Medical Devices Global Market Opportunities and Strategies To 2030: COVID-19 Impact and Recovery provides the strategists, marketers and senior management with the critical information they need to assess the global medical devices market as it emerges from the COVID 19 shut down.

Reasons to Purchase

- Gain a truly global perspective with the most comprehensive report available on this market covering 14 geographies.

- Understand how the market is being affected by the coronavirus and how it is likely to emerge and grow as the impact of the virus abates.

- Create regional and country strategies on the basis of local data and analysis.

- Identify growth segments for investment.

- Outperform competitors using forecast data and the drivers and trends shaping the market.

- Understand customers based on the latest market research findings.

- Benchmark performance against key competitors.

- Utilize the relationships between key data sets for superior strategizing.

- Suitable for supporting your internal and external presentations with reliable high-quality data and analysis.

Description:

Where is the largest and fastest growing market for medical devices? How does the market relate to the overall economy; demography and other similar markets? What forces will shape the market going forward? The medical devices market global report from the publisher answers all these questions and many more.

The report covers market characteristics; size and growth; segmentation; regional and country breakdowns; competitive landscape; market shares; trends and strategies for this market. It traces the market’s historic and forecast market growth by geography. It places the market within the context of the wider medical devices market; and compares it with other markets.

The report covers the following chapters

- Executive Summary - The executive summary section of the report gives a brief overview and summary of the report.

- Report Structure - This section gives the structure of the report and the information covered in the various sections.

- Introduction - The introduction section of the report gives brief introduction about segmentation by geography and segmentation by type of device, end user and expenditure.

- Market Characteristics - The market characteristics section of the report defines and explains the medical devices market. This chapter includes different products covered in the report and basic definitions.

- Supply Chain - The supply chain section of the report defines and explains the key players in the medical devices industry supply chain.

- Product Analysis - The product analysis section of the report describes the leading products in the market along with key features and differentiators for those products.

- Customer Information - This chapters covers recent customers’ trends/preferences in the global medical devices market.

- Trends and Strategies - This chapter describes the major trends shaping the global medical devices market. This section highlights likely future developments in the market and suggests approaches companies can take to exploit these opportunities.

- PESTEL Analysis - This chapter comprises important factors for the potential of the medical devices market opportunity assessment.

- Impact Of COVID-19 - This section describes newly discovered coronavirus impact on global medical devices market.

- Regulatory Landscape - This section describes the regulations that impact the global medical device industry.

- Global Market Size and Growth - This section contains the global historic (2015-2020) and forecast (2025 and 2030) market values, and drivers and restraints that support and restrain the growth of the market in the historic and forecast periods.

- Regional Analysis - This section contains the historic (2015-2020), forecast (2025 and 2030) market value and growth and market share comparison by region.

- Market Segmentation - This section contains the market values (2015-2020, 2025 and 2030) and analysis for different segments (by type of equipment and by end use) in the market.

- Regional Market Size and Growth - This section contains the region’s market size (2020), historic and forecast (2015-2020, 2025 and 2030) market values, and growth and market share comparison of major countries within the region. This report includes information on all the regions (Asia Pacific, Western Europe, Eastern Europe, North America, South America, Middle East and Africa).

- Competitive Landscape - This section covers details on the competitive landscape of the global medical devices market, estimated market shares and company profiles of the leading players.

- Key Mergers and Acquisitions - This chapter gives the information on recent mergers and acquisitions in the market covered in the report. This section gives key financial details of mergers and acquisitions which have shaped the market in recent years.

- Market Background - This section describes the healthcare market of which the medical devices market is a segment. This chapter includes the healthcare market 2015-2030 values, and regional analyses for the healthcare market.

- Market Opportunities and Strategies - This section gives information on growth opportunities across countries and segments, and strategies to be followed in those markets.

- Conclusions and Recommendations - This section includes recommendations based on findings of the research. This section gives information on growth opportunities across countries, segments and strategies to be followed in those markets. It gives an understanding of where there is significant business to be gained by competitors in the next five years.

- Appendix - This section includes details on the NAICS codes covered, abbreviations and currencies codes used in this report.

Scope

Markets Covered:

- By Type Of Device: In-Vitro Diagnostics; Dental Equipment and Supplies; Ophthalmic Devices; Diagnostic Imaging Equipment; Cardiovascular Devices; Hospital Supplies; Surgical Equipment; Orthopedic Devices; Patient Monitoring Devices; Diabetes Care Devices; Nephrology and Urology Devices; ENT Devices; Anesthesia and Respiratory Devices; Neurology Devices; Wound Care Devices

- By Type Of Expenditure: Public Expenditure; Private Expenditure

- By Type Of End-User: Hospitals and Clinics; Homecare; Diagnostic Centers

Companies Mentioned:

Medtronic Plc; Johnson & Johnson; Abbott Laboratories; Becton, Dickinson and Company; Siemens Healthineers AG

Countries:

China; Australia; India; Indonesia; Japan; South Korea; USA; Brazil; France; Germany; UK; Spain; Italy; Russia

Regions:

Asia-Pacific; Western Europe; Eastern Europe; North America; South America; Middle East; Africa

Time series:

Five years historic and ten years forecast.

Data:

Ratios of market size and growth to related markets; GDP proportions; expenditure per capita; medical devices indicators comparison.

Data segmentations:

Country and regional historic and forecast data; market share of competitors; market segments.

Sourcing and Referencing:

Data and analysis throughout the report is sourced using end notes.

This product will be delivered within 3-5 business days.

Table of Contents

1. Medical Devices Market Executive Summary2. Table of Contents

3. List of Figures

4. List of Tables

5. Report Structure

6. Introduction

6.1. Segmentation By Geography

6.2. Segmentation By Type Of Device

6.3. Segmentation By Type Of Expenditure

6.4. Segmentation By End-User

7. Medical Devices Market Characteristics

7.1. Market Definition

7.2. Market Segmentation By Type Of Device

7.2.1. In-Vitro Diagnostics

7.2.2. Dental Equipment And Supplies

7.2.3. Ophthalmic Devices

7.2.4. Diagnostic Imaging Equipment

7.2.5. Cardiovascular Devices

7.2.6. Hospital Supplies

7.2.7. Surgical Equipment

7.2.8. Orthopedic Devices

7.2.9. Patient Monitoring Devices

7.2.10. Diabetes Care Devices

7.2.11. Nephrology And Urology Devices

7.2.12. ENT Devices

7.2.13. Anesthesia And Respiratory Devices

7.2.14. Neurology Devices

7.2.15. Wound Care Devices

7.3. Market Segmentation By Type Of Expenditure

7.3.1. Public Expenditure

7.3.2. Private Expenditure

7.4. Market Segmentation By Type Of End-User

7.4.1. Hospitals and Clinics

7.4.2. Homecare

7.4.3. Diagnostic Centers

8. Medical Devices Market, Supply Chain Analysis

8.1. Raw Material And Component Suppliers

8.1.1. Metals And Plastics Suppliers

8.1.2. Components Suppliers

8.2. Brand Manufacturers

8.3. Contract Manufacturers

8.4. Wholesalers And Distributors

8.5. Retailers

8.6. End Users

9. Medical Devices Market, Product Analysis - Product Examples

10. Medical Devices Market Customer Information

10.1. Decrease In The Use Of Wearable Technology

10.2. Diabetes Devices Pulse Survey

10.2.1. India

10.2.2. USA

10.3. Tube-Free Patches And Fewer Insulin Injections Are Key For Diabetes Patients

10.4. Consistent Outcomes And Positive Patient Outcomes Are The Major Deciding Factors For Purchasing Medical Devices

10.5. Medical Device Makers Face Challenges With UDI Implementation

10.6. A High Rate Of Equipment Unavailability Is The Major Challenge In Medical Devices Maintenance

10.7. Lack Of Evidence In Scientific Methods Raised The Question Of Whether Health Technology Assessment (HTA) Agencies Need To Develop New Methods

