Global Glyoxal Market - Key Trends and Drivers Summarized

Why Is Glyoxal Emerging as a Key Chemical in Industrial Applications and Sustainable Manufacturing?

Glyoxal is gaining importance across multiple industries due to its versatility and wide-ranging applications, particularly in textiles, paper, pharmaceuticals, and agriculture. But why is glyoxal so crucial today? Glyoxal is an organic compound, a dialdehyde with the chemical formula C2H2O2, known for its highly reactive nature. It is commonly used as a crosslinking agent, a building block in organic synthesis, and a key player in various industrial processes. Glyoxal's ability to form strong chemical bonds with materials like cellulose, proteins, and other organic molecules makes it invaluable in enhancing the properties of a wide range of products.In the textile industry, glyoxal is widely used for wrinkle resistance and to improve fabric durability. It acts as a crosslinking agent, binding to cellulose fibers to create fabrics that retain their shape, require less ironing, and are more resistant to shrinkage. In paper production, glyoxal is used to increase the wet strength of paper, making it more durable and resilient, especially in packaging applications. Glyoxal's application as a crosslinker also extends to the production of resins and adhesives, where it enhances bonding strength and durability. Furthermore, glyoxal plays a role in the agriculture and cosmetics industries, where it is used as a preservative and intermediate in chemical synthesis. As industries shift towards more sustainable manufacturing practices, glyoxal's multifunctional role and eco-friendly profile make it increasingly relevant in modern industrial processes.

How Are Technological Advancements Enhancing the Production and Applications of Glyoxal?

Technological advancements are significantly improving both the production efficiency of glyoxal and expanding its applications across various industries. One major advancement is the development of more sustainable and environmentally friendly glyoxal production processes. Traditionally, glyoxal is produced through the oxidation of ethylene glycol, which can be energy-intensive and generate undesirable byproducts. However, recent advancements have focused on optimizing this process to reduce energy consumption and emissions. For example, new catalytic oxidation methods using silver catalysts enable more efficient conversion of ethylene glycol into glyoxal, reducing waste and improving yield. These greener production techniques are aligning with the growing demand for more sustainable chemical manufacturing practices across industries.In addition, innovations in glyoxal formulations have expanded its use as a crosslinking agent, particularly in textiles and paper. By modifying the molecular structure of glyoxal or developing glyoxal derivatives, manufacturers have been able to improve its compatibility with a broader range of materials and enhance its effectiveness as a crosslinker. In textiles, for instance, advanced glyoxal-based resins now allow for greater flexibility in fabric treatments, enabling the production of high-performance textiles with enhanced durability, wrinkle resistance, and water repellency. In the paper industry, improvements in glyoxal chemistry have led to stronger paper products that retain their wet strength without compromising flexibility or printability.

Another area of advancement is the use of glyoxal in biopolymer and bio-based material production. Glyoxal's ability to crosslink natural polymers, such as starches and proteins, is being leveraged to create more sustainable materials for packaging, adhesives, and coatings. These bio-based materials offer a greener alternative to traditional plastics and synthetic resins, aligning with the global shift towards circular economy practices and reducing reliance on petrochemical-based products. By using glyoxal in bio-based material development, industries are contributing to the reduction of plastic waste and the environmental footprint of packaging materials.

In the field of water treatment, glyoxal is gaining recognition as a safer alternative to formaldehyde-based biocides. Formaldehyde has long been used as a disinfectant and preservative, but its toxicity has raised environmental and health concerns. Glyoxal, with its lower toxicity profile, is being developed as a more eco-friendly alternative for industrial water treatment applications, such as controlling microbial growth in cooling towers, boilers, and other water systems. These advancements are expanding glyoxal's reach into new markets, where environmental safety and regulatory compliance are driving innovation.

Why Is Glyoxal Critical for Crosslinking, Preservation, and Sustainable Industrial Processes?

