Global Commercial Aircraft Batteries Market - Key Trends and Drivers Summarized

What Are Commercial Aircraft Batteries and Why Are They Crucial for Aircraft Operation?

Commercial aircraft batteries play a vital role in ensuring the safety, reliability, and efficiency of modern air travel. These batteries are used to power essential systems during flight, provide emergency backup in the event of power failure, and supply energy to auxiliary systems while the aircraft is on the ground. Typically, commercial aircraft are equipped with two types of batteries: primary batteries, which handle critical functions such as powering the avionics and flight control systems, and auxiliary batteries, which serve as backup power sources. While traditional aircraft relied primarily on lead-acid or nickel-cadmium batteries, the aviation industry is now increasingly shifting towards more advanced lithium-ion (Li-ion) batteries due to their higher energy density, lighter weight, and longer lifespan. These batteries are responsible for starting the aircraft's auxiliary power unit (APU), which powers the cockpit displays, cabin lighting, and hydraulic systems before the engines are activated. Batteries also provide the energy required for emergency systems like backup flight controls and communication tools in the event of an in-flight electrical system failure. As the demand for more fuel-efficient, reliable, and environmentally friendly aircraft grows, the role of advanced battery systems is becoming increasingly central to the future of commercial aviation.How Are Technological Innovations Transforming Commercial Aircraft Batteries?

The transformation of commercial aircraft batteries is largely being driven by technological advancements aimed at improving efficiency, safety, and sustainability. One of the most significant changes is the widespread adoption of lithium-ion batteries, which offer several advantages over older battery technologies. Lithium-ion batteries provide higher energy density, meaning they can store more energy while being lighter than their nickel-cadmium or lead-acid counterparts. This weight reduction contributes directly to the overall fuel efficiency of the aircraft, a key consideration for airlines seeking to lower operational costs and reduce carbon emissions. Additionally, advances in battery management systems (BMS) have improved the safety and reliability of aircraft batteries by allowing for more precise monitoring of voltage, temperature, and charge levels. These systems help prevent common issues like overcharging or overheating, which have historically posed risks in battery-operated devices. Another significant trend is the research and development of solid-state batteries, which promise even higher energy densities and improved safety characteristics by using solid electrolytes instead of the liquid or gel electrolytes found in traditional batteries. Furthermore, advancements in rapid charging technologies are reducing the time required to recharge batteries, which is crucial for the quick turnaround times demanded by commercial flight operations. As the aviation industry explores hybrid-electric and fully electric aircraft, the role of cutting-edge battery technology will become even more central, pushing the boundaries of what commercial aviation can achieve in terms of efficiency, sustainability, and performance.What Challenges Do Commercial Aircraft Batteries Face in Adoption and Development?

Despite the numerous advantages offered by modern commercial aircraft batteries, there are still several challenges associated with their widespread adoption and ongoing development. One of the most pressing issues is safety, particularly concerning the thermal runaway risks associated with lithium-ion batteries. These batteries are known to overheat under certain conditions, which can lead to fires or explosions - posing a serious threat in aviation. While advancements in battery management systems and thermal controls have mitigated some of these risks, ensuring the absolute safety of lithium-ion batteries in all operational conditions remains a key challenge for manufacturers. Another challenge is the limited lifespan of current battery technologies. Frequent charging cycles can lead to degradation, reducing the battery's overall efficiency and requiring more frequent replacements, which increases maintenance costs for airlines. Additionally, the aviation industry is bound by stringent regulatory requirements, and developing new battery technologies that meet safety certifications can be a time-consuming and expensive process. The weight-to-power ratio of batteries also remains a concern, especially as the industry looks towards the development of electric aircraft. While batteries have improved, they still lag behind conventional jet fuel in terms of energy density, limiting the range and payload capacity of electric or hybrid aircraft. Furthermore, supply chain issues, particularly the sourcing of materials like lithium, cobalt, and other rare minerals needed for advanced battery production, could potentially slow the expansion of battery technologies in aviation. Addressing these challenges will be critical for the future of battery-powered commercial flight.What Factors Are Supporting Rapid Growth of the Commercial Aircraft Battery Market?

