Global Thick Film Resistors Market - Key Trends and Drivers Summarized

Why Are Thick Film Resistors Essential in Modern Electronics?

Thick film resistors have become a vital component in modern electronics, playing a critical role in a wide array of applications. But why are they so integral to today's technology landscape? Thick film resistors are widely used in electronic circuits due to their stability, reliability, and ability to operate in harsh environments. They are created by applying a resistive layer, usually made of a metal oxide or cermet paste, onto a ceramic substrate through screen printing, which is then fired at high temperatures. This process allows thick film resistors to be produced with precise resistance values while also maintaining a high degree of durability and thermal stability. Their robustness makes them ideal for use in automotive systems, industrial controls, telecommunications, and consumer electronics, where they help regulate current, reduce signal noise, and protect sensitive components. Additionally, their versatility in resistance range, tolerance, and power ratings has allowed them to be widely adopted in both high-power and low-power electronic devices.How Do Thick Film Resistors Meet the Needs of Evolving Electronic Devices?

As electronic devices continue to evolve, particularly in terms of miniaturization and complexity, thick film resistors have proven to be a reliable solution to meet these changing demands. One of the key advantages of thick film resistors is their ability to be manufactured in extremely small sizes while still offering high resistance values and excellent performance. This makes them particularly useful in compact devices such as smartphones, wearables, and medical equipment, where space is at a premium. In addition, thick film resistors are capable of withstanding high temperatures and challenging environmental conditions, which is crucial in industries like automotive and aerospace, where components must perform reliably under stress. Their ability to handle high voltage and high power applications further increases their value in industrial and power management systems, making them a go-to solution for engineers designing rugged, reliable electronic products. Another significant advantage is the cost-effectiveness of thick film resistors compared to other types of resistors. The manufacturing process for thick film resistors is highly scalable, enabling mass production at relatively low costs, which makes them an attractive option for consumer electronics and other high-volume applications. This combination of high performance, durability, and affordability has positioned thick film resistors as a preferred component across multiple sectors, helping to drive their adoption in both current and next-generation technologies.What Technological Advancements Are Shaping the Future of Thick Film Resistors?

Technological advancements are continuously pushing the boundaries of thick film resistor capabilities, allowing them to meet the increasingly complex demands of modern electronics. One of the most significant developments is the improvement in materials science, where advances in resistive pastes have enhanced the performance of thick film resistors in terms of temperature coefficient of resistance (TCR), stability, and precision. These improvements allow for better control over resistance values, making thick film resistors more reliable in high-precision applications, such as in aerospace, defense, and medical devices. Moreover, innovations in substrate materials, such as the use of alumina and other high-performance ceramics, have further improved the thermal management capabilities of thick film resistors, enabling them to handle higher power densities and operate more efficiently in high-temperature environments. Additionally, advancements in manufacturing techniques, such as laser trimming, have made it possible to fine-tune resistance values to very tight tolerances, improving overall performance and reducing component variability. This precision is particularly important in industries like telecommunications and automotive electronics, where consistent, reliable performance is essential. The rise of automation and digital manufacturing technologies has also contributed to the enhanced scalability and cost-effectiveness of producing thick film resistors, ensuring that they remain competitive in an industry that demands both innovation and affordability. These advancements are not only expanding the range of applications for thick film resistors but also enhancing their performance in critical sectors such as power electronics, IoT devices, and renewable energy systems.What Factors Are Driving Growth in the Thick Film Resistors Market?

The growth in the thick film resistors market is driven by several factors, including technological advancements, the expansion of high-demand end-use industries, and the increasing need for robust electronic components in harsh environments. One of the primary growth drivers is the rise of the automotive sector, particularly with the increasing integration of electronics in electric vehicles (EVs) and advanced driver-assistance systems (ADAS). These applications require resistors that can perform reliably under high power and temperature conditions, making thick film resistors an ideal choice. Additionally, the growing adoption of renewable energy systems, such as solar and wind power, has spurred demand for thick film resistors due to their ability to handle high voltage and power in energy conversion and management applications. Another key driver is the proliferation of IoT devices and connected technologies, where the need for compact, energy-efficient components is essential. Thick film resistors, with their small form factor and high resistance values, are well-suited to these applications, supporting the continued miniaturization of electronic devices. The expansion of telecommunications infrastructure, driven by the rollout of 5G networks, is also creating opportunities for thick film resistors, as they are integral to the signal processing and power management systems that support high-speed data transmission. Finally, consumer behavior is shifting towards more durable, reliable electronics, particularly in industrial, medical, and aerospace sectors, where failure of critical components can lead to costly downtime or safety issues. This demand for high-quality, long-lasting components is contributing to the sustained growth of the thick film resistors market, as manufacturers continue to innovate and improve their offerings to meet the needs of these industries.Report Scope

The report analyzes the Thick Film Resistors market, presented in terms of market value (USD). The analysis covers the key segments and geographic regions outlined below.- Segments: Resistor Type (Thick Film Power Resistors, Shunt Type); End-Use (Automotive, Electrical & Electronics, Telecommunications).

- Geographic Regions/Countries: World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; and Rest of Europe); Asia-Pacific; Rest of World.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the Automotive End-Use segment, which is expected to reach US$568.7 Million by 2030 with a CAGR of 5%. The Electrical & Electronics End-Use segment is also set to grow at 6.1% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $190.8 Million in 2024, and China, forecasted to grow at an impressive 4.8% CAGR to reach $147.5 Million by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Thick Film Resistors Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Thick Film Resistors Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Thick Film Resistors Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

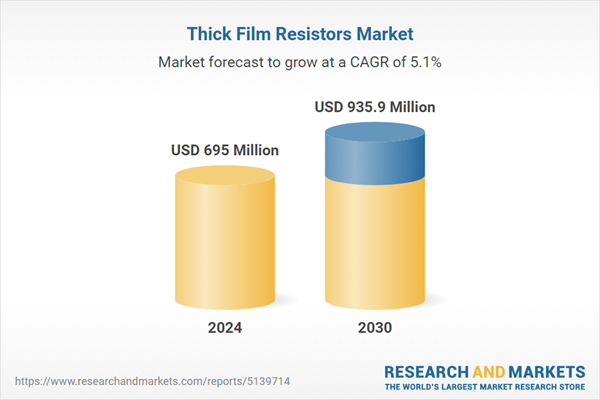

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as Bourns, Inc., Murata Manufacturing Co., Ltd., Panasonic Industrial Devices Sales Korea Co., Ltd, Rohm Semiconductors, TE Connectivity Corporation and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 52 companies featured in this Thick Film Resistors market report include:

- Bourns, Inc.

- Murata Manufacturing Co., Ltd.

- Panasonic Industrial Devices Sales Korea Co., Ltd

- Rohm Semiconductors

- TE Connectivity Corporation

- Vishay Intertechnology, Inc.

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Bourns, Inc.

- Murata Manufacturing Co., Ltd.

- Panasonic Industrial Devices Sales Korea Co., Ltd

- Rohm Semiconductors

- TE Connectivity Corporation

- Vishay Intertechnology, Inc.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 199 |

| Published | February 2026 |

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 695 Million |

| Forecasted Market Value ( USD | $ 935.9 Million |

| Compound Annual Growth Rate | 5.1% |

| Regions Covered | Global |