Global Electrophysiology Ablation Catheters Market - Key Trends and Drivers Summarized

How Are Electrophysiology Ablation Catheters Transforming Cardiac Care?

Electrophysiology ablation catheters are revolutionizing cardiac care by providing targeted treatments for arrhythmias, such as atrial fibrillation and ventricular tachycardia. These specialized catheters are used in catheter ablation procedures to correct abnormal electrical pathways in the heart. The procedure involves the catheter delivering energy (such as radiofrequency, cryotherapy, or laser) to precise areas of the heart muscle, creating small scars that block irregular electrical signals and restore normal heart rhythms. This minimally invasive approach offers an effective alternative to long-term medication therapy for arrhythmia management, often with shorter recovery times and reduced risk of complications. Electrophysiology ablation catheters are critical for improving patient outcomes and quality of life by providing a durable solution to arrhythmia problems, reducing symptoms, and sometimes curing the condition altogether.What Innovations Are Enhancing the Functionality of Electrophysiology Ablation Catheters?

Recent innovations in electrophysiology ablation catheters focus on enhancing precision, safety, and efficiency. Advanced mapping technologies are now integrated with ablation systems to provide real-time, detailed 3D images of the heart's electrical activity, allowing for more accurate targeting and less invasive procedures. Improvements in catheter design, such as the development of contact force-sensing catheters, help physicians ensure that the right amount of pressure is applied to the heart tissue, optimizing ablation success and minimizing the risk of complications. Additionally, the introduction of cryoballoon catheters, which use freezing rather than heating to create lesions, offers an alternative for patients where traditional radiofrequency ablation may not be suitable. These technological advancements are enhancing the precision and outcomes of ablation therapies, significantly impacting the field of cardiac electrophysiology.How Do Electrophysiology Ablation Catheters Impact Healthcare Efficiency?

Electrophysiology ablation catheters significantly impact healthcare efficiency by reducing the need for long-term drug therapies and lowering the recurrence rates of arrhythmias. Catheter ablation procedures can provide a permanent solution to arrhythmia conditions, which decreases the overall healthcare burden associated with managing these diseases chronically through medications. By reducing hospital stays and follow-up visits required for drug therapy management, ablation catheters decrease healthcare costs and free up medical resources. Moreover, the procedure's minimally invasive nature leads to quicker patient recovery and shorter hospitalization, enhancing patient throughput and satisfaction. These factors collectively improve the efficiency of healthcare delivery in cardiology.What Trends Are Driving Growth in the Electrophysiology Ablation Catheters Market?

Several trends are driving growth in the electrophysiology ablation catheters market, including the rising prevalence of cardiac arrhythmias, technological advancements in catheter technology, and an increasing preference for minimally invasive procedures. As the global population ages, the incidence of conditions such as atrial fibrillation, which is strongly associated with older age, is increasing, thereby boosting the demand for effective arrhythmia treatments. Advancements in catheter technology and imaging systems that improve the safety and efficacy of ablation procedures are also encouraging more physicians and patients to opt for this treatment. Additionally, the shift towards minimally invasive procedures in healthcare is making catheter ablation a more attractive option for arrhythmia management, compared to more invasive cardiac surgeries. These trends, supported by ongoing research and development efforts in the field, are poised to continue driving the expansion and improvement of electrophysiology ablation catheters.Report Scope

The report analyzes the Electrophysiology Ablation Catheters market, presented in terms of market value (USD). The analysis covers the key segments and geographic regions outlined below.- Segments: Product (Radiofrequency (RF) Ablation Catheters, Microwave Ablation (MWA) Systems, Laser Ablation Systems, Navigational Advanced Mapping Accessories, Cryoablation Electrophysiology Catheters); End-Use (Hospitals, Ambulatory Surgery Centers, Specialty Clinics).

- Geographic Regions/Countries: World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; and Rest of Europe); Asia-Pacific; Rest of World.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the Radiofrequency (RF) Ablation Catheters segment, which is expected to reach US$1.9 Billion by 2030 with a CAGR of 7%. The Microwave Ablation (MWA) Systems segment is also set to grow at 5.8% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $801 Million in 2024, and China, forecasted to grow at an impressive 6.1% CAGR to reach $655.1 Million by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Electrophysiology Ablation Catheters Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Electrophysiology Ablation Catheters Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Electrophysiology Ablation Catheters Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as Abbott Laboratories, Biosense Webster, Inc., Biotronik SE & Co. KG, Boston Scientific Corporation, GE Healthcare and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 44 companies featured in this Electrophysiology Ablation Catheters market report include:

- Abbott Laboratories

- Biosense Webster, Inc.

- Biotronik SE & Co. KG

- Boston Scientific Corporation

- GE Healthcare

- Medtronic Inc.

- MicroPort Scientific Corporation

- Philips Healthcare

- Siemens Healthineers

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Abbott Laboratories

- Biosense Webster, Inc.

- Biotronik SE & Co. KG

- Boston Scientific Corporation

- GE Healthcare

- Medtronic Inc.

- MicroPort Scientific Corporation

- Philips Healthcare

- Siemens Healthineers

Table Information

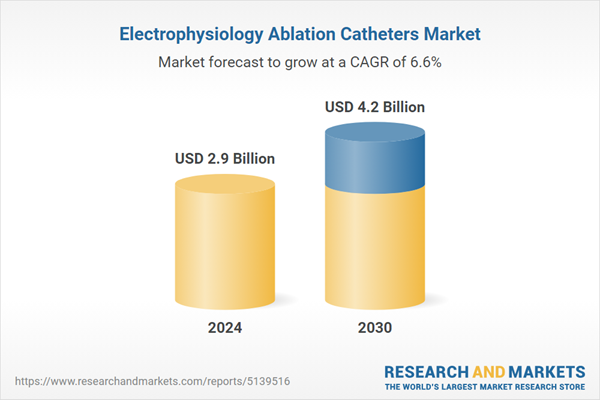

| Report Attribute | Details |

|---|---|

| No. of Pages | 193 |

| Published | January 2026 |

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 2.9 Billion |

| Forecasted Market Value ( USD | $ 4.2 Billion |

| Compound Annual Growth Rate | 6.6% |

| Regions Covered | Global |