Global Gas Turbines Market - Key Trends and Drivers Summarized

Why Are Gas Turbines Essential for Modern Power Generation and Industrial Applications?

Gas turbines have become fundamental in power generation and various industrial applications due to their efficiency, versatility, and ability to produce high power output. But why are they so crucial in today's energy landscape? Gas turbines are used extensively in electricity generation, aviation, and mechanical drives for industrial operations, such as in the oil and gas industry. In power plants, gas turbines are the backbone of combined cycle power plants (CCPPs), where they generate electricity and utilize the excess heat to drive steam turbines, enhancing overall energy efficiency. This ability to convert fuel into mechanical energy and electricity at high efficiency makes gas turbines indispensable for meeting the growing energy demands of cities and industries.In the aviation sector, gas turbines power jet engines, providing the necessary thrust for airplanes. The compact and lightweight design of gas turbines allows them to deliver large amounts of power in a relatively small footprint, making them ideal for aerospace applications. Additionally, gas turbines are essential in industrial processes where large mechanical drives are required for pumping, compression, and power generation in sectors like petrochemical refining and natural gas processing. Their ability to run on various fuels - natural gas, diesel, and even renewable gases - further increases their flexibility. With their wide-ranging applications and ability to support both power generation and industrial processes, gas turbines remain a cornerstone of modern energy infrastructure and transportation systems.

How Is Technology Improving the Efficiency and Environmental Impact of Gas Turbines?

Technological advancements are pushing the boundaries of gas turbine efficiency and reducing their environmental impact, making them more sustainable and cost-effective. One of the most significant technological improvements is in the development of higher-efficiency turbine blades. These blades are made from advanced materials that can withstand extreme temperatures, allowing gas turbines to operate at higher temperatures and pressures, which directly translates into higher efficiency. By utilizing materials such as ceramic composites and superalloys, gas turbines can now achieve efficiency levels that were previously unattainable, helping reduce fuel consumption and emissions.Another breakthrough is in the integration of advanced combustion technologies. Lean-burn combustion systems, for example, allow gas turbines to burn fuel more cleanly by reducing the amount of excess oxygen in the combustion process. This results in lower emissions of nitrogen oxides (NOx), carbon monoxide (CO), and unburned hydrocarbons, which are significant contributors to air pollution. Moreover, digitalization and smart technologies are playing a transformative role in gas turbine operations. Advanced sensors and AI-driven control systems enable real-time monitoring of turbine performance, allowing operators to optimize fuel usage and prevent mechanical failures before they occur. These systems can also adjust combustion parameters automatically to maintain optimal efficiency while minimizing emissions.

Furthermore, the development of gas turbines capable of running on hydrogen and other renewable fuels is shaping the future of the industry. As the global focus shifts toward decarbonization and reducing reliance on fossil fuels, gas turbines that operate on hydrogen or synthetic natural gas (SNG) offer a promising solution for greener power generation. These innovations are enhancing the performance of gas turbines while addressing environmental concerns, positioning them as a critical technology in the transition to cleaner energy sources.

Why Are Gas Turbines Becoming More Sustainable and Cost-Effective?

As global energy demands rise and sustainability becomes a key focus, gas turbines are evolving to become more environmentally friendly and cost-effective. One major reason for this shift is the increasing integration of gas turbines into combined cycle power plants (CCPPs), which significantly boost energy efficiency. In these plants, waste heat from the gas turbine is used to power a steam turbine, effectively capturing energy that would otherwise be lost. This process increases the overall thermal efficiency of power generation, sometimes reaching efficiencies of over 60%. By generating more electricity from the same amount of fuel, CCPPs help reduce both operational costs and emissions, making gas turbines a more sustainable choice for power generation.Additionally, gas turbines are increasingly capable of running on cleaner, alternative fuels such as biogas, hydrogen, and synthetic fuels. Hydrogen-fueled gas turbines, in particular, hold promise for reducing carbon emissions, as hydrogen combustion produces only water vapor as a byproduct. As the hydrogen economy develops and renewable energy sources like wind and solar become more prevalent, gas turbines running on hydrogen will play a pivotal role in balancing intermittent renewable energy with consistent, on-demand power.

Moreover, advancements in turbine maintenance technologies are reducing the operational costs associated with gas turbines. Predictive maintenance powered by AI and machine learning is becoming standard, allowing operators to anticipate and address issues before they lead to expensive breakdowns or downtime. This not only improves the lifespan of gas turbines but also reduces the need for costly, unscheduled repairs. By lowering fuel consumption, increasing efficiency, and reducing emissions, modern gas turbines are becoming more cost-effective and sustainable, aligning with global goals to reduce environmental impact while maintaining reliable energy supplies.

What Factors Are Driving the Growth of the Gas Turbine Market?

