Global Hydrochloric Acid Market - Key Trends and Drivers Summarized

Is Hydrochloric Acid the Backbone of Modern Industrial Processes and Chemical Synthesis?

Hydrochloric acid (HCl) is one of the most widely used chemical compounds in industrial processes, but why is it so critical for sectors ranging from manufacturing to water treatment and beyond? Hydrochloric acid is a strong, highly corrosive acid that is essential for chemical synthesis, metal processing, food production, and environmental applications. It is used to adjust pH levels, catalyze chemical reactions, and refine metals like steel. Its versatility makes it a cornerstone in industries such as pharmaceuticals, petrochemicals, food processing, and water treatment.The significance of hydrochloric acid lies in its powerful reactivity and the wide range of applications it serves. Whether it's used to produce chlorine-based chemicals, clean metal surfaces, or neutralize alkaline solutions, HCl is indispensable for ensuring efficient and effective industrial operations. Its role in refining metals and processing raw materials helps support large-scale manufacturing, while its use in water treatment helps maintain safe and clean water supplies. From the smallest laboratory experiments to the largest industrial operations, hydrochloric acid remains one of the most essential compounds in modern chemistry and industry.

How Have Technological Advancements Enhanced the Production and Application of Hydrochloric Acid?

Technological advancements have significantly improved both the production and application of hydrochloric acid, making it more efficient, sustainable, and accessible to a broader range of industries. One key advancement is the development of more environmentally friendly production methods. Traditionally, hydrochloric acid has been produced as a byproduct of chlorination processes, but modern production methods now focus on reducing emissions and optimizing chemical yields. For example, advancements in membrane cell technology used in the electrolysis of sodium chloride have improved the efficiency of HCl production, minimizing energy consumption and reducing the environmental impact of the process.In the realm of industrial applications, innovations in material science have enhanced the durability and safety of equipment that comes into contact with hydrochloric acid. HCl's corrosive nature presents significant challenges in industries such as metal processing and chemical manufacturing, where it is often used to clean, etch, or refine metal surfaces. The development of corrosion-resistant alloys, specialized linings, and advanced plastic polymers for storage and transportation containers has greatly improved the handling of hydrochloric acid, reducing the risk of spills, leaks, and equipment failure.

One important technological improvement in the use of hydrochloric acid has been in the steel pickling process. Pickling involves the use of HCl to remove impurities such as rust or scale from the surface of steel, preparing it for further processing. The implementation of closed-loop systems for acid recovery has made this process more sustainable. These systems capture and recycle spent hydrochloric acid, significantly reducing the amount of fresh acid needed and minimizing waste. This not only improves environmental sustainability but also reduces operational costs for industries that rely heavily on steel production.

In water treatment applications, technological advancements have made hydrochloric acid more effective and easier to manage. Automated dosing systems allow for precise control over the addition of HCl in water treatment plants, ensuring that the pH levels of water are maintained within safe limits. These systems reduce the risk of over- or under-dosing, leading to more efficient water purification processes. Additionally, modern monitoring technologies enable real-time data collection on water quality, ensuring that hydrochloric acid is used only when necessary and in the correct amounts, further improving the sustainability and efficiency of water treatment operations.

Advances in safety technology have also improved how hydrochloric acid is stored and transported. The development of advanced containment systems, including double-walled tanks and pressure-relief devices, has made it safer to handle large volumes of this corrosive substance. These innovations help prevent accidents during transport and storage, ensuring that industries can use hydrochloric acid with greater confidence and fewer risks to personnel and the environment. This is particularly important in industries like oil and gas, where HCl is often used in fracturing fluids and requires secure handling under challenging conditions.

The development of specialized catalysts has also improved the role of hydrochloric acid in chemical synthesis. HCl is used in a variety of chemical reactions as a reagent or catalyst, and advancements in catalysis have made these reactions more efficient, often reducing the amount of acid needed and lowering waste generation. These improvements are particularly valuable in pharmaceutical and petrochemical industries, where precision in chemical reactions is critical for ensuring product quality and minimizing environmental impact.

Why Is Hydrochloric Acid Critical for Industrial Processes and Chemical Manufacturing?