10.8. Industry Experts Say Medical Devices Sales Are On Rise

10.9. Cyber-Attacks May Target Medical Devices

11. Medical Devices Market Trends And Strategies

11.1. Expansion Of Medical Technologies

11.2. Medical Device Manufacturers Are Repurposing Production Lines

11.3. Self-Diagnosis/Treatment Is Increasing

11.4. Technology And Analytics In Patient Care

11.5. Health Monitors And Mobile Applications Receive Investments

11.6. Hybrid Imaging Technology

11.7. Devices With Low Ionizing Radiation

11.8. Wearables And Mobile Applications

11.9. COVID Product Trends

11.9.1. Increased Demand For Portable Sterilization Devices

11.9.2. Adoption Of Infrared Thermometers

11.9.3. High Demand For Disposable Medical Products

12. Medical Devices Market Opportunity Assessment, PESTEL Analysis

12.1. Political

12.1.1. Government Policies

12.1.2. Political Uncertainties

12.1.3. Government Initiatives And Subsidies

12.1.4. Increasing Public Insurance Coverage

12.1.5. Increasing Tie-ups Between Government And Manufacturers Due To COVID-19 Effect

12.1.6. Corruption Affecting The Medical Devices Market In Developing Countries

12.1.7. Trade Restrictions

12.2. Economic

12.2.1. Emerging Markets

12.2.2. Globalization

12.2.3. High Interest Rates

12.2.4. Increase In Inflation Rates

12.3. Social

12.3.1. Aging Global Populations

12.3.2. Unhealthy Lifestyles

12.3.3. Increasing Health Consciousness

12.3.4. COVID Effect On Health Consciousness

12.4. Technological

12.4.1. Technological Advances

12.4.2. Increasing R&D Investment

12.5. Environmental

12.5.1. Air Pollution

12.5.2. Global Warming

12.5.3. Rising Airborne Diseases

12.5.4. Growing Environmental Consciousness

12.6. Legal

12.6.1. Stringent Regulations

12.6.2. Taxation On Medical Devices

13. Global Medical Equipment Market - COVID-19 Impact And Recovery Analysis

13.1. Impact On Global Medical Equipment Supply Chain

13.2. Impact On Global Medical Equipment Production

13.3. Impact On Global Medical Equipment Demand

13.4. Impact On Global Medical Equipment Prices

13.5. Impact On Global Medical Equipment Regulations/Initiatives

13.6. Impact On The Top Five Global Medical Equipment Companies

13.6.1. Medtronic Plc

13.6.2. Johnson & Johnson

13.6.3. Abbott Laboratories

13.6.4. Becton, Dickinson & Company (BD)

13.6.5. Siemens Healthineers AG

13.7. Impact Of COVID-19 On The Medical Devices/Equipment Products

13.8. Impact Of COVID-19 On The N95 Respirators And Other Surgical Masks Market

13.8.1. Soaring Demand

13.8.2. Restrictions On Supply

13.8.3. Market Normality

13.9. Impact Of COVID-19 On The Operating Room Equipment Market

13.9.1. Operating Theatre Respiratory Devices

13.9.2. Patient Monitoring Devices

13.9.3. Disposables

13.10. Impact of COVID-19 On The Respiratory Devices Market

13.10.1. High Mortality Among Asthma Patients

13.10.2. Respiratory Devices And Equipment (Therapeutic)

13.10.3. Nebulizers

13.10.4. Ventilators

13.11. Impact Of COVID-19 On The Other Medical Products

13.11.1. PCR and Realtime PCR testing

13.11.2. In-Vitro Diagnostics

13.11.3. Immunochemistry Diagnostic Devices And Equipment

13.11.4. Molecular Diagnostics Devices And Equipment

13.11.5. Microbiology Diagnostic Devices And Equipment

13.11.6. Dialysis Devices And Equipment

13.11.7. Chest CT

13.11.8. Infrared Thermometers

13.11.9. Pulse Oximeters

13.11.10. Spirometers

13.11.11. Laryngoscope

14. Global Medical Devices Market Regulatory Landscape

14.1. Pre-Market Regulation

14.2. “Placing On The Market” Regulation

14.3. Post-Market Regulation

15. Global Medical Devices Market Size And Growth

15.1. Market Size

15.2. Historic Market Growth, 2015 - 2020, Value ($ Billion)

15.2.1. Drivers Of The Market 2015 - 2020

15.2.2. Restraints On The Market 2015 - 2020

15.3. Forecast Market Growth, 2020 - 2025, 2030F, Value ($ Billion)

15.3.1. Drivers Of The Market 2020 - 2025

15.3.2. Restraints On The Market 2020 - 2025

16. Medical Devices Market, Regional Analysis

16.1. Global Medical Devices Market, By Region, Historic and Forecast, 2015 - 2020, 2025F, 2030F, Value ($ Billion)

16.2. Global Medical Devices Market, 2015 - 2025, Historic And Forecast, By Region

16.3. Global Medical Devices Market, 2020 - 2025, Growth And Market Share Comparison, By Region

16.4. Global Medical Devices Market, By Country, Historic and Forecast, 2015 - 2020, 2025F, 2030F, Value ($ Billion)

16.5. Global Medical Devices Market, 2015 - 2025, Historic And Forecast, By Country

16.6. Global Medical Devices Market, 2020 - 2025, Growth And Market Share Comparison, By Country

17. Global Medical Devices Market Segmentation

17.1. Global Medical Devices Market, Segmentation By Type Of Device, Historic And Forecast, 2015 - 2020, 2025F, 2030F, Value ($ Billion)

17.1.1. In-Vitro Diagnostics

17.1.2. Cardiovascular Devices

17.1.3. Orthopedic Devices

17.1.4. Hospital Supplies

17.1.5. Diabetes Care Devices

17.1.6. Diagnostic Imaging Equipment

17.1.7. Anesthesia And Respiratory Devices

17.1.8. Ophthalmic Devices

17.1.9. Nephrology And Urology Devices

17.1.10. Wound Care Devices

17.1.11. Dental Equipment And Supplies

17.1.12. Patient Monitoring Devices

17.1.13. ENT Devices

17.1.14. Surgical Equipment

17.1.15. Neurology Devices

17.2. Global Medical Devices Market, Segmentation By Type Of Expenditure, Historic And Forecast, 2015 - 2020, 2025F, 2030F, Value ($ Billion)

17.2.1. Public

17.2.2. Private

17.3. Global Medical Devices Market, Segmentation By End User, Historic And Forecast, 2015 - 2020, 2025F, 2030F, Value ($ Billion)

17.3.1. Hospitals And Clinics

17.3.2. Homecare

17.3.3. Diagnostic Centers

18. Medical Devices Market Segments

18.1. In-Vitro Diagnostics

18.1.1. Market Characteristics

18.1.2. In-Vitro Diagnostics Market Segmentation By Type Of Device

18.1.3. In-Vitro Diagnostics Market Trends And Strategies

18.1.4. Global In-Vitro Diagnostics Market, Segmentation By Type Of Device, Historic And Forecast, 2015 - 2020, 2025F, 2030F, Value ($ Billion)

