Global Automotive Steel Wheels Market - Key Trends and Drivers Summarized

Why Do Steel Wheels Remain a Staple in the Automotive Industry?

Automotive steel wheels have been a cornerstone in the automotive industry for decades, known for their durability, strength, and cost-effectiveness. Despite the growing popularity of alloy wheels, steel wheels continue to hold a significant place in the market, particularly for vehicles that require robust performance under challenging conditions. Typically made from pressed and welded steel sheets, these wheels offer exceptional resistance to impact and bending, making them ideal for heavy-duty applications such as trucks, SUVs, and off-road vehicles. Steel wheels are also favored in colder climates where roads are frequently treated with salt and chemicals, as their resilience to corrosion and damage from harsh conditions is unmatched. Their simple construction not only makes them easy to manufacture but also more affordable, which is why they are often the go-to choice for budget-conscious consumers and fleet operators.What Technological Advances Are Shaping the Future of Steel Wheels?

Recent technological advancements in the production and design of steel wheels are ensuring that they remain competitive in an increasingly diverse market. One of the key innovations is the development of high-strength, low-alloy steels, which allow for the production of thinner, lighter steel wheels without compromising strength or durability. This advancement has helped mitigate one of the traditional disadvantages of steel wheels - their heavier weight compared to alloy alternatives. Additionally, new coating technologies have significantly improved the corrosion resistance of steel wheels, extending their lifespan and maintaining their aesthetic appeal even in harsh environments. Advances in precision engineering have also allowed manufacturers to design steel wheels that are more balanced and offer smoother rides, narrowing the performance gap between steel and alloy wheels. Furthermore, the integration of automated manufacturing processes has enhanced the consistency and quality of steel wheels, reducing production costs and making them even more competitive.Why Are Steel Wheels Particularly Important in Commercial and Off-Road Applications?

Steel wheels are especially crucial in commercial and off-road applications where durability and reliability are paramount. For commercial vehicles, such as trucks and vans, which are subject to heavy loads and frequent use, steel wheels provide the necessary strength to withstand the rigors of daily operations. Their ability to absorb shocks and impacts without cracking or bending makes them ideal for off-road vehicles that encounter rough and uneven terrain. Moreover, steel wheels are easily repairable, which is an important consideration for fleet operators and off-road enthusiasts who need to maintain their vehicles' performance without incurring high costs. The ability to withstand harsh environmental conditions, including exposure to mud, gravel, and corrosive substances, further cements steel wheels as the preferred choice for these demanding applications. As electric and hybrid commercial vehicles gain traction, steel wheels' contribution to cost efficiency and durability will remain essential in ensuring the viability of these vehicles in tough operating environments.What Is Driving the Growth in the Automotive Steel Wheels Market?

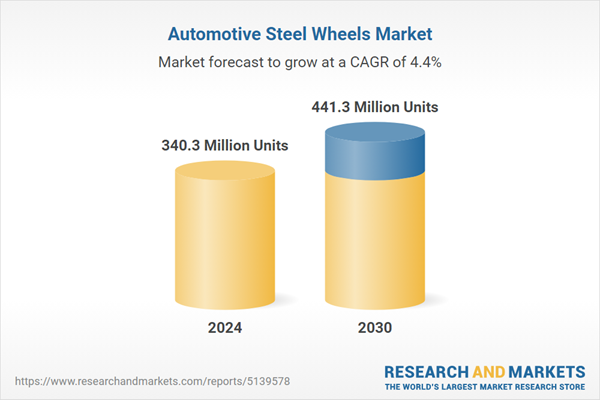

The growth in the automotive steel wheels market is driven by several factors that align with the broader trends in the automotive and transportation sectors. A primary driver is the increasing demand for commercial vehicles, particularly in emerging markets where cost-efficiency and durability are critical. The expansion of infrastructure projects and the need for reliable transportation in rural and rugged areas are further propelling the demand for steel wheels. Additionally, advancements in steel wheel manufacturing, including the use of high-strength materials and improved corrosion-resistant coatings, are making steel wheels more competitive in the market. The rise of electric and hybrid vehicles, especially in the commercial sector, is also contributing to market growth as these vehicles often require robust wheel solutions that steel provides. Furthermore, the ongoing economic uncertainties and the need for cost-effective vehicle components are encouraging both consumers and manufacturers to opt for steel wheels over more expensive alternatives. As a result, the automotive steel wheels market is expected to see sustained growth, driven by their proven reliability, evolving technologies, and the expanding commercial vehicle sector.Report Scope

The report analyzes the Automotive Steel Wheels market, presented in terms of market value (USD). The analysis covers the key segments and geographic regions outlined below.- Segments: End-Use (Passenger Cars, Light Commercial Vehicles, Heavy Commercial Vehicles).

- Geographic Regions/Countries: World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; Spain; Russia; and Rest of Europe); Asia-Pacific (Australia; India; South Korea; and Rest of Asia-Pacific); Latin America (Argentina; Brazil; Mexico; and Rest of Latin America); Middle East (Iran; Israel; Saudi Arabia; United Arab Emirates; and Rest of Middle East); and Africa.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the Passenger Cars End-Use segment, which is expected to reach 324.3 Million Units by 2030 with a CAGR of 4.5%. The Light Commercial Vehicles End-Use segment is also set to grow at 4.5% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at 89.3 Million Units in 2024, and China, forecasted to grow at an impressive 6.9% CAGR to reach 95.8 Million Units by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Automotive Steel Wheels Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Automotive Steel Wheels Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Automotive Steel Wheels Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as Accuride Corporation, Alcar Holding Gmbh, American Offroad Wheels, Atlantic Products, Atvunlimited and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 46 companies featured in this Automotive Steel Wheels market report include:

- Accuride Corporation

- Alcar Holding Gmbh

- American Offroad Wheels

- Atlantic Products

- Atvunlimited

- Autoliv Japan Ltd.

- Avant Garde Wheels

- bd breyton design GmbH

- Beijing Jianlong Heavy Industry Group Co. Ltd

- Benedict Miller

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Accuride Corporation

- Alcar Holding Gmbh

- American Offroad Wheels

- Atlantic Products

- Atvunlimited

- Autoliv Japan Ltd.

- Avant Garde Wheels

- bd breyton design GmbH

- Beijing Jianlong Heavy Industry Group Co. Ltd

- Benedict Miller

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 196 |

| Published | February 2026 |

| Forecast Period | 2024 - 2030 |

| Estimated Market Value in 2024 | 340.3 Million Units |

| Forecasted Market Value by 2030 | 441.3 Million Units |

| Compound Annual Growth Rate | 4.4% |

| Regions Covered | Global |