Hydrochloric acid is critical for industrial processes and chemical manufacturing because of its powerful chemical properties, which make it an effective reagent, catalyst, and pH regulator. One of its primary roles is in the production of organic and inorganic chemicals. In the production of chlorine-based compounds, HCl is essential for synthesizing chemicals such as vinyl chloride (used to make PVC plastics) and polyurethane foams. The reactivity of HCl makes it a versatile tool for initiating and controlling chemical reactions, ensuring that products are synthesized with the required precision and purity.The metal processing industry also relies heavily on hydrochloric acid, particularly in steel manufacturing. Steel pickling, which uses HCl to remove impurities such as rust, mill scale, and other contaminants from steel surfaces, is a critical step in ensuring that steel products meet industry standards for quality and performance. Without pickling, steel would retain surface impurities that weaken its structural integrity and reduce its corrosion resistance. The use of hydrochloric acid in pickling helps ensure that steel can be used for applications ranging from construction materials to automotive parts and industrial machinery.

In the oil and gas industry, hydrochloric acid is a key component of well stimulation fluids, particularly in hydraulic fracturing (fracking) and acidizing operations. When injected into oil and gas wells, HCl helps dissolve mineral deposits and improve the permeability of the rock formations, allowing for the more efficient extraction of oil and natural gas. This role is critical in enhancing the productivity of wells, particularly in mature or low-permeability reservoirs. The use of HCl in these processes increases the efficiency of resource extraction, helping meet global energy demands more effectively.

Hydrochloric acid is also indispensable in water treatment plants, where it is used to regulate the pH levels of water. Maintaining proper pH levels is essential for ensuring that water is safe for consumption and does not corrode pipes or equipment. In industrial wastewater treatment, hydrochloric acid is used to neutralize alkaline waste streams, preventing environmental damage from improperly treated effluent. The precise control of pH through the use of hydrochloric acid ensures that water treatment processes are efficient and effective, making it a vital tool for protecting both public health and the environment.

In the food processing industry, hydrochloric acid plays a crucial role in the production of food additives, preservatives, and flavor enhancers. It is used to produce ingredients like gelatin, which is derived from animal collagen and requires acid treatment to break down the raw material into usable form. HCl is also involved in the processing of starches and the extraction of edible oils. The versatility of hydrochloric acid in food production makes it an essential compound for ensuring that food products meet safety and quality standards.

Another key industrial use of hydrochloric acid is in the pharmaceutical industry, where it serves as a reagent in the synthesis of active pharmaceutical ingredients (APIs) and intermediates. HCl is used to create the salts of various drugs, enhancing their solubility and absorption in the human body. This is particularly important for the production of medications that require precise formulation and purity levels. Without hydrochloric acid, many of the drugs used to treat illnesses would be difficult, if not impossible, to produce efficiently.

What Factors Are Driving the Growth of the Hydrochloric Acid Market?

Several factors are driving the rapid growth of the hydrochloric acid market, including increasing demand from industries such as steel manufacturing, water treatment, pharmaceuticals, and oil and gas. One of the primary drivers is the expansion of the steel industry, particularly in emerging economies. As global infrastructure development accelerates, the demand for steel products is rising, and with it, the need for hydrochloric acid in steel pickling processes. Steel production requires large volumes of HCl to ensure that the material meets quality and performance standards, making the acid an essential component of this booming industry.The growing focus on water treatment and environmental sustainability is another key factor driving the hydrochloric acid market. With global water resources becoming increasingly strained, industries are investing more in water purification and wastewater treatment systems. Hydrochloric acid's role in adjusting pH levels and neutralizing waste streams is crucial in ensuring that water treatment plants operate efficiently and meet regulatory standards. As environmental regulations tighten and industries seek to reduce their environmental footprint, the use of HCl in water treatment processes is expected to increase.

The pharmaceutical and food processing industries are also contributing to the rising demand for hydrochloric acid. As the global population grows and healthcare needs increase, the demand for pharmaceutical products continues to expand. Hydrochloric acid is widely used in the synthesis of active pharmaceutical ingredients and as a reagent in chemical reactions that produce medications. Additionally, the food processing industry relies on HCl for the production of food additives, preservatives, and processing aids. The growing need for processed and packaged foods is fueling demand for hydrochloric acid in this sector.