18.1.5. Point-of-Care Diagnostics Devices And Equipment

18.1.6. Molecular Diagnostics Devices And Equipment

18.1.7. Immunochemistry Diagnostic Devices And Equipment

18.1.8. Clinical Chemistry Diagnostics Devices And Equipment

18.1.9. Microbiology Diagnostic Devices And Equipment

18.1.10. Hematology Diagnostic Devices And Equipment

18.1.11. Hemostasis Diagnostic Devices And Equipment

18.1.12. Immunohematology Diagnostic Devices And Equipment

18.2. Dental Equipment And Supplies

18.2.1. Market Characteristics

18.2.2. Dental Equipment And Supplies Market Segmentation By Type Of Device

18.2.3. Dental Equipment And Supplies Market Trends And Strategies

18.2.4. Global Dental Equipment And Supplies Market, Segmentation By Type Of Device, Historic And Forecast, 2015 - 2020, 2025F, 2030F, Value ($ Billion)

18.2.5. General Dental Devices And Equipment

18.2.6. Dental Surgical Devices And Equipment

18.2.7. Dental Diagnostic Imaging Devices And Equipment

18.2.8. Therapeutic Dental Equipment

18.3. Ophthalmic Devices

18.3.1. Market Characteristics

18.3.2. Ophthalmic Devices Market Segmentation By Type Of Device

18.3.3. Ophthalmic Devices Market Trends And Strategies

18.3.4. Global Ophthalmic Devices Market, Segmentation By Type Of Device, Historic And Forecast, 2015 - 2020, 2025F, 2030F, Value ($ Billion)

18.3.5. Vision Care Devices And Equipment

18.3.6. Cataract Surgery Devices And Equipment

18.3.7. Diagnostic And Monitoring Ophthalmic Devices And Equipment

18.3.8. Refractive Surgery Devices And Equipment

18.4. Diagnostic Imaging Equipment

18.4.1. Market Characteristics

18.4.2. Diagnostic Imaging Equipment Market Segmentation By Type Of Device

18.4.3. Diagnostic Imaging Equipment Market Trends And Strategies

18.4.4. Global Diagnostic Imaging Equipment Market, Segmentation By Type Of Device, Historic And Forecast, 2015 - 2020, 2025F, 2030F, Value ($ Billion)

18.4.5. X-Ray Systems Devices And Equipment

18.4.6. Ultrasound Systems Devices And Equipment

18.4.7. Computed Tomography (CT) Scanners Devices And Equipment

18.4.8. Magnetic Resonance Imaging Systems Devices And Equipment

18.4.9. Cardiovascular Monitoring And Diagnostic Devices And Equipment

18.4.10. Nuclear Imaging Devices And Equipment

18.5. Hospital Supplies

18.5.1. Market Characteristics

18.5.2. Hospital Supplies Market Segmentation By Type Of Product

18.5.3. Hospital Supplies Market Trends And Strategies

18.5.4. Global Hospital Supplies Market, Segmentation By Type Of Product, Historic And Forecast, 2015 - 2020, 2025F, 2030F, Value ($ Billion)

18.5.5. Disposable Hospital Supplies

18.5.6. Sterilization Equipment And Disinfectants

18.5.7. Operating Room Equipment

18.5.8. Mobility Aids And Transportation Equipment

18.6. Cardiovascular Devices

18.6.1. Market Characteristics

18.6.2. Cardiovascular Devices Market Segmentation By Type Of Device

18.6.3. Cardiovascular Devices Market Trends And Strategies

18.6.4. Global Cardiovascular Devices Market, Segmentation By Type Of Device, Historic And Forecast, 2015 - 2020, 2025F, 2030F, Value ($ Billion)

18.6.5. Cardiovascular Surgery Devices And Equipment

18.6.6. Cardiac Rhythm Management (CRM) Devices And Equipment

18.6.7. Interventional Cardiology Devices And Equipment

18.6.8. Peripheral Vascular Devices And Equipment

18.6.9. Defibrillator Devices And Equipment

18.6.10. Electrophysiology Devices And Equipment

18.6.11. Prosthetic Heart Valve Devices And Equipment

18.6.12. Cardiac Assist Devices And Equipment

18.7. Surgical Equipment

18.7.1. Market Characteristics

18.7.2. Surgical Equipment Market Segmentation By Type Of Device

18.7.3. Surgical Equipment Market Trends And Strategies

18.7.4. Global Surgical Equipment Market, Segmentation By Type Of Device, Historic And Forecast, 2015 - 2020, 2025F, 2030F, Value ($ Billion)

18.7.5. Surgical Sutures And Staples

18.7.6. Handheld Surgical Devices And Equipment

18.7.7. Electrosurgical Devices And Equipment

18.8. Patient Monitoring Devices

18.8.1. Market Characteristics

18.8.2. Patient Monitoring Devices Market Segmentation By Type Of Device

18.8.3. Patient Monitoring Devices Market Trends And Strategies

18.8.4. Global Patient Monitoring Devices Market, Segmentation By Type Of Device, Historic And Forecast, 2015 - 2020, 2025F, 2030F, Value ($ Billion)

18.8.5. Vital Parameter Monitoring Devices And Equipment

18.8.6. Fetal And Neonatal Monitoring Devices

18.8.7. Weight Monitoring And Body Temperature Monitoring Devices And Equipment

18.8.8. Remote Patient Monitoring Devices And Equipment

18.8.9. Global Vital Parameter Monitoring Devices And Equipment Market, Segmentation By Type Of Device, Historic And Forecast, 2015 - 2020, 2025F, 2030F, Value ($ Billion)

18.8.10. Global Fetal And Neonatal Monitoring Devices Market, Segmentation By Type Of Device, Historic And Forecast, 2015 - 2020, 2025F, 2030F, Value ($ Billion)

18.8.11. Global Weight Monitoring And Body Temperature Monitoring Devices Market, Segmentation By Type Of Device, Historic And Forecast, 2015 - 2020, 2025F, 2030F, Value ($ Billion)

18.8.12. Global Remote Patient Monitoring Devices And Equipment Market, Segmentation By Type Of Device, Historic And Forecast, 2015 - 2020, 2025F, 2030F, Value ($ Billion)

18.9. Orthopedic Devices

18.9.1. Market Characteristics

18.9.2. Orthopedic Devices Market Segmentation By Type Of Device

18.9.3. Orthopedic Devices Market Trends And Strategies

18.9.4. Global Orthopedic Devices Market, Segmentation By Type Of Device, Historic And Forecast, 2015 - 2020, 2025F, 2030F, Value ($ Billion)

18.9.5. Joint Reconstruction Devices And Equipment

18.9.6. Spinal Surgery Devices And Equipment

18.9.7. Trauma Fixation Devices And Equipment

18.9.8. Orthobiologics Devices And Equipment

18.9.9. Orthopedic Braces And Support Devices And Equipment

18.9.10. Arthroscopy Devices And Equipment

18.9.11. Craniomaxillofacial (CMF) Devices And Equipment

18.9.12. Orthopedic Prosthetics

18.9.13. Orthopedic Accessories

18.10. Diabetes Care Devices

18.10.1. Market Characteristics

18.10.2. Diabetes Care Devices Market Segmentation By Type Of Device

18.10.3. Diabetes Care Devices Market Trends And Strategies

18.10.4. Global Diabetes Care Devices Market, Segmentation By Type Of Device, Historic And Forecast, 2015 - 2020, 2025F, 2030F, Value ($ Billion)

