Global Array Instruments Market - Key Trends and Drivers Summarized

How Are Array Instruments Revolutionizing Biomedical Research?

Array instruments have become indispensable tools in the field of biomedical research, offering unprecedented capabilities in analyzing complex biological data. These instruments, which include DNA microarrays, protein arrays, and tissue arrays, enable researchers to study the expression of thousands of genes, proteins, or other biomolecules simultaneously. The high-throughput nature of array instruments has transformed the way scientists approach genomics, proteomics, and personalized medicine, allowing for more comprehensive and precise analyses. By facilitating the simultaneous examination of multiple biomarkers, array instruments have accelerated the pace of discovery in areas such as cancer research, genetic disorders, and drug development. The ability to quickly and accurately assess gene expression patterns and protein interactions has made these instruments a cornerstone of modern laboratory practices, leading to significant advancements in our understanding of disease mechanisms and potential therapeutic targets.What Technological Innovations Are Enhancing the Capabilities of Array Instruments?

The evolution of array instruments has been driven by continuous technological innovations that have expanded their functionality and application scope. Recent advancements in microarray technology have increased the sensitivity, specificity, and resolution of these instruments, enabling the detection of even minute changes in gene or protein expression. Additionally, the integration of advanced computational tools has enhanced data analysis capabilities, allowing researchers to interpret complex datasets with greater accuracy and efficiency. Innovations in array design, such as the development of high-density arrays, have further increased the throughput of these instruments, making them more powerful than ever before. Moreover, the emergence of multiplexed arrays, which can analyze multiple types of biomolecules simultaneously, has opened new avenues for research, particularly in the field of systems biology. These technological strides have not only improved the performance of array instruments but have also broadened their applicability, making them essential in a wide range of research areas, from basic science to clinical diagnostics.Why Are Array Instruments Critical in Personalized Medicine and Diagnostics?

Array instruments play a pivotal role in the advancement of personalized medicine and diagnostics, where precision and accuracy are paramount. The ability of these instruments to provide detailed molecular profiles of individual patients has revolutionized the way diseases are diagnosed and treated. In personalized medicine, array instruments are used to identify specific genetic mutations or expression patterns that can predict a patient's response to certain therapies, allowing for more tailored and effective treatment strategies. In diagnostics, these instruments enable the detection of biomarkers that can indicate the presence or progression of diseases such as cancer, cardiovascular conditions, and autoimmune disorders. The adoption of array instruments in clinical settings has facilitated the transition from one-size-fits-all treatment approaches to more individualized care, improving patient outcomes and reducing healthcare costs. As the demand for personalized healthcare solutions continues to grow, the importance of array instruments in both research and clinical practice is expected to increase significantly.What Is Driving the Growth of the Array Instruments Market?

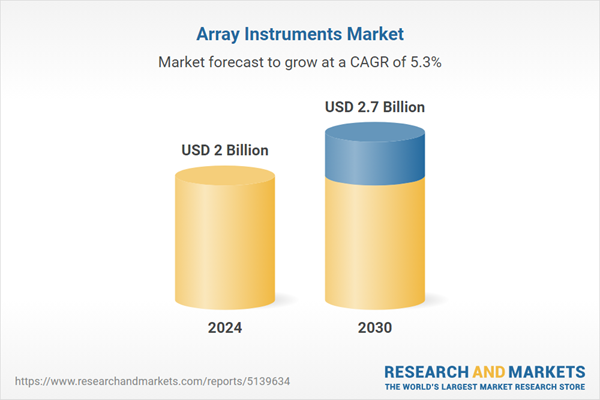

The growth in the array instruments market is driven by several factors that are shaping its expansion and evolution. A key driver is the increasing demand for high-throughput technologies in biomedical research, where the need to analyze large datasets quickly and accurately is paramount. The rise of personalized medicine has also significantly contributed to market growth, as healthcare providers seek advanced tools for molecular diagnostics and tailored treatment strategies. Technological advancements, such as the development of next-generation microarrays and the integration of AI and machine learning in data analysis, are further propelling the market by enhancing the capabilities and efficiency of these instruments. The expanding application of array instruments in areas such as cancer research, drug development, and agricultural biotechnology is creating new opportunities for market growth. Additionally, the growing emphasis on early disease detection and the development of precision medicine are driving the adoption of array instruments in clinical diagnostics, particularly in developed countries with advanced healthcare infrastructures. As these trends continue to evolve, the array instruments market is poised for sustained growth, driven by innovation and the expanding need for sophisticated analytical tools in both research and healthcare.Report Scope

The report analyzes the Array Instruments market, presented in terms of market value (USD). The analysis covers the key segments and geographic regions outlined below.- Segments: Technology (DNA Microarrays, Protein Microarrays, Other Technologies); End-Use (R&D Laboratories, Clinical Diagnostic Labs, Other End-Uses).

- Geographic Regions/Countries: World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; and Rest of Europe); Asia-Pacific; Rest of World.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the DNA Microarrays Technology segment, which is expected to reach US$1.4 Billion by 2030 with a CAGR of 5.4%. The Protein Microarrays Technology segment is also set to grow at 5.8% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $540.2 Million in 2024, and China, forecasted to grow at an impressive 5.1% CAGR to reach $422.7 Million by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Array Instruments Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Array Instruments Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Array Instruments Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as Affymetrix, Inc., Agilent Technologies, Inc., Arrayit Corporation, Bio-Rad Laboratories, Inc., Illumina, Inc. and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 43 companies featured in this Array Instruments market report include:

- Affymetrix, Inc.

- Agilent Technologies, Inc.

- Arrayit Corporation

- Bio-Rad Laboratories, Inc.

- Illumina, Inc.

- Laboratory Corporation of America Holdings (LabCorp)

- Luminex Corporation

- Meso Scale Diagnostics, LLC.

- MilliporeSigma

- Mingyuan Medicare Development Company Limited

- Molecular Devices LLC

- Novus Biologicals LLC

- OriGene Technologies, Inc.

- Orla Protein Technologies Ltd.

- Oxford Gene Technology

- Partek, Inc.

- Pepscan

- PerkinElmer, Inc.

- Phalanx Biotech Group

- ProteoGenix

- Qiagen NV

- RayBiotech, Inc.

- Retrogenix Ltd.

- Thermo Fisher Scientific, Inc.

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Affymetrix, Inc.

- Agilent Technologies, Inc.

- Arrayit Corporation

- Bio-Rad Laboratories, Inc.

- Illumina, Inc.

- Laboratory Corporation of America Holdings (LabCorp)

- Luminex Corporation

- Meso Scale Diagnostics, LLC.

- MilliporeSigma

- Mingyuan Medicare Development Company Limited

- Molecular Devices LLC

- Novus Biologicals LLC

- OriGene Technologies, Inc.

- Orla Protein Technologies Ltd.

- Oxford Gene Technology

- Partek, Inc.

- Pepscan

- PerkinElmer, Inc.

- Phalanx Biotech Group

- ProteoGenix

- Qiagen NV

- RayBiotech, Inc.

- Retrogenix Ltd.

- Thermo Fisher Scientific, Inc.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 193 |

| Published | January 2026 |

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 2 Billion |

| Forecasted Market Value ( USD | $ 2.7 Billion |

| Compound Annual Growth Rate | 5.3% |

| Regions Covered | Global |