The oil and gas industry, particularly the hydraulic fracturing and well acidizing segments, is another major driver of hydrochloric acid demand. With global energy needs on the rise, oil and gas companies are looking for ways to improve the efficiency of resource extraction. HCl is used extensively in well stimulation treatments to dissolve rock formations and improve well productivity. As the exploration and extraction of unconventional oil and gas reserves continue to grow, so does the demand for hydrochloric acid in these critical energy production processes.

Technological advancements in the production of hydrochloric acid, such as improved membrane cell technology and more efficient production methods, are also contributing to market growth. These innovations have made HCl production more energy-efficient and environmentally sustainable, reducing the overall cost of production and making it more accessible to a wide range of industries. Additionally, advances in safety and storage technologies have made the handling of hydrochloric acid safer, encouraging its wider use in industries where its corrosive nature may have previously been a barrier to adoption.

With increasing demand from industries such as steel, water treatment, pharmaceuticals, and energy, coupled with technological advancements in production and safety, the hydrochloric acid market is poised for continued growth. As industries seek to optimize processes, improve efficiency, and meet environmental standards, hydrochloric acid will remain a critical component in driving industrial and chemical advancements across the globe.

Report Scope

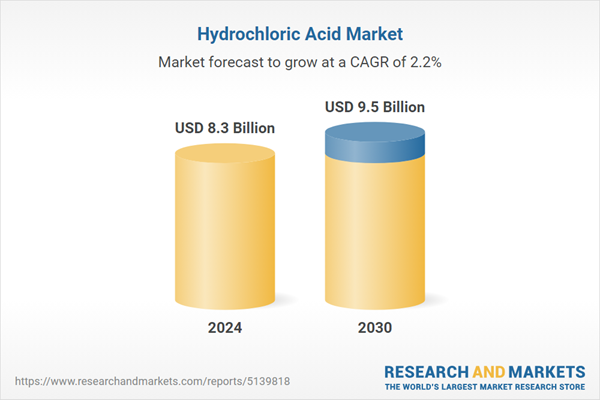

The report analyzes the Hydrochloric Acid market, presented in terms of market value (USD). The analysis covers the key segments and geographic regions outlined below.- Segments: End-Use (Food & Beverage, Oil & Gas, Steel, Pharmaceuticals, Textiles, Agriculture, Other End-Uses).

- Geographic Regions/Countries: World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; Spain; Russia; and Rest of Europe); Asia-Pacific (Australia; India; South Korea; and Rest of Asia-Pacific); Latin America (Argentina; Brazil; Mexico; and Rest of Latin America); Middle East (Iran; Israel; Saudi Arabia; United Arab Emirates; and Rest of Middle East); and Africa.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the Food & Beverage End-Use segment, which is expected to reach US$3.1 Billion by 2030 with a CAGR of 2.5%. The Oil & Gas End-Use segment is also set to grow at 2.1% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $2.2 Billion in 2024, and China, forecasted to grow at an impressive 3.2% CAGR to reach $1.8 Billion by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Hydrochloric Acid Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Hydrochloric Acid Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Hydrochloric Acid Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as AGC Chemicals, Axiall Corporation, BASF SE, Coogee Chemicals Pty., Ltd., Dow, Inc. and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 42 companies featured in this Hydrochloric Acid market report include:

- AGC Chemicals

- Axiall Corporation

- BASF SE

- Coogee Chemicals Pty., Ltd.

- Dow, Inc.

- DuPont de Nemours, Inc.

- Erco Worldwide

- Inovyn

- Solvay S.A

- The Chemours Company

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- AGC Chemicals

- Axiall Corporation

- BASF SE

- Coogee Chemicals Pty., Ltd.

- Dow, Inc.

- DuPont de Nemours, Inc.

- Erco Worldwide

- Inovyn

- Solvay S.A

- The Chemours Company

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 194 |

| Published | February 2026 |

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 8.3 Billion |

| Forecasted Market Value ( USD | $ 9.5 Billion |

| Compound Annual Growth Rate | 2.2% |

| Regions Covered | Global |