18.10.5. Insulin Pens, Syringes, Pumps And Injectors

18.10.6. Blood Glucose Test Strips

18.10.7. Blood Glucose Meters

18.10.8. Continuous Glucose Monitoring Devices And Equipment

18.10.9. Lancing Devices And Equipment

18.10.10. Global Insulin Pens, Syringes, Pumps And Injectors Market, Segmentation By Type Of Device, Historic And Forecast, 2015 - 2020, 2025F, 2030F, Value ($ Billion)

18.10.11. Global Blood Glucose Test Strips Market, Segmentation By Type Of Device, Historic And Forecast, 2015 - 2020, 2025F, 2030F, Value ($ Billion)

18.11. Nephrology And Urology Devices

18.11.1. Market Characteristics

18.11.2. Nephrology And Urology Devices Market Segmentation By Type Of Device

18.11.3. Nephrology And Urology Devices Market Trends And Strategies

18.11.4. Global Nephrology And Urology Devices Market, Segmentation By Type Of Device, Historic And Forecast, 2015 - 2020, 2025F, 2030F, Value ($ Billion)

18.11.5. Dialysis Devices And Equipment

18.11.6. Endoscopy Devices And Equipment

18.11.7. Benign Prostatic Hyperplasia (BPH) Treatment Devices And Equipment

18.11.8. Urinary Stone Treatment Devices And Equipment

18.11.9. Urinary Incontinence & Pelvic Organ Prolapse Devices And Equipment

18.12. ENT Devices

18.12.1. Market Characteristics

18.12.2. ENT Devices Market Segmentation By Type Of Device

18.12.3. ENT Devices Market Trends And Strategies

18.12.4. Global ENT Devices Market, Segmentation By Type Of Device, Historic And Forecast, 2015 - 2020, 2025F, 2030F, Value ($ Billion)

18.12.5. Hearing Aid Devices And Equipment

18.12.6. Nasal Splints

18.12.7. Ent Surgical Devices And Equipment

18.12.8. Hearing Diagnostic Devices And Equipment

18.12.9. Voice Prosthesis Devices And Equipment

18.13. Anesthesia And Respiratory Devices

18.13.1. Market Characteristics

18.13.2. Anesthesia And Respiratory Devices Market Segmentation By Type Of Device

18.13.3. Anesthesia And Respiratory Devices Market Trends And Strategies

18.13.4. Global Anesthesia And Respiratory Devices Market, Segmentation By Type Of Device, Historic And Forecast, 2015 - 2020, 2025F, 2030F, Value ($ Billion)

18.13.5. Respiratory Devices And Equipment (Therapeutic And Diagnostic)

18.13.6. Anesthesia Machines

18.13.7. Respiratory Disposables

18.13.8. Anesthesia Disposables

18.14. Neurology Devices

18.14.1. Market Characteristics

18.14.2. Neurology Devices Market Segmentation By Type Of Device

18.14.3. Neurology Devices Market Trends And Strategies

18.14.4. Global Neurology Devices Market, Segmentation By Type Of Device, Historic And Forecast, 2015 - 2020, 2025F, 2030F, Value ($ Billion)

18.14.5. Neurostimulation Devices

18.14.6. Neurosurgery Devices And Equipment

18.14.7. Interventional Neurology Devices And Equipment

18.14.8. Cerebrospinal Fluid Management (CSF) Devices And Equipment

18.14.9. Global Neurostimulation Devices Market, Segmentation By Type Of Device, Historic And Forecast, 2015 - 2020, 2025F, 2030F, Value ($ Billion)

18.14.10. Global Neurosurgery Devices And Equipment Market, Segmentation By Type Of Device, Historic And Forecast, 2015 - 2020, 2025F, 2030F, Value ($ Billion)

18.14.11. Global Interventional Neurology Devices And Equipment Market, Segmentation By Type Of Device, Historic And Forecast, 2015 - 2020, 2025F, 2030F, Value ($ Billion)

18.14.12. Global Cerebrospinal Fluid Management (CSF) Devices And Equipment Market, Segmentation By Type Of Device, Historic And Forecast, 2015 - 2020, 2025F, 2030F, Value ($ Billion)

18.15. Wound Care Devices

18.15.1. Market Characteristics

18.15.2. Wound Care Devices Market Segmentation By Type Of Device

18.15.3. Wound Care Devices Market Trends And Strategies

18.15.4. Global Wound Care Devices Market, Segmentation By Type Of Device, Historic And Forecast, 2015 - 2020, 2025F, 2030F, Value ($ Billion)

18.15.5. Traditional Adhesive Dressings

18.15.6. Advanced Wound Care Devices

18.15.7. Traditional Gauze Dressings

18.15.8. Negative-Pressure Wound Therapy (NPWT)

19. Global Medical Devices Market Comparison with Macro Economic Factors

19.1. Medical Devices Market Size, Percentage Of GDP, Global

19.2. Per Capita Average Medical Devices Market Expenditure, Global20. Global Medical Devices Market Comparison With Macro Economic Factors Across Countries

20.1. Medical Devices Market Size, Percentage Of GDP, 2020, By Country

20.2. Per Capita Medical Devices Expenditure, 2020, By Country

21. Global Medical Devices Market Comparison With Industry Metrics

21.1. Proportion Of Elderly Population (65+), By Country, 2020

21.2. Number Of Hospitals, By Country, 2019

21.3. Number Of Hospital Beds, By Country, 2019

21.4. Number Of Surgical Procedures Performed, By Country, 2019

21.5. Estimated Number Of Medical Device Enterprises, By Country, 2019

21.6. Estimated Number Of Medical Device Industry Employees, By Country, 2019

22. Asia-Pacific Medical Devices Market

22.1. Asia-Pacific Medical Devices Market Overview

22.1.1. Region Information

22.1.2. Impact Of COVID-19

22.1.3. Market Information

22.1.4. Background Information

22.1.5. Government Initiatives

22.1.6. Regulatory Bodies

22.1.7. Regulations

22.1.8. Major Associations

22.1.9. Export And Import Duties

22.1.10. Taxes Levied

22.1.11. Corporate Tax Structure

22.1.12. Investments

22.1.13. Major Companies

22.2. Asia-Pacific Medical Devices Market, Historic Market Growth, 2015 - 2020, Value ($ Billion)

22.3. Asia-Pacific Medical Devices Market, Forecast Market Growth, 2020 - 2025, 2030F, Value ($ Billion)

22.4. Asia-Pacific Medical Devices Market, Segmentation By Type Of Device, Historic And Forecast, 2015 - 2020, 2025F, 2030F, Value ($ Billion)

22.5. Asia-Pacific Medical Devices Market, Segmentation By End User, Historic And Forecast, 2015 - 2020, 2025F, 2030F, Value ($ Billion)

22.6. Asia-Pacific Medical Devices Market: Country Analysis

22.7. China Medical Devices Market

22.8. China Medical Devices Market Overview

22.8.1. Country Information

22.8.2. Impact Of COVID-19

22.8.3. Market Information

22.8.4. Background Information

22.8.5. Government Initiatives

22.8.6. Regulatory Bodies

22.8.7. Regulations

22.8.8. Major Associations

22.8.9. Export And Import Data

22.8.10. Taxes Levied

22.8.11. Corporate Tax Structure

22.8.12. Investments

22.8.13. Major Companies

22.9. China Medical Devices Market, Historic Market Growth, 2015 - 2020, Value ($ Billion)

22.10. China Medical Devices Market, Forecast Market Growth, 2020 - 2025, 2030F, Value ($ Billion)

22.11. China Medical Devices Market, Segmentation By Type Of Device, Historic And Forecast, 2015 - 2020, 2025F, 2030F, Value ($ Billion)

