Global Flare Gas Recovery Systems Market - Key Trends and Drivers Summarized

Why Are Flare Gas Recovery Systems Becoming Essential in Industrial Operations?

Flare gas recovery systems (FGRS) are increasingly seen as crucial for industrial facilities, but why have they become such a vital part of modern operations? In industries such as oil and gas, petrochemicals, and refining, excess gas produced during operations is often burned off through flaring. This process, while preventing dangerous pressure buildup, results in significant energy waste and environmental pollution due to the release of greenhouse gases like CO2 and methane. Flare gas recovery systems address this issue by capturing and repurposing the gas that would otherwise be flared, converting it into usable energy or feedstock for further industrial processes.The growing focus on environmental sustainability and energy efficiency is driving the adoption of FGRS. These systems not only help reduce the carbon footprint of industrial operations by minimizing the release of harmful emissions, but they also offer economic benefits by turning waste into valuable resources. Captured flare gas can be reintegrated into the facility's processes, used as fuel for heating, or sold as a commercial product. As industries face increasing pressure to meet stringent environmental regulations and improve operational efficiency, flare gas recovery systems are emerging as an essential technology for reducing waste and promoting sustainability in industrial operations.

How Do Flare Gas Recovery Systems Work, and What Makes Them So Effective?

Flare gas recovery systems are designed to capture and reuse gases that would otherwise be flared, but how exactly do they work, and what makes them effective in industrial applications? FGRS consists of compressors, gas treatment units, storage facilities, and distribution systems that work together to capture, process, and redirect flare gas. When excess gas is generated, instead of being burned off in a flare stack, the system compresses the gas and removes any impurities, such as water vapor or sulfur compounds. Once treated, the recovered gas can either be reused within the facility or exported for use as fuel or chemical feedstock.The effectiveness of flare gas recovery systems lies in their ability to prevent the unnecessary loss of valuable resources and reduce environmental impact. Flaring not only wastes potential energy but also contributes to air pollution and greenhouse gas emissions. FGRS minimizes these issues by capturing up to 95% of flare gas that would otherwise be emitted into the atmosphere. By repurposing this gas, facilities can cut operational costs by reducing their reliance on external fuel sources and meet environmental regulations more easily.

Additionally, flare gas recovery systems are adaptable to a variety of industrial settings and can be customized to meet the specific needs of different operations. For example, in refineries or gas processing plants, where large volumes of gas are often flared, FGRS can be designed to handle high throughput while maintaining energy efficiency. The system's ability to capture and recycle gas in real-time also makes it a valuable tool for optimizing plant efficiency, reducing waste, and improving overall sustainability. These attributes make FGRS highly effective for industries looking to balance environmental responsibility with economic performance.

How Are Flare Gas Recovery Systems Impacting the Future of Energy and Environmental Sustainability?

Flare gas recovery systems are transforming how industries manage waste and emissions, but how are they shaping the future of energy and sustainability? With increasing global efforts to combat climate change, industries are under pressure to reduce their carbon emissions and improve resource efficiency. FGRS plays a pivotal role in achieving these goals by capturing waste gases and converting them into usable energy, thereby reducing both the environmental and economic costs of flaring. As industries continue to transition towards greener practices, FGRS is becoming a key technology for meeting sustainability targets while maintaining operational efficiency.In addition to reducing greenhouse gas emissions, FGRS contributes to the circular economy by ensuring that excess gases are not simply wasted but are reintegrated into the production cycle. This shift from a linear to a circular approach - where resources are reused and recycled - helps industries reduce their environmental impact and conserve natural resources. For example, recovered gas can be used to fuel boilers, generate electricity, or serve as feedstock for chemical processes, significantly reducing the need for external energy sources and lowering operational costs. This approach aligns with global energy efficiency goals and helps industries become more resilient in the face of rising energy costs and stricter regulations.

FGRS is also supporting the broader transition to low-carbon and renewable energy systems. By capturing flare gas, these systems reduce the reliance on fossil fuels for energy production and create opportunities for integrating recovered gas into cleaner energy networks. For instance, flare gas can be processed and converted into liquefied natural gas (LNG) or compressed natural gas (CNG), which can then be used as cleaner alternatives to traditional fossil fuels in transportation and other sectors. As industries and governments continue to invest in carbon reduction and energy efficiency, FGRS will play a critical role in enabling more sustainable energy practices and reducing the environmental footprint of industrial operations.

What Factors Are Driving the Growth of the Flare Gas Recovery Systems Market?

