Global Chilled Processed Foods Market - Key Trends and Drivers Summarized

Why Are Chilled Processed Foods Gaining Popularity in Modern Diets?

Chilled processed foods have seen a significant rise in demand over recent years, becoming a staple in the diets of many households across the globe. Chilled processed foods are primarily pre-prepared, ready-to-eat or ready-to-cook meals, salads, meats, and dairy products that are stored at low temperatures to extend their shelf life while retaining freshness. They offer convenience, quick meal solutions, and a healthier alternative to shelf-stable processed foods, as they typically contain fewer preservatives. With the pace of modern life increasing, consumers are seeking out convenient meal options that require minimal preparation time while still delivering fresh, flavorful, and nutritious content. In addition, as urbanization rises and the global workforce becomes busier, the demand for convenient, high-quality meals is climbing. Chilled processed foods meet this need, providing a balance between ready-to-eat options and the perception of fresh ingredients. Their accessibility and ease of storage have made them a popular choice for consumers looking to maintain a balanced diet without sacrificing time or quality.How Are Health Trends Influencing the Chilled Processed Foods Market?

Consumer interest in health and wellness has significantly influenced the development and marketing of chilled processed foods. With the growing awareness of the negative effects of preservatives, artificial additives, and high-sodium content in traditional processed foods, health-conscious consumers are increasingly gravitating towards options that promise freshness, nutritional value, and transparency. Chilled processed foods are typically perceived as healthier alternatives to frozen or canned products because of their reduced reliance on preservatives and their fresh-like quality. Many chilled food products now highlight clean labels, containing fewer ingredients and focusing on natural, organic, and locally sourced components. This shift is particularly evident in segments such as chilled organic meats, plant-based products, and dairy alternatives, which cater to vegetarian, vegan, and flexitarian diets. Moreover, the rising demand for plant-based and allergen-free options, driven by the increasing incidence of food intolerances and lifestyle choices, has expanded the range of chilled processed foods available, further boosting their popularity among health-conscious consumers.What Technological Advancements Are Driving Innovation in Chilled Processed Foods?

Technological innovations are playing a pivotal role in the production, packaging, and distribution of chilled processed foods, allowing the industry to meet growing consumer expectations for convenience and quality. A major advancement is in food preservation techniques, such as high-pressure processing (HPP), which extends shelf life while preserving the natural taste, texture, and nutrients of foods without the need for heat or chemicals. HPP has become particularly popular for chilled meats, juices, and ready-to-eat meals, enabling manufacturers to offer products that retain their fresh-like qualities for longer periods. Advances in packaging technologies, such as modified atmosphere packaging (MAP), have also significantly impacted the chilled food market. MAP adjusts the oxygen and carbon dioxide levels inside the packaging to slow down spoilage, ensuring that products stay fresh for extended durations without relying on artificial preservatives. Cold chain logistics innovations, which ensure temperature consistency from production to retail, have further enabled the expansion of chilled processed foods. Improved refrigeration technology, coupled with better monitoring systems, ensures that products maintain optimal conditions throughout transportation and storage, reducing spoilage and food waste. Additionally, the development of eco-friendly and recyclable packaging solutions is in response to growing consumer demand for sustainability. These innovations have made it possible for chilled processed foods to meet the high standards of today's health- and environmentally-conscious consumers, while also enhancing convenience and shelf life.What Is Driving the Growth of the Chilled Processed Foods Market?

The growth in the chilled processed foods market is driven by several factors, including evolving consumer lifestyles, technological advancements, and changing dietary preferences. As urbanization increases and work-life balance becomes more challenging, consumers are seeking convenient food solutions that offer freshness and nutrition. The rising trend toward health and wellness has also driven the demand for clean-label, minimally processed foods that align with dietary trends such as veganism, plant-based eating, and gluten-free diets. This has expanded the market for chilled products that promise better nutritional content and fewer artificial ingredients. Technological advancements, such as high-pressure processing and modified atmosphere packaging, have propelled the market by extending shelf life and maintaining product quality, thus supporting the demand for fresher, healthier, and longer-lasting foods. In addition, the growth of e-commerce and direct-to-consumer delivery services has increased the accessibility of chilled processed foods, as consumers increasingly turn to online platforms for their grocery needs. Cold chain logistics, backed by innovations in refrigeration and temperature monitoring, have ensured that chilled foods maintain their integrity from production to the consumer's refrigerator, boosting confidence in these products' quality and safety. Finally, growing environmental consciousness among consumers has encouraged the development of sustainable packaging solutions, further driving the appeal of chilled processed foods in a market that prioritizes both convenience and sustainability.Report Scope

