Global Green Coatings Market - Key Trends and Drivers Summarized

Why Are Green Coatings Becoming Essential for Sustainability and Environmental Compliance Across Industries?

Green coatings are rapidly becoming essential for industries aiming to meet sustainability goals, reduce environmental impact, and comply with stricter environmental regulations. But why are green coatings so important today? Green coatings refer to environmentally friendly paints and coatings that are formulated to have lower levels of volatile organic compounds (VOCs), heavy metals, and other harmful substances. These coatings are designed to minimize the release of toxic chemicals into the air and reduce overall environmental impact. Green coatings include water-based coatings, powder coatings, UV-curable coatings, and other eco-friendly alternatives that are being increasingly adopted across various industries, including automotive, construction, aerospace, and consumer goods.Industries worldwide are under mounting pressure to reduce their carbon footprints and adopt sustainable practices, not only to meet government regulations but also to respond to consumer demand for eco-friendly products. Green coatings are a key part of this movement, as they help reduce air pollution, lower greenhouse gas emissions, and contribute to healthier working environments by reducing harmful emissions. For example, traditional solvent-based coatings can emit high levels of VOCs during application and drying, contributing to air pollution and health hazards. Green coatings provide a safer alternative without sacrificing performance. As companies continue to focus on sustainability, green coatings are playing a critical role in making industrial processes more environmentally friendly while maintaining product quality and durability.

How Are Technological Advancements Enhancing the Performance and Availability of Green Coatings?

Technological advancements are significantly improving the performance, durability, and availability of green coatings, making them more suitable for a wide range of industrial and commercial applications. One of the most important advancements is the development of water-based coatings, which use water as a solvent instead of organic solvents that contain VOCs. Water-based coatings provide comparable performance to traditional solvent-based coatings but with a drastically reduced environmental impact. These coatings are now being formulated to offer enhanced resistance to corrosion, weathering, and chemicals, making them ideal for use in industries such as automotive, construction, and manufacturing, where durability is a key requirement.Another critical advancement is the growth of powder coating technology, which has become one of the most popular types of green coatings. Powder coatings involve the application of a dry powder to a surface, which is then cured to form a hard, protective layer. Since powder coatings do not require solvents, they emit virtually no VOCs and generate less waste than liquid coatings. Powder coatings are used in a variety of applications, including metal furniture, automotive parts, appliances, and architectural components. Recent advancements in formulation have also made powder coatings more versatile, allowing for a wider range of colors, textures, and finishes. Additionally, newer powder coating technologies enable thinner applications without compromising on durability, making them more efficient and cost-effective.

The development of UV-curable coatings is another technological breakthrough that is contributing to the growth of the green coatings market. UV-curable coatings use ultraviolet light to cure and harden the coating, which significantly reduces drying time and energy consumption compared to traditional thermal curing processes. These coatings contain fewer harmful chemicals and are used in applications such as wood finishes, electronics, and packaging. The rapid curing process not only improves production efficiency but also reduces the environmental footprint by minimizing energy use and VOC emissions. With continued advancements in UV-curable formulations, the range of materials and surfaces that can benefit from these eco-friendly coatings is expanding.

Nanotechnology is also playing a significant role in enhancing the performance of green coatings. Nanocoatings, which incorporate nanoparticles to improve characteristics like hardness, scratch resistance, and water repellency, offer superior performance compared to conventional coatings while maintaining an eco-friendly profile. Nanocoatings are increasingly being used in industries like electronics, automotive, and aerospace to provide long-lasting protection without the use of harmful chemicals. Additionally, nanotechnology is being applied to improve the durability of water-based coatings and powder coatings, ensuring that green coatings can meet the high-performance demands of modern industries.

The use of bio-based raw materials in green coatings is another area of innovation. Researchers are developing coatings derived from renewable resources such as plant-based oils, natural resins, and biopolymers. These bio-based coatings not only reduce the reliance on petrochemical-derived ingredients but also provide a sustainable alternative that can biodegrade at the end of their life cycle. As the demand for renewable and sustainable materials continues to rise, bio-based green coatings are gaining traction in industries like packaging, construction, and consumer goods, where companies are seeking to reduce their environmental impact.

Why Are Green Coatings Critical for Environmental Compliance, Health Safety, and Market Competitiveness?

