Global Blotting Systems Market - Key Trends and Drivers Summarized

Why Are Blotting Systems Integral to Molecular Biology Research?

Blotting systems are fundamental tools in molecular biology, playing a critical role in the detection and analysis of biomolecules such as DNA, RNA, and proteins. Techniques like Western blotting, Southern blotting, and Northern blotting enable researchers to transfer and immobilize nucleic acids or proteins onto a membrane for further analysis, allowing for the identification, quantification, and characterization of specific molecules within a complex mixture. These systems are indispensable in various applications, including genetic research, diagnostics, and drug development, where precise molecular analysis is crucial. The ability of blotting systems to detect low-abundance molecules with high specificity and sensitivity makes them invaluable for researchers seeking to understand the molecular underpinnings of diseases and develop targeted therapies.How Are Technological Advancements Shaping the Future of Blotting Systems?

The field of blotting systems is evolving rapidly, driven by technological advancements that are enhancing the efficiency, sensitivity, and throughput of these techniques. Innovations such as automated blotting systems are streamlining the blotting process, reducing manual labor and minimizing errors, which is particularly beneficial in high-throughput laboratories. The development of enhanced chemiluminescence and fluorescence detection methods has significantly improved the sensitivity of blotting assays, enabling the detection of even minute quantities of target molecules. Additionally, the integration of digital imaging and analysis software is providing researchers with more accurate and reproducible data, facilitating better interpretation of results. These technological improvements are making blotting systems more accessible and effective, thereby expanding their applications in both research and clinical settings.What Challenges and Market Dynamics Are Influencing the Blotting Systems Industry?

The blotting systems market is influenced by a range of challenges and dynamic market forces. One of the key challenges is the need for systems that can deliver high sensitivity and specificity while being cost-effective and easy to use. This has driven companies to invest in the development of more robust and user-friendly systems that can meet the diverse needs of researchers across different fields. Another significant challenge is the competition from alternative technologies, such as mass spectrometry and next-generation sequencing, which offer high-throughput and multiplexing capabilities. Despite these challenges, blotting systems remain a staple in molecular biology due to their established protocols, versatility, and the deep-rooted familiarity of these techniques among researchers. Market dynamics are also shaped by the growing demand for personalized medicine and the need for precise molecular diagnostics, which continue to drive the adoption of advanced blotting technologies.What Factors Are Driving the Growth of the Blotting Systems Market?

The growth in the blotting systems market is driven by several factors, including the increasing demand for proteomics and genomics research, which relies heavily on blotting techniques for the analysis of proteins and nucleic acids. The expanding scope of biomedical research, particularly in the fields of cancer, infectious diseases, and genetic disorders, is also fueling the need for advanced blotting systems that can provide detailed molecular insights. Additionally, the rise of personalized medicine, which requires precise molecular characterization of patient samples, is driving the adoption of more sophisticated blotting technologies. Technological advancements, such as the development of high-sensitivity detection methods and automated systems, are further propelling market growth by making blotting assays more efficient and accessible to a broader range of laboratories. Moreover, the increasing emphasis on reproducibility and accuracy in scientific research is enhancing the demand for high-quality blotting systems that can deliver reliable results. As research continues to push the boundaries of molecular biology, the need for advanced and versatile blotting systems is expected to grow, driving further innovation and expansion in the market.Report Scope

The report analyzes the Blotting Systems market, presented in terms of market value (USD). The analysis covers the key segments and geographic regions outlined below.- Segments: End-Use (Pharma & Biotech Companies, Academic & Research Institutes, Hospitals & Diagnostic Laboratories).

- Geographic Regions/Countries: World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; Spain; Russia; and Rest of Europe); Asia-Pacific (Australia; India; South Korea; and Rest of Asia-Pacific); Latin America (Argentina; Brazil; Mexico; and Rest of Latin America); Middle East (Iran; Israel; Saudi Arabia; United Arab Emirates; and Rest of Middle East); and Africa.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the Pharma & Biotech Companies End-Use segment, which is expected to reach US$776.2 Million by 2030 with a CAGR of 6%. The Academic & Research Institutes End-Use segment is also set to grow at 5.5% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $310 Million in 2024, and China, forecasted to grow at an impressive 8.5% CAGR to reach $379.2 Million by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Blotting Systems Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Blotting Systems Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Blotting Systems Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

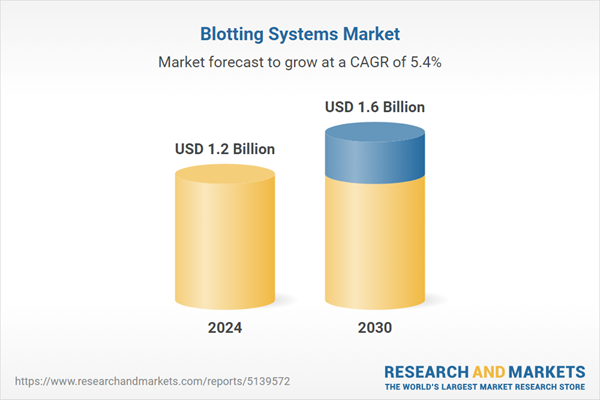

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as Advansta Inc., Bio-Rad Laboratories, Inc., Bio-Techne Coporation, Cell Signaling Technology, Inc., F. Hoffmann-La Roche AG and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 44 companies featured in this Blotting Systems market report include:

- Advansta Inc.

- Bio-Rad Laboratories, Inc.

- Bio-Techne Coporation

- Cell Signaling Technology, Inc.

- F. Hoffmann-La Roche AG

- GE Healthcare

- LI-COR, Inc. (LI-COR Biosciences)

- Merck KgaA

- PerkinElmer, Inc.

- Thermo Fisher Scientific, Inc.

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Advansta Inc.

- Bio-Rad Laboratories, Inc.

- Bio-Techne Coporation

- Cell Signaling Technology, Inc.

- F. Hoffmann-La Roche AG

- GE Healthcare

- LI-COR, Inc. (LI-COR Biosciences)

- Merck KgaA

- PerkinElmer, Inc.

- Thermo Fisher Scientific, Inc.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 193 |

| Published | February 2026 |

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 1.2 Billion |

| Forecasted Market Value ( USD | $ 1.6 Billion |

| Compound Annual Growth Rate | 5.4% |

| Regions Covered | Global |