Global Cold Cuts Market - Key Trends and Drivers Summarized

What Are Cold Cuts and Why Are They Popular in the Global Food Market?

Cold cuts, also known as deli meats or luncheon meats, refer to pre-cooked or cured meats that are sliced and served cold, typically in sandwiches, salads, or as part of charcuterie boards. Common varieties include ham, turkey, salami, roast beef, and mortadella, each offering distinct flavors and textures. Cold cuts are widely consumed because of their convenience, versatility, and taste, making them a staple in homes, restaurants, and catering services. Available in both pre-packaged forms and freshly sliced at deli counters, they cater to the busy lifestyles of modern consumers, who seek quick yet satisfying meal options. The appeal of cold cuts lies in their ability to deliver protein-packed, ready-to-eat solutions that fit into various meal occasions. Whether used in school lunches, corporate catering, or gourmet platters, cold cuts have become an integral part of daily meal planning due to their ease of preparation and wide range of flavor profiles.How Are Changing Consumer Preferences Shaping the Cold Cuts Market?

Consumer preferences in the cold cuts market are evolving rapidly, with shifts toward healthier eating habits and premiumization. In response to the growing awareness of nutrition and wellness, there has been an increasing demand for cold cuts made from natural ingredients, with low sodium, reduced fat, and no artificial preservatives. Health-conscious consumers are now seeking deli meats that align with their dietary preferences, such as organic, grass-fed, or nitrate-free options. The shift toward plant-based diets has also impacted the market, leading to the rise of plant-based cold cuts as alternatives for vegetarians and flexitarians. These plant-based cold cuts mimic the taste and texture of traditional meats, offering a protein-rich solution for those looking to reduce their meat consumption while still enjoying similar flavors. Additionally, the trend toward premium and artisanal products has spurred growth in gourmet cold cuts. Consumers are willing to pay more for high-quality meats, such as prosciutto, chorizo, or coppa that offer unique flavors and are often tied to traditional curing methods. The rise of charcuterie boards as a popular dining option has further boosted demand for a broader variety of cold cuts, from traditional offerings to more exotic and regional varieties. As consumers become more adventurous with their food choices, cold cuts are being increasingly paired with premium cheeses, breads, and spreads, enhancing their appeal to gourmet experiences.What Technologies and Innovations Are Driving Advancements in the Cold Cuts Industry?

The cold cuts industry is benefiting from technological advancements and innovations that are enhancing product quality, safety, and sustainability. One key development is the increasing use of clean-label processing techniques, which eliminate the need for artificial preservatives while ensuring product freshness and longevity. Natural curing processes and the use of organic acids are becoming more prevalent as manufacturers aim to meet consumer demand for 'clean' and minimally processed food products. Additionally, packaging innovations such as vacuum sealing, modified atmosphere packaging (MAP), and resealable packs are helping to extend the shelf life of cold cuts while maintaining their flavor and texture. These innovations not only improve the convenience for consumers but also reduce food waste by keeping products fresher for longer. Automation and digitization are also transforming the production and distribution of cold cuts. Automated slicing and portioning technologies ensure precision in product size and thickness, reducing waste and improving consistency. This allows manufacturers to meet the demands of both retail and foodservice sectors more efficiently. Moreover, advancements in traceability technologies, such as blockchain, are being integrated to ensure greater transparency in the supply chain, allowing consumers to know the origin and production methods of their cold cuts. This focus on transparency is particularly important as consumers become more concerned with sourcing and ethical practices in the meat industry.What Factors Are Behind the Growth of the Cold Cuts Market?

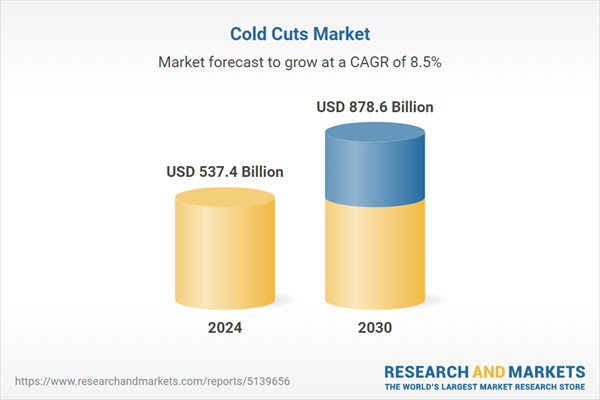

The growth in the cold cuts market is driven by several factors, including the increasing demand for convenient meal solutions, the rise of premium and health-conscious products, and evolving consumer behaviors. One of the primary drivers is the global trend toward convenience and time-saving food options. As consumers face busier lifestyles, cold cuts offer a quick, easy, and versatile meal solution, whether for sandwiches, snacks, or prepared meals. This demand is particularly strong in urban areas, where busy professionals and families seek ready-to-eat options that fit into their fast-paced routines. The growing popularity of meal kits and food delivery services is also boosting demand for pre-sliced deli meats, as they are often included as part of meal components. Health trends are also shaping the market. As consumers become more health-conscious, there is a growing demand for cold cuts that are lower in sodium, fat, and preservatives, as well as for organic and ethically sourced meats. The rise of plant-based cold cuts reflects the broader shift toward flexitarian diets, where consumers seek plant-based alternatives without fully eliminating meat from their diets. Additionally, the trend toward premiumization is fueling the demand for gourmet and artisanal cold cuts, as consumers are increasingly willing to spend more on high-quality, flavorful products. The surge in popularity of charcuterie boards, driven by social media and food trends, has expanded the market for more diverse and exotic cold cut options. Lastly, regional and global market expansion is also contributing to growth. As global cuisines become more popular, particularly Mediterranean and European cured meats, there is increasing interest in a wider variety of cold cuts. This globalization of tastes is introducing new flavors and varieties to markets that were previously dominated by traditional deli meats. These combined factors are driving both product diversification and consumer demand, ensuring sustained growth in the cold cuts market across different regions and demographic segments.Report Scope

The report analyzes the Cold Cuts market, presented in terms of market value (USD). The analysis covers the key segments and geographic regions outlined below.- Segments: Product Type (Deli Cold Cuts, Packaged Cold Cuts).

- Geographic Regions/Countries: World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; Spain; Russia; and Rest of Europe); Asia-Pacific (Australia; India; South Korea; and Rest of Asia-Pacific); Latin America (Argentina; Brazil; Mexico; and Rest of Latin America); Middle East (Iran; Israel; Saudi Arabia; United Arab Emirates; and Rest of Middle East); and Africa.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the Deli Cold Cuts segment, which is expected to reach US$537.7 Billion by 2030 with a CAGR of 7.5%. The Packaged Cold Cuts segment is also set to grow at 10.2% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $138.6 Billion in 2024, and China, forecasted to grow at an impressive 12.4% CAGR to reach $220.4 Billion by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Cold Cuts Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Cold Cuts Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Cold Cuts Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as Boar's Head Brand, Cargill, Inc., Hormel Foods Corporation, Seaboard Corporation, The Kraft Heinz Company and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 48 companies featured in this Cold Cuts market report include:

- Boar's Head Brand

- Cargill, Inc.

- Hormel Foods Corporation

- Seaboard Corporation

- The Kraft Heinz Company

- Tyson Foods, Inc.

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Boar's Head Brand

- Cargill, Inc.

- Hormel Foods Corporation

- Seaboard Corporation

- The Kraft Heinz Company

- Tyson Foods, Inc.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 326 |

| Published | January 2026 |

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 537.4 Billion |

| Forecasted Market Value ( USD | $ 878.6 Billion |

| Compound Annual Growth Rate | 8.5% |

| Regions Covered | Global |