22.12. China Medical Devices Market, Segmentation By Type Of Expenditure, Historic And Forecast, 2015 - 2020, 2025F, 2030F, Value ($ Billion)

22.13. China Medical Devices Market, Segmentation By End User, Historic And Forecast, 2015 - 2020, 2025F, 2030F, Value ($ Billion)

22.14. India Medical Devices Market

22.15. India Medical Devices Market Overview

22.15.1. Country Information

22.15.2. Impact Of COVID-19

22.15.3. Market Information

22.15.4. Background Information

22.15.5. Government Initiatives

22.15.6. Regulatory Bodies

22.15.7. Regulations

22.15.8. Major Associations

22.15.9. Export And Import Duties

22.15.10. Taxes Levied

22.15.11. Corporate Tax Structure

22.15.12. Investments

22.15.13. Major Companies

22.16. India Medical Devices Market, Historic Market Growth, 2015 - 2020, Value ($ Billion)

22.17. India Medical Devices Market, Forecast Market Growth, 2020 - 2025, 2030F, Value ($ Billion)

22.18. India Medical Devices Market, Segmentation By Type Of Device, Historic And Forecast, 2015 - 2020, 2025F, 2030F, Value ($ Billion)

22.19. India Medical Devices Market, Segmentation By Type Of Expenditure, Historic And Forecast, 2015 - 2020, 2025F, 2030F, Value ($ Billion)

22.20. India Medical Devices Market, Segmentation By End User, Historic And Forecast, 2015 - 2020, 2025F, 2030F, Value ($ Billion)

22.21. Japan Medical Devices Market

22.22. Japan Medical Devices Market Overview

22.22.1. Country Information

22.22.2. Impact Of COVID-19

22.22.3. Market Information

22.22.4. Background Information

22.22.5. Government Initiatives

22.22.6. Regulations

22.22.7. Regulatory Bodies

22.22.8. Major Associations

22.22.9. Export And Import Data

22.22.10. Taxes Levied

22.22.11. Corporate Tax Structure

22.22.12. Investments

22.22.13. Major Companies

22.23. Japan Medical Devices Market, Historic Market Growth, 2015 - 2020, Value ($ Billion)

22.24. Japan Medical Devices Market, Forecast Market Growth, 2020 - 2025, 2030F, Value ($ Billion)

22.25. Japan Medical Devices Market, Segmentation By Type Of Device, Historic And Forecast, 2015 - 2020, 2025F, 2030F, Value ($ Billion)

22.26. Japan Medical Devices Market, Segmentation By Type Of Expenditure, Historic And Forecast, 2015 - 2020, 2025F, 2030F, Value ($ Billion)

22.27. Japan Medical Devices Market, Segmentation By End User, Historic And Forecast, 2015 - 2020, 2025F, 2030F, Value ($ Billion)

22.28. Australia Medical Devices Market

22.29. Australia Medical Devices Market, Historic Market Growth, 2015 - 2020, Value ($ Billion)

22.30. Australia Medical Devices Market, Forecast Market Growth, 2020 - 2025, 2030F, Value ($ Billion)

22.31. Australia Medical Devices Market, Segmentation By Type Of Device, Historic And Forecast, 2015 - 2020, 2025F, 2030F, Value ($ Billion)

22.32. Australia Medical Devices Market, Segmentation By Type Of Expenditure, Historic And Forecast, 2015 - 2020, 2025F, 2030F, Value ($ Billion)

22.33. Australia Medical Devices Market, Segmentation By End User, Historic And Forecast, 2015 - 2020, 2025F, 2030F, Value ($ Billion)

22.34. Indonesia Medical Devices Market

22.35. Indonesia Medical Devices Market, Historic Market Growth, 2015 - 2020, Value ($ Billion)

22.36. Indonesia Medical Devices Market, Forecast Market Growth, 2020 - 2025, 2030F, Value ($ Billion)

22.37. Indonesia Medical Devices Market, Segmentation By Type Of Device, Historic And Forecast, 2015 - 2020, 2025F, 2030F, Value ($ Billion)

22.38. Indonesia Medical Devices Market, Segmentation By Type Of Expenditure, Historic And Forecast, 2015 - 2020, 2025F, 2030F, Value ($ Billion)

22.39. Indonesia Medical Devices Market, Segmentation By End User, Historic And Forecast, 2015 - 2020, 2025F, 2030F, Value ($ Billion)

22.40. South Korea Medical Devices Market

22.41. South Korea Medical Devices Market, Historic Market Growth, 2015 - 2020, Value ($ Billion)

22.42. South Korea Medical Devices Market, Forecast Market Growth, 2020 - 2025, 2030F, Value ($ Billion)

22.43. South Korea Medical Devices Market, Segmentation By Type Of Device, Historic And Forecast, 2015 - 2020, 2025F, 2030F, Value ($ Billion)

22.44. South Korea Medical Devices Market, Segmentation By Type Of Expenditure, Historic And Forecast, 2015 - 2020, 2025F, 2030F, Value ($ Billion)

22.45. South Korea Medical Devices Market, Segmentation By End User, Historic And Forecast, 2015 - 2020, 2025F, 2030F, Value ($ Billion)

23. Western Europe Medical Devices Market

23.1. Western Europe Medical Devices Market Overview

23.1.1. Region Information

23.1.2. Impact Of COVID-19

23.1.3. Market Information

23.1.4. Background Information

23.1.5. Government Initiatives

23.1.6. Regulatory Bodies

23.1.7. Regulations

23.1.8. Associations

23.1.9. Taxes Levied

23.1.10. Corporate Tax Structure

23.1.11. Investments

23.1.12. Major Players

23.2. Western Europe Medical Devices Market, Historic Market Growth, 2015 - 2020, Value ($ Billion)

23.3. Western Europe Medical Devices Market, Forecast Market Growth, 2020 - 2025, 2030F, Value ($ Billion)

23.4. Western Europe Medical Devices Market, Segmentation By Type Of Device, Historic And Forecast, 2015 - 2020, 2025F, 2030F, Value ($ Billion)

23.5. Western Europe Medical Devices Market, Segmentation By End User, Historic And Forecast, 2015 - 2020, 2025F, 2030F, Value ($ Billion)

23.6. Western Europe Medical Devices Market: Country Analysis

23.7. UK Medical Devices Market Medical Devices Market Overview

23.8. UK Medical Devices Market Overview

23.8.1. Country Information

23.8.2. Impact Of COVID-19

23.8.3. Market Information

23.8.4. Background Information

23.8.5. Government Initiatives

23.8.6. Regulatory Bodies

23.8.7. Regulations

23.8.8. Major Contracts/ R&D

23.8.9. Major Associations

23.8.10. Taxes Levied

23.8.11. Corporate Tax Structure

23.8.12. Investments

23.8.13. Major players

23.9. UK Medical Devices Market, Historic Market Growth, 2015 - 2020, Value ($ Billion)

23.10. UK Medical Devices Market, Forecast Market Growth, 2020 - 2025, 2030F, Value ($ Billion)

23.11. UK Medical Devices Market, Segmentation By Type Of Device, Historic And Forecast, 2015 - 2020, 2025F, 2030F, Value ($ Billion)

