Global Commercial Aircraft Seat Actuation Market - Key Trends and Drivers Summarized

How Do Aircraft Seat Actuation Systems Enhance the Passenger Experience?

Commercial aircraft seat actuation systems are essential technologies that enhance passenger comfort by enabling the adjustment of seat positions through electronic or manual controls. These systems are particularly important in premium classes, such as business and first class, where passengers expect higher levels of comfort, including lie-flat seating for long-haul flights. Seat actuators allow passengers to recline their seats, adjust lumbar support, footrests, and headrests to suit their preferences, providing a customizable in-flight experience. The functionality of seat actuation systems has advanced significantly over the years, incorporating more refined motor controls and electronics to deliver smoother, quieter, and more precise adjustments. For airlines, these systems are a key component of the cabin experience, allowing them to differentiate their services in a highly competitive market where comfort and passenger satisfaction are critical. Seat actuation technology is designed to balance comfort with efficient space management, particularly in premium cabins where seats take up a larger footprint. As passenger expectations for personalized in-flight experiences continue to grow, the importance of reliable, user-friendly seat actuation systems cannot be overstated.What Technological Innovations Are Shaping the Future of Seat Actuation?

The technological landscape of commercial aircraft seat actuation systems has evolved dramatically, driven by innovations in automation, materials, and electronics. Modern seat actuation systems leverage lightweight materials such as aluminum and composite structures to reduce the overall weight of the seats, which is crucial for maintaining aircraft fuel efficiency. At the same time, advancements in miniaturized electric motors, sensors, and actuators allow for more intricate and seamless adjustments, with some systems incorporating up to 20 different movements, such as reclining, tilting, and rotating functions. The integration of brushless motors in seat actuation systems has significantly improved energy efficiency and reduced operational noise, enhancing the in-flight experience. In addition, many modern aircraft now feature actuators equipped with memory functions, allowing passengers to save their preferred seat positions. Automation and connectivity are also beginning to play a role, with seat actuation systems increasingly integrated into in-flight entertainment (IFE) systems, enabling passengers to control their seats via touchscreens or personal devices. Furthermore, the use of smart actuators that can self-diagnose and report maintenance needs is becoming more common, allowing airlines to address technical issues proactively and improve seat reliability. These technological advancements are continually reshaping how seat actuation systems function, making them more efficient and intuitive while improving passenger comfort.What Challenges Are Faced by Modern Seat Actuation Systems in Aviation?

Despite the advancements in technology, commercial aircraft seat actuation systems face several challenges, particularly related to weight, maintenance, and integration. One of the primary issues is finding a balance between creating highly functional, adjustable seats and maintaining the overall weight of the aircraft. The more sophisticated the seat actuation system, the heavier the seat, which can negatively impact the fuel efficiency of the aircraft. As airlines push for more fuel-efficient fleets, seat manufacturers must innovate to produce lighter seat actuation systems without compromising on functionality or passenger comfort. Another challenge is reliability and maintenance. As seat actuation systems become more complex with advanced electronic controls and multiple actuators, the potential for mechanical failure increases. Malfunctions in seat actuation systems can disrupt the passenger experience and lead to costly repairs or replacements, especially in high-end cabins where the seats are more intricate. Additionally, the integration of seat actuation systems with other in-flight technologies, such as IFE and cabin management systems, adds further complexity. Ensuring that all systems work seamlessly together without causing power or communication issues requires sophisticated engineering and testing. Furthermore, retrofitting older aircraft with modern seat actuation systems poses another challenge, as it often requires modifications to the cabin layout and electrical systems, leading to higher costs for airlines.What Is Driving the Growth in the Commercial Aircraft Seat Actuation Market?

