Global Rubber Testing Equipment Market - Key Trends and Drivers Summarized

Why Is Rubber Testing Equipment Integral To Modern Manufacturing Processes And Quality Assurance?

Rubber testing equipment is a cornerstone in the quality assurance processes of numerous industries, such as automotive, aerospace, construction, healthcare, and consumer goods, where the durability, elasticity, and overall performance of rubber products are critical. In the automotive sector, for instance, the rigorous testing of tires, seals, hoses, and gaskets is essential to ensure their safety, longevity, and performance under diverse conditions. This is especially crucial as the industry shifts toward electric vehicles (EVs), which demand components that can withstand higher temperatures and provide better insulation. Similarly, in aerospace, rubber materials are tested extensively for their ability to endure extreme temperatures and pressures, ensuring safety and reliability in high-altitude conditions. The construction sector also relies heavily on rubber testing equipment to evaluate the performance of rubber-based materials used in vibration dampening, sealing, and waterproofing applications. The need for consistent product quality in medical devices and consumer goods further underscores the critical role of rubber testing equipment in maintaining compliance with stringent regulatory standards.How Are Technological Advancements Expanding The Scope And Capabilities Of Rubber Testing Equipment?

The rubber testing equipment market is witnessing substantial growth, propelled by rapid technological advancements that enhance the accuracy, efficiency, and versatility of testing methods. Modern testing equipment, such as rheometers, tensile testers, dynamic mechanical analyzers (DMA), hardness testers, and aging ovens, are increasingly equipped with automated and digitalized features that reduce human error and improve the precision of results. The development of portable and handheld testing devices has revolutionized on-site testing, allowing for quick and efficient quality checks in real-time, which is vital in industries like automotive and construction. The integration of IoT (Internet of Things) and AI (Artificial Intelligence) in rubber testing equipment enables predictive maintenance, data analytics, and remote monitoring, thereby optimizing testing processes and ensuring consistent quality control. Additionally, the advent of non-destructive testing (NDT) methods is gaining popularity in industries where maintaining the integrity of the material is paramount, such as in aerospace and medical device manufacturing. These technological advancements are driving the demand for rubber testing equipment that meets evolving industry requirements and enhances operational efficiency.What Are The Key Segments And End-Use Markets For Rubber Testing Equipment?

The rubber testing equipment market is highly segmented, with various types of testing equipment catering to specific end-use markets and applications. Key segments include physical testing equipment, chemical testing equipment, and dynamic testing equipment. Physical testing equipment, such as tensile testers and hardness testers, is widely used in the automotive, aerospace, and construction sectors to assess the mechanical properties of rubber materials. Chemical testing equipment, including aging ovens and chemical resistance testers, is crucial for evaluating rubber's resistance to environmental factors, making it indispensable in industries like healthcare and consumer goods. Dynamic testing equipment, such as rheometers and DMA, is essential in sectors that require precise analysis of rubber's viscoelastic properties, such as tire manufacturing and industrial machinery. End-use markets are broad, ranging from automotive, aerospace, healthcare, and construction to industrial and consumer goods. Each of these markets has specific requirements, driving the demand for specialized rubber testing equipment that ensures compliance with industry standards and enhances product performance.What Are The Key Drivers Fueling The Growth Of The Rubber Testing Equipment Market?

The growth in the rubber testing equipment market is driven by several factors, including the increasing demand for high-quality rubber products, technological advancements in testing equipment, and stringent regulatory standards. The expansion of industries such as automotive and aerospace, which require rigorous testing protocols to ensure component safety and performance, is a significant contributor to market growth. Technological innovations like AI and IoT integration are enhancing the efficiency and precision of testing processes, driving greater adoption of advanced rubber testing solutions. The growing emphasis on sustainability and recycling in the rubber industry is generating demand for innovative testing methods to assess the quality and properties of recycled rubber materials. Additionally, the expansion of the healthcare sector, where rubber materials are critical in medical devices and equipment, is further driving demand for high-quality rubber testing equipment. The need for compliance with international standards, such as ISO and ASTM, is pushing manufacturers to invest in state-of-the-art testing solutions, reinforcing the market's growth potential.Report Scope

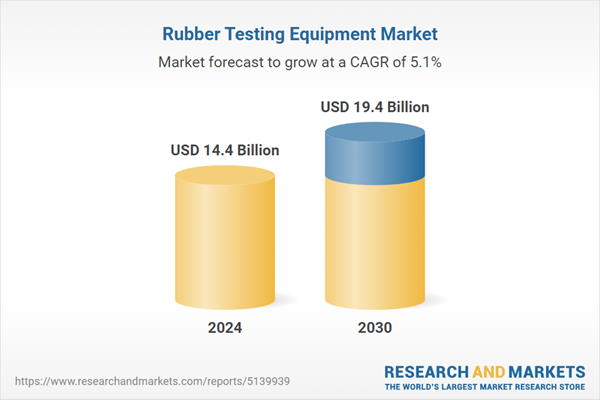

The report analyzes the Rubber Testing Equipment market, presented in terms of market value (USD). The analysis covers the key segments and geographic regions outlined below.- Segments: Testing Type (Density Testing, Viscosity Testing, Hardness Testing, Flex Testing, Other Testing Types); Application (Tires, General Rubber Goods, Industrial Rubber Products, Other Applications).

- Geographic Regions/Countries: World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; Spain; Russia; and Rest of Europe); Asia-Pacific (Australia; India; South Korea; and Rest of Asia-Pacific); Latin America (Argentina; Brazil; Mexico; and Rest of Latin America); Middle East (Iran; Israel; Saudi Arabia; United Arab Emirates; and Rest of Middle East); and Africa.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the Density Testing segment, which is expected to reach US$8.7 Billion by 2030 with a CAGR of 5.8%. The Viscosity Testing segment is also set to grow at 5.1% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $3.8 Billion in 2024, and China, forecasted to grow at an impressive 8.2% CAGR to reach $4.3 Billion by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Rubber Testing Equipment Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Rubber Testing Equipment Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Rubber Testing Equipment Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as Akron Rubber Development Laboratory, Inc., Alliance Caoutchouc, Alliance Seals Ltd., Allied Rubber Technologies (Australia) Pty., Ltd., Alsace Protection and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 31 companies featured in this Rubber Testing Equipment market report include:

- Akron Rubber Development Laboratory, Inc.

- Alliance Caoutchouc

- Alliance Seals Ltd.

- Allied Rubber Technologies (Australia) Pty., Ltd.

- Alsace Protection

- Anant Rubber Products

- Ankra Spol. Sro

- Beijing Cap High Technology Co.,Ltd.Â

- Benlong Automation Technology

- Ektron Tek Co., Ltd.

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Akron Rubber Development Laboratory, Inc.

- Alliance Caoutchouc

- Alliance Seals Ltd.

- Allied Rubber Technologies (Australia) Pty., Ltd.

- Alsace Protection

- Anant Rubber Products

- Ankra Spol. Sro

- Beijing Cap High Technology Co.,Ltd.Â

- Benlong Automation Technology

- Ektron Tek Co., Ltd.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 289 |

| Published | January 2026 |

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 14.4 Billion |

| Forecasted Market Value ( USD | $ 19.4 Billion |

| Compound Annual Growth Rate | 5.1% |

| Regions Covered | Global |