The report analyzes the Chilled Processed Foods market, presented in terms of market value (USD). The analysis covers the key segments and geographic regions outlined below.- Segments: Food Type (Ready Meals, Processed Meat, Processed Fish / Sea Food, Processed Vegetables & Potatoes, Bakery Products, Pizza, Soup & Noodles).

- Geographic Regions/Countries: World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; Spain; Russia; and Rest of Europe); Asia-Pacific (Australia; India; South Korea; and Rest of Asia-Pacific); Latin America (Argentina; Brazil; Mexico; and Rest of Latin America); Middle East (Iran; Israel; Saudi Arabia; United Arab Emirates; and Rest of Middle East); and Africa.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the Processed Meat segment, which is expected to reach US$270.5 Billion by 2030 with a CAGR of 6.9%. The Ready Meals segment is also set to grow at 3.8% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $217.7 Billion in 2024, and China, forecasted to grow at an impressive 7.4% CAGR to reach $242.6 Billion by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Chilled Processed Foods Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Chilled Processed Foods Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Chilled Processed Foods Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as ALDI Einkauf GmbH & Co. OHG, Conagra Brands, Inc., General Mills, Inc., Grupo Bimbo, S.A.B. de C.V., Hormel Foods Corporation and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 41 companies featured in this Chilled Processed Foods market report include:

- ALDI Einkauf GmbH & Co. OHG

- Conagra Brands, Inc.

- General Mills, Inc.

- Grupo Bimbo, S.A.B. de C.V.

- Hormel Foods Corporation

- Kellogg Company

- Mondelez International

- Nestle SA

- New Covent Garden Soup Company Limited

- PepsiCo, Inc.

- Primo Smallgoods

- REWE Markt GmbH

- Sigma Alimentos S.A. de C.V.

- The Kraft Heinz Company

- The Kroger Co.

- Unilever PLC

- Wm Morrison Supermarkets PLC

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- ALDI Einkauf GmbH & Co. OHG

- Conagra Brands, Inc.

- General Mills, Inc.

- Grupo Bimbo, S.A.B. de C.V.

- Hormel Foods Corporation

- Kellogg Company

- Mondelez International

- Nestle SA

- New Covent Garden Soup Company Limited

- PepsiCo, Inc.

- Primo Smallgoods

- REWE Markt GmbH

- Sigma Alimentos S.A. de C.V.

- The Kraft Heinz Company

- The Kroger Co.

- Unilever PLC

- Wm Morrison Supermarkets PLC

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 323 |

| Published | February 2026 |

| Forecast Period | 2024 - 2030 |

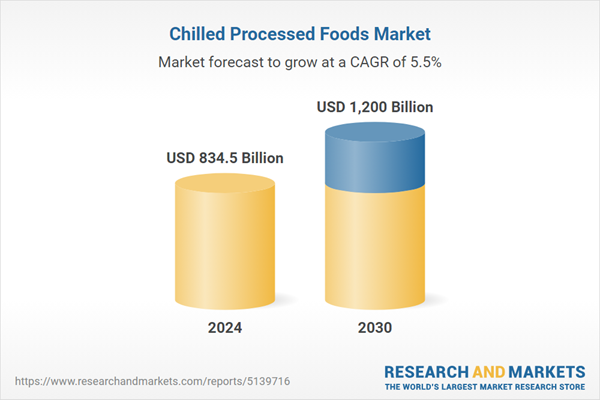

| Estimated Market Value ( USD | $ 834.5 Billion |

| Forecasted Market Value ( USD | $ 1200 Billion |

| Compound Annual Growth Rate | 5.5% |

| Regions Covered | Global |