Global Car Sharing Market - Key Trends & Drivers Summarized

Car sharing represents a paradigm shift in urban transportation, offering a cost-effective and flexible alternative to traditional car ownership. This model enables users to rent vehicles for short durations - often hourly - facilitating convenient access to transportation for errands and short trips. A distinguishing feature of car sharing is its reliance on digital platforms, which seamlessly connect users with available vehicles, embodying the principles of the sharing economy. Car sharing concept is designed to reduce the number of private vehicles on the road, decrease traffic congestion, and lower emissions. Car sharing services operate through a network of vehicles that are strategically placed around urban areas for easy access. Users typically book a car through a smartphone app or website, unlock it with a digital key, and return it to a designated spot when finished. This model is particularly popular in densely populated cities where parking is limited and public transportation is robust, offering a convenient and cost-effective mobility option.Technological advancements have significantly enhanced the car-sharing experience, making it more seamless and user-friendly. The integration of GPS and mobile technology allows for real-time tracking of vehicle availability and easy booking processes. Innovations in mobile technology have been pivotal, enabling the emergence of platforms that allow car owners to rent out their vehicles during idle periods, enhancing service flexibility and affordability. Advanced telematics systems enable companies to monitor vehicle usage, maintenance needs, and driving behavior, ensuring efficient fleet management. Electric and hybrid vehicles are increasingly being incorporated into car-sharing fleets, supporting environmental sustainability goals and appealing to eco-conscious consumers. Furthermore, developments in autonomous driving technology hold the potential to revolutionize car sharing, as self-driving cars could autonomously reposition themselves to meet user demand, further enhancing convenience and efficiency.

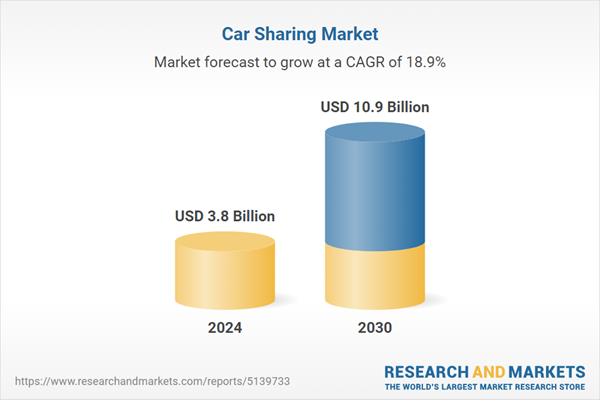

The growth in the car sharing market is driven by several factors. The global car sharing market has thrived by leveraging the escalating costs and logistical challenges associated with car ownership, especially in densely populated urban centers. The increasing urbanization and associated challenges such as traffic congestion and parking shortages are pushing more people towards car-sharing services as a practical alternative to car ownership. Economic factors, including the high costs of purchasing, maintaining, and insuring a private vehicle, make car sharing an attractive option, especially for younger generations who prioritize experiences over ownership. Environmental concerns and the push for sustainable urban mobility solutions are also significant drivers, as car sharing helps reduce the overall number of vehicles on the road and lowers carbon emissions. Additionally, government policies and incentives promoting shared mobility and the development of smart city initiatives are encouraging the expansion of car-sharing services. These factors, combined with continuous technological advancements and changing consumer preferences, are propelling the robust growth of the car sharing market, making it a vital component of modern urban transportation systems.

Report Scope

The report analyzes the Car Sharing market, presented in terms of market value (USD). The analysis covers the key segments and geographic regions outlined below.- Segments: Model (Free Floating, Station-based, P2P); Business Model (Round Trip, One Way Trip); Application (Business, Private).

- Geographic Regions/Countries: World; USA; Canada; Japan; China; Europe; France; Germany; Italy; UK; Spain; Russia; Rest of Europe; Asia-Pacific; Australia; India; South Korea; Rest of Asia-Pacific; Latin America; Argentina; Brazil; Mexico; Rest of Latin America; Middle East; Iran; Israel; Saudi Arabia; UAE; Rest of Middle East; Africa.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the Free Floating Model segment, which is expected to reach US$4.4 Billion by 2030 with a CAGR of 18.4%. The Station-Based Model segment is also set to grow at 17.4% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $916.3 Million in 2024, and China, forecasted to grow at an impressive 24.6% CAGR to reach $2.3 Billion by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Car Sharing Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Car Sharing Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Car Sharing Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as Avis Budget Group Inc., Cambio Mobility Service GmbH & Co. KG, Communauto Inc., Ekar Car Rental LLC (UAE), Enterprise Holdings Inc. (Enterprise Mobility) and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 79 companies featured in this Car Sharing market report include:

- Avis Budget Group Inc.

- Cambio Mobility Service GmbH & Co. KG

- Communauto Inc.

- Ekar Car Rental LLC (UAE)

- Enterprise Holdings Inc. (Enterprise Mobility)

- Getaround Inc.

- Goldbell Engineering Pte. Ltd.

- Hertz Global Holdings Inc.

- Sixt SE

- Stellantis NV

- Turo Inc.

- Share Now GmbH

- Socar Mobility Malaysia Sdn. Bhd.

- Zipcar, Inc.

- Zoomcar™ Ltd.

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Avis Budget Group Inc.

- Cambio Mobility Service GmbH & Co. KG

- Communauto Inc.

- Ekar Car Rental LLC (UAE)

- Enterprise Holdings Inc. (Enterprise Mobility)

- Getaround Inc.

- Goldbell Engineering Pte. Ltd.

- Hertz Global Holdings Inc.

- Sixt SE

- Stellantis NV

- Turo Inc.

- Share Now GmbH

- Socar Mobility Malaysia Sdn. Bhd.

- Zipcar, Inc.

- Zoomcar™ Ltd.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 372 |

| Published | February 2026 |

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 3.8 Billion |

| Forecasted Market Value ( USD | $ 10.9 Billion |

| Compound Annual Growth Rate | 18.9% |

| Regions Covered | Global |