Global Boring Tools Market - Key Trends and Drivers Summarized

Why Are Boring Tools Essential in Precision Machining?

Boring tools play a critical role in precision machining, but why are they so vital to modern manufacturing processes? These tools are specifically designed for enlarging and finishing pre-drilled or cast holes with high accuracy, ensuring that the diameter, surface finish, and tolerance meet exact specifications. Boring tools are used extensively in industries such as automotive, aerospace, and heavy machinery, where the precision of components is paramount. They are capable of producing exceptionally smooth finishes and precise tolerances that are often required for parts that will undergo high-stress applications. Boring tools come in various types, including single-point and multiple-point tools, as well as adjustable and fixed options, each suited for different materials and cutting conditions. Their ability to achieve consistent and repeatable results makes them indispensable for creating complex components where even the smallest deviation can compromise the entire assembly.How Are Technological Advancements Revolutionizing Boring Tools?

The technological advancements in boring tools have significantly enhanced their performance, durability, and versatility, transforming how precision machining is conducted. One of the key innovations is the development of advanced coatings and materials for cutting edges, such as polycrystalline diamond (PCD) and cubic boron nitride (CBN), which offer superior wear resistance and longer tool life, especially when working with hard or abrasive materials. Additionally, the introduction of digitally controlled boring heads allows for real-time adjustments during machining, providing unparalleled precision and reducing the likelihood of errors. These advancements are particularly beneficial in industries where tolerances are becoming increasingly tighter, and the cost of errors is high. Moreover, the integration of sensor technology into boring tools has enabled predictive maintenance, allowing operators to monitor tool wear and performance, thereby optimizing the machining process and reducing downtime. The ongoing development of high-speed boring tools, capable of maintaining accuracy at increased cutting speeds, is further pushing the boundaries of what can be achieved in precision machining, making these tools even more valuable in high-production environments.What Challenges Do Boring Tools Face in Modern Machining?

Despite their importance, boring tools face several challenges in modern machining that require ongoing innovation to overcome. One of the primary challenges is the need to maintain accuracy and consistency across a wide range of materials, from soft metals like aluminum to hard alloys and composites. As materials become more complex and harder to machine, the demands on boring tools increase, necessitating the development of more robust and versatile tools. Another challenge is managing the heat generated during the boring process, which can lead to tool wear and affect the quality of the finished hole. To address this, manufacturers are exploring advanced cooling techniques, such as through-tool coolant delivery systems, which help to dissipate heat more effectively and extend tool life. Additionally, the trend toward miniaturization in industries like electronics and medical devices is pushing the limits of boring tools, requiring them to achieve high precision on increasingly smaller scales. Finally, cost pressures in manufacturing are driving the need for more efficient boring tools that can deliver high performance while minimizing downtime and waste. Meeting these challenges is crucial for the continued advancement and adoption of boring tools in precision machining.What's Fueling the Growth of the Boring Tools Market?

The growth in the boring tools market is driven by several factors that are closely linked to advancements in manufacturing technology and changing industry demands. The increasing complexity and precision required in the production of automotive and aerospace components are significant drivers, as these industries demand tools that can deliver consistent accuracy and reliability. Technological advancements, such as the development of digital and high-speed boring tools, are also fueling market growth by enabling more efficient and precise machining processes. The rising adoption of automated and CNC (Computer Numerical Control) machining centers in manufacturing facilities is further boosting the demand for advanced boring tools that can integrate seamlessly with these systems, offering greater flexibility and productivity. Additionally, the shift towards lightweight materials in industries like automotive and aerospace, to improve fuel efficiency, is driving the need for boring tools capable of handling a diverse range of materials. Moreover, the increasing focus on reducing manufacturing costs and improving production efficiency is leading to the development of longer-lasting and more durable boring tools, which can reduce tool changeover times and improve overall process efficiency. Finally, the expansion of manufacturing activities in emerging markets is creating new opportunities for growth in the boring tools sector, as these regions invest in modernizing their production capabilities to compete on a global scale.Report Scope

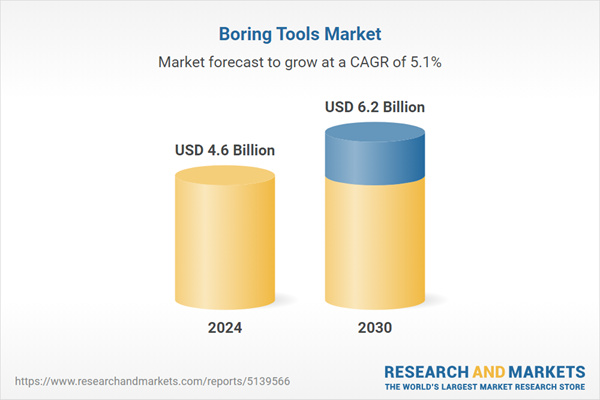

The report analyzes the Boring Tools market, presented in terms of market value (USD). The analysis covers the key segments and geographic regions outlined below.- Segments: End-Use (Transportation, General Machinery, Precision Engineering, Other End-Uses).