The growth in the commercial aircraft seat actuation market is driven by several factors, including evolving consumer expectations, advancements in lightweight materials, and the increasing demand for premium cabin upgrades. One of the most significant growth drivers is the rising demand for comfort, particularly in long-haul travel, as passengers increasingly prioritize in-flight comfort over cost. This has led airlines to invest heavily in seat technology, especially in business and first-class cabins, where seat actuation systems play a crucial role in differentiating their services. Technological advancements, such as the development of lighter, more energy-efficient actuators and motors, are also driving growth. These innovations not only reduce the weight and complexity of the seats but also improve durability and reduce maintenance costs, making them more attractive to airlines. Another key driver is the growing trend toward retrofitting older aircraft fleets with modern seating systems. As airlines seek to extend the life of their aircraft while meeting modern passenger expectations, upgrading to newer seat actuation systems is becoming a priority. Additionally, the rise of ultra-long-haul flights has intensified the need for high-quality seat actuation systems that can offer extended comfort over long periods. The increasing integration of seat actuation with other in-flight technologies, such as entertainment and connectivity systems, is also contributing to market growth, as passengers expect seamless, personalized control over their seat environment. These factors, combined with the broader push for more luxurious, customizable in-flight experiences, are fueling the expansion of the commercial aircraft seat actuation market.Report Scope

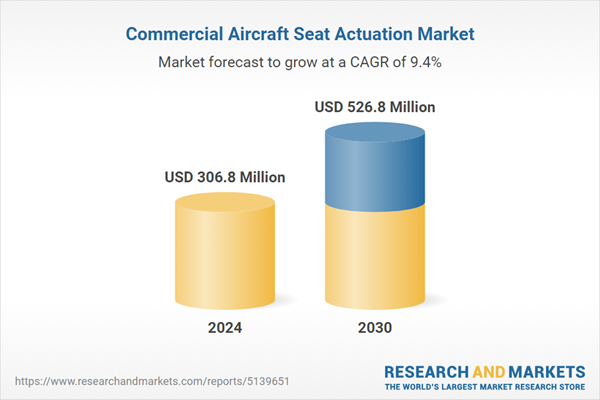

The report analyzes the Commercial Aircraft Seat Actuation market, presented in terms of market value (USD). The analysis covers the key segments and geographic regions outlined below.- Segments: Segment (Hydraulic, Electro-Mechanical).

- Geographic Regions/Countries: World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; Spain; Russia; and Rest of Europe); Asia-Pacific (Australia; India; South Korea; and Rest of Asia-Pacific); Latin America (Argentina; Brazil; Mexico; and Rest of Latin America); Middle East (Iran; Israel; Saudi Arabia; United Arab Emirates; and Rest of Middle East); and Africa.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the Hydraulic Actuation segment, which is expected to reach US$260.5 Million by 2030 with a CAGR of 7.9%. The Electro-Mechanical Actuation segment is also set to grow at 11.1% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $81.1 Million in 2024, and China, forecasted to grow at an impressive 14.5% CAGR to reach $128.6 Million by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Commercial Aircraft Seat Actuation Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Commercial Aircraft Seat Actuation Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Commercial Aircraft Seat Actuation Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as Astronics PGA, Buhler Motor GmbH, Crane Aerospace & Electronics, Dornier Technology, Inc., Global Airworks, Inc. and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 47 companies featured in this Commercial Aircraft Seat Actuation market report include:

- Astronics PGA

- Buhler Motor GmbH

- Crane Aerospace & Electronics

- Dornier Technology, Inc.

- Global Airworks, Inc.

- ITT Enivate

- Nook Industries, Inc.

- UTC Aerospace Systems

- Zodiac Aerospace

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Astronics PGA

- Buhler Motor GmbH

- Crane Aerospace & Electronics

- Dornier Technology, Inc.

- Global Airworks, Inc.

- ITT Enivate

- Nook Industries, Inc.

- UTC Aerospace Systems

- Zodiac Aerospace

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 247 |

| Published | February 2026 |

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 306.8 Million |

| Forecasted Market Value ( USD | $ 526.8 Million |

| Compound Annual Growth Rate | 9.4% |

| Regions Covered | Global |