Global Foam Blowing Agents Market - Key Trends and Drivers Summarized

Why Are Foam Blowing Agents Revolutionizing the Production of Insulating and Cushioning Materials?

Foam blowing agents are transforming the way insulating and cushioning materials are produced, but why are they becoming so crucial in modern manufacturing processes? Foam blowing agents are chemical substances used to create cellular structures in materials like polyurethane, polystyrene, and polyolefin foams. These agents generate gas that expands the foam, creating lightweight, insulating, and cushioning properties that are essential for industries such as construction, automotive, packaging, and furniture manufacturing. By facilitating the formation of foam, these agents contribute to the production of materials with improved thermal insulation, shock absorption, and energy efficiency.One of the main reasons foam blowing agents are revolutionizing industrial applications is their ability to create lightweight yet durable materials. These foams are widely used in construction for insulation purposes, helping to reduce energy consumption in buildings by maintaining temperature control. In automotive manufacturing, foam materials contribute to vehicle weight reduction, improving fuel efficiency. Foam blowing agents play a critical role in making these materials efficient and reliable. As industries focus on sustainability and energy efficiency, the demand for innovative foam blowing agents continues to grow, particularly in the production of materials that enhance thermal performance and reduce environmental impact.

How Do Foam Blowing Agents Work, and What Makes Them So Effective?

Foam blowing agents enable the production of lightweight foams, but how do they work, and what makes them so effective in various industrial applications? These agents work by creating gas bubbles within a polymer matrix during the foaming process. There are two primary types of foam blowing agents: physical and chemical. Physical blowing agents, such as hydrocarbons, HFCs (hydrofluorocarbons), and HFOs (hydrofluoroolefins), vaporize during the foaming process, creating gas bubbles. Chemical blowing agents, on the other hand, decompose under heat to release gases like nitrogen or carbon dioxide, which expand the foam.What makes foam blowing agents so effective is their ability to precisely control the foam's density, cell size, and thermal properties. For example, in the construction industry, foam insulation made with blowing agents provides excellent thermal resistance, reducing energy consumption in buildings. In packaging, lightweight foams protect fragile goods during transportation while minimizing material use. The versatility of foam blowing agents also allows manufacturers to produce foams with varying degrees of rigidity, elasticity, and insulating properties, making them suitable for a wide range of applications.

Additionally, foam blowing agents are engineered to optimize the environmental performance of the foams they produce. With the phase-out of ozone-depleting substances like chlorofluorocarbons (CFCs), manufacturers have shifted to more eco-friendly alternatives like HFCs and HFOs. These next-generation blowing agents have lower global warming potential (GWP) and are less harmful to the environment. This balance between functionality and environmental responsibility is key to their effectiveness in meeting both industrial needs and regulatory requirements.

How Are Foam Blowing Agents Shaping the Future of Sustainable Manufacturing and Insulation Technologies?

Foam blowing agents are not only enhancing current manufacturing processes - they are shaping the future of sustainable manufacturing and insulation technologies. One of the most significant ways these agents are driving change is through their role in producing more eco-friendly foams. As industries seek to reduce their carbon footprint, there has been a growing demand for foam blowing agents that offer lower environmental impact. Hydrofluoroolefins (HFOs) are among the most promising next-generation blowing agents due to their low global warming potential and zero ozone depletion potential. These agents are increasingly being used in the production of insulation materials that help reduce energy consumption in buildings, contributing to global energy efficiency goals.In the automotive sector, foam blowing agents are helping manufacturers reduce vehicle weight by enabling the production of lightweight yet durable foam components. Lighter vehicles consume less fuel, which reduces greenhouse gas emissions. As electric vehicles become more prevalent, the need for lightweight materials that offer excellent thermal insulation and cushioning properties will continue to grow, positioning foam blowing agents as a key component in the automotive industry's sustainability efforts.

Foam blowing agents are also playing a vital role in the development of circular economy practices. The use of recyclable and bio-based foam materials is on the rise, and blowing agents are being adapted to work with these new materials. Innovations in foam technology are focused on producing materials that can be recycled or that break down more easily at the end of their life cycle. These advancements are helping industries reduce waste and move toward more sustainable production processes.

Furthermore, the building and construction industry is seeing increased use of foam blowing agents to improve energy efficiency in residential and commercial buildings. High-performance foam insulation reduces heat transfer, leading to lower energy consumption for heating and cooling. As countries implement stricter energy efficiency regulations, the demand for advanced insulation materials produced with eco-friendly blowing agents is expected to rise. Foam blowing agents are thus becoming integral to the future of green building technologies and sustainable construction practices.

What Factors Are Driving the Growth of the Foam Blowing Agent Market?

