Global Hardware Wallets Market - Key Trends and Drivers Summarized

Why Are Hardware Wallets Becoming Essential for Secure Cryptocurrency Management and Protection?

Hardware wallets have become essential tools for securely managing and protecting cryptocurrencies as the popularity and value of digital assets continue to rise. But why are hardware wallets so critical today? With the increasing incidence of cyberattacks, such as hacking, phishing, and malware targeting cryptocurrency holders, hardware wallets provide an offline, secure solution for storing digital assets. Unlike software wallets, which are often connected to the internet and vulnerable to online threats, hardware wallets store private keys in a physical device, ensuring that sensitive information remains isolated from potential hackers.The decentralized nature of cryptocurrencies means users are responsible for the security of their assets, and the loss or theft of private keys can result in the permanent loss of funds. Hardware wallets mitigate this risk by offering a high level of protection, even if the device connected to the wallet is compromised. As cryptocurrencies gain mainstream acceptance, hardware wallets have become a key tool for both retail investors and institutions looking to safeguard their digital wealth.

How Are Technological Advancements Improving the Security and Usability of Hardware Wallets?

Technological advancements are significantly improving both the security and usability of hardware wallets, making them more reliable and user-friendly for a growing base of cryptocurrency holders. One of the most important advancements is the development of secure elements, specialized chips embedded in hardware wallets that store private keys in a tamper-resistant environment. These secure elements ensure that even if a hardware wallet is physically tampered with or accessed by malicious actors, the cryptographic keys remain protected. This level of security is crucial in preventing unauthorized access and ensuring that private keys are never exposed, even during transactions.Another major improvement is the integration of passphrase protection, which adds an additional layer of security to hardware wallets. In the event that a wallet is lost or stolen, a passphrase can act as a backup protection, ensuring that even if the physical device is compromised, the funds cannot be accessed without the passphrase. This feature provides peace of mind to users, knowing that their assets are doubly protected against both physical and digital theft.

Advancements in user interface design and connectivity options have also made hardware wallets more convenient for everyday use. Modern wallets now offer more intuitive, user-friendly interfaces, making it easier for both novice and experienced users to navigate their devices, manage multiple cryptocurrencies, and execute transactions. Additionally, many hardware wallets now feature Bluetooth or USB-C connectivity, allowing seamless integration with smartphones, tablets, and computers, without compromising security. These connectivity improvements make it easier for users to interact with their digital assets while keeping private keys safely stored offline.

The development of multi-currency support is another significant innovation in hardware wallets. Early versions of hardware wallets were often limited to supporting only a few cryptocurrencies, but modern wallets now offer compatibility with a wide range of digital assets, including Bitcoin, Ethereum, and many altcoins. This flexibility is essential for users who hold diversified portfolios and want a single, secure device to manage all of their digital assets.

Furthermore, advancements in backup and recovery systems have made hardware wallets more resilient. Features such as seed phrases (a list of words used to recover the wallet) ensure that users can regain access to their funds in the event of a lost or damaged device. This capability, combined with improved encryption and secure storage for backup information, provides users with a more robust and secure way to recover their funds, without relying on third-party services or exposing their private keys to additional risks.

Why Are Hardware Wallets Critical for Protecting Digital Assets, Ensuring Privacy, and Reducing the Risk of Cyberattacks?

Hardware wallets are critical for protecting digital assets, ensuring privacy, and reducing the risk of cyberattacks because they provide an isolated, offline environment for storing private keys, which are essential for accessing and managing cryptocurrency holdings. One of the primary reasons hardware wallets are so valuable is their ability to shield private keys from online threats. Unlike software wallets or exchanges, which are vulnerable to hacks and breaches due to their constant internet connection, hardware wallets store private keys offline, drastically reducing the risk of cyberattacks.The security of private keys is fundamental to the ownership and control of cryptocurrencies. If a user's private key is compromised, their funds can be stolen, often with no possibility of recovery. Hardware wallets prevent this by keeping private keys isolated from the connected device during transactions. Even when users connect their hardware wallets to a computer or smartphone to send or receive cryptocurrencies, the private key never leaves the secure environment of the wallet. This ensures that even if the connected device is infected with malware or compromised, the private keys remain safe and inaccessible to attackers.

Hardware wallets also play a crucial role in ensuring privacy for cryptocurrency users. Since these wallets do not require users to store their private keys on centralized platforms, such as exchanges or online wallets, they allow for greater control over one's financial privacy. Many users are concerned about the security of their funds on exchanges, where large sums of cryptocurrency are often stored in centralized wallets, making them prime targets for hacking. By using hardware wallets, users can keep full control of their digital assets without having to rely on third-party platforms that could be susceptible to breaches.

In addition to preventing external threats, hardware wallets reduce the risk of insider threats, such as those from custodial services. When individuals or institutions store their cryptocurrency on centralized platforms, they are placing trust in the service provider to protect their funds. However, there have been numerous instances of exchange hacks, fraud, or mismanagement leading to the loss of customer funds. With a hardware wallet, users maintain sole control of their private keys, ensuring that no external party can access or manipulate their assets.

The reduction in risk associated with cyberattacks is another critical benefit of hardware wallets. Given the rise in phishing attacks, keylogging malware, and social engineering techniques used by hackers to steal cryptocurrency, hardware wallets offer a reliable defense. Since the private keys are never exposed to the connected device, attackers cannot steal them through traditional malware or phishing techniques. This makes hardware wallets an essential tool for individuals and businesses that need to secure large amounts of digital currency against sophisticated threats.

