Fatty alcohols are straight-chain primary alcohols of high molecular weight. They are used as solids (waxy) or oily liquids of natural or petrochemical origin. These fatty alcohols are widely used in personal care because hygiene and sanitation are so important amid the coronavirus pandemic. The market is further anticipated to benefit in growth from rising interest in green and biodegradable cosmetics. In addition, increased expenditure on cosmetics and higher per capita income would further drive market growth. However, factors like crude raw material pricing instability and disruption in the supply chain would hinder market growth.

Fatty Alcohol Market Drivers:

Increasing demand for bio-based products is contributing to the fatty alcohol market expansion

As people get worried about the adverse effects of petroleum-based products, the global demand for sustainable products increases dramatically. Hence, consumers started preferring bio-based products, causing manufacturers to turn to eco-friendly components. Compared with their conventional counterparts, these eco-friendly alcohols made from bio-based oleochemicals are recyclable and less harmful. As they have fewer adverse effects, these alcohols have a big demand in the pharmaceutical and personal care sectors. For instance, KLK OLEO, a subsidiary of Wilmar International, markets numerous fatty alcohols derived from vegetables under the brand name PALMEROL. Moreover, the industry is likely to thrive because of international regulations such as REACH that restrict the environmental effects of petroleum-derived products.Geographical Outlook of the Fatty Alcohol Market:

Adia Pacific is witnessing exponential growth during the forecast period.Significantly, Asia-Pacific will see growth because of major demand from the surfactant, personal care, cosmetic, and pharmaceutical industries in some of the leading economies: China, India, and Japan. This increase will be fueled further by the rise in application sectors such as cleaners and detergents. The increasing population in emerging countries in Asia-Pacific has contributed to the rapid increase in demand for cleaning goods. For over two decades, the Chinese economy has made rapid strides with these multiple indicators - industrial output, import and export, consumer demand, and capital investment.

Moreover, the JCIA, or Japan Cosmetic Industry Association, was established in April 2023 to promote the development of cosmetics in Japan through the merger of the Tokyo Cosmetic Industry Association, the Japan Cosmetic Industry Federation, the West Japan Cosmetic Industry Association, and the Chubu Cosmetic Industry Association. As reported by the popular giant in the Japanese cosmetic industry, namely the Kao Corporation, the overall market in Japan grew by more than 3% last year, with further development expected in the years to come.

Reasons for buying this report:

- Insightful Analysis: Gain detailed market insights covering major as well as emerging geographical regions, focusing on customer segments, government policies and socio-economic factors, consumer preferences, industry verticals, other sub-segments.

- Competitive Landscape: Understand the strategic maneuvers employed by key players globally to understand possible market penetration with the correct strategy.

- Market Drivers & Future Trends: Explore the dynamic factors and pivotal market trends and how they will shape up future market developments.

- Actionable Recommendations: Utilize the insights to exercise strategic decision to uncover new business streams and revenues in a dynamic environment.

- Caters to a Wide Audience: Beneficial and cost-effective for startups, research institutions, consultants, SMEs, and large enterprises.

What do businesses use our reports for?

Industry and Market Insights, Opportunity Assessment, Product Demand Forecasting, Market Entry Strategy, Geographical Expansion, Capital Investment Decisions, Regulatory Framework & Implications, New Product Development, Competitive IntelligenceReport Coverage:

- Historical data & forecasts from 2022 to 2030

- Growth Opportunities, Challenges, Supply Chain Outlook, Regulatory Framework, Customer Behaviour, and Trend Analysis

- Competitive Positioning, Strategies, and Market Share Analysis

- Revenue Growth and Forecast Assessment of segments and regions including countries

- Company Profiling (Strategies, Products, Financial Information, and Key Developments among others)

The fatty alcohol market is segmented and analyzed as follows:

By Type

- C6 to C10 Fatty Alcohol

- C11 to C14 Fatty alcohol

- C15 to C22 Fatty Alcohol

By Application

- Industrial & Domestic Cleaning

- Personal Care

- Lubricants

- Food & Nutrition

- Others

By Geography

- North America

- South America

- Europe

- Middle East and Africa

- Asia-Pacific

Table of Contents

Companies Mentioned

- Oleon NV

- Wilmar International Ltd.

- Sasol

- Musim Mas

- Godrej Industries Ltd.

- Teck Guan Holdings

- Kao Corporations

- Emery Oleochemicals

- BASF

- Ecogreen Oleochemicals

- Shell Plc.

- Atlas Chemicals

- SABIC

- The Proctor & Gamble Co.

- KLK OLEO

- ChemCeed

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 120 |

| Published | December 2024 |

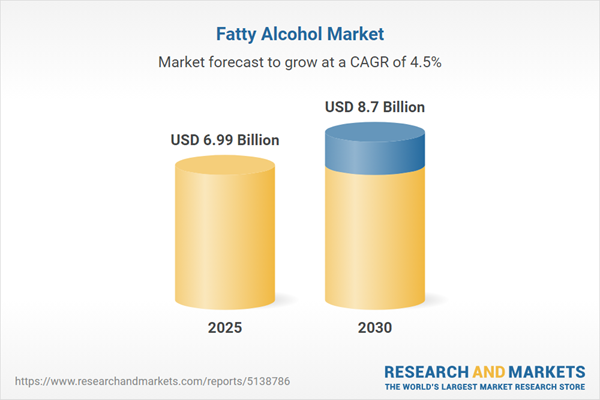

| Forecast Period | 2025 - 2030 |

| Estimated Market Value ( USD | $ 6.99 Billion |

| Forecasted Market Value ( USD | $ 8.7 Billion |

| Compound Annual Growth Rate | 4.5% |

| Regions Covered | Global |

| No. of Companies Mentioned | 16 |