23.12. UK Medical Devices Market, Segmentation By Type Of Expenditure, Historic And Forecast, 2015 - 2020, 2025F, 2030F, Value ($ Billion)

23.13. UK Medical Devices Market, Segmentation By End User, Historic And Forecast, 2015 - 2020, 2025F, 2030F, Value ($ Billion)

23.14. Germany Medical Devices Market

23.15. Germany Medical Devices Market, Historic Market Growth, 2015 - 2020, Value ($ Billion)

23.16. Germany Medical Devices Market, Forecast Market Growth, 2020 - 2025, 2030F, Value ($ Billion)

23.17. Germany Medical Devices Market, Segmentation By Type Of Device, Historic And Forecast, 2015 - 2020, 2025F, 2030F, Value ($ Billion)

23.18. Germany Medical Devices Market, Segmentation By Type Of Expenditure, Historic And Forecast, 2015 - 2020, 2025F, 2030F, Value ($ Billion)

23.19. Germany Medical Devices Market, Segmentation By End User, Historic And Forecast, 2015 - 2020, 2025F, 2030F, Value ($ Billion)

23.20. France Medical Devices Market

23.21. France Medical Devices Market, Historic Market Growth, 2015 - 2020, Value ($ Billion)

23.22. France Medical Devices Market, Forecast Market Growth, 2020 - 2025, 2030F, Value ($ Billion)

23.23. France Medical Devices Market, Segmentation By Type Of Device, Historic And Forecast, 2015 - 2020, 2025F, 2030F, Value ($ Billion)

23.24. France Medical Devices Market, Segmentation By Type Of Expenditure, Historic And Forecast, 2015 - 2020, 2025F, 2030F, Value ($ Billion)

23.25. France Medical Devices Market, Segmentation By End User, Historic And Forecast, 2015 - 2020, 2025F, 2030F, Value ($ Billion)

23.26. Italy Medical Devices Market

23.27. Italy Medical Devices Market, Historic Market Growth, 2015 - 2020, Value ($ Billion)

23.28. Italy Medical Devices Market, Forecast Market Growth, 2020 - 2025, 2030F, Value ($ Billion)

23.29. Italy Medical Devices Market, Segmentation By Type Of Device, Historic And Forecast, 2015 - 2020, 2025F, 2030F, Value ($ Billion)

23.30. Italy Medical Devices Market, Segmentation By Type Of Expenditure, Historic And Forecast, 2015 - 2020, 2025F, 2030F, Value ($ Billion)

23.31. Italy Medical Devices Market, Segmentation By End User, Historic And Forecast, 2015 - 2020, 2025F, 2030F, Value ($ Billion)

23.32. Spain Medical Devices Market

23.33. Spain Medical Devices Market, Historic Market Growth, 2015 - 2020, Value ($ Billion)

23.34. Spain Medical Devices Market, Forecast Market Growth, 2020 - 2025, 2030F, Value ($ Billion)

23.35. Spain Medical Devices Market, Segmentation By Type Of Device, Historic And Forecast, 2015 - 2020, 2025F, 2030F, Value ($ Billion)

23.36. Spain Medical Devices Market, Segmentation By Type Of Expenditure, Historic And Forecast, 2015 - 2020, 2025F, 2030F, Value ($ Billion)

23.37. Spain Medical Devices Market, Segmentation By End User, Historic And Forecast, 2015 - 2020, 2025F, 2030F, Value ($ Billion)

24. Eastern Europe Medical Devices Market

24.1. Eastern Europe Medical Devices Market Overview

24.1.1. Region Information

24.1.2. Impact of COVID-19

24.1.3. Market Information

24.1.4. Background Information

24.1.5. Government Initiatives

24.1.6. Regulatory Bodies

24.1.7. Regulations

24.1.8. Associations

24.1.9. Taxes Levied

24.1.10. Corporate Tax Structure

24.1.11. Investments

24.1.12. Major Companies

24.2. Eastern Europe Medical Devices Market, Historic Market Growth, 2015 - 2020, Value ($ Billion)

24.3. Eastern Europe Medical Devices Market, Forecast Market Growth, 2020 - 2025, 2030F, Value ($ Billion)

24.4. Eastern Europe Medical Devices Market, Segmentation By Type Of Device, Historic And Forecast, 2015 - 2020, 2025F, 2030F, Value ($ Billion)

24.5. Eastern Europe Medical Devices Market, Segmentation By End User, Historic And Forecast, 2015 - 2020, 2025F, 2030F, Value ($ Billion)

24.6. Eastern Europe Medical Devices Market: Country Analysis

24.7. Russia Medical Devices Market

24.8. Russia Medical Devices Market, Historic Market Growth, 2015 - 2020, Value ($ Billion)

24.9. Russia Medical Devices Market, Forecast Market Growth, 2020 - 2025, 2030F, Value ($ Billion)

24.10. Russia Medical Devices Market, Segmentation By Type Of Device, Historic And Forecast, 2015 - 2020, 2025F, 2030F, Value ($ Billion)

24.11. Russia Medical Devices Market, Segmentation By Type Of Expenditure, Historic And Forecast, 2015 - 2020, 2025F, 2030F, Value ($ Billion)

24.12. Russia Medical Devices Market, Segmentation By End User, Historic And Forecast, 2015 - 2020, 2025F, 2030F, Value ($ Billion)

25. North America Medical Devices Market

25.1. North America Medical Devices Market Overview

25.1.1. Region Information

25.1.2. Impact Of COVID-19

25.1.3. Market Information

25.1.4. Background Information

25.1.5. Government Initiatives

25.1.6. Regulatory Bodies

25.1.7. Regulations

25.1.8. Associations

25.1.9. Corporate Tax Structure

25.1.10. Investments

25.1.11. Major players

25.2. North America Medical Devices Market, Historic Market Growth, 2015 - 2020, Value ($ Billion)

25.3. North America Medical Devices Market, Forecast Market Growth, 2020 - 2025, 2030F, Value ($ Billion)

25.4. North America Medical Devices Market, Segmentation By Type Of Device, Historic And Forecast, 2015 - 2020, 2025F, 2030F, Value ($ Billion)

25.5. North America Medical Devices Market, Segmentation By End User, Historic And Forecast, 2015 - 2020, 2025F, 2030F, Value ($ Billion)

25.6. North America Medical Devices Market: Country Analysis

25.7. USA Medical Devices Market

25.8. USA Medical Devices Market Overview

25.8.1. Country Information

25.8.2. Impact Of COVID-19

25.8.3. Market Information

25.8.4. Background Information

25.8.5. Government Initiatives

25.8.6. Regulatory Bodies

25.8.7. Regulations

25.8.8. Associations

25.8.9. Taxes And Duties

25.8.10. Corporate Tax Structure

25.8.11. Investments

25.8.12. Major Players

25.9. USA Medical Devices Market, Historic Market Growth, 2015 - 2020, Value ($ Billion)

25.10. USA Medical Devices Market, Forecast Market Growth, 2020 - 2025, 2030F, Value ($ Billion)

25.11. USA Medical Devices Market, Segmentation By Type Of Device, Historic And Forecast, 2015 - 2020, 2025F, 2030F, Value ($ Billion)

25.12. USA Medical Devices Market, Segmentation By Type Of Expenditure, Historic And Forecast, 2015 - 2020, 2025F, 2030F, Value ($ Billion)

