Global Furfural Market - Key Trends and Drivers Summarized

How Is Furfural Revolutionizing the Green Chemistry and Renewable Energy Sectors?

Furfural, an organic compound derived from agricultural biomass, is transforming the green chemistry and renewable energy sectors by serving as a key platform chemical in the production of biofuels, bioplastics, and other valuable chemicals. Produced from the hemicellulose found in agricultural residues like corncobs, sugarcane bagasse, and rice husks, furfural represents a renewable alternative to petroleum-based chemicals. This sustainable production process aligns with the growing demand for greener and more eco-friendly materials in industrial applications. Furfural's role in creating bio-based products helps reduce reliance on fossil fuels, contributing to a more sustainable and circular economy.One of the most significant applications of furfural is its use as a precursor to biofuels and bio-based chemicals. Furfural can be processed into furfuryl alcohol, a compound widely used in the production of resins, and further into furan-based chemicals that are essential for creating biofuels, lubricants, and even pharmaceuticals. Additionally, furfural's use in the production of tetrahydrofuran (THF), an important solvent and intermediate for bioplastics, highlights its potential to replace petroleum-derived products in the chemical industry. As the world shifts toward more sustainable practices, furfural is emerging as a critical building block in the development of renewable materials, making it an essential component of the bioeconomy.

What Technological Advancements Are Improving the Production and Use of Furfural?

Several technological advancements are enhancing the efficiency and scalability of furfural production, making it more viable for widespread industrial use. One of the key innovations is the development of advanced biomass processing techniques that improve the yield of furfural from agricultural residues. Traditional production methods involve the acid hydrolysis of hemicellulose to release xylose, which is then dehydrated to produce furfural. However, new catalytic and process intensification technologies are being developed to increase the conversion efficiency and reduce energy consumption in furfural production. These advancements are making it possible to extract furfural more efficiently from a wider range of biomass sources, expanding its availability and reducing production costs.Another significant advancement is the use of biorefinery models that integrate furfural production with other bio-based products, optimizing the use of raw materials and minimizing waste. In these integrated systems, agricultural residues are processed to extract furfural, lignin, and other valuable compounds in a single, streamlined operation. This approach maximizes the economic and environmental benefits of biomass utilization, creating a more sustainable production process. By recovering multiple products from the same feedstock, biorefineries are helping to make furfural production more cost-effective and eco-friendly.

Further innovations in the catalytic upgrading of furfural are expanding its applications in green chemistry. Researchers are developing new catalytic processes to convert furfural into a broader range of chemicals, including biofuels, polymers, and fine chemicals. One such innovation is the hydrogenation of furfural into furfuryl alcohol, which can be used in resins and adhesives, as well as its conversion into furan-based fuels and chemicals. These advances are unlocking new possibilities for furfural as a versatile platform chemical in the production of sustainable materials. As these technologies continue to evolve, the efficiency and environmental impact of furfural production and utilization are expected to improve, further solidifying its role in the green chemistry and renewable energy sectors.

How Is Furfural Supporting the Transition to Sustainable Materials and Biofuels?

Furfural is playing a pivotal role in supporting the global transition to sustainable materials and biofuels by providing a renewable alternative to fossil-based chemicals and fuels. One of its most important applications is in the production of biofuels, where furfural is used as a precursor to furan-based fuels such as 2-methylfuran and dimethylfuran (DMF). These biofuels have properties similar to gasoline and can be used as fuel additives or alternatives in internal combustion engines. As the demand for cleaner, renewable energy sources grows, furfural-based biofuels are emerging as a promising solution for reducing greenhouse gas emissions and reducing reliance on petroleum.In the field of sustainable materials, furfural serves as a key building block for the production of bio-based polymers and resins. Furfuryl alcohol, derived from furfural, is widely used in the manufacture of furan resins, which are employed in various industrial applications such as foundry binders, adhesives, and coatings. These bio-based resins offer an environmentally friendly alternative to synthetic resins made from petrochemicals, aligning with the growing demand for sustainable and non-toxic materials in industries like construction, automotive, and packaging. Additionally, furfural is used in the production of tetrahydrofuran (THF), a precursor for biodegradable plastics and synthetic fibers, further supporting the development of eco-friendly materials.

Furfural's role in the chemical industry extends beyond biofuels and plastics. It is also used in the production of pharmaceuticals, agrochemicals, and specialty chemicals, making it a versatile platform chemical for a wide range of applications. By replacing petroleum-based feedstocks with renewable furfural, companies can reduce their carbon footprint and contribute to a more sustainable, circular economy. As the world moves toward greener practices in energy and materials production, furfural is becoming an essential resource for industries seeking to develop bio-based alternatives that support environmental sustainability.

What's Driving the Growth of the Furfural Market?

Several factors are driving the growth of the furfural market, including the increasing demand for bio-based chemicals, the rising focus on sustainable materials, and advancements in biomass processing technologies. One of the primary drivers is the growing need for renewable alternatives to petroleum-based chemicals in industries such as plastics, pharmaceuticals, and agrochemicals. As companies and governments work to reduce their environmental impact and meet sustainability goals, furfural's role as a bio-based platform chemical is gaining importance. Its ability to replace petrochemicals in the production of resins, solvents, and biofuels makes furfural a key component of the transition to greener, more sustainable industrial processes.The expansion of the biofuel industry is also contributing to the growth of the furfural market. As countries adopt stricter regulations to reduce carbon emissions and promote renewable energy, the demand for biofuels is on the rise. Furfural's use in the production of furan-based biofuels, such as DMF and other fuel additives, is positioning it as a crucial player in the development of next-generation biofuels. These biofuels not only offer a renewable energy source but also have the potential to significantly reduce greenhouse gas emissions compared to traditional fossil fuels, driving further interest in furfural-based fuels.

