The country’s harsh and humid climate, along with a growing share of smartphone users, has resulted in the market gaining traction in the region. Most of the demand is created by tourists, as eyewear products are a part of their daily requirements or a souvenir of the culture. The presence of brands has leveraged the eyewear platform and made it a highly competitive sector for established players. Online retailing for the same has undertaken an upswing, driven by the millennial population's vying for new and enhanced products that go along with regular fashion.

The growth of the corrective glasses segment is mainly driven by the increasing population suffering from refractive errors, raising awareness, and the cost-effectiveness of eye care devices over refractive surgeries. Owing to such factors, renowned e-commerce stores in the Saudi Arabian market, such as Barakat Opticals, Eyewa, and Magrabi, are facilitating consumers with eye test booking options, club cards, and a range of branded eyewear. Moreover, the increasing use of smartphones and computers is triggering cases of computer vision syndrome (CVS). This factor has also been influencing the sale of corrective eyewear for the past few years.

Online retail sales increased in the Saudi Arabian region, which gave the market an increasing value in sales. The presence of many highly competitive players in the market focusing on various kinds of eyewear, etc. Moreover, the government’s support and initiatives to promote e-commerce platforms via Vision 2030, which supports disruptive technological innovation, are creating a huge opportunity for the players, as the government intends to increase the contribution of alternative retail channels, including e-commerce, to 80% of retail sector activity by 2030.

Key Market Trends

Booming Online Retail Industry

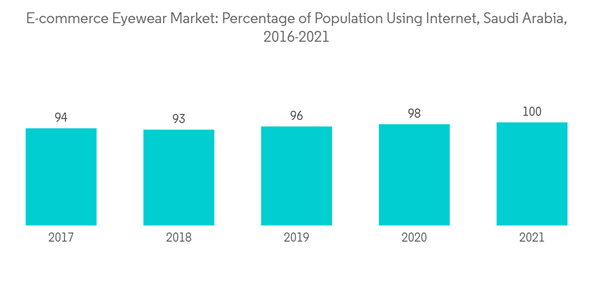

The main reason behind the rise in sales through internet retailing is the convenience it provides consumers, as they find it easy to choose their preferred brands and get a wide variety of product choices. Thus, online and e-commerce stores have been gradually increasing their market share, in terms of revenue and popularity, among consumers in Saudi Arabia. The growth opportunity for the sale of consumer goods through online channels has forced online vendors to improve their purchase processes in terms of security and reliability, which, in turn, has propelled the demand for these products. In addition, a large number of foreign investors are vying for the opportunity presented by the online platform and have opened business accounts with the Saudi Ministry of Commerce.Such registration numbers increased from 14,154 in 2015 to 25,238 in 2020, according to the Saudi Arabian Ministry of Commerce.Moreover, vendors are adopting online retail strategies to increase their consumer reach and offer them a low cost to entice the users, thus increasing their margins, which will benefit the market during the forecast period. On the other hand, social media influencers, celebrity endorsements, and video beauty bloggers are some of the niche groups of sources in Saudi Arabia. The availability of rare products in online marketplaces is likely to build more confidence in consumers. Likewise, quality at reasonable prices is expected to spoil such consumers for their choices. However, e-commerce retailers, such as Amazon, Souq, Namshi, Al-Duliman, and Net a Porter, are among the few examples of international and regional e-commerce players battling for a share in Saudi fashion.

Inclination Towards Premium Sunglasses

The eyewear industry is driven by a paradigm shift in consumer perception. Consumers consider spectacle frames and sunglasses to be fashion accessories. Saudi Arabia has been one of the most visited countries, following the United Arab Emirates, in terms of tourist count. The influx of visitors led to the emergence of high-end shopping complexes that display a range of western brands. Both European and American brands have a strong presence in the sunglasses market, accounting for roughly 60% and 15% of the market studied, respectively. Style is emerging as one of the factors driving the robust sales of sunglasses, where consumers are increasingly choosing these products for aesthetic reasons and to enhance their facial features. Thus, aesthetics takes precedence over functionality (UV protection). ClubMaster Classic is a popular choice among consumers, owing to its circular eyeglasses and classic designs.Major eyewear brands and online eyewear stores dealing with luxury eyewear are aggressively implementing online marketing and promotional activities, as online marketing and promotion provide customers with easy access and help vendors reduce operational costs. Eyewa, a Dubai-based company, is one of the largest eyewear e-commerce platforms catering to the market studied. The platform offers an extensive portfolio of premium products from over 50 renowned brands, including Ray-Ban, Oakley, Prada, and Chloe. Due to the factors mentioned above, global players offering premium sunglasses are expanding their distribution networks in Saudi Arabian regions like Riyadh and Jeddah to broaden their geographical presence and customer base. Furthermore, according to the International Conference on Management, Saudi Arabia is one of the most important luxury markets in the Middle East, with consumer preference for brands ranging from nearly 82% for quality to 58% for uniqueness to 50% for emotional value. Such factors are likely to drive the sales of premium sunglasses with unique portfolios.

Competitive Landscape

The Saudi Arabia e-commerce eyewear market is highly competitive due to the presence of local and international major players in the market, including Essilor-Luxottica SA, LVMH Mot Hennessy Louis Vuitton, Safilo Group S.p.A., De Rigo Vision SpA, and Kering SA. Companies are thriving for their market share, with merger and acquisition (M&A) and expansion being the most adopted strategies, followed by partnerships and product innovation. Players operating in the e-commerce eyewear market in Saudi Arabia gained prominence due to the expansion of their distribution channels by establishing stores and warehouses at different locations across the country, which helps with easy and faster delivery.Additional benefits of purchasing the report:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

This product will be delivered within 2 business days.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- EssilorLuxottica SA

- Burberry Group PLC

- De Rigo Vision SpA

- Johnson & Johnson Services, Inc.

- Safilo Group S.p.A.

- Kering SA

- LVMH Moët Hennessy Louis Vuitton

- Charmant Group

- Bausch Health Companies Inc.

- Alcon Laboratories Inc.