25.13. USA Medical Devices Market, Segmentation By End User, Historic And Forecast, 2015 - 2020, 2025F, 2030F, Value ($ Billion)

26. South America Medical Devices Market

26.1. South America Medical Devices Market Overview

26.1.1. Region Information

26.1.2. Impact of COVID-19

26.1.3. Market Information

26.1.4. Background Information

26.1.5. Government Initiatives

26.1.6. Regulatory Bodies

26.1.7. Regulations

26.1.8. Associations

26.1.9. Taxes And Duties

26.1.10. Corporate Tax Structure

26.1.11. Investment

26.1.12. Major Players

26.2. South America Medical Devices Market, Historic Market Growth, 2015 - 2020, Value ($ Billion)

26.3. South America Medical Devices Market, Forecast Market Growth, 2020 - 2025, 2030F, Value ($ Billion)

26.4. South America Medical Devices Market, Segmentation By Type Of Device, Historic And Forecast, 2015 - 2020, 2025F, 2030F, Value ($ Billion)

26.5. South America Medical Devices Market, Segmentation By End User, Historic And Forecast, 2015 - 2020, 2025F, 2030F, Value ($ Billion)

26.6. South America Medical Devices Market: Country Analysis

26.7. Brazil Medical Devices Market

26.8. Brazil Medical Devices Market, Historic Market Growth, 2015 - 2020, Value ($ Billion)

26.9. Brazil Medical Devices Market, Forecast Market Growth, 2020 - 2025, 2030F, Value ($ Billion)

26.10. Brazil Medical Devices Market, Segmentation By Type Of Device, Historic And Forecast, 2015 - 2020, 2025F, 2030F, Value ($ Billion)

26.11. Brazil Medical Devices Market, Segmentation By Type Of Expenditure, Historic And Forecast, 2015 - 2020, 2025F, 2030F, Value ($ Billion)

26.12. Brazil Medical Devices Market, Segmentation By End User, Historic And Forecast, 2015 - 2020, 2025F, 2030F, Value ($ Billion)

27. Middle East Medical Devices Market

27.1. Middle East Medical Devices Market Overview

27.1.1. Region Information

27.1.2. Impact of COVID-19

27.1.3. Market Information

27.1.4. Background Information

27.1.5. Government Initiatives

27.1.6. Regulatory Bodies

27.1.7. Regulations

27.1.8. Associations

27.1.9. Taxes And Duties

27.1.10. Corporate Tax Structure

27.1.11. Investments

27.1.12. Major Players

27.2. Middle East Medical Devices Market, Historic Market Growth, 2015 - 2020, Value ($ Billion)

27.3. Middle East Medical Devices Market, Forecast Market Growth, 2020 - 2025, 2030F, Value ($ Billion)

27.4. Middle East Medical Devices Market, Segmentation By Type Of Device, Historic And Forecast, 2015 - 2020, 2025F, 2030F, Value ($ Billion)

27.5. Middle East Medical Devices Market, Segmentation By End User, Historic And Forecast, 2015 - 2020, 2025F, 2030F, Value ($ Billion)

28. Africa Medical Devices Market

28.1. Africa Medical Devices Market Overview

28.1.1. Region Information

28.1.2. Impact of COVID-19

28.1.3. Market Information

28.1.4. Background Information

28.1.5. Government Initiatives

28.1.6. Regulatory Bodies

28.1.7. Regulations

28.1.8. Major Associations

28.1.9. Taxes Levied

28.1.10. Investments

28.1.11. Major Players

28.2. Africa Medical Devices Market, Historic Market Growth, 2015 - 2020, Value ($ Billion)

28.3. Africa Medical Devices Market, Forecast Market Growth, 2020 - 2025, 2030F, Value ($ Billion)

28.4. Africa Medical Devices Market, Segmentation By Type Of Device, Historic And Forecast, 2015 - 2020, 2025F, 2030F, Value ($ Billion)

28.5. Africa Medical Devices Market, Segmentation By End User, Historic And Forecast, 2015 - 2020, 2025F, 2030F, Value ($ Billion)

29. Global Medical Devices Market Competitive Landscape

29.1. Company Profiles

29.2. Medtronic Plc

29.2.1. Company Overview

29.2.2. Products And Services

29.2.3. Business Strategy

29.2.4. Financial Overview

29.3. Johnson & Johnson

29.3.1. Company Overview

29.3.2. Products And Services

29.3.3. Business Strategy

29.3.4. Financial Overview

29.4. Abbott Laboratories

29.4.1. Company Overview

29.4.2. Products And Services

29.4.3. Business Strategy

29.4.4. Financial Overview

29.5. Becton, Dickinson and Company

29.5.1. Company Overview

29.5.2. Products And Services

29.5.3. Business Strategy

29.5.4. Financial Overview

29.6. Siemens Healthineers AG

29.6.1. Company Overview

29.6.2. Products And Services

29.6.3. Business Strategy

29.6.4. Financial overview

30. Key Mergers And Acquisitions In The Medical Devices Market

30.1. Resonetics Acquired Distal Solutions

30.2. NextPhase Medical Device Acquires Proven Process Medical Devices

30.3. GE Healthcare Acquires Zionexa

30.4. Siemens Healthineers Acquires Varian Medical Systems

30.5. Oncocyte Corporation Acquires Chronix Biomedical Inc.

30.6. Olympus Acquires Quest Photonic Devices

30.7. Olympus Acquired Veran Medical Technologies

30.8. Medtronic Acquired Ai Biomed

30.9. Medtronic Acquired Medicrea International

30.10. Aspen Surgicals Acquired Precept Medical Products

30.11. OrthoPediatrics Corporation Acquired ApiFix Limited

30.12. Albyn Medical Acquired Endo-Technik

30.13. Erbe Elektromedizin Acquired Maxer Endoscopy

30.14. Halma Plc Acquired NovaBone Products, LLC,

30.15. Fujifilm Acquired Diagnostic Imaging Business Of Hitachi

30.16. Royal Philips Acquired Carestream Health’s HCIS Business

30.17. Becton, Dickinson (BD) Acquired C. R. Bard

30.18. Thermo Fisher Scientific Acquired Patheon

30.19. Becton Dickinson And Co. Acquired C R Bard Inc.

30.20. Cyberonics Merged With Sorin SpA

30.21. Cardinal Health Acquired Johnson And Johnson’s Cordis Business

30.22. Mallinckrodt Pharmaceuticals Acquired Therakos

30.23. St Jude Medical Acquired Thoratec Corp

30.24. Zimmer Holdings, Inc. Acquired Biomet

30.25. Medtronic PLC Acquired Covidien PLC

31. Market Background: Healthcare Market

31.1. Healthcare Market Characteristics

31.1.1. Market Definition

31.1.2. Segmentation By Type Of Product

31.2. Historic Market Growth, 2015 - 2020, Value ($ Billion)

31.3. Forecast Market Growth, 2020 - 2025, 2030F, Value ($ Billion)

31.4. Global Healthcare Market, Segmentation By Application, Historic And Forecast, 2015 - 2020, 2025F, 2030F, Value ($ Billion)