The growth in the gas turbine market is driven by several factors, including the increasing demand for cleaner energy, technological innovations, and the rising adoption of combined cycle power plants. First, the global shift toward reducing carbon emissions is a major driver for gas turbines, as they offer a cleaner alternative to coal-fired power plants. Natural gas produces significantly fewer emissions compared to coal, and gas turbines, especially when used in combined cycle configurations, offer higher efficiency and lower greenhouse gas output. Governments and industries worldwide are investing in gas turbine technologies as part of their broader decarbonization strategies, which is driving market growth.Second, rapid advancements in technology are boosting the adoption of gas turbines across various sectors. The development of turbines that can operate on a mix of hydrogen and natural gas is particularly significant, as it aligns with the global push toward the use of hydrogen as a clean energy source. The growing hydrogen economy, coupled with increasing investments in renewable energy, is expected to create new opportunities for gas turbines capable of running on low-carbon fuels. Additionally, innovations in materials, cooling systems, and digital controls are enhancing turbine performance, making them more attractive for utilities and industrial users.

Third, the increasing adoption of combined cycle power plants is a key factor driving the gas turbine market. Combined cycle plants are highly efficient, making them the preferred choice for new power plant installations in many parts of the world. As countries seek to meet rising energy demand while minimizing environmental impact, the efficiency advantages of combined cycle gas turbine (CCGT) plants are driving the demand for advanced gas turbines.

Finally, the rise of distributed energy systems and microgrids is creating new opportunities for gas turbines. Industries and utilities are increasingly adopting decentralized power generation models, where gas turbines play a critical role in providing reliable, on-demand power, especially in remote or off-grid locations. Gas turbines are also essential in supporting grid stability as renewable energy sources become more prevalent, offering flexible power generation that can ramp up or down quickly in response to fluctuating supply from wind and solar. These factors, combined with the need for sustainable energy solutions, are propelling the growth of the gas turbine market, positioning it as a key technology for the future of global energy.

Report Scope

The report analyzes the Gas Turbines market, presented in terms of market value (USD). The analysis covers the key segments and geographic regions outlined below.- Segments: Technology (Combined Cycle, Open Cycle); End-Use (Power & Utility, Industrial).

- Geographic Regions/Countries: World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; Spain; Russia; and Rest of Europe); Asia-Pacific (Australia; India; South Korea; and Rest of Asia-Pacific); Latin America (Argentina; Brazil; Mexico; and Rest of Latin America); Middle East (Iran; Israel; Saudi Arabia; United Arab Emirates; and Rest of Middle East); and Africa.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the Combined Cycle Gas Turbines segment, which is expected to reach US$28.8 Billion by 2030 with a CAGR of 5.4%. The Open Cycle Gas Turbines segment is also set to grow at 4.1% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $7.5 Billion in 2024, and China, forecasted to grow at an impressive 7.8% CAGR to reach $8.7 Billion by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Gas Turbines Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Gas Turbines Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Gas Turbines Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as Ansaldo, Bharat Heavy Electricals Limited, Capstone Turbine Corporation, Cryostar, General Electric and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 26 companies featured in this Gas Turbines market report include:

- Ansaldo

- Bharat Heavy Electricals Limited

- Capstone Turbine Corporation

- Cryostar

- General Electric

- Harbin Turbine Company Limited

- Kawasaki Heavy Industries Ltd.

- MAN Energy Solutions

- Mitsubishi Hitachi Power Systems Ltd.

- Opra Turbines B.V.

- Siemens AG

- Solar Turbines Incorporated

- UEC Saturn

- Vericor Power Systems

- Wärtsilä

- Zorya-Mashproekt

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Ansaldo

- Bharat Heavy Electricals Limited

- Capstone Turbine Corporation

- Cryostar

- General Electric

- Harbin Turbine Company Limited

- Kawasaki Heavy Industries Ltd.

- MAN Energy Solutions

- Mitsubishi Hitachi Power Systems Ltd.

- Opra Turbines B.V.

- Siemens AG

- Solar Turbines Incorporated

- UEC Saturn

- Vericor Power Systems

- Wärtsilä

- Zorya-Mashproekt

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 236 |

| Published | February 2026 |

| Forecast Period | 2024 - 2030 |

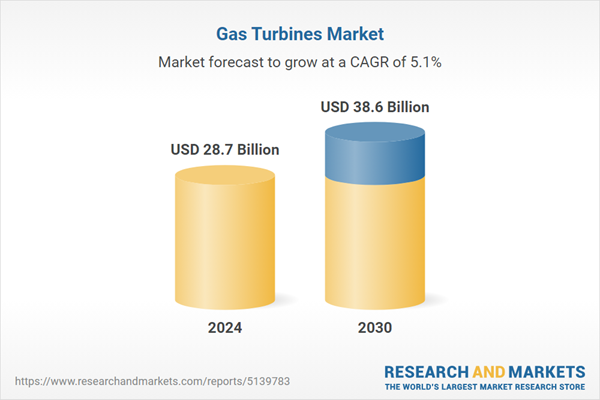

| Estimated Market Value ( USD | $ 28.7 Billion |

| Forecasted Market Value ( USD | $ 38.6 Billion |

| Compound Annual Growth Rate | 5.1% |

| Regions Covered | Global |