Global Intermittent Catheters Market - Key Trends & Drivers Summarized

What Are Intermittent Catheters and Why Are They Crucial in Urological Care?

Intermittent catheters are medical devices used for the temporary drainage of urine from the bladder in individuals who cannot empty their bladder naturally. These catheters are crucial in urological care as they provide an effective solution for managing conditions such as urinary retention, neurogenic bladder, and spinal cord injuries. Unlike indwelling catheters, which remain in place for extended periods, intermittent catheters are inserted multiple times a day and removed after each use, reducing the risk of infections and complications. They are widely used in hospitals, long-term care facilities, and home care settings, offering patients greater control over their bladder management and improving their quality of life. As awareness of the benefits of intermittent catheterization grows, these devices are becoming an essential component of urological care for many patients.How Are Technological Advancements Shaping the Intermittent Catheters Market?

Technological advancements are significantly shaping the intermittent catheters market, particularly through innovations in materials, design, and user convenience. The development of advanced materials, such as hydrophilic coatings and silicone, is enhancing the comfort, safety, and ease of use of intermittent catheters, reducing the risk of urethral trauma and infections. Innovations in catheter design, including pre-lubricated and compact catheters, are making the devices more portable and discreet, improving patient compliance and convenience. The integration of user-friendly features, such as easy-to-open packaging and intuitive insertion aids, is further enhancing the usability of these devices, particularly for patients with limited dexterity. These technological trends are driving the adoption of intermittent catheters across healthcare settings, as they offer improved patient outcomes and align with the growing emphasis on patient-centered care.Why Is There an Increasing Demand for Intermittent Catheters in Healthcare?

The demand for intermittent catheters is increasing in healthcare due to the rising prevalence of urological conditions, aging populations, and the growing awareness of the benefits of intermittent catheterization. As the global population ages, the incidence of conditions such as urinary retention, neurogenic bladder, and spinal cord injuries is increasing, leading to a greater need for effective bladder management solutions. Intermittent catheters are also being increasingly recommended by healthcare providers as a safer alternative to indwelling catheters, particularly for long-term bladder management, as they reduce the risk of urinary tract infections (UTIs) and other complications. The growing awareness among patients about the benefits of intermittent catheterization, including greater independence and improved quality of life, is further driving demand. Additionally, the increasing focus on home healthcare and the need for cost-effective, patient-friendly medical devices are contributing to the expansion of the intermittent catheters market.What Factors Are Driving the Growth in the Intermittent Catheters Market?

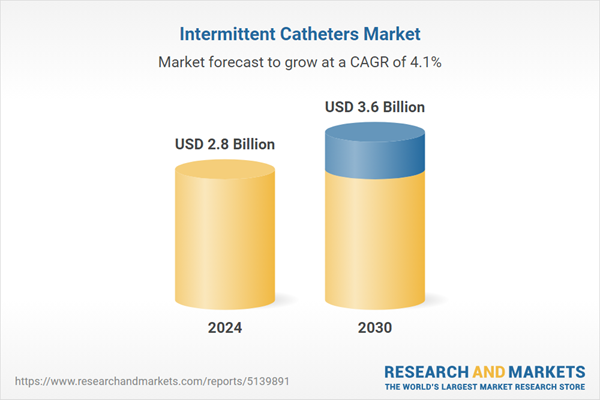

The growth in the intermittent catheters market is driven by several factors related to demographic trends, technological advancements, and evolving healthcare practices. One of the primary drivers is the rising prevalence of urological conditions and the increasing demand for effective bladder management solutions, particularly among the aging population. Technological advancements in catheter materials and design, which enhance patient comfort, safety, and convenience, are also propelling market growth. The growing emphasis on reducing healthcare-associated infections, such as UTIs, is driving the adoption of intermittent catheters as a safer alternative to indwelling catheters. Additionally, the expansion of home healthcare services and the increasing focus on patient-centered care are contributing to the market's growth, as more patients seek convenient and effective solutions for managing their urological conditions at home. As these trends continue to shape the healthcare landscape, the intermittent catheters market is expected to experience sustained growth, driven by the need for safer, more comfortable, and user-friendly bladder management devices.Report Scope

The report analyzes the Intermittent Catheters market, presented in terms of market value (USD). The analysis covers the key segments and geographic regions outlined below.- Segments: Indication (Urinary Incontinence, Spinal Cord Injuries, General Surgeries, Other Indications); Category (Female Length Catheters, Male Length Catheters, Kid Length Catheters); Product (Uncoated, Coated); End-Use (Hospitals, Ambulatory Surgery Centers, Medical Research Centers).

- Geographic Regions/Countries: World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; and Rest of Europe); Asia-Pacific; Rest of World.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the Urinary Incontinence Indication segment, which is expected to reach US$1.6 Billion by 2030 with a CAGR of 4%. The Spinal Cord Injuries Indication segment is also set to grow at 5.2% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $761.2 Million in 2024, and China, forecasted to grow at an impressive 3.9% CAGR to reach $565.3 Million by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Intermittent Catheters Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Intermittent Catheters Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Intermittent Catheters Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as Adapta Medical, Inc., B. Braun Melsungen AG, Becton, Dickinson and Company, Coloplast A/S, Cure Medical LLC and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 41 companies featured in this Intermittent Catheters market report include:

- Adapta Medical, Inc.

- B. Braun Melsungen AG

- Becton, Dickinson and Company

- Coloplast A/S

- Cure Medical LLC

- Hollister, Inc.

- Medical Technologies of Georgia, Inc.

- Pennine Healthcare Ltd.

- Teleflex, Inc.

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Adapta Medical, Inc.

- B. Braun Melsungen AG

- Becton, Dickinson and Company

- Coloplast A/S

- Cure Medical LLC

- Hollister, Inc.

- Medical Technologies of Georgia, Inc.

- Pennine Healthcare Ltd.

- Teleflex, Inc.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 194 |

| Published | January 2026 |

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 2.8 Billion |

| Forecasted Market Value ( USD | $ 3.6 Billion |

| Compound Annual Growth Rate | 4.1% |

| Regions Covered | Global |