The growth in the commercial aircraft battery market is driven by several factors, including advancements in electric and hybrid aircraft, the push for greater fuel efficiency, and the rising need for reliable power systems in modern aviation. One of the most significant growth drivers is the increasing interest in hybrid-electric and fully electric aircraft as the aviation industry seeks to reduce its carbon footprint. With major aerospace companies like Airbus and Boeing investing in electric aircraft prototypes, the demand for advanced battery technologies is expected to surge. As airlines aim to meet stricter environmental regulations and fuel efficiency targets, battery-powered systems are seen as a viable solution for reducing fuel consumption during taxiing, takeoff, and landing, while also minimizing the environmental impact of short-haul flights. Another key factor driving growth is the ongoing modernization of commercial aircraft fleets. Airlines are replacing aging aircraft with newer models that incorporate more advanced electrical systems, which in turn require more powerful and reliable batteries to support critical functions. The expansion of battery usage into secondary systems, such as in-flight entertainment and cabin amenities, has also contributed to market growth as passengers expect a more seamless and high-tech travel experience. Additionally, the rise of the more electric aircraft (MEA) concept - where traditional hydraulic and pneumatic systems are replaced by electrical systems - creates further demand for advanced battery technology. Lastly, improvements in battery safety, lifespan, and efficiency have made modern batteries more attractive to airlines, ensuring that these systems can meet the operational demands of commercial aviation without compromising safety or performance. Collectively, these trends are driving significant growth in the commercial aircraft battery market, positioning it as a critical component of the future of aviation.Report Scope

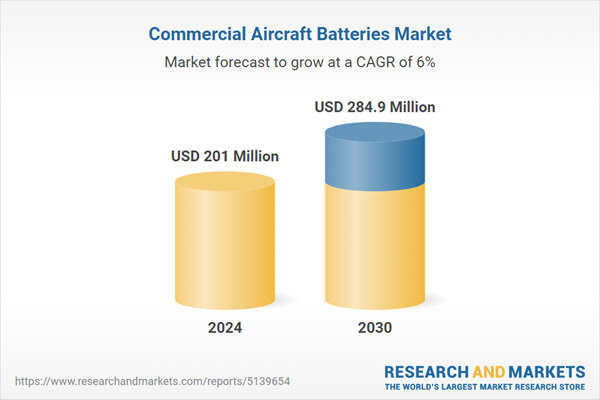

The report analyzes the Commercial Aircraft Batteries market, presented in terms of market value (USD). The analysis covers the key segments and geographic regions outlined below.- Segments: Segment (Lithium-Based Battery, Nickel-Based Battery, Lead Acid Battery).

- Geographic Regions/Countries: World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; Spain; Russia; and Rest of Europe); Asia-Pacific (Australia; India; South Korea; and Rest of Asia-Pacific); Latin America (Argentina; Brazil; Mexico; and Rest of Latin America); Middle East (Iran; Israel; Saudi Arabia; United Arab Emirates; and Rest of Middle East); and Africa.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the Lithium-based Battery segment, which is expected to reach US$234.3 Million by 2030 with a CAGR of 6.9%. The Nickel-based Battery segment is also set to grow at 2.1% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $52.3 Million in 2024, and China, forecasted to grow at an impressive 9.2% CAGR to reach $67.2 Million by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Commercial Aircraft Batteries Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Commercial Aircraft Batteries Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Commercial Aircraft Batteries Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as Aerolithium Batteries, Cella Energy Ltd., Concorde Battery Corporation, EaglePicher Technologies, GS Yuasa International Ltd. and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 23 companies featured in this Commercial Aircraft Batteries market report include:

- Aerolithium Batteries

- Cella Energy Ltd.

- Concorde Battery Corporation

- EaglePicher Technologies

- GS Yuasa International Ltd.

- HBL Power Systems Ltd.

- SAFT

- Sion Power Corporation

- Tadiran Batteries GmbH

- Teledyne Battery Products

- True Blue Power

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Aerolithium Batteries

- Cella Energy Ltd.

- Concorde Battery Corporation

- EaglePicher Technologies

- GS Yuasa International Ltd.

- HBL Power Systems Ltd.

- SAFT

- Sion Power Corporation

- Tadiran Batteries GmbH

- Teledyne Battery Products

- True Blue Power

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 233 |

| Published | February 2026 |

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 201 Million |

| Forecasted Market Value ( USD | $ 284.9 Million |

| Compound Annual Growth Rate | 6.0% |

| Regions Covered | Global |