What Factors Are Driving the Growth of the Hardware Wallet Market?

Several key factors are driving the rapid growth of the hardware wallet market, including the increasing adoption of cryptocurrencies, growing concerns over cybersecurity, the need for decentralized asset control, and advancements in wallet technology. First and foremost, the growing popularity of cryptocurrencies such as Bitcoin, Ethereum, and a wide variety of altcoins has created a significant demand for secure storage solutions. As more individuals and institutions invest in digital assets, they are looking for reliable ways to protect their holdings from theft, hacks, and fraud. Hardware wallets offer one of the most secure methods of storing cryptocurrencies, making them increasingly popular as more people enter the market.Concerns over cybersecurity are another major factor driving the growth of the hardware wallet market. High-profile exchange hacks and data breaches, in which millions of dollars' worth of cryptocurrency have been stolen, have raised awareness about the vulnerabilities of online wallets and centralized platforms. As a result, cryptocurrency users are seeking out hardware wallets to gain full control over their private keys and ensure that their assets are protected from both external and internal threats. With the growing sophistication of cyberattacks targeting cryptocurrency holders, hardware wallets provide a robust solution that minimizes exposure to online threats.

The desire for decentralized control over digital assets is also contributing to the growth of hardware wallets. One of the key tenets of cryptocurrency is decentralization - the idea that users should have complete ownership and control of their assets without relying on centralized authorities or third-party services. Hardware wallets allow users to maintain self-custody of their cryptocurrencies, aligning with the decentralized ethos of blockchain technology. This has become particularly important as governments and regulatory bodies around the world introduce stricter regulations on cryptocurrency exchanges and custodial services, pushing users to seek alternatives that give them direct control over their funds.

Advancements in hardware wallet technology are further fueling market growth. The development of multi-currency wallets, improved user interfaces, and enhanced security features has made hardware wallets more accessible to a broader audience. Wallets that support multiple cryptocurrencies allow users to manage all their digital assets in one place, while improvements in usability have made hardware wallets easier to navigate for both beginners and experienced cryptocurrency holders. These technological advancements are helping to expand the appeal of hardware wallets beyond early adopters and institutional users to the general public.

Additionally, the rise of decentralized finance (DeFi) and the growing use of non-fungible tokens (NFTs) are contributing to the increased demand for hardware wallets. As more people engage with DeFi platforms and invest in NFTs, they require secure storage solutions that can protect these valuable digital assets. Hardware wallets provide the security and flexibility needed to interact with DeFi applications and manage NFTs, further driving their adoption in the cryptocurrency ecosystem.

In conclusion, the growth of the hardware wallet market is driven by the increasing adoption of cryptocurrencies, heightened concerns over cybersecurity, the demand for decentralized control of digital assets, and ongoing technological innovations. As more individuals and institutions seek secure and reliable ways to protect their cryptocurrency holdings, hardware wallets are becoming a vital tool for ensuring the safety, privacy, and accessibility of digital assets in a rapidly evolving financial landscape.

Report Scope

The report analyzes the Hardware Wallets market, presented in terms of market value (USD). The analysis covers the key segments and geographic regions outlined below.- Segments: Type (Hot Wallet, Cold Wallet); Segment (USB Wallet, Bluetooth, NFC Wallet); End-Use (Individual, Commercial).

- Geographic Regions/Countries: World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; and Rest of Europe); Asia-Pacific; Rest of World.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the Hot Wallet segment, which is expected to reach US$1.9 Billion by 2030 with a CAGR of 21.1%. The Cold Wallet segment is also set to grow at 18.8% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $236.5 Million in 2024, and China, forecasted to grow at an impressive 19.9% CAGR to reach $383.9 Million by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Hardware Wallets Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Hardware Wallets Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Hardware Wallets Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as Coinkite Inc., CoolBitX Ltd., KeepKey LLC, Ledger SAS, Penta Security Systems Inc. and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 46 companies featured in this Hardware Wallets market report include:

- Coinkite Inc.

- CoolBitX Ltd.

- KeepKey LLC

- Ledger SAS

- Penta Security Systems Inc.

- Satoshi Labs S.R.O

- Shift Devices AG

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Coinkite Inc.

- CoolBitX Ltd.

- KeepKey LLC

- Ledger SAS

- Penta Security Systems Inc.

- Satoshi Labs S.R.O

- Shift Devices AG

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 196 |

| Published | January 2026 |

| Forecast Period | 2024 - 2030 |

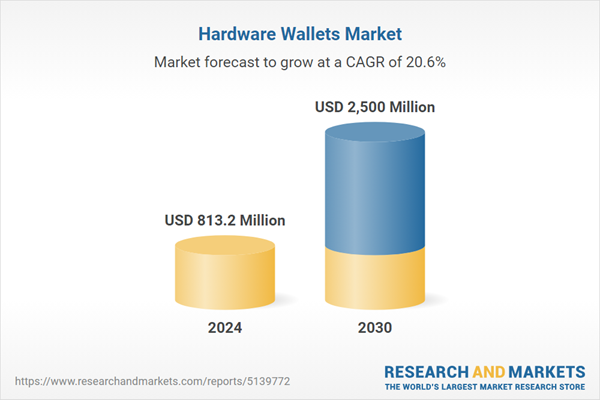

| Estimated Market Value ( USD | $ 813.2 Million |

| Forecasted Market Value ( USD | $ 2500 Million |

| Compound Annual Growth Rate | 20.6% |

| Regions Covered | Global |