Green coatings are critical for environmental compliance, health safety, and market competitiveness because they address the growing regulatory requirements, promote healthier work environments, and meet the rising consumer demand for eco-friendly products. As governments around the world enforce stricter environmental regulations aimed at reducing VOC emissions and hazardous chemical usage, industries must adopt greener processes and materials to remain compliant. For example, regulations such as the U.S. Environmental Protection Agency's (EPA) standards on VOC emissions, the European Union's REACH (Registration, Evaluation, Authorisation, and Restriction of Chemicals), and similar policies in other regions are pushing companies to transition to low-VOC or VOC-free coatings. Green coatings not only help businesses comply with these regulations but also reduce the risk of costly fines and production delays caused by non-compliance.In addition to regulatory compliance, green coatings contribute to healthier workplaces by minimizing the release of harmful chemicals during application and curing processes. Traditional solvent-based coatings can release toxic fumes, leading to health risks for workers such as respiratory issues, skin irritation, and long-term exposure risks like cancer. By using water-based, powder, or UV-curable coatings, companies can reduce the exposure of their employees to hazardous substances, improving workplace safety. Healthier work environments not only help companies meet safety standards but also reduce the liability and costs associated with worker health issues, creating a safer and more efficient production environment.

Market competitiveness is another major factor driving the adoption of green coatings. Consumers and businesses are increasingly demanding eco-friendly products that align with their sustainability values. Companies that embrace green coatings can leverage this trend to differentiate their products and brands as environmentally responsible, appealing to eco-conscious customers. In industries like automotive, construction, packaging, and electronics, where sustainability is becoming a key selling point, the use of green coatings can enhance brand image and market appeal. For example, automakers are increasingly adopting low-VOC and water-based coatings to reduce their environmental impact and meet consumer expectations for greener vehicles. In packaging, green coatings help brands offer sustainable solutions that resonate with customers who prioritize reducing their carbon footprint.

Moreover, green coatings play a vital role in reducing the environmental impact of the entire product lifecycle. By reducing VOC emissions, hazardous waste, and energy consumption during the coating process, green coatings contribute to a lower overall environmental footprint. In applications such as building materials, protective coatings, and industrial machinery, green coatings provide durable protection while supporting companies' sustainability initiatives. This not only helps businesses meet corporate social responsibility (CSR) goals but also enhances long-term competitiveness by aligning with global sustainability trends. Companies that adopt green coatings early gain a competitive edge by positioning themselves as industry leaders in sustainability.

Furthermore, the increasing global focus on green building standards, such as LEED (Leadership in Energy and Environmental Design) certification, is driving the demand for green coatings in the construction and architectural industries. Green coatings contribute to LEED credits by reducing VOC emissions and improving indoor air quality. Builders and architects are specifying eco-friendly coatings for projects that aim to achieve green certifications, making green coatings a critical component of sustainable building practices. As green building continues to grow in popularity, the demand for coatings that contribute to sustainability goals will continue to rise.

What Factors Are Driving the Growth of the Green Coatings Market?

Several key factors are driving the rapid growth of the green coatings market, including increasing environmental regulations, rising consumer demand for sustainable products, advancements in green coating technologies, and the push for corporate sustainability initiatives. First, the increasing stringency of environmental regulations aimed at reducing VOC emissions and hazardous chemicals is a major driver of the green coatings market. Governments around the world are enforcing stricter rules to limit the use of harmful substances in industrial processes, pushing manufacturers to adopt eco-friendly coatings. In regions like North America, Europe, and Asia-Pacific, industries such as automotive, construction, and manufacturing must meet legal requirements related to air quality and chemical safety, making green coatings an essential solution for compliance.Second, the rise in consumer demand for sustainable and eco-friendly products is fueling the growth of the green coatings market. Consumers are increasingly concerned about the environmental impact of the products they purchase, and they expect companies to adopt sustainable practices in their production processes. In response, industries such as automotive, packaging, and electronics are turning to green coatings to reduce their environmental impact and align with consumer preferences. This trend is particularly strong in developed markets, where eco-conscious consumers are willing to pay a premium for products that are marketed as environmentally friendly.

Advancements in green coating technologies are also driving market growth. The development of high-performance water-based coatings, powder coatings, and UV-curable coatings has made eco-friendly alternatives more effective and accessible. These advancements allow industries to adopt green coatings without sacrificing performance, durability, or aesthetics. As a result, green coatings are being used in more diverse applications, from automotive finishes to architectural surfaces, and are replacing traditional solvent-based coatings in sectors where sustainability and performance are both critical.