Glyoxal is critical for crosslinking, preservation, and sustainable industrial processes because of its highly reactive nature and ability to enhance the properties of various materials. One of glyoxal's primary functions is as a crosslinking agent, where it forms covalent bonds between polymer chains, thereby improving the strength, durability, and flexibility of materials. In the textile industry, glyoxal is essential for producing wrinkle-resistant fabrics, as it crosslinks the cellulose fibers in cotton and other natural fabrics, enabling them to maintain their shape and resist shrinkage after washing. This not only improves fabric quality but also reduces the need for frequent ironing, saving energy and time for consumers.In the paper industry, glyoxal's crosslinking ability is used to improve the wet strength of paper products. Without glyoxal treatment, paper can lose its structural integrity when exposed to moisture, making it unsuitable for applications like packaging, paper towels, or tissues. Glyoxal-based treatments increase the paper's resistance to water, enhancing its durability while maintaining flexibility and softness. This is particularly important in packaging, where strength and moisture resistance are critical for protecting goods during transportation and storage. By improving the performance of paper products, glyoxal plays a vital role in industries that require high-quality, durable packaging materials.

Glyoxal is also crucial in preservation, particularly in water treatment and agriculture. Its ability to act as a biocide allows it to control microbial growth in water systems and agricultural products, where it prevents the development of harmful bacteria and fungi. Unlike formaldehyde, glyoxal offers a less toxic alternative with similar efficacy in microbial control, making it a safer option for preserving water systems and extending the shelf life of agricultural products. This aligns with the growing demand for safer and environmentally friendly biocides in industrial and agricultural applications, where regulatory pressure is pushing industries to reduce their use of toxic chemicals.

Sustainability is another area where glyoxal's role is becoming increasingly important. As industries strive to reduce their reliance on petrochemical-derived products, glyoxal is playing a key role in the development of bio-based materials and more sustainable industrial processes. For example, glyoxal's ability to crosslink natural polymers like starch and proteins is being used to create biodegradable materials for packaging and coatings, offering an eco-friendly alternative to traditional plastics. This shift toward bio-based materials helps reduce plastic waste and promotes circular economy practices, where materials are designed for reuse and recycling. Glyoxal's role in these sustainable solutions highlights its importance in addressing environmental challenges while maintaining product performance.

In industrial applications, glyoxal's lower toxicity and biodegradability compared to more hazardous chemicals like formaldehyde make it a more sustainable choice for companies looking to reduce their environmental impact. This is particularly relevant in industries such as water treatment, where glyoxal's use as a biocide helps control microbial growth while minimizing the risk of environmental contamination. By providing a safer and more environmentally responsible alternative, glyoxal is helping industries comply with stringent environmental regulations while maintaining high levels of efficiency and product quality.

What Factors Are Driving the Growth of the Glyoxal Market?

Several key factors are driving the rapid growth of the glyoxal market, including increasing demand for sustainable and eco-friendly chemicals, the expanding applications of glyoxal in industrial processes, regulatory pressures on the use of toxic chemicals, and technological advancements in bio-based materials. First, the global push towards sustainability and greener industrial practices is a major driver of the glyoxal market. As industries across the board seek to reduce their environmental footprint, glyoxal offers a safer, less toxic alternative to traditional chemicals like formaldehyde. Its biodegradability and lower toxicity make it an attractive choice for companies looking to adopt more environmentally responsible manufacturing processes, particularly in sectors like textiles, paper, and water treatment.Second, the expanding applications of glyoxal across multiple industries are contributing to market growth. In the textile industry, glyoxal's role in producing wrinkle-resistant and durable fabrics is driving demand, especially as consumer preferences shift toward high-performance, low-maintenance textiles. In the paper and packaging industries, glyoxal is increasingly used to enhance the wet strength and durability of paper products, particularly as packaging becomes more critical in global supply chains. The growing use of glyoxal in adhesives, coatings, and biopolymers is also opening up new markets for the compound, as industries seek high-performance crosslinking agents for a variety of applications.

The increasing regulatory pressure on the use of toxic chemicals, particularly formaldehyde, is another significant factor driving the demand for glyoxal. Formaldehyde has been widely used in industrial processes for decades, but its toxicity and potential health risks have led to tighter regulations and restrictions on its use. Glyoxal, with its lower toxicity profile and similar chemical properties, is emerging as a preferred alternative in industries like water treatment, agriculture, and preservatives. As more countries implement stricter regulations on harmful chemicals, the demand for safer alternatives like glyoxal is expected to increase, particularly in applications where environmental and human safety are paramount.

Technological advancements in bio-based materials and chemicals are also contributing to the growth of the glyoxal market. As industries focus on developing more sustainable materials, glyoxal's role as a crosslinking agent for natural polymers is becoming increasingly important. The ability to use glyoxal in the production of biodegradable materials, such as bio-based plastics and packaging, aligns with the global shift toward circular economy practices and reduced plastic waste. Innovations in glyoxal-based materials are creating new opportunities for its use in eco-friendly packaging, coatings, and adhesives, further driving demand in industries that are seeking greener alternatives to traditional petrochemical-based products.

