Global Chemical Logistics Market - Key Trends and Drivers Summarized

Why Is Chemical Logistics Essential for Global Supply Chain Efficiency?

Chemical logistics is a critical component of the global supply chain, ensuring the safe, timely, and compliant transportation, storage, and handling of chemicals across various industries, including pharmaceuticals, petrochemicals, agriculture, and manufacturing. Given the hazardous nature of many chemicals, including flammable, corrosive, and toxic substances, chemical logistics requires specialized expertise, equipment, and adherence to stringent regulations. This sector not only manages the physical movement of chemical products but also ensures compliance with safety standards, environmental regulations, and risk management protocols. Effective chemical logistics are essential for maintaining the operational continuity of industries that depend on these raw materials, as any disruption can lead to costly delays, regulatory fines, or safety incidents. Furthermore, the globalization of chemical production and consumption has increased the complexity of the chemical supply chain, requiring logistics providers to operate across multiple geographies and regulatory environments. As industries continue to expand their reach into emerging markets, the demand for reliable, compliant, and efficient chemical logistics solutions becomes increasingly critical to support global manufacturing and production efforts.How Have Technology and Innovation Transformed Chemical Logistics?

Technological advancements and innovations have dramatically transformed chemical logistics, improving safety, efficiency, and transparency across the supply chain. One of the key developments is the integration of digital technologies such as the Internet of Things (IoT), real-time tracking, and blockchain. These tools enable real-time monitoring of chemical shipments, providing accurate data on the location, temperature, and condition of products during transit. This level of visibility allows logistics providers to ensure that sensitive chemicals, particularly those that are temperature-sensitive or prone to spoilage, are transported under optimal conditions, reducing the risk of contamination or degradation. Additionally, blockchain technology enhances transparency and security, enabling tamper-proof documentation of the entire supply chain, from production to delivery, which is critical for regulatory compliance and quality assurance. Automation in warehousing and transportation, including the use of robotics and autonomous vehicles, is also optimizing chemical handling, minimizing human error, and improving operational efficiency. Furthermore, advances in packaging technology, such as smart containers and specialized tanks, have increased the safety and efficiency of chemical storage and transport, particularly for hazardous materials. These innovations are not only transforming the logistics process but also enabling businesses to manage their chemical supply chains more effectively and sustainably.What Challenges and Regulatory Issues Impact Chemical Logistics?

Chemical logistics is fraught with numerous challenges, primarily due to the highly regulated and hazardous nature of the materials involved. One of the biggest issues is ensuring compliance with international and regional regulations that govern the transportation and handling of chemicals, such as the Globally Harmonized System of Classification and Labelling of Chemicals (GHS) and the International Maritime Dangerous Goods (IMDG) Code. Non-compliance can lead to severe penalties, product recalls, or environmental incidents, particularly when hazardous chemicals are involved. The sector also faces challenges related to infrastructure, as transporting chemicals often requires specialized vehicles, storage facilities, and containers to prevent accidents or contamination. The lack of adequate infrastructure in certain regions can delay shipments, increase costs, or pose significant safety risks. Another critical issue is managing the risks associated with handling dangerous goods, such as potential spills, leaks, or explosions, which necessitates rigorous safety protocols, employee training, and emergency response planning. Furthermore, the volatility of global trade, driven by geopolitical tensions, trade barriers, and fluctuating fuel prices, adds additional layers of complexity to the chemical logistics market. Despite these challenges, companies that invest in advanced risk management strategies and maintain strict regulatory compliance are better positioned to navigate the complexities of this sector.What Are the Key Growth Drivers in the Chemical Logistics Market?

The growth in the chemical logistics market is driven by several factors, reflecting advancements in technology, increased demand from end-user industries, and evolving regulatory frameworks. One of the primary drivers is the rising demand for chemicals across sectors such as agriculture, pharmaceuticals, and consumer goods, all of which require efficient logistics solutions to support large-scale production and distribution. As global chemical production continues to shift towards emerging markets, particularly in Asia-Pacific, the need for advanced logistics infrastructure is growing rapidly. The adoption of digital technologies, such as IoT-enabled tracking systems and blockchain for secure documentation, is also driving the market by improving efficiency, safety, and transparency across the supply chain. Additionally, stricter environmental regulations and safety standards are prompting companies to invest in greener and more sustainable logistics solutions, such as the use of electric or hybrid transportation fleets and eco-friendly packaging materials. Another significant driver is the growing complexity of global trade and the demand for chemicals in regions with challenging logistical environments, such as remote or underdeveloped areas. This trend is creating opportunities for specialized logistics providers that can offer tailored solutions to meet the unique requirements of chemical transportation and storage. Lastly, the heightened focus on risk management, particularly in handling hazardous materials, is fueling the demand for advanced safety systems and automated logistics processes that reduce human error and ensure compliance with international safety standards. Together, these factors are contributing to the robust expansion of the chemical logistics market, with technology and regulatory compliance playing central roles in shaping the industry's future.Report Scope

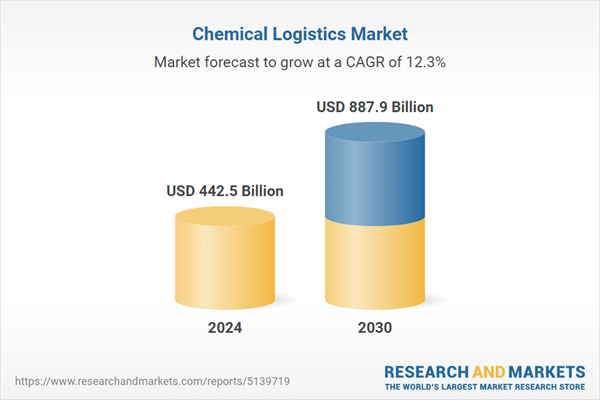

The report analyzes the Chemical Logistics market, presented in terms of market value (USD). The analysis covers the key segments and geographic regions outlined below.- Segments: Segment (Transportation, Warehousing & Distribution, Other Segments).

- Geographic Regions/Countries: World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; Spain; Russia; and Rest of Europe); Asia-Pacific (Australia; India; South Korea; and Rest of Asia-Pacific); Latin America (Argentina; Brazil; Mexico; and Rest of Latin America); Middle East (Iran; Israel; Saudi Arabia; United Arab Emirates; and Rest of Middle East); and Africa.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the Transportation segment, which is expected to reach US$439.8 Billion by 2030 with a CAGR of 13.3%. The Warehousing & Distribution segment is also set to grow at 11.8% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $106.9 Billion in 2024, and China, forecasted to grow at an impressive 18.6% CAGR to reach $282.8 Billion by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Chemical Logistics Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Chemical Logistics Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Chemical Logistics Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as Agility, BDP International, C.H. Robinson Worldwide, Inc., Cold Chain Technologies, DB Schenker and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 46 companies featured in this Chemical Logistics market report include:

- Agility

- BDP International

- C.H. Robinson Worldwide, Inc.

- Cold Chain Technologies

- DB Schenker

- DHL International GmbH

- L&M Transportation Services

- Montreal Chemical Logistics

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Agility

- BDP International

- C.H. Robinson Worldwide, Inc.

- Cold Chain Technologies

- DB Schenker

- DHL International GmbH

- L&M Transportation Services

- Montreal Chemical Logistics

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 273 |

| Published | February 2026 |

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 442.5 Billion |

| Forecasted Market Value ( USD | $ 887.9 Billion |

| Compound Annual Growth Rate | 12.3% |

| Regions Covered | Global |