The increasing focus on corporate sustainability initiatives is another major factor driving the adoption of green coatings. Companies across industries are under pressure to reduce their environmental footprint and meet sustainability goals, whether it's through reducing energy consumption, minimizing waste, or adopting cleaner production methods. Green coatings are a key component of corporate sustainability strategies, allowing companies to improve the environmental performance of their products and processes. Industries such as packaging, construction, and consumer goods are increasingly using green coatings to enhance the sustainability of their products, meet CSR objectives, and appeal to environmentally conscious stakeholders.

In addition to these factors, the economic benefits of green coatings are driving their adoption. While eco-friendly coatings may initially be more expensive, they often lead to long-term cost savings through reduced waste, lower energy consumption, and fewer regulatory compliance costs. For example, UV-curable coatings significantly reduce drying times and energy requirements compared to traditional coatings, leading to faster production cycles and lower energy bills. Similarly, powder coatings generate less overspray and waste, making them more cost-effective over time. As companies recognize these economic advantages, they are increasingly investing in green coatings to improve both their environmental impact and operational efficiency.

In conclusion, the growth of the green coatings market is being driven by increasing environmental regulations, rising consumer demand for sustainable products, technological advancements, and the push for corporate sustainability. As businesses and industries continue to prioritize sustainability and environmental responsibility, green coatings will play a critical role in reducing emissions, improving workplace safety, and delivering eco-friendly solutions across a wide range of applications. Green coatings are not only key to regulatory compliance but also a vital component of the future of sustainable industry.

Report Scope

The report analyzes the Green Coatings market, presented in terms of market value (USD). The analysis covers the key segments and geographic regions outlined below.- Segments: Segment (Waterborne Coatings, Powder Coatings, High-Solids Coatings, Radiation Cure Coatings); End-Use (Architectural Coatings, Industrial Coatings, Automotive Coatings, Wood Coatings, Packaging Coatings, Other End-Uses).

- Geographic Regions/Countries: World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; and Rest of Europe); Asia-Pacific; Rest of World.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the Waterborne Coatings segment, which is expected to reach US$94.8 Billion by 2030 with a CAGR of 4.6%. The Powder Coatings segment is also set to grow at 3.8% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $25.6 Billion in 2024, and China, forecasted to grow at an impressive 4% CAGR to reach $19 Billion by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Green Coatings Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Green Coatings Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Green Coatings Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as Akzo Nobel NV, Asian Paints (India) Ltd., Axalta Coating Systems LLC, BASF SE, Berger Paints India Ltd. and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 23 companies featured in this Green Coatings market report include:

- Akzo Nobel NV

- Asian Paints (India) Ltd.

- Axalta Coating Systems LLC

- BASF SE

- Berger Paints India Ltd.

- Deutsche Amphibolin Works SE

- Hempel A/S

- Kansai Paint Co., Ltd.

- Masco Corporation

- Nippon Paint Co., Ltd.

- PPG Industries, Inc.

- RPM International, Inc.

- The Sherwin-Williams Company

- The Valspar Corporation

- Tikkurila Oyj

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Akzo Nobel NV

- Asian Paints (India) Ltd.

- Axalta Coating Systems LLC

- BASF SE

- Berger Paints India Ltd.

- Deutsche Amphibolin Works SE

- Hempel A/S

- Kansai Paint Co., Ltd.

- Masco Corporation

- Nippon Paint Co., Ltd.

- PPG Industries, Inc.

- RPM International, Inc.

- The Sherwin-Williams Company

- The Valspar Corporation

- Tikkurila Oyj

Table Information

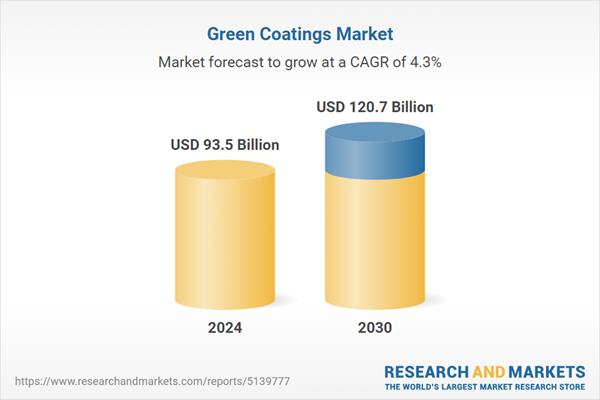

| Report Attribute | Details |

|---|---|

| No. of Pages | 183 |

| Published | February 2026 |

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 93.5 Billion |

| Forecasted Market Value ( USD | $ 120.7 Billion |

| Compound Annual Growth Rate | 4.3% |

| Regions Covered | Global |