Before the COVID-19 outbreak, Asia-Pacific was the fastest-growing region in the world for the aviation industry and attracted global MRO players to enter the market and expand their customer base. However, the COVID-19 pandemic caused a severe downturn in the airline and associated industries. Due to lower demand for commercial aviation, major airlines have restructured their growth strategies, which included early retirement of a few aircraft, postponement of new aircraft deliveries, and scaling down operations, among others. A majority of the fleet remained grounded for a significant period in 2020 and a few months in 2021, while some airlines opted for major maintenance work during this period.

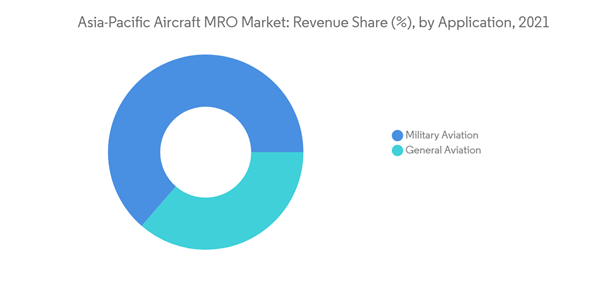

In the military segment, though several countries are procuring new aircraft every year, the region still has some of the oldest aircraft fleets in the world, which is also increasing the demand for aircraft MRO activities. On the other hand, the demand for general aviation operations like jet charters grew in the region, while the demand for commercial airlines declined, which had an overall positive impact on the general aviation MRO industry.

Asia Aircraft MRO Market Trends

Commercial Aviation Segment Projected to Dominate the Market During the Forecast Period

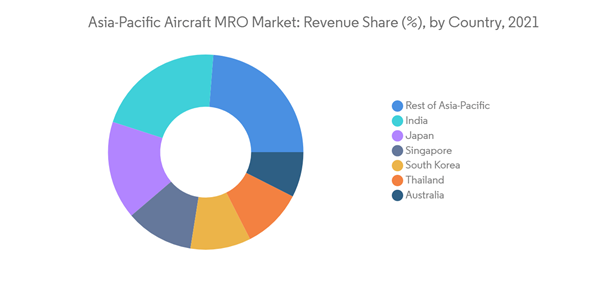

The commercial aviation segment held the largest market share in the region in 2021 and is expected to continue its growth during the forecast period. After a severe downturn in passenger traffic in 2020 due to the COVID-19 pandemic, domestic airline traffic quickly recovered in key markets like China and India in 2021, which helped the low-cost carriers (LCCs) in the region to focus on quickly operationalizing their fleets. Thus, MRO providers in the Asia-Pacific region are expected to face a capacity crunch temporarily as airlines return more of their fleets to service. Also, the region is witnessing an increase in the penetration and expansion of LCCs, thereby increasing the demand for aircraft MRO. In addition to China and India, countries like Japan, Thailand, Singapore, and South Korea in the Asia-Pacific region are also experiencing a recovery in domestic commercial aviation passenger traffic and are witnessing an increasing trend for commercial aircraft MRO activities. The airlines in the region are also planning to strengthen their MRO capabilities and award contracts to other specialized MRO providers. In February 2022, AirAsia's parent Capital A Bhd announced that it is raising more than USD 95 million (MYR 400 million) in capital for its engineering arm as it plans to build maintenance, repair, and overhaul (MRO) facilities at the Kuala Lumpur International Airport. Such activities are expected to drive the commercial aviation segment during the forecast period.China Held the Largest Market Share in 2021

China held the largest share of the market studied in 2021. In the commercial sector, according to the Civil Aviation Administration of China, air passenger numbers rose to 440 million in 2021, which is 66.8% of pre-pandemic levels. By the end of 2021, the active aircraft fleet of China crossed its pre-pandemic levels, which resulted in increased demand for MRO operations. Furthermore, the increase in aircraft fleet and a quick recovery in flight activity are expected to make China one of the few countries in the world to cross pre-pandemic MRO levels in 2022. The airlines in China are planning to procure a large number of aircraft during the forecast period, which is expected to further increase the demand for commercial aircraft MRO activities in the country. Several MRO contracts are being awarded by Chinese airlines to various MRO providers. In February 2022, Collins Aerospace announced that China Airlines and its low-cost subsidiary Tigerair Taiwan have awarded long-term contracts to Collins Aerospace for its FlightSense program. Under the contract, Collins will provide engine accessory repair services for China Airlines' fleet of 25 A321neo aircraft and engine accessory repair and spare support for Tigerair Taiwan's fleet of 15 A320neo aircraft. Such contracts are expected to boost the market's growth in China during the forecast period. In the military segment, the Chinese government is working to make its air force stronger, more efficient, and more technologically advanced to become a top-tier force within the next 30 years. With the rapid induction of new aircraft, the need for quality MRO services has also become significant in maintaining the airworthiness of the fleet. The country also has the largest number of general aviation aircraft in the Asia-Pacific, which is reflected in the higher demand for general aviation MRO activities. All these factors are expected to support the dominance of the Chinese aircraft MRO industry during the forecast period.Asia Aircraft MRO Industry Overview

ST Engineering, SIA Engineering Company, Hong Kong Aircraft Engineering Company Limited (HAECO), AAR, and Lufthansa Technik are some of the prominent players in the market. Players from Singapore and Hong Kong dominate the MRO market in Asia. In recent years, several players from other Asian countries have increased their investment in MRO facilities to replicate the success of players from Singapore and Hong Kong in this sector. Simultaneously, companies from Indonesia and Thailand are entering the market to challenge the dominance of established Singapore-based players, which is expected to change the region's competitive landscape in the years to come. In addition, due to the huge potential of the Asia-Pacific aviation market, several global players are establishing new centers in the region to cater to the growing demand. For instance, AAR recently obtained several new maintenance contracts with customers from China, Japan, and India and is looking to increase its presence in the region with the help of partnerships and joint ventures. Moreover, with the growing dominance of OEMs, small and independent MRO facilities have had to rework their business models to sustain themselves in the increasing competition in the Asia-Pacific MRO market.Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

This product will be delivered within 2 business days.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Hong Kong Aircraft Engineering Company Limited (HAECO)

- ST Engineering

- Lufthansa Technik

- AAR Corporation

- SIA Engineering Company

- Air Works India (Engineering) Private Limited

- Guangzhou Aircraft Maintenance Engineering Company Limited

- Lockheed Martin Corporation

- The Boeing Company

- Dassault Aviation

- General Electric

- Safran SA

- GMF AeroAsia

- Rolls Royce PLC

- ExecuJet MRO Services

- AVIA SOLUTIONS GROUP PLC

- Sepang Aircraft Engineering Sdn Bhd