Several key factors are driving the rapid growth of the foam blowing agent market, reflecting broader trends in industrial efficiency, sustainability, and technological advancements. One of the primary drivers is the increasing demand for energy-efficient insulation materials. As governments and regulatory bodies introduce stricter energy efficiency standards for buildings, there is a growing need for high-performance insulation products that can meet these standards. Foam blowing agents are essential in producing these materials, enabling the creation of foams that provide superior thermal resistance while minimizing energy loss in buildings.Another significant factor contributing to the growth of the foam blowing agent market is the rise of eco-friendly alternatives. With the phase-out of ozone-depleting substances and the increasing awareness of global warming, the demand for blowing agents with lower environmental impact has surged. Manufacturers are increasingly adopting HFOs and other low-GWP alternatives that comply with environmental regulations while still delivering excellent performance in foam production. This shift toward greener blowing agents is driven by both regulatory requirements and consumer demand for sustainable products.

The expansion of key industries, including construction, automotive, and packaging, is also fueling demand for foam blowing agents. In the construction industry, there is a growing focus on creating energy-efficient buildings with advanced insulation systems. Foam blowing agents are critical in producing the insulation materials that meet these needs. In the automotive industry, lightweight foam components help reduce vehicle weight, improving fuel efficiency and reducing emissions. Packaging, particularly for fragile and high-value goods, requires protective foam materials that can be customized for specific applications, further increasing the demand for blowing agents that can produce high-quality foams.

Finally, technological advancements in foam blowing agent formulations and applications are expanding their use across various industries. Innovations in the development of low-GWP and high-performance blowing agents are enabling manufacturers to produce foams with enhanced properties, such as improved fire resistance, better thermal insulation, and greater mechanical strength. As industries continue to push for more efficient, sustainable, and high-performing materials, the foam blowing agent market is expected to grow significantly, playing a crucial role in the future of manufacturing and material science.

Report Scope

The report analyzes the Foam Blowing Agents market, presented in terms of market value (USD). The analysis covers the key segments and geographic regions outlined below.- Segments: Product (HFC, HCFC, HFOS, HCS, Other Products); Application (Polyurethane, Polystyrene, Polyolefins, Other Applications).

- Geographic Regions/Countries: World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; Spain; Russia; and Rest of Europe); Asia-Pacific (Australia; India; South Korea; and Rest of Asia-Pacific); Latin America (Argentina; Brazil; Mexico; and Rest of Latin America); Middle East (Iran; Israel; Saudi Arabia; United Arab Emirates; and Rest of Middle East); and Africa.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the HFC segment, which is expected to reach US$506 Million by 2030 with a CAGR of 6.1%. The HCFC segment is also set to grow at 5.2% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $291.4 Million in 2024, and China, forecasted to grow at an impressive 7.9% CAGR to reach $339.1 Million by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Foam Blowing Agents Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Foam Blowing Agents Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Foam Blowing Agents Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as Arkema Group, Daikin Industries Ltd., Dow, Inc., DuPont de Nemours, Inc., Exxon Mobil Corporation and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 48 companies featured in this Foam Blowing Agents market report include:

- Arkema Group

- Daikin Industries Ltd.

- Dow, Inc.

- DuPont de Nemours, Inc.

- Exxon Mobil Corporation

- Haltermann Carless Deutschland GmbH

- Harp International Ltd.

- Honeywell International, Inc.

- Sinochem Group Co., Ltd.

- Solvay SA

- ZEON Corporation

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Arkema Group

- Daikin Industries Ltd.

- Dow, Inc.

- DuPont de Nemours, Inc.

- Exxon Mobil Corporation

- Haltermann Carless Deutschland GmbH

- Harp International Ltd.

- Honeywell International, Inc.

- Sinochem Group Co., Ltd.

- Solvay SA

- ZEON Corporation

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 197 |

| Published | February 2026 |

| Forecast Period | 2024 - 2030 |

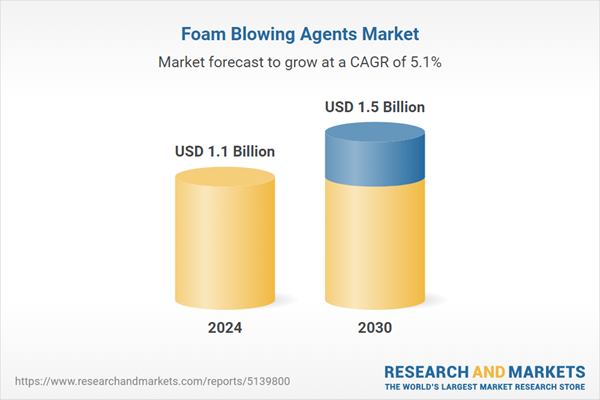

| Estimated Market Value ( USD | $ 1.1 Billion |

| Forecasted Market Value ( USD | $ 1.5 Billion |

| Compound Annual Growth Rate | 5.1% |

| Regions Covered | Global |