Global Child Resistant Packaging Market - Key Trends and Drivers Summarized

Why Is Child Resistant Packaging Crucial in Today's Consumer Products Market?

Child-resistant packaging has become a fundamental aspect of product safety in the consumer goods industry, particularly for pharmaceuticals, chemicals, and household products. Child-resistant packaging is specifically designed to prevent children from accessing potentially harmful substances, which could lead to accidental poisoning or injury. As the number of dual income households rises with children often being left unsupervised for short periods, the risk of accidental ingestion of hazardous substances increases. Products such as medications, cleaning agents, and personal care items can pose significant health risks if accessed by children, which has made secure packaging a top priority for manufacturers and regulators alike. Moreover, the growing awareness among consumers regarding safety standards has amplified the demand for packaging that meets stringent regulatory requirements. Governments and international safety organizations have mandated the use of child-resistant packaging for certain products, ensuring that safety is built into the design of items commonly found in homes. By making these products harder for children to open while still maintaining ease of access for adults, child-resistant packaging plays a critical role in reducing accidental poisoning incidents.How Does Child Resistant Packaging Balance Safety with Usability?

Child-resistant packaging is designed to strike a delicate balance between preventing children from accessing dangerous products while ensuring that adults, particularly the elderly or disabled, can easily use these items. The core challenge lies in creating packaging that is secure enough to deter young children yet not so difficult that it frustrates legitimate users. Typically, this involves using design features such as push-and-turn caps, squeeze-and-pull mechanisms, or blister packs that require a certain level of dexterity to open. These systems are tested to ensure that a specified percentage of children under five years of age cannot open the packaging within a given time frame, while the majority of adults can do so with ease. The inclusion of clear instructions is also critical, helping users understand the proper method to open the product without compromising safety. Usability has become a major focus for manufacturers, especially as the global population ages. Elderly individuals or those with arthritis often struggle with standard child-resistant mechanisms, prompting the development of senior-friendly designs. These include packaging solutions that require less physical strength or more intuitive opening mechanisms while still adhering to safety regulations for children. Innovations in packaging materials and design have allowed companies to create products that meet regulatory standards without sacrificing ease of use. This balance ensures that while children are protected from potential hazards, adults - especially those who may have difficulty with traditional packaging - can access the products they need without excessive frustration.What Innovations Are Shaping the Future of Child Resistant Packaging?

Innovations in child-resistant packaging are driving the industry forward, combining technology, materials science, and user-centric design to create safer, more efficient packaging solutions. One of the most significant developments is the integration of smart packaging technologies. RFID (Radio-Frequency Identification) tags and digital locks are being explored as potential solutions that could add a layer of security to packaging while maintaining accessibility for adults. These technologies could allow only authorized users to open certain types of products by using a smartphone app or a specific RFID key, providing an additional level of safety. Material innovation is another key area of development. Biodegradable and sustainable materials are increasingly being used in child-resistant packaging, addressing the growing consumer demand for environmentally friendly products. Traditionally, child-resistant packaging has relied on plastic, but new materials, including bio-based plastics and recyclable composites, are being engineered to offer the same level of safety with a reduced environmental footprint. Additionally, customization and personalization of packaging are becoming more common, allowing manufacturers to create tailored solutions for specific product lines or customer demographics. For instance, pharmaceutical companies are exploring packaging designs that cater specifically to elderly users while maintaining child resistance, combining ergonomic features with regulatory compliance.What Is Driving the Growth of the Child Resistant Packaging Market?

