Various studies have depicted that During pandemic, 89% of the ski companies recorded an activity loss of up to 50% due to the closure of ski lifts for the 2020-2021 winter sports season. More worrying, 11% registered an activity loss of more than 80%. Even in the countries where ski lifts were open, 67% of the companies have observed a strong decrease in the number of visitors. For instance, sporting equipment companies, including winter sports equipment market witnessed a step decline in their market shares during initial months of pandemic. However, the key players, UVEX group, witnessed a decrease in net sales of 3% in this segment during 2020. As tourism recovers following the pandemic, the market for winter sports equipment is likely to expand once again.

In Europe winter sports are more than just exciting sports, it is a part of the culture and is also seen as a glamorous leisure industry that brings together healthy sporting activity, tourism, and hospitality. Winter tourism forms an important industry in the European Alps, and the growth of this sector is poised to act as a favorable factor, following strong participation from women. Apart from this, the fusion of gadgets in skiing and snowboarding with respect to a strong inclination toward technological innovation and implementation is expected to boost the market studied. The market is likely to have slow growth in terms of the “looming impact of Brexit”, however, the growth is expected to be short-lived, as more mainstream sports enthusiasts are anticipated to fulfill the gap at a significant rate.

Key Market Trends

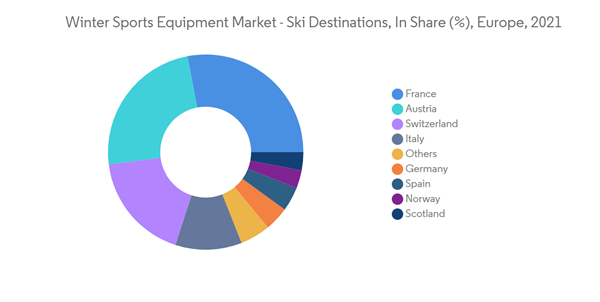

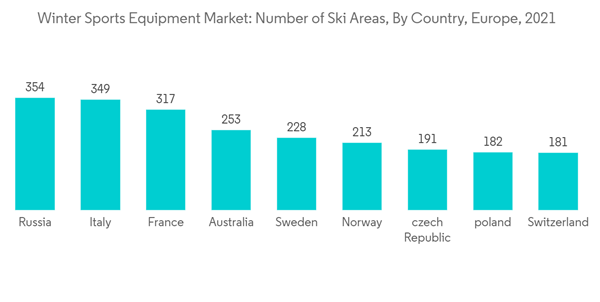

Growing Number Of Ski Destinations Drives the Market

The ski industry in Europe is largely dependent on the snow season. The increased inflow of tourists has led to a surging demand among people to hire ski equipment, thereby, pivoting the sales of such materials through ski resorts. In fact, resorts that can avail equipment during the peak seasons and have a larger ground compared to competitors are more likely to have stable growth in a mature market, like Europe. The size of resorts has also changed since consumers’ preferences in covering more distance and area in a day have witnessed a massive demand. Accordingly, larger resorts, which can incorporate other activities for consumers in their mountain stays, for example, horseback rides, development of culinary experiences, along with community development programs, have garnered a significant inflow of tourists.

Gadgets Fusion - The Next Big Thing

The winter sports equipment market across Europe is expected to be primarily driven by the Alpine touring concept. Alpine Touring gear is both accustomed for uphill and downhill travel and is more comfortable, efficient, durable, and lighter. It is also far more widely available on a rental basis. On the other hand, the aging set of consumers who are tired of crowds, lift lines, and crowded slopes but still love to be outdoors in winter, are the main targeted segments for the sales of AT gear. Technology associated with skiing and snowboarding is advancing with new innovations and start-ups appearing almost daily. In general, as cited by Club Meds, one in five Brits took an action camera, such as a GoPro (23%) or an activity tracker, like a Fitbit (21%) on their ski holiday. More than one in ten (13%) admitted of carrying a drone to take on their next ski or snowboard holiday, showing that technology on the slopes has hit the mainstream.

Competitive Landscape

Europe Winter Sports Equipment market is highly competative and comprises of a few large players, who hold most of the share in the market. Key players were actively engaging in activities, such as expansions, product innovations, mergers and acquisitions, and partnerships. Some of the major players in the market are Amer Sports Oyj, Fischer Beteiligungsverwaltungs GmbH, Åre Skidfabrik AB, Clarus Corporation, Groupe Rossignol, Marker Dalbello Völkl (International) GmbH, Burton Snowboards, UVEX group, Alpina, d.o.o., Tecnica Group SpA, among others.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

This product will be delivered within 2 business days.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Amer Sports Oyj

- Fischer Beteiligungsverwaltungs GmbH

- Åre Skidfabrik AB

- Clarus Corporation

- Groupe Rossignol

- Marker Dalbello Volkl (International) GmbH

- Vista Outdoor Inc.

- Burton Snowboards

- UVEX group

- Alpina, d.o.o.

- Tecnica Group SpA