- Geographic Regions/Countries: World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; Spain; Russia; and Rest of Europe); Asia-Pacific (Australia; India; South Korea; and Rest of Asia-Pacific); Latin America (Argentina; Brazil; Mexico; and Rest of Latin America); Middle East (Iran; Israel; Saudi Arabia; United Arab Emirates; and Rest of Middle East); and Africa.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the Transportation End-Use segment, which is expected to reach US$2.9 Billion by 2030 with a CAGR of 5.4%. The General Machinery End-Use segment is also set to grow at 4.4% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $1.2 Billion in 2024, and China, forecasted to grow at an impressive 7.6% CAGR to reach $1.4 Billion by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Boring Tools Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Boring Tools Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Boring Tools Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as Advanced Carbide Tool Company, Alesa AG, Allegheny Technologies, Inc. (ATI), AMAMCO Tool, Asahi Diamond Industrial Co., Ltd. and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 47 companies featured in this Boring Tools market report include:

- Advanced Carbide Tool Company

- Alesa AG

- Allegheny Technologies, Inc. (ATI)

- AMAMCO Tool

- Asahi Diamond Industrial Co., Ltd.

- BECKER Diamantwerkzeuge GmbH

- BIG KAISER Precision Tooling, Inc.

- Boehlerit GmbH & Co.KG

- CeramTec GmbH

- CERATIZIT Deutschland GmbH

- Cerin S.p.A.

- DAPRA Corporation

- DIJET Industrial Co., Ltd.

- Dorian Tool International Incorporated

- Dura-Mill, Inc.

- Elenco Carbide Tool Corporation

- Ferguson Enterprises, Inc.

- Five Star Tool Company

- Forbes & Company Limited

- Fullerton Tool Company

- Guhring KG

- Harvey Tool Company, LLC

- Higred Tools Co. Ltd.

- IMCO Carbide Tool Inc.

- Internal Tool, Inc.

- ISCAR Ltd.

- Jarvis Cutting Tools

- Kennametal Inc.

- KOMET GROUP GmbH

- KYOCERA SGS Precision Tools

- LMT TOOLS

- LUKAS-ERZETT Vereinigte Schleif- und Fraswerkzeugfabriken GmbH & Co. KG

- M.A. Ford Mfg. Co., Inc.

- MAPAL Dr. Kress KG

- Mastercut Tool Corporation

- Melin Tool Company

- Miranda Tools

- Mitsubishi Materials Corporation

- Morgood Tools, Inc.

- Nachi-Fujikoshi Corporation

- OSG Corporation

- Rigibore Ltd.

- Rock River Tool Inc.

- Sandvik AB

- SECO Tools AB

- Swiss Tool Systems AG

- Walter AG

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Advanced Carbide Tool Company

- Alesa AG

- Allegheny Technologies, Inc. (ATI)

- AMAMCO Tool

- Asahi Diamond Industrial Co., Ltd.

- BECKER Diamantwerkzeuge GmbH

- BIG KAISER Precision Tooling, Inc.

- Boehlerit GmbH & Co.KG

- CeramTec GmbH

- CERATIZIT Deutschland GmbH

- Cerin S.p.A.

- DAPRA Corporation

- DIJET Industrial Co., Ltd.

- Dorian Tool International Incorporated

- Dura-Mill, Inc.

- Elenco Carbide Tool Corporation

- Ferguson Enterprises, Inc.

- Five Star Tool Company

- Forbes & Company Limited

- Fullerton Tool Company

- Guhring KG

- Harvey Tool Company, LLC

- Higred Tools Co. Ltd.

- IMCO Carbide Tool Inc.

- Internal Tool, Inc.

- ISCAR Ltd.

- Jarvis Cutting Tools

- Kennametal Inc.

- KOMET GROUP GmbH

- KYOCERA SGS Precision Tools

- LMT TOOLS

- LUKAS-ERZETT Vereinigte Schleif- und Fraswerkzeugfabriken GmbH & Co. KG

- M.A. Ford Mfg. Co., Inc.

- MAPAL Dr. Kress KG

- Mastercut Tool Corporation

- Melin Tool Company

- Miranda Tools

- Mitsubishi Materials Corporation

- Morgood Tools, Inc.

- Nachi-Fujikoshi Corporation

- OSG Corporation

- Rigibore Ltd.

- Rock River Tool Inc.

- Sandvik AB

- SECO Tools AB

- Swiss Tool Systems AG

- Walter AG

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 247 |

| Published | January 2026 |

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 4.6 Billion |

| Forecasted Market Value ( USD | $ 6.2 Billion |

| Compound Annual Growth Rate | 5.1% |

| Regions Covered | Global |