The growth in the child-resistant packaging market is driven by several factors, including regulatory pressure, rising consumer safety awareness, and innovations in packaging technology. One of the primary drivers is the increasing regulatory requirement across the globe for child-resistant packaging on products that pose a potential hazard to children, such as prescription medications, over-the-counter drugs, and household chemicals. Regulatory agencies like the U.S. Consumer Product Safety Commission (CPSC) and the European Medicines Agency (EMA) have strict guidelines that mandate the use of child-resistant packaging for products containing substances that could be harmful if ingested by children. This is pushing manufacturers to continually improve their packaging solutions to meet these stringent standards. Another major factor propelling the growth of this market is the rising awareness among consumers about the importance of safety in everyday products. Parents, in particular, are becoming more vigilant about the packaging of products they bring into their homes, creating strong demand for solutions that ensure the safety of their children. Companies are responding by investing in packaging designs that not only meet regulatory standards but also resonate with consumers looking for peace of mind. Technological advancements are also driving growth, with innovations such as smart caps and multi-step opening mechanisms providing enhanced security while maintaining ease of use for adults. The increasing focus on sustainability is also fueling the market's expansion. As consumers and businesses alike become more concerned with environmental impact, there is growing demand for eco-friendly child-resistant packaging solutions. This has led to the development of new materials and processes that reduce waste without compromising safety. Biodegradable and recyclable materials are being incorporated into child-resistant designs, addressing both environmental and safety concerns. With the growing prevalence of e-commerce, demand for secure and tamper-evident packaging has further expanded, particularly in the pharmaceutical and cannabis sectors, where safety regulations are strict. These trends collectively point to a robust future for the child-resistant packaging market as innovation, regulation, and consumer demand continue to drive its expansion.Report Scope

The report analyzes the Child Resistant Packaging market, presented in terms of market value (USD). The analysis covers the key segments and geographic regions outlined below.- Segments: End-Use (Pharmaceuticals, Food & Beverage, Cosmetics & Personal Care, Other End-Uses).

- Geographic Regions/Countries: World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; Spain; Russia; and Rest of Europe); Asia-Pacific (Australia; India; South Korea; and Rest of Asia-Pacific); Latin America (Argentina; Brazil; Mexico; and Rest of Latin America); Middle East (Iran; Israel; Saudi Arabia; United Arab Emirates; and Rest of Middle East); and Africa.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the Pharmaceuticals End-Use segment, which is expected to reach US$26 Billion by 2030 with a CAGR of 4.1%. The Food & Beverage End-Use segment is also set to grow at 6.4% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $7.6 Billion in 2024, and China, forecasted to grow at an impressive 7.1% CAGR to reach $8.2 Billion by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Child Resistant Packaging Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Child Resistant Packaging Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Child Resistant Packaging Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as Amcor Ltd., Bemis Company, Inc., British Plastics Federation, Colbert Packaging Corp., Ecobliss Holding BV and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 42 companies featured in this Child Resistant Packaging market report include:

- Amcor Ltd.

- Bemis Company, Inc.

- British Plastics Federation

- Colbert Packaging Corp.

- Ecobliss Holding BV

- Global Closure Systems

- Kaufman Container

- LeafLocker USA

- Mold-Rite Plastics

- O.Berk Company, LLC

- Romaco Holding GmbH

- Rondo AG

- Stora Enso Oyj

- Sun Grown Packaging

- WestRock Company

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Amcor Ltd.

- Bemis Company, Inc.

- British Plastics Federation

- Colbert Packaging Corp.

- Ecobliss Holding BV

- Global Closure Systems

- Kaufman Container

- LeafLocker USA

- Mold-Rite Plastics

- O.Berk Company, LLC

- Romaco Holding GmbH

- Rondo AG

- Stora Enso Oyj

- Sun Grown Packaging

- WestRock Company

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 273 |

| Published | January 2026 |

| Forecast Period | 2024 - 2030 |

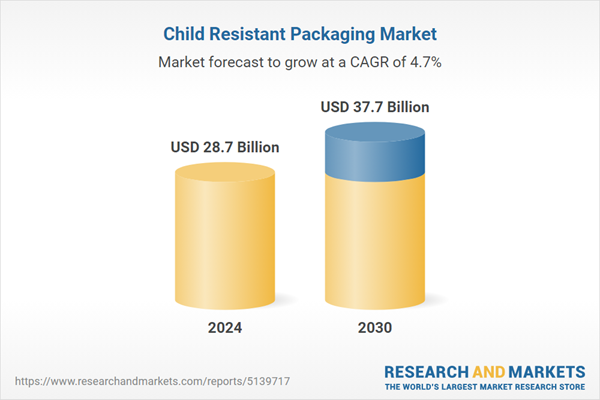

| Estimated Market Value ( USD | $ 28.7 Billion |

| Forecasted Market Value ( USD | $ 37.7 Billion |

| Compound Annual Growth Rate | 4.7% |

| Regions Covered | Global |