Global Biopsy Devices Market - Key Trends and Drivers Summarized

Why Are Biopsy Devices Gaining Attention?

Biopsy devices have become a cornerstone in the diagnostic process, particularly in the early detection and monitoring of various cancers. Recent technological advancements in biopsy devices have significantly improved their accuracy, safety, and patient comfort. From traditional needle biopsies to advanced image-guided and robotic-assisted techniques, the evolution of these devices is remarkable. These innovations have not only enhanced the precision of tissue sampling but also minimized the invasiveness of the procedure, leading to quicker recovery times and fewer complications. The integration of imaging technologies like ultrasound, MRI, and CT scans with biopsy devices has further revolutionized the field, enabling real-time guidance during the procedure and ensuring that the samples collected are from the most relevant areas, thereby increasing diagnostic accuracy.How Are End-Use Trends Shaping the Biopsy Devices Market?

The utilization of biopsy devices is seeing a notable shift, driven by changes in end-use trends within the healthcare sector. With the rising incidence of cancer and other chronic diseases, there is an increasing demand for early and accurate diagnostic tools. Hospitals and diagnostic centers are the primary users of biopsy devices, but there's a growing trend of outpatient clinics and specialized cancer centers adopting these technologies. This shift is largely due to the emphasis on early detection and personalized medicine, which requires precise and timely diagnosis. Moreover, the aging global population, coupled with the growing awareness of regular health check-ups, is driving the demand for routine biopsy procedures. This trend is particularly noticeable in developed regions, where healthcare infrastructure supports advanced diagnostic practices, but emerging markets are quickly catching up, further fueling the demand for these devices.What Innovations Are Shaping the Future of Biopsy Devices?

The future of biopsy devices is being shaped by continuous innovations aimed at improving patient outcomes and diagnostic accuracy. One of the most significant developments is the advent of liquid biopsies, which offer a less invasive alternative to traditional tissue biopsies. Liquid biopsies analyze circulating tumor cells or DNA from a blood sample, providing crucial information about the presence and progression of cancer without the need for surgery. Another area of innovation is the development of single-use, disposable biopsy devices that reduce the risk of cross-contamination and infection. These devices are particularly valuable in settings where sterility is a top priority. Additionally, advancements in robotic-assisted biopsy procedures are enhancing the precision and consistency of sample collection, reducing human error, and enabling more complex procedures to be performed with greater ease. These innovations are not only improving the efficiency of the biopsy process but are also expanding the range of conditions that can be diagnosed through biopsy.What's Driving the Growth in the Biopsy Devices Market?

The growth in the biopsy devices market is driven by several factors. The rising prevalence of cancer and other chronic diseases has led to an urgent need for early and accurate diagnosis, which is one of the primary drivers of market growth. Technological advancements, such as the integration of imaging technologies and the development of less invasive biopsy techniques, have significantly improved the accuracy and safety of biopsies, making them more accessible and acceptable to patients. Additionally, the trend toward personalized medicine is fueling demand for precise diagnostic tools, as treatments are increasingly tailored to the specific characteristics of an individual's disease. Moreover, the expansion of healthcare infrastructure in emerging markets is creating new opportunities for the adoption of advanced biopsy devices. Government initiatives and funding for cancer research and early diagnosis programs are also playing a crucial role in supporting market growth. As awareness of the importance of early detection continues to grow, the biopsy devices market is expected to experience sustained demand, driven by both technological innovations and shifts in healthcare practices globally.Report Scope

The report analyzes the Biopsy Devices market, presented in terms of market value (USD). The analysis covers the key segments and geographic regions outlined below.- Segments: Imaging Technology (Ultrasound-Guided Biopsy, CT Scan-Guided Biopsy, MRI-Guided Biopsy, Steretactics-Guided Biopsy, Other Imaging Technologies); End-Use (Hospitals, Diagnostics Centers).

- Geographic Regions/Countries: World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; and Rest of Europe); Asia-Pacific; Rest of World.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the Hospitals End-Use segment, which is expected to reach US$4.5 Billion by 2030 with a CAGR of 4.7%. The Diagnostics Centers End-Use segment is also set to grow at 3.9% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $1.2 Billion in 2024, and China, forecasted to grow at an impressive 4.2% CAGR to reach $927.2 Million by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Biopsy Devices Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Biopsy Devices Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Biopsy Devices Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as Argon Medical Devices, Inc., B. Braun Melsungen AG, BARD, A Becton, Dickinson Company, Becton, Dickinson and Company, Boston Scientific Corporation and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 46 companies featured in this Biopsy Devices market report include:

- Argon Medical Devices, Inc.

- B. Braun Melsungen AG

- BARD, A Becton, Dickinson Company

- Becton, Dickinson and Company

- Boston Scientific Corporation

- Cardinal Health, Inc.

- Cook Group, Inc.

- FUJIFILM Holdings Corporation

- Hologic, Inc.

- Inrad, Inc.

- Medtronic PLC

- Olympus Corporation

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Argon Medical Devices, Inc.

- B. Braun Melsungen AG

- BARD, A Becton, Dickinson Company

- Becton, Dickinson and Company

- Boston Scientific Corporation

- Cardinal Health, Inc.

- Cook Group, Inc.

- FUJIFILM Holdings Corporation

- Hologic, Inc.

- Inrad, Inc.

- Medtronic PLC

- Olympus Corporation

Table Information

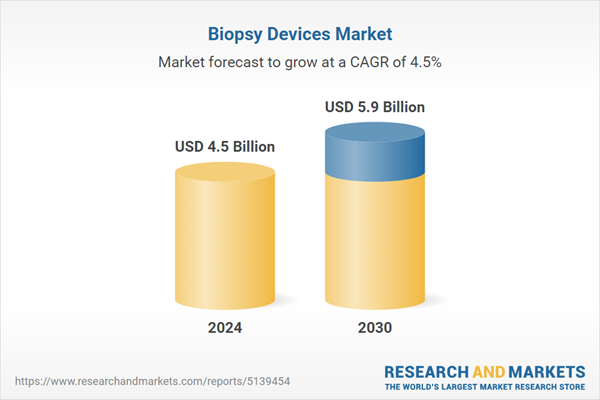

| Report Attribute | Details |

|---|---|

| No. of Pages | 196 |

| Published | February 2026 |

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 4.5 Billion |

| Forecasted Market Value ( USD | $ 5.9 Billion |

| Compound Annual Growth Rate | 4.5% |

| Regions Covered | Global |