The North America region has one of the world's largest fleets of commercial and military aircraft. The aging fleet of aircraft in the military and commercial sectors and the growing use of retrofitting technologies for aircraft improvement are expected to drive the market. With the introduction of new aircraft in commercial aviation, several new long-term aircraft engine maintenance contracts will be signed shortly between the airlines and aircraft engine MRO providers. Such contracts are anticipated to further boost the growth of the market during the forecast period.

The growth of emission regulations for the airspace by various regulatory bodies, like FAA, IATA, and ICAO, will lead to generating greater demand for better engine maintenance for older aircraft, as their emissions are higher compared to the newer generation aircraft engines, which in turn will be a significant factor driving the market during the forecast period. On the other hand, supply chain issues and shortage of skilled workforce and engine components hinder the market growth.

North America Aircraft Engine MRO Market Trends

Commercial Aviation Segment Will Showcase Remarkable Growth During the Forecast Period

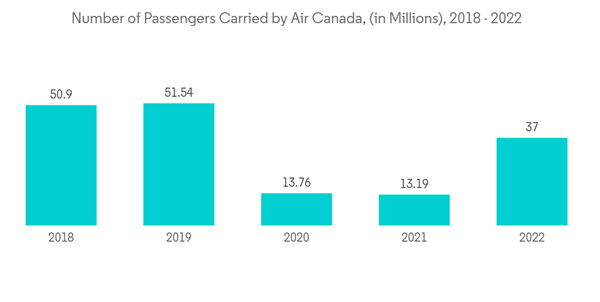

The commercial aviation segment is anticipated to show significant growth in the North America aircraft engine MRO market during the forecast period. The growth is attributed to the increase in air passenger traffic in the North American region and the growing spending on the aviation sector in the United States. Moreover, increasing commercial aircraft acquisitions within the United States and Canada will help bolster the market growth during the forecast period.Furthermore, the United States and Canada have witnessed significant growth in several commercial aircraft acquisitions in 2022. For instance, in September 2023, Air Canada announced that it had placed a firm order with The Boeing Company for 18 Boeing 787-10 Dreamliner aircraft. The deliveries of the new aircraft are scheduled to begin in two years, with the last aircraft scheduled for delivery in four years.

The growth in the number of commercial aircraft acquisitions by countries such as Canada and the United States will also push for the growth of commercial aircraft engine MRO facilities and services within the North American region. Additionally, in recent years, the North American region has witnessed an increase in the demand for commercial aircraft engine MRO services and facilities. For instance, in April 2019, Lufthansa Technik, based out of Germany, announced their plans to expand their aircraft engine MRO center in Montreal, Canada. Moreover, Lufthansa Technik has also announced that they will set up a professional training workshop, which the German dual model inspired.

Thus, the growth in the number of air passenger traffic and commercial aircraft acquisitions in the United States and Canada in recent years will bolster the growth for various new market players to provide significant aircraft engine MRO services within the region to ensure increased lifecycle of the commercial aircraft in the North American region thereby leading to significant market growth during the forecast period.

The United States Will Showcase Remarkable Growth During the Forecast Period

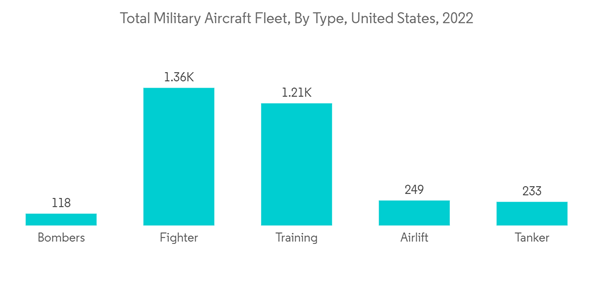

The United States is projected to show the highest growth during the forecast period. There has been a growth in the number of commercial and military aircraft acquisitions in the United States in recent years. With several MRO companies focused on providing advanced aircraft engine MRO services, such factors will lead to the United States showing the highest growth during the forecast period.According to the data published by World Population Review, in 2022, the United States had 13,247 fighter aircraft, with 5,217 military aircraft in the Air Force, 4,409 military aircraft in the Army as well as 2,464 military aircraft in the Navy, and 1,157 military aircraft used by the marines. Moreover, there has been significant growth in the number of new military aircraft acquisitions by the United States in recent years.

The average commercial aircraft fleet in the United States is close to 11 years, while that for military aircraft is over 26 years, with some bomber aircraft being operational for more than five decades. In the current scenario, the United States Department of Defense is engaged in signing various long-term contracts with MRO providers in the country to maintain its growing fleet of military aircraft.

Moreover, the presence of various companies engaged in providing aircraft engine MRO services within the United States, such as Honeywell International Plc. and AAR Corp., is leading to the United States witnessing significant growth in the market in recent years. Additionally, such players are also engaged in increasing their research investments for better aircraft engine MRO services.

Thus, the increase in several aircraft acquisitions and the growing presence of aircraft engine MRO service providers within the United States will lead to a positive outlook and significant market growth during the forecast period.

North America Aircraft Engine MRO Industry Overview

The North America aircraft engine MRO market is moderately fragmented, with various market players attempting to gain significant market share through product differentiation. Some of the major market players include Delta Airlines, Inc., Rolls-Royce Plc., RTX Corporation, MTU Aero Engines AG, and Honeywell International Inc., amongst others.Generally, the airlines and MRO service providers sign long-term contracts to provide engine MRO services. This allows the companies to increase their customer base in the region, making it difficult for new entrants to capture new opportunities in the market. Moreover, in the current scenario, various airlines and MRO providers plan to upgrade their facilities to increase their service offerings. Therefore, such programs will help the MRO providers improve their services and support the companies in further capturing new market opportunities in the North American Region.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

This product will be delivered within 2 business days.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Delta Air Lines, Inc.

- Rolls-Royce plc

- Raytheon Technologies Corporation

- Safran SA

- General Electric Company

- MTU Aero Engines AG

- AAR Corp

- Honeywell International Inc.

- IAG Aero Group

- GKN Aerospace

- Lockheed Martin Corporation

- StandardAero