The growth in the flare gas recovery systems market is driven by several key factors that reflect broader industrial, economic, and environmental trends. One of the primary drivers is the increasing pressure from environmental regulations. Governments and international bodies are implementing stricter laws aimed at reducing greenhouse gas emissions, particularly in industries such as oil and gas, where flaring is a common practice. Regulations like the Paris Agreement, as well as country-specific emissions targets, are compelling companies to adopt technologies like FGRS to comply with these rules and avoid penalties. The ability of FGRS to significantly reduce emissions by capturing flare gas and preventing it from being released into the atmosphere makes it a critical technology for companies looking to meet these regulatory demands.Another factor contributing to market growth is the economic incentive associated with flare gas recovery. Rather than wasting valuable gas through flaring, companies can repurpose this gas as fuel for internal processes or sell it, creating an additional revenue stream. By reducing the need to purchase external energy sources, companies can also lower operational costs and improve profitability. In regions where natural gas prices are high, flare gas recovery becomes even more attractive as it provides a cost-effective alternative to importing gas or other fuels. As a result, industries are increasingly seeing FGRS not just as an environmental tool, but as a smart economic investment that boosts efficiency and reduces costs.

Technological advancements are also fueling the adoption of flare gas recovery systems. Modern FGRS designs are more efficient, compact, and capable of handling a wide range of gas compositions. The integration of digital monitoring and automation systems further enhances the performance of FGRS by enabling real-time adjustments and optimizing gas recovery rates. These technological innovations have made FGRS more accessible and scalable, allowing for easier integration into new and existing industrial facilities. With the rise of Industry 4.0 and smart manufacturing, FGRS is becoming a key component in the drive toward more automated and energy-efficient industrial operations.

Lastly, the push for corporate sustainability and environmental responsibility is playing a significant role in the growth of the FGRS market. Many companies are setting ambitious carbon reduction goals and adopting sustainable business practices to improve their brand reputation and meet stakeholder expectations. Flare gas recovery aligns with these goals by reducing carbon emissions, promoting energy efficiency, and minimizing environmental impact. As sustainability becomes a central theme in corporate strategy, the demand for solutions like FGRS is expected to continue growing, further cementing its role in the future of industrial operations. Together, these factors are driving the expansion of the flare gas recovery systems market and ensuring its importance in the global push for cleaner, more sustainable industries.

Report Scope

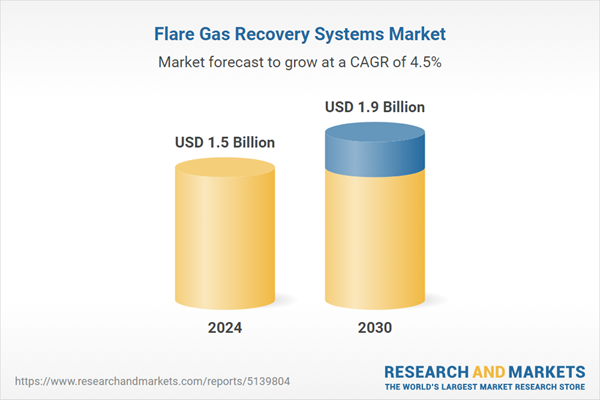

The report analyzes the Flare Gas Recovery Systems market, presented in terms of market value (USD). The analysis covers the key segments and geographic regions outlined below.- Segments: Capacity (Very Large, Large, Medium, Small); Component (Gaskets, Heat Exchangers, Compressors, Separators).

- Geographic Regions/Countries: World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; and Rest of Europe); Asia-Pacific; Rest of World.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the Gaskets Component segment, which is expected to reach US$627.7 Million by 2030 with a CAGR of 4.8%. The Heat Exchangers Component segment is also set to grow at 4.1% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $401.6 Million in 2024, and China, forecasted to grow at an impressive 4.2% CAGR to reach $300.2 Million by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Flare Gas Recovery Systems Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Flare Gas Recovery Systems Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Flare Gas Recovery Systems Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as Aerzener Maschinenfabrik GmbH, Gardner Denver Nash, Honeywell International, Inc., John Zink Company LLC, Transvac Systems Ltd. and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 51 companies featured in this Flare Gas Recovery Systems market report include:

- Aerzener Maschinenfabrik GmbH

- Gardner Denver Nash

- Honeywell International, Inc.

- John Zink Company LLC

- Transvac Systems Ltd.

- Wartsila Corporation

- Zeeco Inc.

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Aerzener Maschinenfabrik GmbH

- Gardner Denver Nash

- Honeywell International, Inc.

- John Zink Company LLC

- Transvac Systems Ltd.

- Wartsila Corporation

- Zeeco Inc.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 249 |

| Published | February 2026 |

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 1.5 Billion |

| Forecasted Market Value ( USD | $ 1.9 Billion |

| Compound Annual Growth Rate | 4.5% |

| Regions Covered | Global |