Advancements in biomass processing technologies are making furfural production more efficient and cost-effective, further fueling market growth. As new methods of converting agricultural waste into furfural become more scalable, the availability of furfural is increasing, making it a more viable option for large-scale industrial applications. The integration of furfural production into biorefinery models, where multiple bio-based products are extracted from a single biomass feedstock, is also helping to lower production costs and improve the sustainability of the process. These technological advancements are making furfural more competitive with traditional petrochemicals, encouraging broader adoption in industries seeking to transition to renewable materials.

What Future Trends Are Shaping the Development of Furfural?

Several emerging trends are shaping the future development of furfural, including advancements in catalytic conversion technologies, the rise of biorefineries, and the growing focus on sustainability and circular economy practices. One of the most significant trends is the development of new catalytic processes to convert furfural into a broader range of high-value chemicals. Researchers are exploring ways to optimize the hydrogenation, oxidation, and polymerization of furfural to produce a variety of bio-based chemicals and fuels, including renewable solvents, polymers, and advanced biofuels. These catalytic advancements are expected to unlock new applications for furfural in green chemistry, further expanding its role in the production of sustainable materials.The rise of biorefineries is another key trend driving the development of furfural. In a biorefinery model, biomass is processed to extract multiple products, including furfural, bioethanol, lignin, and other value-added chemicals. This integrated approach maximizes the use of agricultural residues and minimizes waste, creating a more sustainable and economically viable production process. Biorefineries are emerging as a critical part of the bioeconomy, where renewable resources are used to produce energy, chemicals, and materials. The continued development of biorefinery technologies will play a major role in increasing the availability and affordability of furfural, making it a key component of sustainable industrial production.

Sustainability is also becoming a major focus in the future development of furfural, with increasing interest in using non-food biomass and agricultural residues as feedstocks. As concerns about food security and land use intensify, there is growing emphasis on sourcing biomass from waste materials rather than dedicated crops. Furfural production from agricultural waste, such as corncobs, sugarcane bagasse, and rice husks, offers a sustainable solution that reduces waste and promotes the circular use of resources. This trend toward using waste biomass is expected to drive further innovation in furfural production, making it an even more sustainable alternative to petrochemical-based products.

As these trends continue to evolve, the future of furfural will be defined by its role in green chemistry, biofuel production, and sustainable material development. With advancements in catalytic processes, biorefinery integration, and the use of waste biomass, furfural is set to play an increasingly important role in supporting the global shift toward renewable, eco-friendly industrial practices.

Report Scope

The report analyzes the Furfural market, presented in terms of market value (USD). The analysis covers the key segments and geographic regions outlined below.- Segments: Application (Furfural Alcohol, Solvents, Other Applications); End-Use (Refineries, Pharmaceuticals, Paints & Coatings, Agriculture, Other End-Uses).

- Geographic Regions/Countries: World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; Spain; Russia; and Rest of Europe); Asia-Pacific (Australia; India; South Korea; and Rest of Asia-Pacific); Latin America (Argentina; Brazil; Mexico; and Rest of Latin America); Middle East (Iran; Israel; Saudi Arabia; United Arab Emirates; and Rest of Middle East); and Africa.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the Furfural Alcohol Application segment, which is expected to reach US$825.9 Million by 2030 with a CAGR of 5.5%. The Solvents Application segment is also set to grow at 4.8% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $179.6 Million in 2024, and China, forecasted to grow at an impressive 8.3% CAGR to reach $212.9 Million by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Furfural Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Furfural Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Furfural Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as Furnova Polymers Ltd., Harborchem, Lenzing AG, Linzi Organic Chemical Inc. Ltd., Silvateam SpA and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 41 companies featured in this Furfural market report include:

- Furnova Polymers Ltd.

- Harborchem

- Lenzing AG

- Linzi Organic Chemical Inc. Ltd.

- Silvateam SpA

- Tanin Sevnica d.d.

- TransFurans Chemicals bvba

- Zhucheng Taisheng Chemical Co., Ltd.

- Zibo Huaao Chemical Co., Ltd.

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Furnova Polymers Ltd.

- Harborchem

- Lenzing AG

- Linzi Organic Chemical Inc. Ltd.

- Silvateam SpA

- Tanin Sevnica d.d.

- TransFurans Chemicals bvba

- Zhucheng Taisheng Chemical Co., Ltd.

- Zibo Huaao Chemical Co., Ltd.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 194 |

| Published | February 2026 |

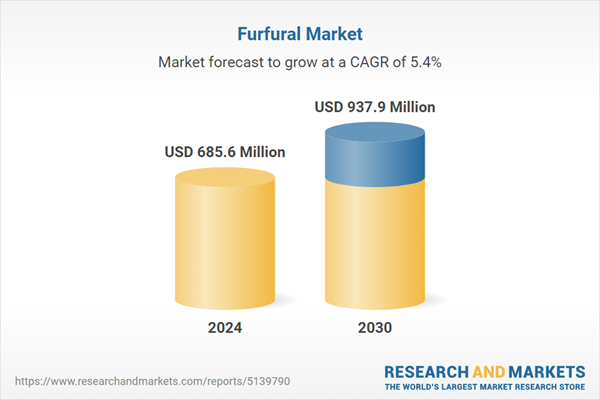

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 685.6 Million |

| Forecasted Market Value ( USD | $ 937.9 Million |

| Compound Annual Growth Rate | 5.4% |

| Regions Covered | Global |