Finally, the increasing focus on water treatment and resource management is fueling the demand for glyoxal in biocide applications. Glyoxal's use as a safer alternative to formaldehyde in water treatment systems helps industries control microbial growth while reducing the environmental impact of their operations. As water conservation and sustainable resource management become top priorities for industries worldwide, the need for effective and environmentally safe biocides like glyoxal is expected to grow.

In conclusion, the growth of the glyoxal market is being driven by the rising demand for sustainable and eco-friendly chemicals, the expanding industrial applications of glyoxal, increasing regulatory pressures on toxic chemicals, and advancements in bio-based materials. As industries continue to prioritize sustainability, safety, and performance, glyoxal will play a central role in shaping the future of manufacturing, textiles, water treatment, and other key sectors.

Report Scope

The report analyzes the Glyoxal market, presented in terms of market value (USD). The analysis covers the key segments and geographic regions outlined below.- Segments: Distribution Channel (Offline, Online); Application (Crosslinking, Intermediate, Other Applications); End-Use (Oil & Gas, Textile, Leather, Resins & Polymers, Cosmetics, Paper & Packaging, Other End-Uses).

- Geographic Regions/Countries: World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; Spain; Russia; and Rest of Europe); Asia-Pacific (Australia; India; South Korea; and Rest of Asia-Pacific); Latin America (Argentina; Brazil; Mexico; and Rest of Latin America); Middle East (Iran; Israel; Saudi Arabia; United Arab Emirates; and Rest of Middle East); and Africa.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the Crosslinking Application segment, which is expected to reach US$329.3 Million by 2030 with a CAGR of 5.1%. The Intermediate Application segment is also set to grow at 4% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $79.1 Million in 2024, and China, forecasted to grow at an impressive 7.4% CAGR to reach $88.8 Million by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Glyoxal Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Glyoxal Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Glyoxal Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as Alberta & Orient Glycol, Amazole India Pvt. Ltd., BASF SE, Celanese Corp., China Petrochemical Corporation and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 46 companies featured in this Glyoxal market report include:

- Alberta & Orient Glycol

- Amazole India Pvt. Ltd.

- BASF SE

- Celanese Corp.

- China Petrochemical Corporation

- Clariant

- Dow Chemical Company (The)

- Eastman Chemical Company

- Formosa Plastics Group

- Huntsman International LLC.

- Ineos Group Limited

- Jubliant Life Sciences Ltd.

- Nan Ya Plastics Corp

- Reliance Industries

- Shell Chemicals

- Silver Fern Chemical

- Zhonglan Industry Co. Ltd.

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Alberta & Orient Glycol

- Amazole India Pvt. Ltd.

- BASF SE

- Celanese Corp.

- China Petrochemical Corporation

- Clariant

- Dow Chemical Company (The)

- Eastman Chemical Company

- Formosa Plastics Group

- Huntsman International LLC.

- Ineos Group Limited

- Jubliant Life Sciences Ltd.

- Nan Ya Plastics Corp

- Reliance Industries

- Shell Chemicals

- Silver Fern Chemical

- Zhonglan Industry Co. Ltd.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 196 |

| Published | February 2026 |

| Forecast Period | 2024 - 2030 |

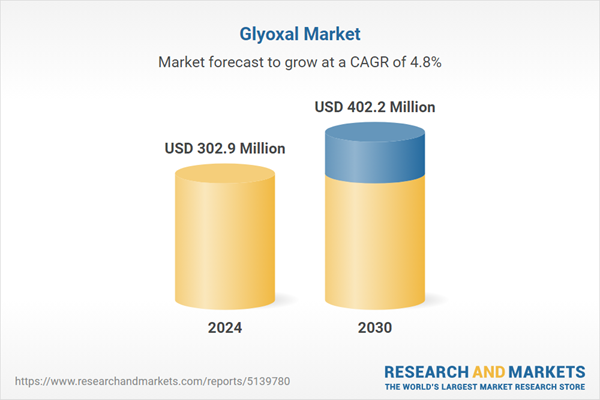

| Estimated Market Value ( USD | $ 302.9 Million |

| Forecasted Market Value ( USD | $ 402.2 Million |

| Compound Annual Growth Rate | 4.8% |

| Regions Covered | Global |