in Hungary and supplying Europe from here. For instance, in April 2020, Yusen Logistics opened a new office located at the regional cargo hub in Budapest, Hungary, which will help clients around the world access Europe more easily. Therefore, the rapid expansion of e-commerce represents a major growth opportunity for logistics companies, as it generates increased demand for dedicated services.

Shift towards Intermodal Freight Transport

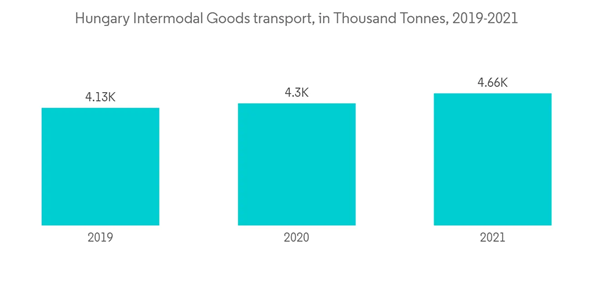

The freight industry is one of the most important industries because it plays a significant role in trade and commerce. Moreover, intermodal transport significantly reduces the cost and time spent on deliveries by using a combination of different modes of transport. In Hungary, the most utilized mode of transporting goods is by road. If about 10-20% of long-distance road freight traffic would be shifted to rail and waterway transport, the environmental burden of public roads could be reduced. There are more than 500,000 heavy goods vehicles on the roads of Budapest and within 70 km of the city every year. About 5 to 10% of this traffic could be a potential business partner for rail intermodal freight transport, which would mean the intermodal transport of up to 25,000 to 50,000 heavy goods trailers per year. To facilitate this shift from roads to rail and waterways, many improvements have been initiated by the Hungarian government. The road, rail, and waterway partnerships have been upgraded, allowing carriers to save costs and compensate for the significant driver shortage. Also, new industrial parks, larger warehouses, and logistics centers are being encouraged to build rail links.Hungary is establishing a logistics base in the port of Trieste, Italy, on an area of 32 hectares. This will allow companies to reach the Hungarian sea exit by road or rail within 24 hours. As part of the National Intermodal Container Terminal Network, the country has also worked on projects to set up intermodal hubs.

The East-West Gate (EWG) terminal is located at a junction between Hungary’s 1435-mm and Ukraine’s 1520-mm-gauge rail lines, south of the border crossing point of Zahony. The facility can handle up to one million 20-foot containers per year. The terminal will load the trucks and conventional road semi-trailers onto the rail as well as provide trans-shipment of wagons between the two gauges. Moreover, the Hungarian government has committed 12.4 billion forints (USD 0.035 Billion) to improve rail infrastructure around EWG as well as the Zahony Wide station.

Hungary Freight and Logistics Industry Overview

The market is highly fragmented in nature, with large companies claiming significant market share. The Hungarian logistics industry is undergoing significant developments in the fields of both indoor and transport logistics, thus creating new market opportunities for existing players in the market. The initiatives taken by the government to develop the logistics market in Hungary are further motivating new players to enter the market. Some of the existing major players in the market include APL, Austromar, Cargill, CEVA, Logistics, DB Schenker, JFC, KTI, Logwin, Nec Logistics, Raben, Rhenus, and Yusen Logistics.Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

This product will be delivered within 2 business days.

Table of Contents

1 INTRODUCTION1.1 Study Assumptions and Market Definition

1.2 Scope of the Study

2 RESEARCH METHODOLOGY

2.1 Research Framework

2.2 Secondary Research

2.3 Primary Research

2.4 Data Triangulation and Insight Generation

2.5 Project Process And Structure

2.6 Engagement Frameworks

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

4.1 Current Market Scenario

4.2 Technological Trends

4.3 Government Regulations and Initiatives

4.4 Insights into the E-commerce Industry (Domestic and Cross-border E-commerce)

4.5 Insights into Intermodal Transportation and Dry Ports

4.6 Brief on Freight Transportation Costs/Freight Rates, Warehousing Rents in Hungary

4.7 Elaboration on the E-commerce Logistics and Courier, Express, and Parcel (CEP) Industry in Hungary

4.8 Brief on Transport Corridors

4.9 Spotlight on Regional Logistics Markets

4.10 Impact of COVID-19 on the Market

5 MARKET DYNAMICS

5.1 Market Drivers

5.2 Market Restraints/Challenges

5.3 Market Opportunities

5.4 Industry Attractiveness - Porter's Five Forces Analysis

5.4.1 Threat of New Entrants

5.4.2 Bargaining Power of Buyers/Consumers

5.4.3 Bargaining Power of Suppliers

5.4.4 Threat of Substitute Products

5.4.5 Intensity of Competitive Rivalry

6 MARKET SEGMENTATION

6.1 By Function

6.1.1 Freight Transport

6.1.1.1 Road

6.1.1.2 Shipping and Inland Water

6.1.1.3 Air

6.1.1.4 Rail

6.1.2 Freight Forwarding

6.1.3 Warehousing

6.1.4 Value-added Services and Other Functions

6.2 By End User

6.2.1 Manufacturing and Automotive

6.2.2 Oil and Gas

6.2.3 Mining and Quarrying

6.2.4 Agriculture, Fishing, and Forestry

6.2.5 Construction

6.2.6 Distributive Trade (Wholesale and Retail Segments - FMCG included)

6.2.7 Other End Users (Telecommunications, Food and Beverage, and Pharmaceuticals)

7 COMPETITIVE LANDSCAPE

7.1 Overview (Market Concentration and Major Players)

7.2 Company Profiles

7.2.1 APL

7.2.2 Austromar

7.2.3 Cargill

7.2.4 CEVA Logistics

7.2.5 DB Schenker

7.2.6 Logwin

7.2.7 NEC Logistics

7.2.8 Raben Group

7.2.9 Rhenus Logistics

7.2.10 Yusen Logistics*

8 MARKET OPPORTUNITIES AND FUTURE TRENDS

9 APPENDIX

9.1 GDP Distribution, by Activity and Region

9.2 Insights into Capital Flows

9.3 Economic Statistics - Transport and Storage Sector, Contribution to Economy

9.4 External Trade Statistics - Export and Import, by Product

9.5 Insights into Key Export Destinations

9.6 Insights into Key Import Origin Countries

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- APL

- Austromar

- Cargill

- CEVA Logistics

- DB Schenker

- Logwin

- NEC Logistics

- Raben Group

- Rhenus Logistics

- Yusen Logistics*