31.5. Global Healthcare Market, 2020, By Region, Value ($ Billion)

31.6. Global Healthcare Market, 2015 - 2025, Historic And Forecast, By Region

32. Medical Devices Market Opportunities And Strategies

32.1. Global Medical Devices Market In 2025 - Countries Offering Most New Opportunities

32.2. Global Medical Devices Market In 2025 - Growth Strategies

32.2.1. Market Trend Based Strategies

32.2.2. Competitor Strategies

33. Medical Devices Market, Conclusions And Recommendations

33.1. Conclusions

33.2. Recommendations

33.2.1. Product

33.2.2. Place

33.2.3. Price

33.2.4. Promotion

33.2.5. People

34. Appendix

34.1. Market Data Sources

34.2. NAICS Definition Of Industry Covered In This Report

34.3. Research Methodology

34.4. Abbreviations

34.5. Currencies

34.6. Research Inquiries

34.7. About the Publisher

34.8. Copyright And Disclaimer

Executive Summary

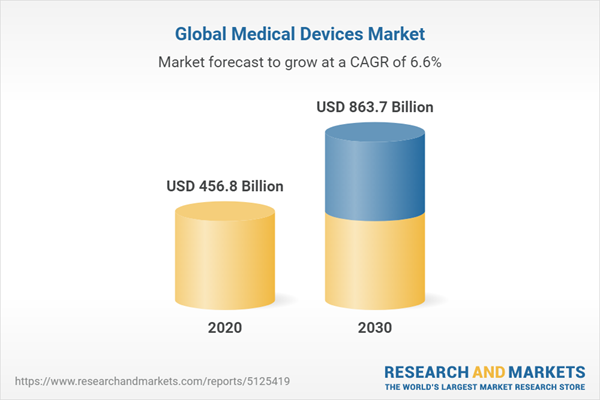

This report describes and explains the global medical devices market and covers 2015 to 2020, termed the historic period, and 2020 to 2025 termed the forecast period, along with further forecasts for the period 2025-2030. The report evaluates the market across each region and for the major economies within each region.The global medical devices market reached a value of nearly $456.8 billion in 2020, having increased at a compound annual growth rate (CAGR) of 3.5% since 2015. The market is expected to grow from $456.8 billion in 2020 to $62.0 billion in 2025 at a rate of 7.7%. The market is then expected to grow at a CAGR of 5.5% from 2025 and reach $863.2.4 billion in 2030.

Growth in the historic period in the medical devices market resulted from growth in the number of healthcare facilities, rapid growth in elderly population, economic growth in emerging markets, rapid technological advances, increased healthcare expenditure. The market was restrained by low healthcare awareness, low healthcare reimbursements.

Going forward increasing prevalence of chronic diseases, sudden emergence of severe infections will drive the growth in the medical devices market. Factors that could hinder the growth of the market in the future include challenges due to regulatory changes, data security issues, covid-19 pandemic.

The medical devices market is segmented by type of device into in-vitro diagnostics, dental equipment and supplies, ophthalmic devices, diagnostic imaging equipment, cardiovascular devices, hospital supplies, surgical equipment, orthopedic devices, patient monitoring devices, diabetes care devices, nephrology and urology devices, ENT devices, anesthesia and respiratory devices, neurology devices, and wound care devices. The in-vitro diagnostics market was the largest segment of the medical devices market segmented by product, accounting for 15.7% of the total in 2020. Going forward, the hospital supplies segment is expected to be the fastest growing segment in the medical devices market segmented by product, at a CAGR of 10.8% during 2020-2025.

The medical devices market is segmented by type of expenditure into public expenditure and private expenditure. The public expenditure market was the largest segment of the medical devices market segmented by application, accounting for 51.7% of the total in 2020. Going forward, the public expenditure segment is expected to be the fastest growing segment in the medical devices market segmented by application, at a CAGR of 8.2% during 2020-2025.

The medical devices market is segmented by type of end-user into hospitals and clinics, homecare, and diagnostic centers. The hospitals and clinics market was the largest segment of the medical devices market segmented by end-user, accounting for 88.7% of the total in 2020. Going forward, the diagnostics centers segment is expected to be the fastest growing segment in the medical devices market segmented by end-user, at a CAGR of 9.2% during 2020-2025.

North America was the largest region in the global medical devices market, accounting for 39.7% of the total in 2020. It was followed by the Asia Pacific, Western Europe and then the other regions. Going forward, the fastest-growing regions in the medical devices market will be South America and, Africa where growth will be at CAGRs of 11.1% and 10.4% respectively. These will be followed by Middle East and Asia Pacific, where the markets are expected to register CAGRs of 10.2% and 9.0% respectively.

The production of non-COVID medical equipment is severely impacted due to the focus of major production lines on the manufacturing of COVID medical equipment such as life support ventilators, PPE and others, less demand for non-COVID medical equipment due to the deferring of elective medical procedures and lowering of patient submissions in hospitals for non-COVID medical procedures due to the fear of virus transmission.

The medical devices market is fragmented, with a large number of small players. The top ten competitors in the market made up to 34.5% of the total market in 2020. The market competition is characterized by the rapid changes resulting from technological advances and scientific discoveries. The market fragmentation can be attributed to the high barriers to entry in terms of high fixed costs associated with the production of medical devices and the stringent regulations set up by the regulatory authorities. Medtronic Plc was the largest competitor with 6.3% of the market, followed by Johnson & Johnson with 5.0%, Abbott Laboratories with 4.9%, Becton, Dickinson and Company with 3.7%, Siemens Healthineers AG with 3.87%, Koninklijke Philips N.V. with 3.6%, General Electric Company with 2.2%, Baxter International Inc. with 1.8%, Danaher Corporation with 1.6% and 3M Company with 1.6%.

The top opportunities in the medical devices market segmented by device will arise in the in-vitro diagnostics segment, which will gain $33.6 billion of global annual sales by 2025. The top opportunities in the medical devices market segmented by expenditure will arise in the public segment, which will gain $114.6 billion of global annual sales by 2025. The top opportunities in the medical devices market segmented by end-user will arise in the hospitals and clinics segment, which will gain $181.9 billion of global annual sales by 2025. The medical devices market size will gain the most in the USA at $55.7 billion.

Market-trend-based strategies for the medical devices market include investing in product portfolio expansion, increasingly investing in development of self-diagnostic devices and investing in hybrid imaging technology. Other trend-based strategies include investing in portable sterilization equipment, manufacturing disposable medical products and infrared thermometers.

Player-adopted strategies in the medical devices market include adding new innovative products to product portfolios, expanding geographical presence and establishing new organizations.

To take advantage of the opportunities, the publisher recommends the medical devices companies should focus on disposable medical products, contactless medical devices, wearable devices, portable medical devices, make the devices secure, reliable, and robust, focus on expanding product portfolios through collaborations, focus on self-diagnosis products, virtual reality based medical devices, blockchain for medical devices, expand in emerging markets, leverage e-commerce to maximize reach and revenues, increase domestic production, provide competitively priced offerings in low-income countries to reach new users, premium priced products, increase visibility through a high performance website, focus on increasing awareness, collaborate with government organizations, participate in trade shows and events and focus on making the devices more user friendly to target geriatric populations.

Companies Mentioned

- Medtronic Plc

- Johnson & Johnson

- Abbott Laboratories

- Becton, Dickinson and Company

- Siemens Healthineers AG

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 589 |

| Published | September 2021 |

| Forecast Period | 2020 - 2030 |

| Estimated Market Value ( USD | $ 456.8 Billion |

| Forecasted Market Value ( USD | $ 863.7 Billion |

| Compound Annual Growth Rate | 6.6% |

| Regions Covered | Global |

| No. of Companies Mentioned | 5 |